Visão geral

A estratégia de negociação de balanço múltipla é um sistema de negociação complexo que combina vários indicadores técnicos e níveis de preço. Utiliza indicadores como MACD, RSI, EMA e correia de Brent, em combinação com os níveis de retração de Fibonacci, e usa diferentes estratégias de negociação em diferentes faixas de preços para alcançar uma negociação equilibrada em vários níveis. A idéia central da estratégia é aumentar a precisão da negociação por meio de confirmação múltipla, ao mesmo tempo em que otimiza a gestão de capital por meio de aumentos progressivos de risco.

Princípio da estratégia

Os princípios centrais da estratégia incluem:

- Utilize os indicadores MACD, RSI e EMA para determinar as tendências e a dinâmica do mercado.

- O uso das faixas de Brin e dos níveis de retração de Fibonacci para identificar pontos críticos de suporte e resistência.

- A criação de vários pontos de entrada de negociação em diferentes níveis de preços, permitindo a construção de posições progressivas.

- Gerenciar o risco através da definição de diferentes níveis de stop loss e stop loss.

- O gráfico de Haykanush foi usado para fornecer informações adicionais sobre a estrutura do mercado.

A estratégia consiste em analisar esses fatores em conjunto e adotar comportamentos de negociação correspondentes em diferentes condições de mercado para obter ganhos estáveis.

Vantagens estratégicas

- Confirmação múltipla: aumenta a confiabilidade dos sinais de transação através da combinação de vários indicadores técnicos.

- Gerenciamento de fundos com flexibilidade: o aumento gradual de posições permite um melhor controle de riscos e otimizar o uso de fundos.

- Adaptabilidade: A estratégia pode ajustar o comportamento de negociação a diferentes condições de mercado.

- Gerenciamento de riscos abrangente: há vários níveis de mecanismos de parada e parada para controlar os riscos de forma eficaz.

- Alto grau de automação: A execução da estratégia pode ser totalmente automatizada, reduzindo a intervenção humana.

Risco estratégico

- Transações excessivas: Como a estratégia configura vários níveis de transação, isso pode levar a transações frequentes e aumentar os custos de transação.

- Sensibilidade de parâmetros: a estratégia usa vários indicadores e parâmetros, que precisam ser cuidadosamente ajustados para adaptar-se a diferentes condições de mercado.

- Risco de retirada: Em mercados altamente voláteis, pode haver maior risco de retirada.

- Dependência tecnológica: A estratégia depende fortemente de indicadores tecnológicos e pode falhar em certas condições de mercado.

- Risco de gestão de fundos: a forma gradual de acumulação de depósitos pode, em alguns casos, levar a uma exposição excessiva.

Direção de otimização da estratégia

- Ajuste de parâmetros dinâmicos: introdução de algoritmos de aprendizado de máquina para ajustar automaticamente os parâmetros da estratégia de acordo com as condições do mercado.

- Análise de sentimento de mercado: integração de indicadores de sentimento de mercado, como o índice VIX, para melhorar a adaptabilidade da estratégia.

- Análise de multi-quadros de tempo: introdução de análise de múltiplos quadros de tempo para aumentar a confiabilidade dos sinais de negociação.

- Alteração da taxa de flutuação: Ajusta o volume de negociação e o nível de stop loss de acordo com a dinâmica da taxa de flutuação do mercado.

- Otimização de custos de transação: introdução de modelos de custos de transação para otimizar a frequência e o tamanho das transações.

Resumir

A estratégia de negociação de balanço múltipla é um sistema de negociação integrado, forte e adaptável. A combinação de vários indicadores técnicos e níveis de preços permite que a estratégia mantenha a estabilidade em diferentes ambientes de mercado. Embora existam alguns riscos, esses riscos podem ser controlados de forma eficaz com otimização e ajuste contínuos.

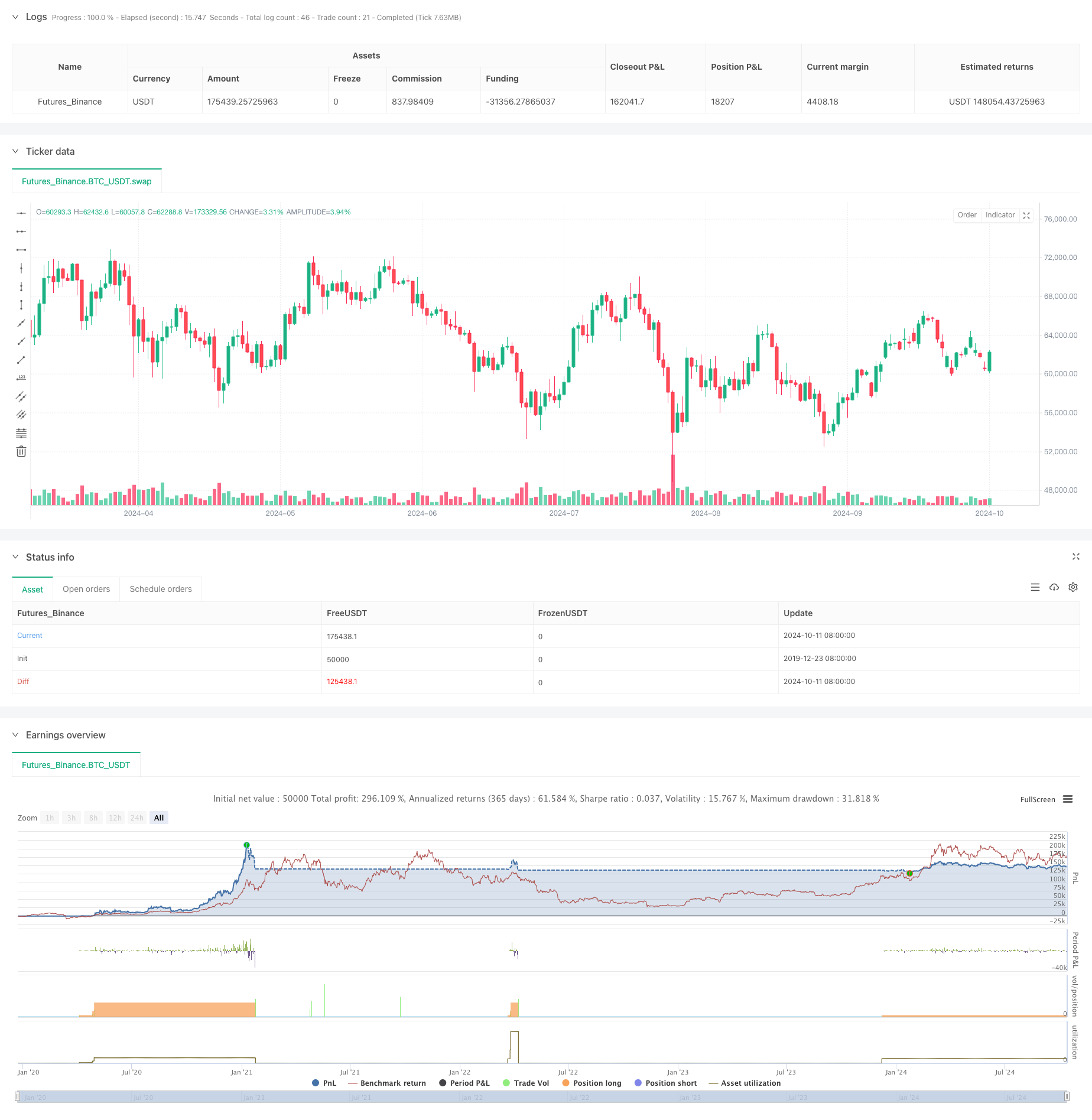

/*backtest

start: 2019-12-23 08:00:00

end: 2024-10-12 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Incremental Order size +', shorttitle='TradingPost', overlay=true, default_qty_value=1, pyramiding=10)

//Heiken Ashi

isHA = input(false, 'HA Candles')

//MACD

fastLength = 12

slowlength = 26

MACDLength = 9

MACD = ta.ema(close, fastLength) - ta.ema(close, slowlength)

aMACD = ta.ema(MACD, MACDLength)

delta = MACD - aMACD

//Bollinger Bands Exponential

src = open

len = 18

e = ta.ema(src, len)

evar = (src - e) * (src - e)

evar2 = math.sum(evar, len) / len

std = math.sqrt(evar2)

Multiplier = input.float(3, minval=0.01, title='# of STDEV\'s')

upband = e + Multiplier * std

dnband = e - Multiplier * std

//EMA

ema3 = ta.ema(close, 3)

//RSIplot

length = 45

overSold = 90

overBought = 10

price = close

vrsi = ta.rsi(price, length)

notna = not na(vrsi)

macdlong = ta.crossover(delta, 0)

macdshort = ta.crossunder(delta, 0)

rsilong = notna and ta.crossover(vrsi, overSold)

rsishort = notna and ta.crossunder(vrsi, overBought)

lentt = input(14, 'Pivot Length')

//The length defines how many periods a high or low must hold to be a "relevant pivot"

h = ta.highest(lentt)

//The highest high over the length

h1 = ta.dev(h, lentt) ? na : h

//h1 is a pivot of h if it holds for the full length

hpivot = fixnan(h1)

//creates a series which is equal to the last pivot

l = ta.lowest(lentt)

l1 = ta.dev(l, lentt) ? na : l

lpivot = fixnan(l1)

//repeated for lows

last_hpivot = 0.0

last_lpivot = 0.0

last_hpivot := h1 ? time : nz(last_hpivot[1])

last_lpivot := l1 ? time : nz(last_lpivot[1])

long_time = last_hpivot > last_lpivot ? 0 : 1

//FIBS

z = input(100, 'Z-Index')

p_offset = 2

transp = 60

a = (ta.lowest(z) + ta.highest(z)) / 2

b = ta.lowest(z)

c = ta.highest(z)

fibonacci = input(0, 'Fibonacci') / 100

//Fib Calls

fib0 = (hpivot - lpivot) * fibonacci + lpivot

fib1 = (hpivot - lpivot) * .21 + lpivot

fib2 = (hpivot - lpivot) * .3 + lpivot

fib3 = (hpivot - lpivot) * .5 + lpivot

fib4 = (hpivot - lpivot) * .62 + lpivot

fib5 = (hpivot - lpivot) * .7 + lpivot

fib6 = (hpivot - lpivot) * 1.00 + lpivot

fib7 = (hpivot - lpivot) * 1.27 + lpivot

fib8 = (hpivot - lpivot) * 2 + lpivot

fib9 = (hpivot - lpivot) * -.27 + lpivot

fib10 = (hpivot - lpivot) * -1 + lpivot

//Heiken Ashi Candles

heikenashi_1 = ticker.heikinashi(syminfo.tickerid)

data2 = isHA ? heikenashi_1 : syminfo.tickerid

res5 = input.timeframe('5', 'Resolution')

//HT Fibs

hfib0 = request.security(data2, res5, fib0[1])

hfib1 = request.security(data2, res5, fib1[1])

hfib2 = request.security(data2, res5, fib2[1])

hfib3 = request.security(data2, res5, fib3[1])

hfib4 = request.security(data2, res5, fib4[1])

hfib5 = request.security(data2, res5, fib5[1])

hfib6 = request.security(data2, res5, fib6[1])

hfib7 = request.security(data2, res5, fib7[1])

hfib8 = request.security(data2, res5, fib8[1])

hfib9 = request.security(data2, res5, fib9[1])

hfib10 = request.security(data2, res5, fib10[1])

vrsiup = vrsi > vrsi[1] and vrsi[1] > vrsi[2]

vrsidown = vrsi < vrsi[1] and vrsi[1] < vrsi[2]

long = ta.cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

short = ta.cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long2 = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short2 = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

reverseOpens = input(false, 'Reverse Orders')

if reverseOpens

tmplong = long

long := short

short := tmplong

short

//Strategy

ts = input(99999, 'TS')

tp = input(30, 'TP')

sl = input(15, 'SL')

last_long = 0.0

last_short = 0.0

last_long := long ? time : nz(last_long)

last_short := short ? time : nz(last_short)

in_long = last_long > last_short

in_short = last_short > last_long

long_signal = ta.crossover(last_long, last_short)

short_signal = ta.crossover(last_short, last_long)

last_open_long = 0.0

last_open_short = 0.0

last_open_long := long ? open : nz(last_open_long[1])

last_open_short := short ? open : nz(last_open_short[1])

last_open_long_signal = 0.0

last_open_short_signal = 0.0

last_open_long_signal := long_signal ? open : nz(last_open_long_signal[1])

last_open_short_signal := short_signal ? open : nz(last_open_short_signal[1])

last_high = 0.0

last_low = 0.0

last_high := not in_long ? na : in_long and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_short ? na : in_short and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

long_ts = not na(last_high) and high <= last_high - ts and high >= last_open_long_signal

short_ts = not na(last_low) and low >= last_low + ts and low <= last_open_short_signal

long_tp = high >= last_open_long + tp and long[1] == 0

short_tp = low <= last_open_short - tp and short[1] == 0

long_sl = low <= last_open_long - sl and long[1] == 0

short_sl = high >= last_open_short + sl and short[1] == 0

last_hfib_long = 0.0

last_hfib_short = 0.0

last_hfib_long := long_signal ? fib1 : nz(last_hfib_long[1])

last_hfib_short := short_signal ? fib5 : nz(last_hfib_short[1])

last_fib7 = 0.0

last_fib10 = 0.0

last_fib7 := long ? fib7 : nz(last_fib7[1])

last_fib10 := long ? fib10 : nz(last_fib10[1])

last_fib8 = 0.0

last_fib9 = 0.0

last_fib8 := short ? fib8 : nz(last_fib8[1])

last_fib9 := short ? fib9 : nz(last_fib9[1])

last_long_signal = 0.0

last_short_signal = 0.0

last_long_signal := long_signal ? time : nz(last_long_signal[1])

last_short_signal := short_signal ? time : nz(last_short_signal[1])

last_long_tp = 0.0

last_short_tp = 0.0

last_long_tp := long_tp ? time : nz(last_long_tp[1])

last_short_tp := short_tp ? time : nz(last_short_tp[1])

last_long_ts = 0.0

last_short_ts = 0.0

last_long_ts := long_ts ? time : nz(last_long_ts[1])

last_short_ts := short_ts ? time : nz(last_short_ts[1])

long_ts_signal = ta.crossover(last_long_ts, last_long_signal)

short_ts_signal = ta.crossover(last_short_ts, last_short_signal)

last_long_sl = 0.0

last_short_sl = 0.0

last_long_sl := long_sl ? time : nz(last_long_sl[1])

last_short_sl := short_sl ? time : nz(last_short_sl[1])

long_tp_signal = ta.crossover(last_long_tp, last_long)

short_tp_signal = ta.crossover(last_short_tp, last_short)

long_sl_signal = ta.crossover(last_long_sl, last_long)

short_sl_signal = ta.crossover(last_short_sl, last_short)

last_long_tp_signal = 0.0

last_short_tp_signal = 0.0

last_long_tp_signal := long_tp_signal ? time : nz(last_long_tp_signal[1])

last_short_tp_signal := short_tp_signal ? time : nz(last_short_tp_signal[1])

last_long_sl_signal = 0.0

last_short_sl_signal = 0.0

last_long_sl_signal := long_sl_signal ? time : nz(last_long_sl_signal[1])

last_short_sl_signal := short_sl_signal ? time : nz(last_short_sl_signal[1])

last_long_ts_signal = 0.0

last_short_ts_signal = 0.0

last_long_ts_signal := long_ts_signal ? time : nz(last_long_ts_signal[1])

last_short_ts_signal := short_ts_signal ? time : nz(last_short_ts_signal[1])

true_long_signal = long_signal and last_long_sl_signal > last_long_signal[1] or long_signal and last_long_tp_signal > last_long_signal[1] or long_signal and last_long_ts_signal > last_long_signal[1]

true_short_signal = short_signal and last_short_sl_signal > last_short_signal[1] or short_signal and last_short_tp_signal > last_short_signal[1] or short_signal and last_short_ts_signal > last_short_signal[1]

// strategy.entry("BLUE", strategy.long, when=long)

// strategy.entry("RED", strategy.short, when=short)

g = delta > 0 and vrsi < overSold and vrsiup

r = delta < 0 and vrsi > overBought and vrsidown

long1 = ta.cross(close, fib1) and g and last_long_signal[1] > last_short_signal // and last_long_signal > long

short1 = ta.cross(close, fib5) and r and last_short_signal[1] > last_long_signal // and last_short_signal > short

last_long1 = 0.0

last_short1 = 0.0

last_long1 := long1 ? time : nz(last_long1[1])

last_short1 := short1 ? time : nz(last_short1[1])

last_open_long1 = 0.0

last_open_short1 = 0.0

last_open_long1 := long1 ? open : nz(last_open_long1[1])

last_open_short1 := short1 ? open : nz(last_open_short1[1])

long1_signal = ta.crossover(last_long1, last_long_signal)

short1_signal = ta.crossover(last_short1, last_short_signal)

last_long1_signal = 0.0

last_short1_signal = 0.0

last_long1_signal := long1_signal ? time : nz(last_long1_signal[1])

last_short1_signal := short1_signal ? time : nz(last_short1_signal[1])

long2 = ta.cross(close, fib2) and g and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short2 = ta.cross(close, fib4) and r and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long2 = 0.0

last_short2 = 0.0

last_long2 := long2 ? time : nz(last_long2[1])

last_short2 := short2 ? time : nz(last_short2[1])

last_open_short2 = 0.0

last_open_short2 := short2 ? open : nz(last_open_short2[1])

long2_signal = ta.crossover(last_long2, last_long1_signal) and long1_signal == 0

short2_signal = ta.crossover(last_short2, last_short1_signal) and short1_signal == 0

last_long2_signal = 0.0

last_short2_signal = 0.0

last_long2_signal := long2_signal ? time : nz(last_long2_signal[1])

last_short2_signal := short2_signal ? time : nz(last_short2_signal[1])

//Trade 4

long3 = ta.cross(close, fib3) and g and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short3 = ta.cross(close, fib3) and r and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long3 = 0.0

last_short3 = 0.0

last_long3 := long3 ? time : nz(last_long3[1])

last_short3 := short3 ? time : nz(last_short3[1])

last_open_short3 = 0.0

last_open_short3 := short3 ? open : nz(last_open_short3[1])

long3_signal = ta.crossover(last_long3, last_long2_signal) and long2_signal == 0

short3_signal = ta.crossover(last_short3, last_short2_signal) and short2_signal == 0

last_long3_signal = 0.0

last_short3_signal = 0.0

last_long3_signal := long3_signal ? time : nz(last_long3_signal[1])

last_short3_signal := short3_signal ? time : nz(last_short3_signal[1])

//Trade 5

long4 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short4 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long4 = 0.0

last_short4 = 0.0

last_long4 := long4 ? time : nz(last_long4[1])

last_short4 := short4 ? time : nz(last_short4[1])

long4_signal = ta.crossover(last_long4, last_long3_signal) and long2_signal == 0 and long3_signal == 0

short4_signal = ta.crossover(last_short4, last_short3_signal) and short2_signal == 0 and short3_signal == 0

last_long4_signal = 0.0

last_short4_signal = 0.0

last_long4_signal := long4_signal ? time : nz(last_long4_signal[1])

last_short4_signal := short4_signal ? time : nz(last_short4_signal[1])

//Trade 6

long5 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short5 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long5 = 0.0

last_short5 = 0.0

last_long5 := long5 ? time : nz(last_long5[1])

last_short5 := short5 ? time : nz(last_short5[1])

long5_signal = ta.crossover(last_long5, last_long4_signal) and long3_signal == 0 and long4_signal == 0

short5_signal = ta.crossover(last_short5, last_short4_signal) and short3_signal == 0 and short4_signal == 0

last_long5_signal = 0.0

last_short5_signal = 0.0

last_long5_signal := long5_signal ? time : nz(last_long5_signal[1])

last_short5_signal := short5_signal ? time : nz(last_short5_signal[1])

//Trade 7

long6 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short6 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long6 = 0.0

last_short6 = 0.0

last_long6 := long6 ? time : nz(last_long6[1])

last_short6 := short6 ? time : nz(last_short6[1])

long6_signal = ta.crossover(last_long6, last_long5_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0

short6_signal = ta.crossover(last_short6, last_short5_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0

last_long6_signal = 0.0

last_short6_signal = 0.0

last_long6_signal := long6_signal ? time : nz(last_long6_signal[1])

last_short6_signal := short6_signal ? time : nz(last_short6_signal[1])

//Trade 8

long7 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short7 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long7 = 0.0

last_short7 = 0.0

last_long7 := long7 ? time : nz(last_long7[1])

last_short7 := short7 ? time : nz(last_short7[1])

long7_signal = ta.crossover(last_long7, last_long6_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0

short7_signal = ta.crossover(last_short7, last_short6_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0

last_long7_signal = 0.0

last_short7_signal = 0.0

last_long7_signal := long7_signal ? time : nz(last_long7_signal[1])

last_short7_signal := short7_signal ? time : nz(last_short7_signal[1])

//Trade 9

long8 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short8 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long8 = 0.0

last_short8 = 0.0

last_long8 := long8 ? time : nz(last_long8[1])

last_short8 := short8 ? time : nz(last_short8[1])

long8_signal = ta.crossover(last_long8, last_long7_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0 and long7_signal == 0

short8_signal = ta.crossover(last_short8, last_short7_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0 and short7_signal == 0

last_long8_signal = 0.0

last_short8_signal = 0.0

last_long8_signal := long8_signal ? time : nz(last_long8_signal[1])

last_short8_signal := short8_signal ? time : nz(last_short8_signal[1])

//Trade 10

long9 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short9 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long9 = 0.0

last_short9 = 0.0

last_long9 := long9 ? time : nz(last_long9[1])

last_short9 := short9 ? time : nz(last_short9[1])

long9_signal = ta.crossover(last_long9, last_long8_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0 and long7_signal == 0 and long8_signal == 0

short9_signal = ta.crossover(last_short9, last_short8_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0 and short7_signal == 0 and short8_signal == 0

last_long9_signal = 0.0

last_short9_signal = 0.0

last_long9_signal := long9_signal ? time : nz(last_long9_signal[1])

last_short9_signal := short9_signal ? time : nz(last_short9_signal[1])

strategy.entry('Long', strategy.long, qty=1, when=long_signal)

strategy.entry('Short', strategy.short, qty=1, when=short_signal)

strategy.entry('Long', strategy.long, qty=2, when=long1_signal)

strategy.entry('Short1', strategy.short, qty=2, when=short1_signal)

strategy.entry('Long', strategy.long, qty=4, when=long2_signal)

strategy.entry('Short2', strategy.short, qty=4, when=short2_signal)

strategy.entry('Long', strategy.long, qty=8, when=long3_signal)

strategy.entry('Short3', strategy.short, qty=8, when=short3_signal)

strategy.entry('Long', strategy.long, qty=5, when=long4_signal)

strategy.entry('Short', strategy.short, qty=5, when=short4_signal)

strategy.entry('Long', strategy.long, qty=6, when=long5_signal)

strategy.entry('Short', strategy.short, qty=6, when=short5_signal)

strategy.entry('Long', strategy.long, qty=7, when=long6_signal)

strategy.entry('Short', strategy.short, qty=7, when=short6_signal)

strategy.entry('Long', strategy.long, qty=8, when=long7_signal)

strategy.entry('Short', strategy.short, qty=8, when=short7_signal)

strategy.entry('Long', strategy.long, qty=9, when=long8_signal)

strategy.entry('Short', strategy.short, qty=9, when=short8_signal)

strategy.entry('Long', strategy.long, qty=10, when=long9_signal)

strategy.entry('Short', strategy.short, qty=10, when=short9_signal)

short1_tp = low <= last_open_short1 - tp and short1[1] == 0

short2_tp = low <= last_open_short2 - tp and short2[1] == 0

short3_tp = low <= last_open_short3 - tp and short3[1] == 0

short1_sl = high >= last_open_short1 + sl and short1[1] == 0

short2_sl = high >= last_open_short2 + sl and short2[1] == 0

short3_sl = high >= last_open_short3 + sl and short3[1] == 0

close_long = ta.cross(close, fib6)

close_short = ta.cross(close, fib0)

// strategy.close("Long", when=close_long)

// strategy.close("Long", when=long_tp)

// strategy.close("Long", when=long_sl)

// strategy.close("Short", when=long_signal)

// strategy.close("Short1", when=long_signal)

// strategy.close("Short2", when=long_signal)

// strategy.close("Short3", when=long_signal)

strategy.close('Short', when=short_tp)

strategy.close('Short1', when=short1_tp)

strategy.close('Short2', when=short2_tp)

strategy.close('Short3', when=short3_tp)

strategy.close('Short', when=short_sl)

strategy.close('Short1', when=short1_sl)

strategy.close('Short2', when=short2_sl)

strategy.close('Short3', when=short3_sl)