Стратегия тепловой карты MACD с несколькими таймфреймами

Обзор

Основная идея этой стратегии заключается в том, чтобы использовать комбинированные сигналы MACD-индикаторов с различных временных периодов для определения времени изменения рыночной тенденции и достижения низкорисковой торговли.

Стратегический принцип

Стратегия использует 5 различных временных периодов MACD, включая 60 минут, 120 минут, 240 минут, 480 минут и солнечный свет, чтобы сформировать комбинацию многократных временных рамок MACD.

Когда MACD-индикаторы всех пяти временных циклов являются положительными (или отрицательными), а верхняя K-линия еще не является полностью MACD-положительной (или отрицательной), то следует рассматривать сигнал как многоголовый (или пустоголовый) сигнал, сделайте многоголовый (или пустоголовый).

Остановка убытков в фиксированном количестве баллов.

Остановка происходит в виде двух уровней мобильной остановки, закрывающей часть и всю позицию соответственно.

Когда в MACD появляется более одного пустого случая, рассматривается как сигнал обратного отсчета и выровняется текущая позиция.

Также используется TsL для отслеживания потерь.

Используйте функцию Stop Loss Moving to Break Even, которая при достижении определенного уровня прибыли перемещает Stop Loss вблизи от начальной цены, чтобы закрепить прибыль.

Используя синтаксис Pineconector, динамически генерируется всплывающее окно транзакционного сигнала.

Стратегические преимущества

Многоразовый MACD-пакет, который позволяет повысить точность сигналов, улавливать тенденции и отфильтровывать часть шума.

Установка движущихся стопов на двух уровнях позволяет получать частичную прибыль в большом тренде несколько раз.

Фиксированное количество точек стоп-убытков, позволяющих контролировать единичные потери.

При несоответствии показателей MACD можно своевременно прекратить убытки, чтобы избежать их нарушения.

TsL следит за остановкой, чтобы остановка следила за изменениями цены в реальном времени.

Стоп-лосс переходит в функцию BE, которая может блокировать часть прибыли после того, как убыток становится прибыльным.

Динамический торговый сигнал, который может быть подключен к MT4/5 для автоматической торговли.

Риски и решения

В MACD-сигнале могут быть ложные прорывы, которые приводят к ненужным потерям. Можно соответствующим образом скорректировать параметры MACD, отфильтровывая избыточные ложные сигналы.

Фиксированный стоп-маркер может быть слишком большим или слишком маленьким. Можно тестировать разные стоп-маркеры, чтобы найти оптимальный параметр.

Две остановки слишком близко или слишком далеко, чтобы достичь оптимального снятия и прибыли. Можно протестировать различные остановки, чтобы найти оптимальные параметры.

Функция BE может срабатывать слишком рано или слишком поздно. Можно тестировать различные точки срабатывания BE, чтобы найти оптимальные параметры.

Следовать за стоп-дистанцией может быть слишком большим или слишком маленьким. Можно тестировать различные следовать за стоп-дистанцией, чтобы найти оптимальные параметры.

Оптимизация стратегии

Можно тестировать множество комбинаций MACD в разных временных рамках, чтобы найти оптимальные комбинации для захвата рыночных тенденций.

Введение дополнительных показателей, позволяющих оценить ситуацию, позволит избежать открытия позиций в неблагоприятных условиях.

Различия в параметрах и настройках различных сортов могут быть изучены для разработки адаптивной системы остановки повреждений.

Динамическая оптимизация параметров стоп-стоп может быть реализована в сочетании с технологиями машинного обучения.

Можно ввести модуль управления капиталом, который позволит динамично регулировать размер позиции и контролировать риск.

Подвести итог

В целом, эта стратегия является относительно устойчивой стратегией для отслеживания тенденций с использованием многократных временных рамок MACD-индикатора для определения тенденции, установки двойных стопов, отслеживания стопов и функций BE для блокировки прибыли и фиксирования риска контроля стопов. Стабильность и доходность стратегии могут быть дополнительно усилены путем оптимизации параметров и расширения функций.

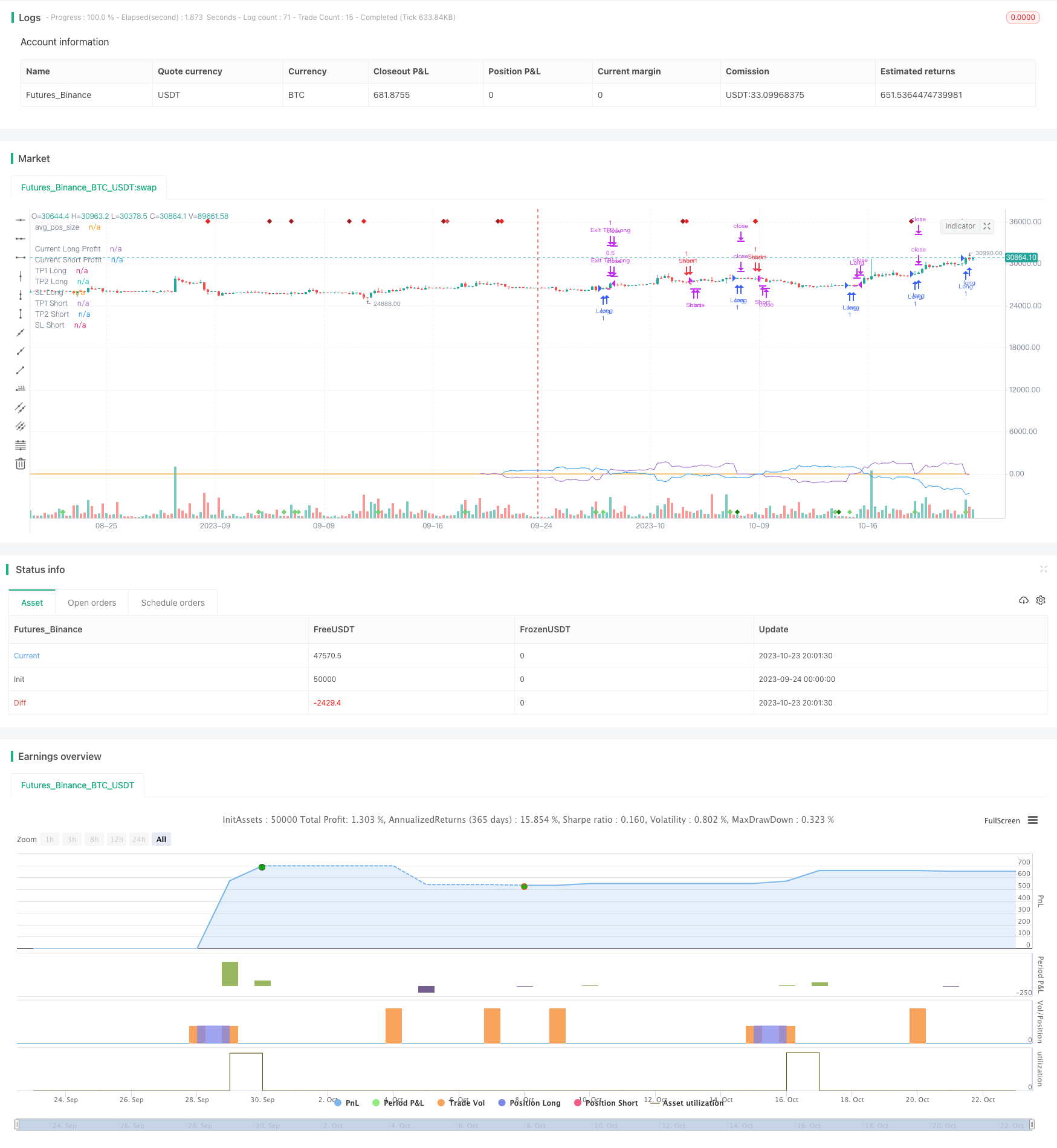

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 6h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//@strategy_alert_message {{strategy.order.alert_message}}

SCRIPT_NAME = "Heatmap MACD Strategy - Pineconnector"

strategy(SCRIPT_NAME,

overlay= true,

process_orders_on_close = true,

calc_on_every_tick = true,

pyramiding = 1,

initial_capital = 100000,

default_qty_type = strategy.fixed,

default_qty_value = 1,

commission_type = strategy.commission.percent,

commission_value = 0.075,

slippage = 1

)

pineconnector_licence_ID = input.string(title = "Licence ID", defval = "123456789", group = "Pineconnector", tooltip = "Insert your Pineconnector Licence ID here")

pos_size = input.float(3, minval = 0, maxval = 100, title = "Position Size", group = "Position Size", tooltip = "Required to specify the position size here for Pineconnector to work properly")

res1 = input.timeframe('60', title='First Timeframe', group = "Timeframes")

res2 = input.timeframe('120', title='Second Timeframe', group = "Timeframes")

res3 = input.timeframe('240', title='Third Timeframe', group = "Timeframes")

res4 = input.timeframe('240', title='Fourth Timeframe', group = "Timeframes")

res5 = input.timeframe('480', title='Fifth Timeframe', group = "Timeframes")

macd_src = input.source(close, title="Source", group = "MACD")

fast_len = input.int(9, minval=1, title="Fast Length", group = "MACD")

slow_len = input.int(26, minval=1, title="Slow Length", group = "MACD")

sig_len = input.int(9, minval=1, title="Signal Length", group = "MACD")

// # ========================================================================= #

// # | Close on Opposite |

// # ========================================================================= #

use_close_opposite = input.bool(false, title = "Close on Opposite Signal?", group = "Close on Opposite", tooltip = "Close the position if 1 or more MACDs become bearish (for longs) or bullish (for shorts)")

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

use_sl = input.bool(true, title = "Use Stop Loss?", group = "Stop Loss")

sl_mode = "pips"//input.string("%", title = "Mode", options = ["%", "pips"], group = "Stop Loss")

sl_value = input.float(40, minval = 0, title = "Value", group = "Stop Loss", inline = "stoploss")// * 0.01

// # ========================================================================= #

// # | Trailing Stop Loss |

// # ========================================================================= #

use_tsl = input.bool(false, title = "Use Trailing Stop Loss?", group = "Trailing Stop Loss")

tsl_input_pips = input.float(10, minval = 0, title = "Trailing Stop Loss (pips)", group = "Trailing Stop Loss")

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

use_tp1 = input.bool(true, title = "Use Take Profit 1?", group = "Take Profit 1")

tp1_value = input.float(30, minval = 0, title = "Value (pips)", group = "Take Profit 1")// * 0.01

tp1_qty = input.float(50, minval = 0, title = "Quantity (%)", group = "Take Profit 1")// * 0.01

use_tp2 = input.bool(true, title = "Use Take Profit 2?", group = "Take Profit 2")

tp2_value = input.float(50, minval = 0, title = "Value (pips)", group = "Take Profit 2")// * 0.01

// # ========================================================================= #

// # | Stop Loss to Breakeven |

// # ========================================================================= #

use_sl_be = input.bool(false, title = "Use Stop Loss to Breakeven Mode?", group = "Break Even")

sl_be_value = input.float(30, step = 0.1, minval = 0, title = "Value (pips)", group = "Break Even", inline = "breakeven")

sl_be_offset = input.int(1, step = 1, minval = 0, title = "Offset (pips)", group = "Break Even", tooltip = "Set the SL at BE price +/- offset value")

[_, _, MTF1_hist] = request.security(syminfo.tickerid, res1, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF2_hist] = request.security(syminfo.tickerid, res2, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF3_hist] = request.security(syminfo.tickerid, res3, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF4_hist] = request.security(syminfo.tickerid, res4, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF5_hist] = request.security(syminfo.tickerid, res5, ta.macd(macd_src, fast_len, slow_len, sig_len))

bull_hist1 = MTF1_hist > 0 and MTF1_hist[1] < 0

bull_hist2 = MTF2_hist > 0 and MTF2_hist[1] < 0

bull_hist3 = MTF3_hist > 0 and MTF3_hist[1] < 0

bull_hist4 = MTF4_hist > 0 and MTF4_hist[1] < 0

bull_hist5 = MTF5_hist > 0 and MTF5_hist[1] < 0

bear_hist1 = MTF1_hist < 0 and MTF1_hist[1] > 0

bear_hist2 = MTF2_hist < 0 and MTF2_hist[1] > 0

bear_hist3 = MTF3_hist < 0 and MTF3_hist[1] > 0

bear_hist4 = MTF4_hist < 0 and MTF4_hist[1] > 0

bear_hist5 = MTF5_hist < 0 and MTF5_hist[1] > 0

plotshape(bull_hist1, title = "Bullish MACD 1", location = location.bottom, style = shape.diamond, size = size.normal, color = #33e823)

plotshape(bull_hist2, title = "Bullish MACD 2", location = location.bottom, style = shape.diamond, size = size.normal, color = #1a7512)

plotshape(bull_hist3, title = "Bullish MACD 3", location = location.bottom, style = shape.diamond, size = size.normal, color = #479c40)

plotshape(bull_hist4, title = "Bullish MACD 4", location = location.bottom, style = shape.diamond, size = size.normal, color = #81cc7a)

plotshape(bull_hist5, title = "Bullish MACD 5", location = location.bottom, style = shape.diamond, size = size.normal, color = #76d66d)

plotshape(bear_hist1, title = "Bearish MACD 1", location = location.top, style = shape.diamond, size = size.normal, color = #d66d6d)

plotshape(bear_hist2, title = "Bearish MACD 2", location = location.top, style = shape.diamond, size = size.normal, color = #de4949)

plotshape(bear_hist3, title = "Bearish MACD 3", location = location.top, style = shape.diamond, size = size.normal, color = #cc2525)

plotshape(bear_hist4, title = "Bearish MACD 4", location = location.top, style = shape.diamond, size = size.normal, color = #a11d1d)

plotshape(bear_hist5, title = "Bearish MACD 5", location = location.top, style = shape.diamond, size = size.normal, color = #ed2424)

bull_count = (MTF1_hist > 0 ? 1 : 0) + (MTF2_hist > 0 ? 1 : 0) + (MTF3_hist > 0 ? 1 : 0) + (MTF4_hist > 0 ? 1 : 0) + (MTF5_hist > 0 ? 1 : 0)

bear_count = (MTF1_hist < 0 ? 1 : 0) + (MTF2_hist < 0 ? 1 : 0) + (MTF3_hist < 0 ? 1 : 0) + (MTF4_hist < 0 ? 1 : 0) + (MTF5_hist < 0 ? 1 : 0)

bull = bull_count == 5 and bull_count[1] < 5 and barstate.isconfirmed

bear = bear_count == 5 and bear_count[1] < 5 and barstate.isconfirmed

signal_candle = bull or bear

entryLongPrice = ta.valuewhen(bull and strategy.position_size[1] <= 0, close, 0)

entryShortPrice = ta.valuewhen(bear and strategy.position_size[1] >= 0, close, 0)

plot(strategy.position_size, title = "avg_pos_size")

get_pip_size() =>

float _pipsize = 1.

if syminfo.type == "forex"

_pipsize := (syminfo.mintick * (str.contains(syminfo.ticker, "JPY") ? 100 : 10))

else if str.contains(syminfo.ticker, "XAU") or str.contains(syminfo.ticker, "XAG")

_pipsize := 0.1

_pipsize

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

var float final_SL_Long = 0.

var float final_SL_Short = 0.

if signal_candle and use_sl

final_SL_Long := entryLongPrice - (sl_value * get_pip_size())

final_SL_Short := entryShortPrice + (sl_value * get_pip_size())

// # ========================================================================= #

// # | Trailing Stop Loss |

// # ========================================================================= #

var MaxReached = 0.0

if signal_candle[1]

MaxReached := strategy.position_size > 0 ? high : low

MaxReached := strategy.position_size > 0

? math.max(nz(MaxReached, high), high)

: strategy.position_size < 0 ? math.min(nz(MaxReached, low), low) : na

if use_tsl and use_sl

if strategy.position_size > 0

stopValue = MaxReached - (tsl_input_pips * get_pip_size())

final_SL_Long := math.max(stopValue, final_SL_Long[1])

else if strategy.position_size < 0

stopValue = MaxReached + (tsl_input_pips * get_pip_size())

final_SL_Short := math.min(stopValue, final_SL_Short[1])

// # ========================================================================= #

// # | Take Profit 1 |

// # ========================================================================= #

var float final_TP1_Long = 0.

var float final_TP1_Short = 0.

final_TP1_Long := entryLongPrice + (tp1_value * get_pip_size())

final_TP1_Short := entryShortPrice - (tp1_value * get_pip_size())

plot(use_tp1 and strategy.position_size > 0 ? final_TP1_Long : na, title = "TP1 Long", color = color.aqua, linewidth=2, style=plot.style_linebr)

plot(use_tp1 and strategy.position_size < 0 ? final_TP1_Short : na, title = "TP1 Short", color = color.blue, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Take Profit 2 |

// # ========================================================================= #

var float final_TP2_Long = 0.

var float final_TP2_Short = 0.

final_TP2_Long := entryLongPrice + (tp2_value * get_pip_size())

final_TP2_Short := entryShortPrice - (tp2_value * get_pip_size())

plot(use_tp2 and strategy.position_size > 0 and tp1_qty != 100 ? final_TP2_Long : na, title = "TP2 Long", color = color.orange, linewidth=2, style=plot.style_linebr)

plot(use_tp2 and strategy.position_size < 0 and tp1_qty != 100 ? final_TP2_Short : na, title = "TP2 Short", color = color.white, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Stop Loss to Breakeven |

// # ========================================================================= #

var bool SL_BE_REACHED = false

// Calculate open profit or loss for the open positions.

tradeOpenPL() =>

sumProfit = 0.0

for tradeNo = 0 to strategy.opentrades - 1

sumProfit += strategy.opentrades.profit(tradeNo)

result = sumProfit

//get_pip_size() =>

// syminfo.type == "forex" ? syminfo.pointvalue * 100 : 1

current_profit = tradeOpenPL()// * get_pip_size()

current_long_profit = (close - entryLongPrice) / (syminfo.mintick * 10)

current_short_profit = (entryShortPrice - close) / (syminfo.mintick * 10)

plot(current_short_profit, title = "Current Short Profit")

plot(current_long_profit, title = "Current Long Profit")

if use_sl_be

if strategy.position_size[1] > 0

if not SL_BE_REACHED

if current_long_profit >= sl_be_value

final_SL_Long := entryLongPrice + (sl_be_offset * get_pip_size())

SL_BE_REACHED := true

else if strategy.position_size[1] < 0

if not SL_BE_REACHED

if current_short_profit >= sl_be_value

final_SL_Short := entryShortPrice - (sl_be_offset * get_pip_size())

SL_BE_REACHED := true

plot(use_sl and strategy.position_size > 0 ? final_SL_Long : na, title = "SL Long", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

plot(use_sl and strategy.position_size < 0 ? final_SL_Short : na, title = "SL Short", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Strategy Calls |

// # ========================================================================= #

string entry_long_limit_alert_message = ""

string entry_long_TP1_alert_message = ""

string entry_long_TP2_alert_message = ""

tp1_qty_perc = tp1_qty / 100

if use_tp1 and use_tp2

entry_long_TP1_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_long_TP2_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size - (pos_size * tp1_qty_perc)) + ",tp=" + str.tostring(final_TP2_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if use_tp1 and not use_tp2

entry_long_TP1_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if not use_tp1 and use_tp2

entry_long_TP2_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP2_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_long_limit_alert_message := entry_long_TP1_alert_message + "\n" + entry_long_TP2_alert_message

//entry_long_limit_alert_message = pineconnector_licence_ID + ",buystop," + syminfo.ticker + ",price=" + str.tostring(buy_price) + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP_Long) + ",sl=" + str.tostring(final_SL_Long)

//entry_short_market_alert_message = pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + (use_tp1 ? ",tp=" + str.tostring(final_TP1_Short) : "")

// + (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "")

//entry_short_limit_alert_message = pineconnector_licence_ID + ",sellstop," + syminfo.ticker + ",price=" + str.tostring(sell_price) + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP_Short) + ",sl=" + str.tostring(final_SL_Short)

string entry_short_limit_alert_message = ""

string entry_short_TP1_alert_message = ""

string entry_short_TP2_alert_message = ""

if use_tp1 and use_tp2

entry_short_TP1_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_short_TP2_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size - (pos_size * tp1_qty_perc)) + ",tp=" + str.tostring(final_TP2_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if use_tp1 and not use_tp2

entry_short_TP1_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if not use_tp1 and use_tp2

entry_short_TP2_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP2_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_short_limit_alert_message := entry_short_TP1_alert_message + "\n" + entry_short_TP2_alert_message

long_update_sl_alert_message = pineconnector_licence_ID + ",newsltplong," + syminfo.ticker + ",sl=" + str.tostring(final_SL_Long)

short_update_sl_alert_message = pineconnector_licence_ID + ",newsltpshort," + syminfo.ticker + ",sl=" + str.tostring(final_SL_Short)

cancel_long = pineconnector_licence_ID + ",cancellong," + syminfo.ticker// + "x"

cancel_short = pineconnector_licence_ID + ",cancellong," + syminfo.ticker// + "x"

close_long = pineconnector_licence_ID + ",closelong," + syminfo.ticker

close_short = pineconnector_licence_ID + ",closeshort," + syminfo.ticker

if bull and strategy.position_size <= 0

alert(close_short, alert.freq_once_per_bar_close)

strategy.entry("Long", strategy.long)

alert(entry_long_TP1_alert_message, alert.freq_once_per_bar_close)

alert(entry_long_TP2_alert_message, alert.freq_once_per_bar_close)

else if bear and strategy.position_size >= 0

alert(close_long, alert.freq_once_per_bar_close)

strategy.entry("Short", strategy.short)

alert(entry_short_TP1_alert_message, alert.freq_once_per_bar_close)

alert(entry_short_TP2_alert_message, alert.freq_once_per_bar_close)

if strategy.position_size[1] > 0

if low <= final_SL_Long and use_sl

strategy.close("Long", alert_message = close_long)

else

strategy.exit("Exit TP1 Long", "Long", limit = final_TP1_Long, comment_profit = "Exit TP1 Long", qty_percent = tp1_qty)

strategy.exit("Exit TP2 Long", "Long", limit = final_TP2_Long, comment_profit = "Exit TP2 Long", alert_message = close_long)

if bull_count[1] == 5 and bull_count < 5 and barstate.isconfirmed and use_close_opposite

strategy.close("Long", comment = "1 or more MACDs became bearish", alert_message = close_long)

else if strategy.position_size[1] < 0

if high >= final_SL_Short and use_sl

//strategy.exit("Exit SL Short", "Short", stop = final_SL_Short, comment_loss = "Exit SL Short")

strategy.close("Short", alert_message = close_short)

else

strategy.exit("Exit TP1 Short", "Short", limit = final_TP1_Short, comment_profit = "Exit TP1 Short", qty_percent = tp1_qty)

strategy.exit("Exit TP2 Short", "Short", limit = final_TP2_Short, comment_profit = "Exit TP2 Short")

if bear_count[1] == 5 and bear_count < 5 and barstate.isconfirmed and use_close_opposite

strategy.close("Short", comment = "1 or more MACDs became bullish", alert_message = close_short)

// # ========================================================================= #

// # | Logs |

// # ========================================================================= #

// if bull and strategy.position_size <= 0

// log.info(entry_long_limit_alert_message)

// else if bear and strategy.position_size >= 0

// log.info(entry_short_limit_alert_message)

// # ========================================================================= #

// # | Reset Variables |

// # ========================================================================= #

if (strategy.position_size > 0 and strategy.position_size[1] <= 0)

or (strategy.position_size < 0 and strategy.position_size[1] >= 0)

//is_TP1_REACHED := false

SL_BE_REACHED := false