Visão geral

A estratégia baseia-se em sinais cruzados de 20 e 200 dias de média móvel do índice (EMA) e é confirmada em combinação com um indicador de fraqueza relativa (RSI) e um indicador de dispersa de convergência de média móvel (MACD) para produzir sinais de compra e venda. A estratégia também usa um método de stop loss dinâmico e um alvo fixo de ganho para gerenciar o risco de negociação e bloquear os lucros.

Princípio da estratégia

- Calculando o 20o e o 200o EMA, quando o 20o EMA atravessa o 200o EMA, um sinal de compra é gerado; quando o 20o EMA atravessa o 200o EMA, um sinal de venda é gerado.

- O RSI e o MACD são usados para confirmar o sinal de cruzamento do EMA. A compra é executada somente quando o RSI é superior a 50 e a linha do MACD é superior à linha do sinal; a venda é executada somente quando o RSI é inferior a 50 e a linha do MACD é inferior à linha do sinal.

- Defina uma taxa de retorno fixa (por exemplo, 20%) e uma taxa de stop loss inicial (por exemplo, 10%).

- Quando o lucro da posição atingir a taxa de retorno alvo, o preço de parada de perda será aumentado para menos de 10% do preço atual, atingindo a parada de perda dinâmica.

- Quando o preço toca o preço de stop loss dinâmico, a posição de equilíbrio termina em lucro.

Vantagens estratégicas

- A combinação de vários indicadores técnicos que confirmam os sinais de transação aumenta a confiabilidade do sinal.

- O método de stop loss dinâmico, ao mesmo tempo em que bloqueia os lucros, dá ao preço um certo espaço de retração, evitando a liquidação prematura.

- Estabelecer uma taxa de retorno fixa ajuda a controlar o risco e a obter um retorno estável.

Risco estratégico

- Os sinais de cruzamento da EMA podem ocorrer com frequência, causando um aumento nos custos de negociação.

- Em mercados turbulentos, a estratégia pode levar a perdas contínuas.

- Os objetivos fixos de taxa de retorno e de stop loss podem não ser adequados a diferentes condições de mercado e precisam ser ajustados de acordo com a volatilidade do mercado.

Direção de otimização da estratégia

- A introdução de mais indicadores técnicos ou de sentimento de mercado para aumentar a precisão e a confiabilidade dos sinais.

- Utilize a taxa de retorno e a taxa de parada adaptáveis, ajustando-se dinamicamente à volatilidade do mercado e às características dos ativos.

- Combinando tendências de mercado e ciclos de flutuação, usando diferentes configurações de parâmetros em diferentes ambientes de mercado.

Resumir

A estratégia, combinada com a confirmação do RSI e do MACD por meio de sinais cruzados da EMA, bem como uma abordagem de gerenciamento de risco de stop loss dinâmico e ganhos de alvo fixo, promete um lucro estável em mercados em tendência. No entanto, em mercados turbulentos, a estratégia pode enfrentar o risco de negociação frequente e perdas contínuas. Portanto, é necessário otimizar e melhorar ainda mais a estratégia para aumentar a adaptabilidade e a robustez da estratégia.

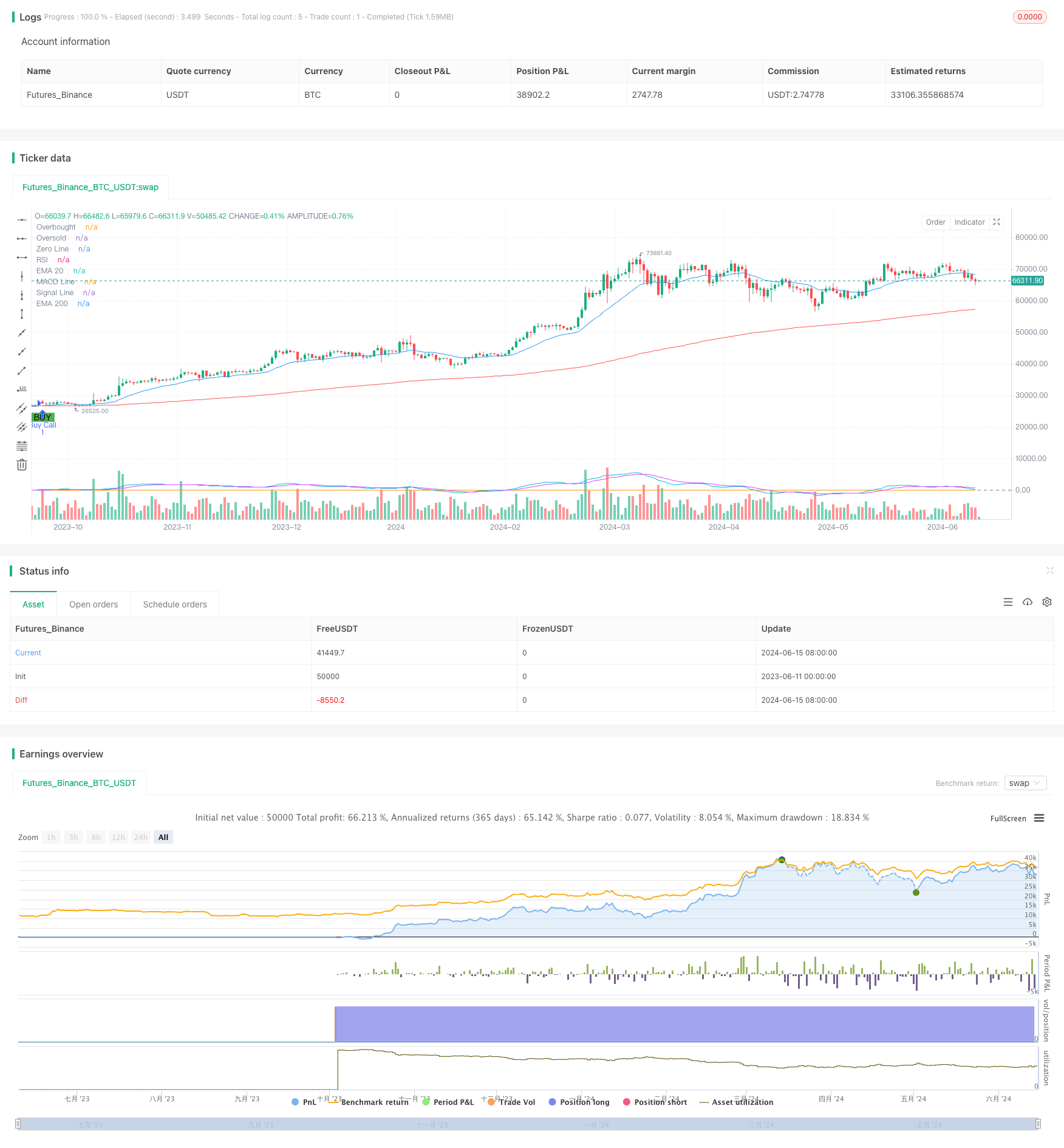

/*backtest

start: 2023-06-11 00:00:00

end: 2024-06-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover Strategy with RSI and MACD Confirmation and Dynamic Trailing Stop Loss", overlay=true)

// Calculate EMAs

ema20 = ta.ema(close, 20)

ema200 = ta.ema(close, 200)

// Calculate RSI

rsi = ta.rsi(close, 14)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Plot EMAs, RSI, and MACD on the chart

plot(ema20, color=color.blue, title="EMA 20")

plot(ema200, color=color.red, title="EMA 200")

hline(70, "Overbought", color=color.red)

hline(30, "Oversold", color=color.green)

plot(rsi, title="RSI", color=color.orange)

hline(0, "Zero Line", color=color.gray)

plot(macdLine, title="MACD Line", color=color.aqua)

plot(signalLine, title="Signal Line", color=color.fuchsia)

// Strategy parameters

targetProfitPercent = 20

trailingStopIncrement = 10

// Strategy variables

var float initialStopLevel = na

var float trailingStopLevel = na

// Strategy rules with RSI and MACD confirmation

longCondition = ta.crossover(ema20, ema200) and rsi > 50 and macdLine > signalLine

shortCondition = ta.crossunder(ema20, ema200) and rsi < 50 and macdLine < signalLine

// Execute trades

if (longCondition)

strategy.entry("Buy Call", strategy.long)

initialStopLevel := strategy.position_avg_price * (1 - 0.10) // Initial stop-loss at 10% below entry price

if (shortCondition)

strategy.entry("Buy Put", strategy.short)

// Calculate profit and loss targets

takeProfit = strategy.position_avg_price * (1 + targetProfitPercent / 100) // 20% profit target

// Update trailing stop loss

if (strategy.opentrades > 0)

if (strategy.position_size > 0) // Long position

if (strategy.netprofit >= takeProfit)

// Update stop-loss based on profit increments

if (trailingStopLevel == na)

trailingStopLevel := strategy.position_avg_price * (1 - 0.10) // Initial trailing stop at 10% below entry price

else

if (strategy.position_avg_price * (1 - 0.10) > trailingStopLevel)

trailingStopLevel := strategy.position_avg_price * (1 - 0.10) // Increase stop-loss to 10% below current price

// Apply trailing stop loss

strategy.exit("Take Profit", "Buy Call", stop=trailingStopLevel)

// Plot buy and sell signals on the chart

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")