Стратегия двойной скользящей средней

Автор:Чао Чжан, Дата: 2023-12-29 16:59:17Тэги:

Обзор

Эта стратегия использует быстрые и медленные скользящие средние перекрестки для определения длинных и коротких позиций. Она становится длинной, когда быстрый MA пересекает медленный MA и закрывает позицию, когда быстрый MA пересекает ниже медленного MA. Чтобы добиться более высокой прибыли, стратегия использует механизм остановки остановки.

Как это работает

Стратегия использует быстрые и медленные линии простой скользящей средней (SMA) для определения входов и выходов. Когда быстрая SMA пересекает медленную SMA, она сигнализирует об восходящем тренде, поэтому стратегия длится. Когда быстрая SMA пересекает ниже медленной SMA, она сигнализирует об обратном тренде, поэтому стратегия готовится к закрытию позиции.

Для максимизации прибыли стратегия внедряет механизм последнего стоп-лосса. Вместо использования фиксированной цены после открытия длинных позиций, она устанавливает цену последнего стоп-лосса, которая поднимается после роста цены. Каждый раз, когда цена повышается на определенный процент, цена последнего стоп-лосса корректируется на заранее определенный процент. Когда цена отступает и достигает цены последнего стоп-лосса, она запускает ордер на остановку по закрытию позиции.

В частности, цена последнего остановки потери рассчитывается как:

Процентные показатели, которые должны быть учтены для определения величины недвижимости.

Стоп-лосс определяется параметром стратегии

Когда цена падает и достигает цены остановки, это запускает сигнал закрытия, и позиция будет закрыта рыночным ордером.

Преимущества

- Использование двойной скользящей средней для определения направления тренда с хорошими результатами обратного теста

- Используйте стоп-лосс для получения более высокой прибыли

- Применимые скользящие средние периоды и процент остановки потерь

- Стоп-лосс продолжает двигаться вверх, когда тренд поднимается, блокируя большинство прибыли

- Быстрая остановка убытков при обратном тренде для предотвращения дальнейших потерь

Риски и решения

- Неправильное время перекрестки скользящей средней может вызвать ложные сигналы.

- Слишком агрессивный стоп-лосс может быть остановлен преждевременно.

- Разрывы в ценах могут напрямую проникать в цену стоп-лосса.

Руководство по оптимизации

- Испытать различные параметры скользящего среднего периода для поиска оптимальной комбинации

- Испытать различные параметры стоп-лосса для определения оптимального уровня стоп-лосса

- Добавление других индикаторов для приостановления торговли в промежуточные периоды, чтобы избежать воздействия спорадических событий

Заключение

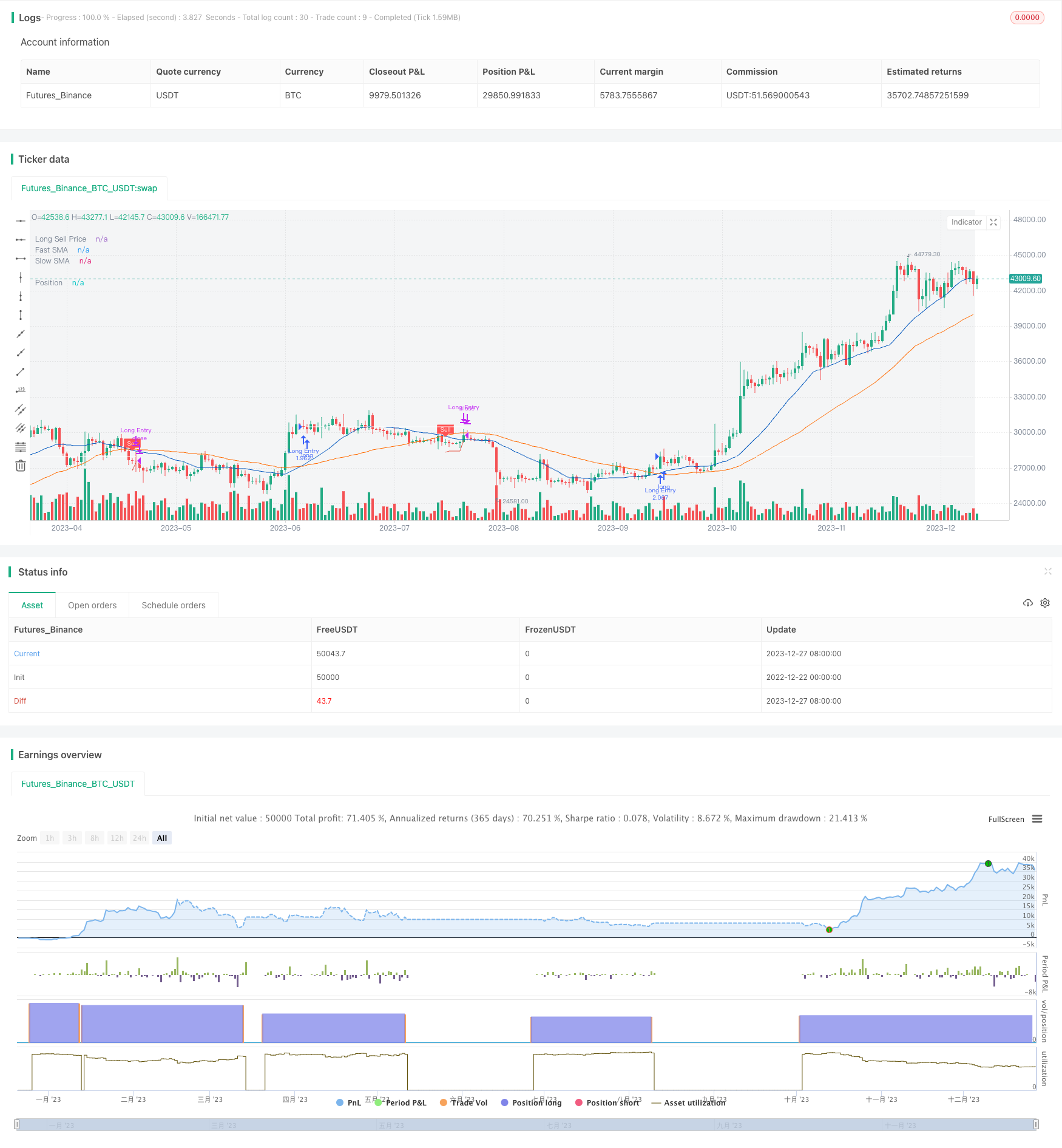

Эта стратегия сочетает в себе движущиеся средние индикаторы для оценки направления тренда и механизм остановки потерь для блокировки прибыли, хорошо работая на данных обучения. Оптимизируя параметры и контролируя риски, она имеет потенциал для достижения устойчивой прибыли. Однако ни одна стратегия не может полностью избежать потерь. Рекомендуется корректировать размер позиций, тестировать различные продукты и диверсифицировать риски.

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2022 Iason Nikolas | jason5480

// Trailing Buy script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @jason5480

// Revision: v1.0.1

// Date: 24-Feb-2022

//

// Description

// =============================================================================

// This strategy will go long if fast MA crosses over slow MA.

// If the 'Enable Trailing` is checked then the strategy instead of exiting from the position

// directly it will follow the price upwards (percentagewise) with small steps

// If the price drops by this percentage then the exit order will be executed

//

// The strategy has the following parameters:

//

// Fast SMA Length - How many candles back to calculte the fast SMA.

// Slow SMA Length - How many candles back to calculte the slow SMA.

// Enable Trailing - Enable or disable the trailing

// Deviation % - The step to follow the price when the open position condition is met.

// Source Exit Control - The source price to compare with the exit price to trigger the exit order when trailing.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealer. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// SETUP ============================================================================================================

strategy(title = 'Trailing Sell',

shorttitle = 'TS',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 100000)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// FILTERS ==========================================================================================================

// INPUT ============================================================================================================

usefromDate = input.bool(defval = true, title = 'From', inline = "From Date", group = "Filters")

fromDate = input(defval = timestamp('01 Jan 2021 00:00 UTC'), title = '', inline = "From Date", group = 'Filters')

usetoDate = input.bool(defval = false, title = 'To ', inline = "To Date", group = "Filters")

toDate = input(defval = timestamp('31 Dec 2121 23:59 UTC'), title = '', inline = "To Date", group = 'Filters')

// LOGIC ============================================================================================================

isWithinPeriod() => true // create function "within window of time"

// PLOT =============================================================================================================

bgcolor(color = isWithinPeriod() ? color.new(color.gray, 90) : na, title = 'Period')

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// STRATEGY =========================================================================================================

// INPUT ============================================================================================================

fastMALen = input.int(defval = 21, title = 'Fast/Slow SMA Length', inline = 'MA Length', group = 'Strategy')

slowMALen = input.int(defval = 49, title = '', tooltip = 'How many candles back to calculte the fast/slow SMA.', inline = 'MA Length', group = 'Strategy')

// LOGIC ============================================================================================================

fastMA = ta.sma(close, fastMALen)

slowMA = ta.sma(close, slowMALen)

bool openLongPosition = isWithinPeriod() and ta.crossover(fastMA, slowMA)

bool closeLongPosition = ta.crossunder(fastMA, slowMA)

// PLOT =============================================================================================================

var fastColor = color.new(#0056BD, 0)

plot(series = fastMA, title = 'Fast SMA', color = fastColor, linewidth = 1, style = plot.style_line)

var slowColor = color.new(#FF6A00, 0)

plot(series = slowMA, title = 'Slow SMA', color = slowColor, linewidth = 1, style = plot.style_line)

plotshape(series = closeLongPosition and strategy.position_size > 0 ? fastMA : na, title = 'Sell', text = 'Sell', style = shape.labeldown, location = location.absolute, color = color.new(color.red, 0), textcolor = color.new(color.white, 0), size = size.tiny)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// EXIT ============================================================================================================

// INPUT ============================================================================================================

enableTrailing = input.bool(defval = true, title = 'Enable Trailing', tooltip = 'Enable or disable the trailing for exit position.', group = 'Exit')

devExitPerc = input.float(defval = 3.0, title = 'Deviation %', minval = 0.01, maxval = 100, step = 0.05, tooltip = 'The step to follow the price when the open position condition is met.', group = 'Exit') / 100

ctrLongExitSrc = input.source(defval = low, title = 'Source Exit Control', tooltip = 'The source price to compare with the exit price to trigger the exit order when trailing.', group = 'Exit')

// LOGIC ============================================================================================================

var bool exitLongPosition = false

int barsSinceOpenLong = nz(ta.barssince(openLongPosition), 999999)

int barsSinceCloseLong = nz(ta.barssince(closeLongPosition), 999999)

int barsSinceExitLong = nz(ta.barssince(exitLongPosition), 999999)

bool closeLongIsActive = barsSinceOpenLong >= barsSinceCloseLong

bool exitLongIsPending = barsSinceExitLong >= barsSinceCloseLong

bool tryExitLongPosition = isWithinPeriod() and closeLongIsActive and exitLongIsPending

float longExitPrice = na

longExitPrice := if closeLongPosition and strategy.position_size > 0

close * (1 - devExitPerc)

else if tryExitLongPosition

math.max(high * (1 - devExitPerc), nz(longExitPrice[1], 999999))

else

na

exitLongPosition := enableTrailing ? isWithinPeriod() and ta.crossunder(closeLongPosition ? close : ctrLongExitSrc, longExitPrice) : closeLongPosition

// PLOT =============================================================================================================

var sellPriceColor = color.new(#e25141, 0)

plot(series = enableTrailing ? longExitPrice : na, title = 'Long Sell Price', color = sellPriceColor, linewidth = 1, style = plot.style_linebr)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITION ORDERS ==================================================================================================

// LOGIC ============================================================================================================

// getting into LONG position

strategy.entry(id = 'Long Entry', direction = strategy.long, when = openLongPosition, alert_message = 'Long(' + syminfo.ticker + '): Started')

// submit close order on trend reversal

strategy.close(id = 'Long Entry', when = exitLongPosition, comment = 'Close Long', alert_message = 'Long(' + syminfo.ticker + '): Closed at market price')

// PLOT =============================================================================================================

var posColor = color.new(color.white, 0)

plot(series = strategy.position_avg_price, title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr)

// ==================================================================================================================

- Перемещение в Вегас Канал Кроссовер Стратегия

- Тенденция в соответствии со стратегией на основе динамической скользящей средней

- Комбо-стратегия отслеживания трендов

- Девять типов стратегии перекрестного использования скользящей средней

- Бина ОКХ с постоянным автоматическим хеджированием

- Динамическая тенденция прорыва в соответствии со стратегией

- Стратегия торговли транзитивным коэффициентом на основе фильтра Калмана и средней реверсии

- Стратегия обратной линейной регрессии

- Стратегия торговли BankNifty Supertrend

- Стратегия переходных зон

- Стратегия прорыва импульса в несколько временных рамок

- Золотое соотношение ключевой точки Покупать высоко Продать низко Стратегия

- Стратегия торговли черепахой на основе простой скользящей средней

- Двойная скользящая средняя Bollinger Band

- Болинджерские полосы и кроссоверная стратегия RSI

- Тенденция после стратегии на основе QQE и MA

- Стратегия средневзвешенной цены по объему

- Стратегия количественного двойного показателя

- Стратегия отслеживания импульса

- Стратегия торговли по улучшению показателя RSI