Стратегия многовременной торговли на основе RSI и скользящих средних

Обзор

Ключевая идея этой стратегии заключается в том, чтобы использовать одновременно относительно сильный индекс ((RSI) и движущиеся средние разных временных циклов, чтобы идентифицировать переломные моменты в тренде, чтобы одновременно улавливать средне- и долгосрочные тенденции. Стратегия объединяет несколько торговых сигналов, направленных на повышение успешности торгов.

Стратегический принцип

- Рассчитывается RSI, а также скорый EMA и медленный WMA.

- Сигнал покупки/продажи возникает, когда линия RSI прорывается через WMA.

- Когда быстрая линия EMA прорывает медленную линию WMA, генерируется сигнал покупки/продажи.

- Когда RSI и EMA одновременно прорывают WMA, создается сильный сигнал покупки/продажи.

- В то же время, когда цена прорывает вспомогательную скользящую среднюю, можно усилить основной сигнал.

- Установка параметров остановки и остановки.

Стратегия сочетает в себе прорывные сигналы от различных технических индикаторов, подвижные средние с различными параметрами, чтобы идентифицировать тенденции в разных периодах, что повышает надежность стратегии. Показатель RSI определяет состояние перепродажи, EMA определяет краткосрочные тенденции, WMA определяет среднесрочные тенденции, а цена и вспомогательные средние подтверждают прорывные тенденции.

Анализ преимуществ

- Используя обратную характеристику RSI, можно воспользоваться возможностью для обратного движения в зоне перепродажи и перекупа.

- Помощь в использовании скользящих средних как фильтра тренда, чтобы избежать ложных прорывов.

- В сочетании с несколькими временными циклами, можно отслеживать как долгосрочные тенденции, так и ловить краткосрочные возможности.

- Интегрированные сигналы различных индикаторов повышают вероятность успешной торговли.

- Установка стратегии стоп-стоп, которая позволяет активно контролировать риск.

Анализ рисков

- RSI может создавать ложные сигналы, требуя дополнительной фильтрации подвижных средних.

- Возвращение к большому циклическому тренду может спровоцировать обратный торговый сигнал, к которому следует относиться с осторожностью.

- Необходимо оптимизировать параметры, такие как длина циклов RSI, циклы скользящих средних и т. д.

- Настройка точки остановки требует осторожности, чтобы избежать попадания в ловушку.

Риск может быть снижен с помощью оптимизации параметров, строгой стратегии стоп-лосса и учета тенденций больших циклов.

Направление оптимизации

- Оптимизируйте RSI, чтобы найти оптимальную длину цикла.

- Испытание различных типов комбинаций скользящих средних.

- Добавление показателей волатильности, таких как ATR, динамическая коррекция стоп-стоп.

- Добавление модуля управления объемом транзакций.

- Оптимизация параметров и оценка качества сигнала с использованием машинного обучения.

Подвести итог

Эта стратегия объединяет идею отслеживания тенденций и реверсионных торговых точек, включая анализ нескольких временных рамок и использование нескольких индикаторов для повышения выигрышной вероятности торгов. Ключевое значение заключается в том, чтобы контролировать риск, оптимизировать параметры, а также учитывать влияние больших циклических тенденций на торговлю.

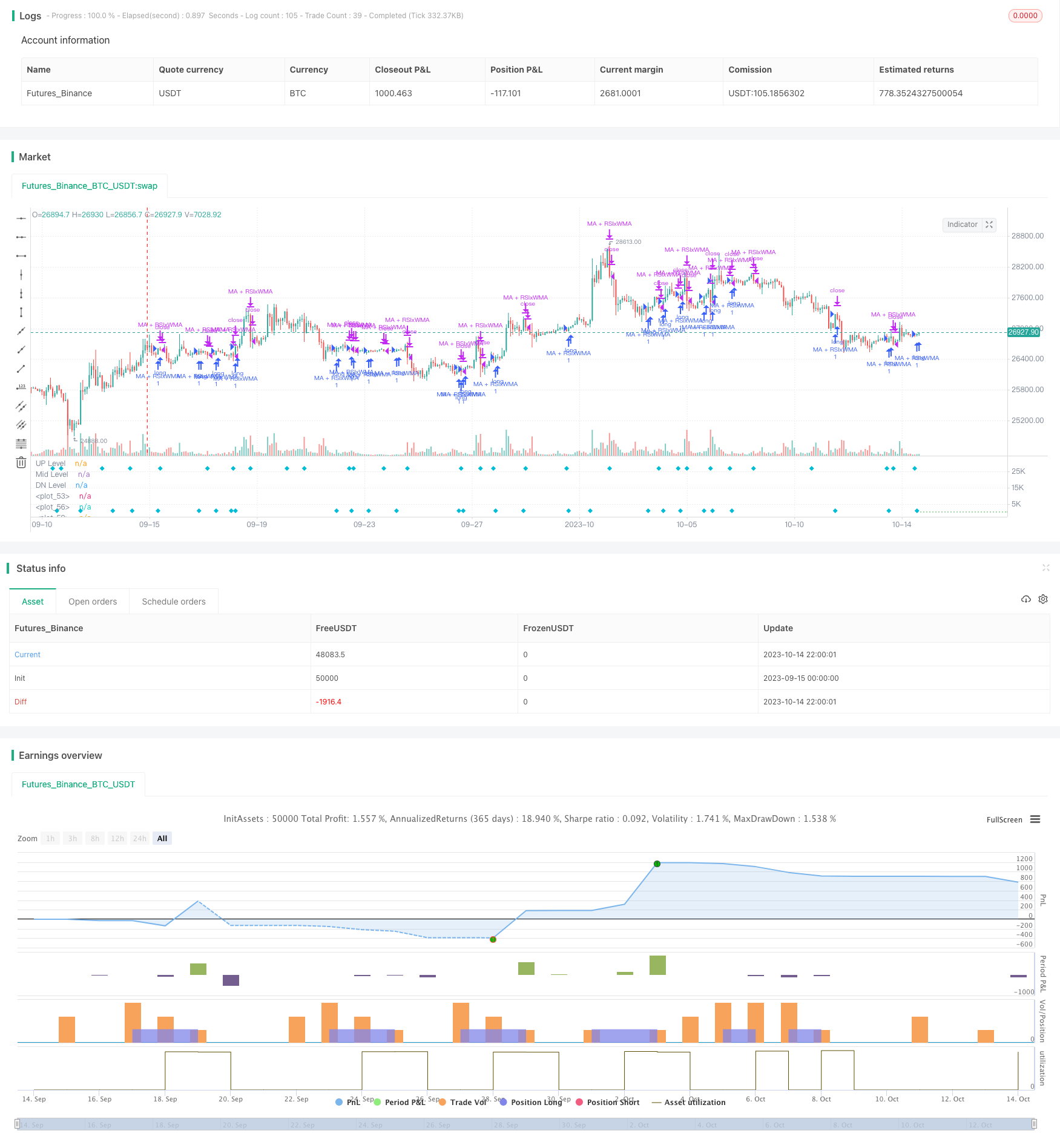

/*backtest

start: 2023-09-15 00:00:00

end: 2023-10-15 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HamidBox

//@version=4

// strategy("H-M By HamidBox-YT", default_qty_type=strategy.cash, default_qty_value= 100, initial_capital=100, currency='USD', commission_type=strategy.commission.percent, commission_value=0.1)

ma(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

WMA(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

WithMA(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

rsi_inline = input(true , title="RSI Value)", inline="rsi")

rsiLength = input(title="Length:", type=input.integer, defval=9, minval=1, inline="rsi")

rsiLineM = input(title="Level:", type=input.integer, defval=50, minval=1, inline="rsi")

rsi_OSOBinline = input(true , title="RSI)", inline="rsiosob")

rsiLineU = input(title="O-BOUGHT", type=input.integer, defval=70, minval=1, inline="rsiosob")

rsiLineD = input(title="O-SOLD", type=input.integer, defval=30, minval=1, inline="rsiosob")

ma_inline = input(true , title="Price-MA)", inline="ma")

ma_type = input(title="Type", defval="EMA", options=["EMA","SMA","WMA","VWMA"], inline="ma")

emaLength = input(title="Length", type=input.integer, defval=3, inline="ma")

wma_inline = input(true , title="Trending-MA)", inline="wma")

ma_type2 = input(title="", defval="WMA", options=["EMA","SMA","WMA","VWMA"], inline="wma")

wmaLength = input(title="Length", type=input.integer, defval=21, inline="wma")

////////////////////////////////////////////////////////////////////////////////

startTime = input(title="Start Time", type = input.time, defval = timestamp("01 Jan 2021 00:00 +0000"), group="Backtest Time Period")

endTime = input(title="End Time", type = input.time, defval = timestamp("01 Jan 2200 00:00 +0000"), group="Backtest Time Period")

inDateRange = true

////////////////////////////////////////////////////////////////////////////////

rsi = rsi(close , rsiLength)

r = plot(rsi_inline ? rsi : na, color=color.yellow, linewidth=2)

EMA = ma(rsi, emaLength, ma_type)

e = plot(ma_inline ? EMA : na, color=color.lime)

myWMA = ma(rsi, wmaLength, ma_type2)

w = plot(wma_inline ? myWMA : na, color=color.white, linewidth=2)

up = hline(rsiLineU, title='UP Level', linewidth=1, color=color.red, linestyle=hline.style_dotted)

mid = hline(rsiLineM, title='Mid Level', linewidth=2, color=color.white, linestyle=hline.style_dotted)

dn = hline(rsiLineD, title='DN Level', linewidth=1, color=color.green, linestyle=hline.style_dotted)

col_e_w = EMA > myWMA ? color.new(color.green , 85) : color.new(color.red , 85)

col_r_w = rsi > myWMA ? color.new(color.green , 85) : color.new(color.red , 85)

fill(e , w, color=col_e_w)

fill(r , w, color=col_r_w)

////////////////////////////////////////////////////////////////////////////////

//Signals = input(true,group="👇 🚦 --- Backtesting Signals Type --- 🚦 ")

///////////////////////////////////////////////////////////////////////////////

RSI_Cross = input(false, "RSI x Trending-MA", inline="wma_cross",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsiBuySignal = crossover(rsi , myWMA)

plotshape(RSI_Cross ? rsiBuySignal : na, title="RSI Crossover", style=shape.labelup, location=location.bottom, color=color.green)

rsiSellSignal = crossunder(rsi , myWMA)

plotshape(RSI_Cross ? rsiSellSignal : na, title="RSI Crossunder", style=shape.labeldown, location=location.top, color=color.red)

if rsiBuySignal and RSI_Cross and inDateRange

strategy.entry("RSIxWMA", strategy.long)

if rsiSellSignal and RSI_Cross and inDateRange

strategy.close("RSIxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

MA_Cross = input(false, "MA x Trendin-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

maBuySignal = crossover(EMA, myWMA)

plotshape(MA_Cross ? maBuySignal : na, title="MA Cross", style=shape.circle, location=location.bottom, color=color.lime)

maSellSignal = crossunder(EMA , myWMA)

plotshape(MA_Cross ? maSellSignal : na, title="RSI Crossunder", style=shape.circle, location=location.top, color=color.maroon)

if maBuySignal and MA_Cross and inDateRange

strategy.entry("MAxWMA", strategy.long)

if maSellSignal and MA_Cross and inDateRange

strategy.close("MAxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

Mix = input(false, "RSI + EMA x Trending-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_ma_buy = crossover(rsi , myWMA) and crossover(EMA, myWMA)

rsi_ma_sell = crossunder(rsi , myWMA) and crossunder(EMA, myWMA)

plotshape(Mix ? rsi_ma_buy : na, title="RSI Crossunder", style=shape.circle, location=location.bottom, color=color.lime, size=size.tiny)

plotshape(Mix ? rsi_ma_sell : na, title="RSI Crossunder", style=shape.circle, location=location.top, color=color.yellow, size=size.tiny)

if rsi_ma_buy and Mix and inDateRange

strategy.entry("RSI+EMA x WMA", strategy.long)

if rsi_ma_sell and Mix and inDateRange

strategy.close("RSI+EMA x WMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

wma_cross = input(false, "Trending-MA x 50",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

wma_buy = crossover(myWMA , rsiLineM)

plotshape(wma_cross ? wma_buy : na, title="WMA Cross", style=shape.diamond, location=location.bottom, color=color.aqua)

wma_sell = crossunder(myWMA , rsiLineM)

plotshape(wma_cross ? wma_sell : na, title="WMA Cross", style=shape.diamond, location=location.top, color=color.aqua)

if wma_buy and wma_cross and inDateRange

strategy.entry("WMA x 50", strategy.long)

if wma_sell and wma_cross and inDateRange

strategy.close("WMA x 50", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

rsi_50 = input(false, "RSI x 50",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_50_buy = crossover(rsi , rsiLineM)

plotshape(rsi_50 ? rsi_50_buy : na, title="WMA Cross", style=shape.cross, location=location.bottom, color=color.purple)

rsi_50_sell = crossunder(rsi , rsiLineM)

plotshape(rsi_50 ? rsi_50_sell : na, title="WMA Cross", style=shape.cross, location=location.top, color=color.purple)

if rsi_50_buy and rsi_50 and inDateRange

strategy.entry("RSI Cross 50", strategy.long)

if rsi_50_sell and rsi_50 and inDateRange

strategy.close("RSI Cross 50", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

RSI_OS_OB = input(false, "RSI OS/OB x Trending-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_OB_buy = (rsi < rsiLineD or rsi[1] < rsiLineD[1] or rsi[2] < rsiLineD[2] or rsi[3] < rsiLineD[3] or rsi[4] < rsiLineD[4] or rsi[5] < rsiLineD[5]) and rsiBuySignal

plotshape(RSI_OS_OB ? rsi_OB_buy : na, title="RSI OB + Cross", style=shape.circle, location=location.bottom, color=color.lime, size=size.tiny)

rsi_OS_sell = (rsi > rsiLineU or rsi[1] > rsiLineU[1] or rsi[2] > rsiLineU[2] or rsi[3] > rsiLineU[3] or rsi[4] > rsiLineU[4] or rsi[5] > rsiLineU[5]) and maSellSignal

plotshape(RSI_OS_OB ? rsi_OS_sell : na, title="RSI OS + Cross", style=shape.circle, location=location.top, color=color.red, size=size.tiny)

if rsi_OB_buy and RSI_OS_OB and inDateRange

strategy.entry("RSI-OBOS x WMA", strategy.long)

if rsi_OS_sell and RSI_OS_OB and inDateRange

strategy.close("RSI-OBOS x WMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

rsi_OB_OS = input(false, "RSI Over Sold/Bought",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsiBuy = crossover(rsi , rsiLineD)

rsiSell = crossunder(rsi, rsiLineU)

rsiExit = crossunder(rsi, rsiLineD)

plotshape(rsi_OB_OS ? rsiBuy : na, title="RSI OB", style=shape.cross, location=location.bottom, color=color.purple)

plotshape(rsi_OB_OS ? crossunder(rsi, rsiLineU) : na, title="RSI OS", style=shape.cross, location=location.top, color=color.purple)

plotshape(rsi_OB_OS ? rsiExit : na, title="RSI OS", style=shape.cross, location=location.bottom, color=color.red)

if rsiBuy and rsi_OB_OS and inDateRange

strategy.entry("RSI OB", strategy.long)

if (rsiSell or rsiExit) and rsi_OB_OS and inDateRange

strategy.close("RSI OB", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

With_MA_Vis = input(true , title="With MA Signal)", inline="WITH MA", group="With MA")

withMA_type = input(title="", defval="SMA", options=["EMA","SMA","WMA","VWMA"], inline="WITH MA", group="With MA")

with_MALen = input(title="", defval=9, type=input.integer, inline="WITH MA", group="With MA")

// TAKE-PROFIT / STOP-LOSS

Stop_Take_Vis = input(true, "TP-SL")

LongSLValue = input(title="SL %", type=input.float, defval=3, minval=0.5) * 0.01

LongTPValue = input(title="TP %", type=input.float, defval=15, minval=0.5) * 0.01

LongSLDetermine = strategy.position_avg_price * (1 - LongSLValue)

LongTPDetermine = strategy.position_avg_price * (1 + LongTPValue)

//////////////////////////

with_ma = WithMA(close, with_MALen, withMA_type)

Close_buy_MA = crossover(close , with_ma)

Close_sell_MA = crossunder(close , with_ma)

// PLOT OPTION

WithMaSignal = input(true, "MA + RSI x Trending-MA",group="With MA") // INPUT

// CONDITION IN VARIABLE

withMA_RSI_BUY = (Close_buy_MA and rsiBuySignal) and WithMaSignal and inDateRange

withMA_RSI_SELL = (Close_sell_MA and rsiSellSignal) and WithMaSignal and inDateRange

// PLOT ING

plotshape(WithMaSignal ? withMA_RSI_BUY : na, title="With MA", style=shape.diamond, location=location.bottom, color=color.aqua)

plotshape(WithMaSignal ? withMA_RSI_SELL : na, title="With MA", style=shape.diamond, location=location.top, color=color.aqua)

if withMA_RSI_BUY

strategy.entry("MA + RSIxWMA", strategy.long)

if withMA_RSI_SELL

strategy.close("MA + RSIxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

// FOR SL - TP

if (strategy.position_size > 0) and Stop_Take_Vis

strategy.exit("BUY", stop=LongSLDetermine, limit=LongTPDetermine)