Estratégia de combinação de média móvel de tendência móvel recursiva combinada com reversão de padrão 123

Visão geral

Esta estratégia é uma combinação de duas estratégias de equilíbrio de tendência de movimentação recorrente e inversão de forma 123, formando um sinal integrado para melhorar a estabilidade e a lucratividade da estratégia.

Princípios

123 Reversão de forma

Esta seção é inspirada no livro de Ulf Jensen Como eu ganho três vezes mais no mercado de futuros. Seu sinal de compra é: o preço de fechamento dos últimos dois dias subiu e o valor do STO SLOWK do ciclo de 9 dias ficou abaixo de 50, quando ele fez mais; o sinal de venda foi: o preço de fechamento dos últimos dois dias caiu e o valor do STO FASTK do ciclo de 9 dias ficou acima de 50, quando ele fez mais.

Linha média de tendência de movimentação recorrente

A ideia é usar o preço dos últimos dias e o preço do dia para prever o preço do dia seguinte. Olhe para baixo quando o preço previsto é maior do que o preço real de ontem.

Vantagens

Esta combinação de estratégias permite aproveitar as vantagens de ambas as estratégias, evitando as limitações de uma única estratégia. A inversão de forma 123 pode capturar a maior parte do mercado quando o preço se reverte.

Riscos e soluções

- A inversão de forma 123 pode gerar sinais errôneos devido a flutuações de curto prazo nos preços. Os parâmetros podem ser ajustados adequadamente para filtrar o ruído.

- A linha média de tendência móvel recorrente pode ser mais lenta na resposta a eventos súbitos. A tendência local pode ser considerada em combinação com outros indicadores.

- Os dois sinais de estratégia podem não ser consistentes. Nesse caso, considere abrir uma posição apenas quando os dois sinais são emitidos, ou escolha seguir apenas um sinal de acordo com a situação do mercado.

Direção de otimização

- Pode testar combinações de diferentes parâmetros de ciclo para encontrar o melhor par de parâmetros

- Pode ser introduzido um mecanismo de parada automática.

- Os parâmetros podem ser ajustados de acordo com as diferentes variedades e condições de mercado

- Pode ser considerado em combinação com outras estratégias ou indicadores para formar um sistema mais robusto

Resumir

Esta estratégia combina dois tipos diferentes de estratégias para aumentar a estabilidade através da geração de sinais integrados. Ao mesmo tempo, a combinação de vantagens de ambos permite a captura de pontos de reversão de preços e a determinação da direção futura dos preços. Se continuar a ser otimizada, espera-se um desempenho ainda melhor.

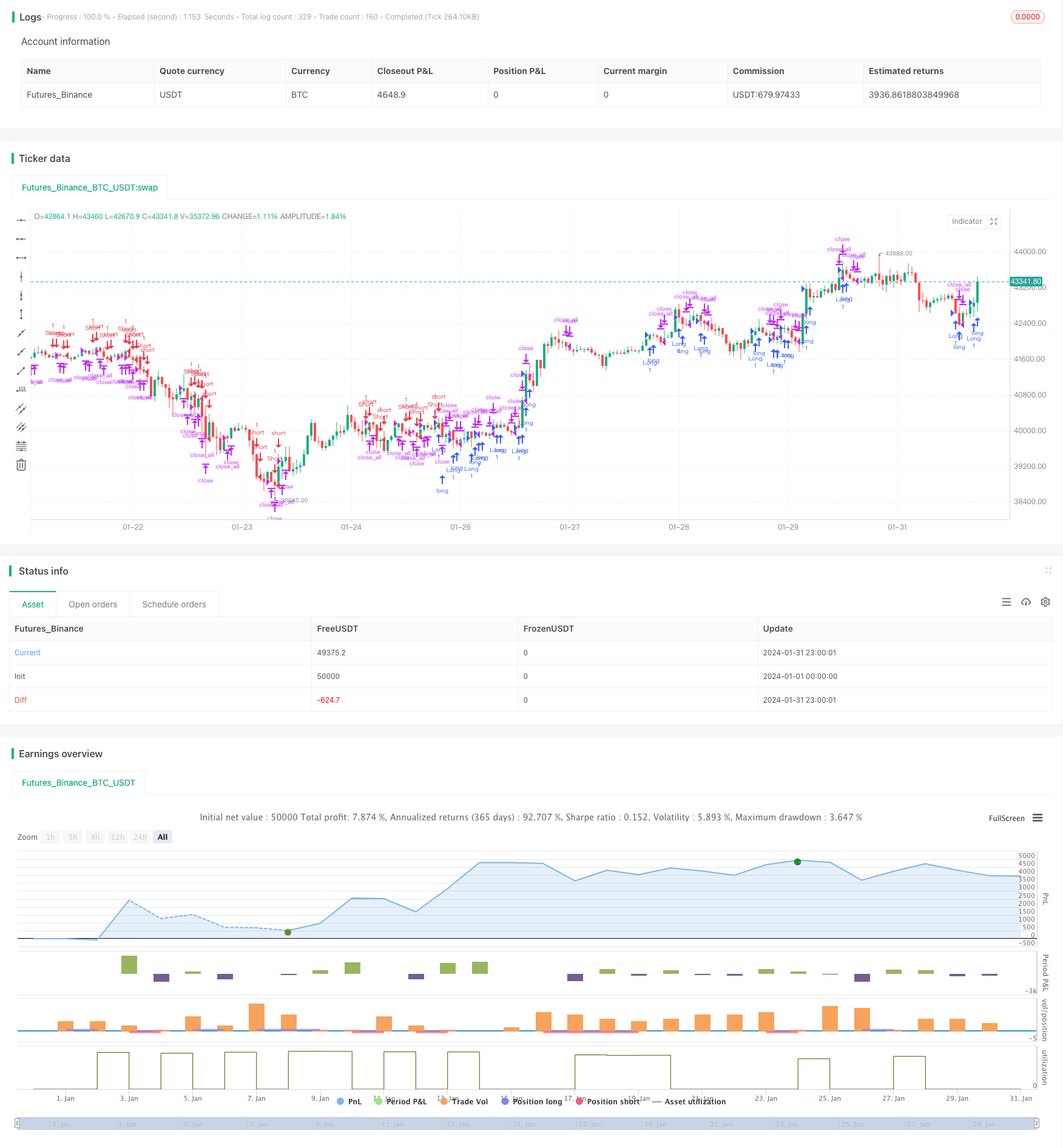

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 01/06/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Taken from an article "The Yen Recused" in the December 1998 issue of TASC,

// written by Dennis Meyers. He describes the Recursive MA in mathematical terms

// as "recursive polynomial fit, a technique that uses a small number of past values

// of the estimated price and today's price to predict tomorrows price."

// Red bars color - short position. Green is long.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

RMTA(Length) =>

pos = 0.0

Bot = 0.0

nRes = 0.0

Alpha = 2 / (Length+1)

Bot := (1-Alpha) * nz(Bot[1],close) + close

nRes := (1-Alpha) * nz(nRes[1],close) + (Alpha*(close + Bot - nz(Bot[1], 0)))

pos:= iff(nRes > close[1], -1,

iff(nRes < close[1], 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Recursive Moving Trend Average", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Recursive Moving Trend Average ----")

LengthRMTA = input(21, minval=3)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posRMTA = RMTA(LengthRMTA)

pos = iff(posReversal123 == 1 and posRMTA == 1 , 1,

iff(posReversal123 == -1 and posRMTA == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )