Стратегия двусторонней прорывной торговли на основе K-линии

Обзор

Это двунаправленная стратегия торговли с прорывом, основанная на K-линии. Она генерирует торговый сигнал, когда текущая цена закрытия K-линии по отношению к самой высокой и самой низкой цене предыдущих двух K-линий имеет прорыв.

Стратегический принцип

Основная логика этой стратегии заключается в следующем:

Определение сигнала быка:

bull = close > open and close > math.max(close[2], open[2]) and low[1] < low[2] and high[1] < high[2]Это означает, что цена закрытия текущей K-линии больше, чем цена открытия, и больше, чем самая высокая цена двух предыдущих K-линий, а самая низкая цена текущей K-линии ниже, чем самая низкая цена предыдущей K-линии.Определение медвежьего сигнала

bear = close < open and close < math.min(close[2], open[2]) and low[1] > low[2] and high[1] > high[2]Это означает, что цена закрытия текущей K-линии меньше, чем цена открытия, и меньше, чем минимальная цена двух предыдущих K-линий, в то время как максимальная цена текущей K-линии выше, чем максимальная цена предыдущей K-линии.Когда вызывается сигнал быка, делайте больше; когда вызывается сигнал медведя, делайте пустоту.

Можно установить стоп-лост и стоп-стайд.

Стратегия использует характеристику двунаправленного прорыва, чтобы оценить изменения в тренде путем прорыва ключевых ценовых диапазонов и, таким образом, создать торговый сигнал.

Анализ преимуществ

Это довольно простая и интуитивно понятная стратегия прорыва, которая имеет следующие преимущества:

В этом случае логика понятна, реализация понятна, порог невысокий.

Прорывы - это обычные торговые сигналы, которые легко формируют тренды.

В то же время, можно делать дополнительные позиции, чтобы иметь возможность торговать в обоих направлениях и получать прибыль.

Гибкость в установке предохранителя и управления рисками.

Анализ рисков

Однако эта стратегия также несет в себе некоторые риски:

Двусторонние сделки являются рискованными и требуют тщательного контроля.

Взлом легко поддается ложному сигналу.

Неправильная настройка параметров может привести к чрезмерной торговле.

Неправильная установка предохранителя также может повлиять на прибыльность.

Можно оптимизировать параметры, выбрав подходящие сорта, чтобы снизить риск.

Направление оптимизации

Эта стратегия может быть оптимизирована в следующих аспектах:

Параметры оптимизации, такие как параметры прорыва цикла, стоп-стап-магнитность и т. д.

Добавить фильтрующие условия, чтобы избежать ошибочных сигналов, таких как арбитраж, колебания и т.д.

В сочетании с трендовыми показателями, избегайте диапазона свертывания.

Оптимизация управления капиталом, улучшение алгоритмов позиций.

Различные сорта имеют разные параметры и могут быть протестированы и оптимизированы по-разному.

Подвести итог

Это простая стратегия, основанная на двухстороннем взрывном мышлении. Она обладает логической ясностью и легкостью реализации, но также имеет определенные риски мониторинга.

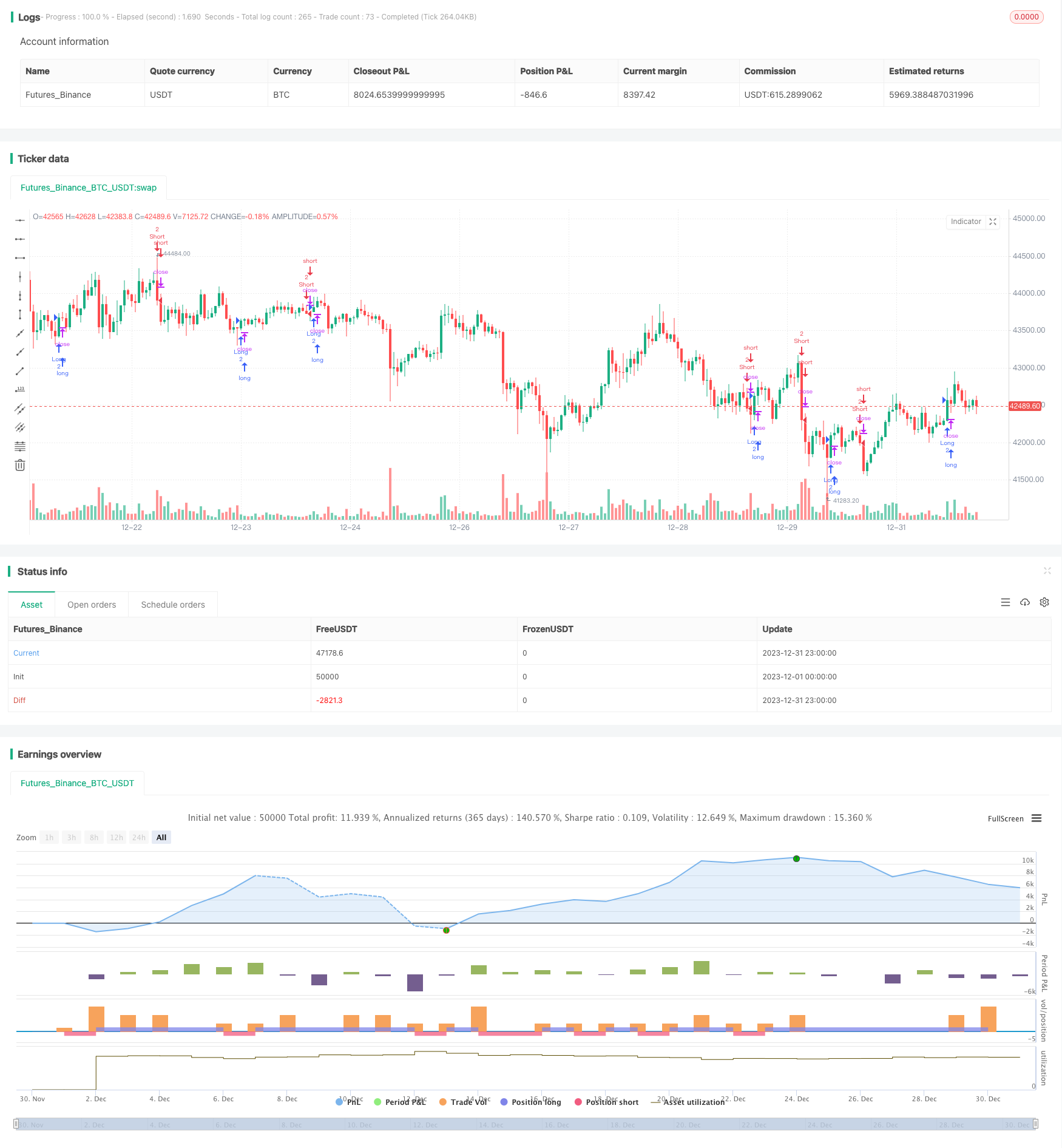

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// # ========================================================================= #

// # | Strategy |

// # ========================================================================= #

SystemName = "Strategy Template Autoview"

TradeId = "S"

// These values are used both in the strategy() header and in the script's relevant inputs as default values so they match.

// Unless these values match in the script's Inputs and the TV backtesting Properties, results between them cannot be compared.

InitCapital = 1000000

InitPosition = 2

InitCommission = 0.075

InitPyramidMax = 1

CalcOnorderFills = false

ProcessOrdersOnClose = true // display the signals one candle earlier

CalcOnEveryTick = true // forward testing

//CloseEntriesRule = "ANY"

strategy(title=SystemName, shorttitle=SystemName,

overlay=true, pyramiding=InitPyramidMax, initial_capital=InitCapital, default_qty_type=strategy.fixed, process_orders_on_close=ProcessOrdersOnClose,

default_qty_value=InitPosition, commission_type=strategy.commission.percent, commission_value=InitCommission, calc_on_order_fills=CalcOnorderFills,

calc_on_every_tick=CalcOnEveryTick,

precision=6, max_lines_count=500, max_labels_count=500)

// # ========================================================================= #

// # ========================================================================= #

// # || Alerts ||

// # ========================================================================= #

// # ========================================================================= #

show_alerts_debug = input.bool(true, title = "Show Alerts Debug Label?", group = "Debug")

//i_alert_txt_entry_long = input.text_area(defval = "", title = "Long Entry Message", group = "Alerts")

//i_alert_txt_entry_short = input.text_area(defval = "", title = "Short Entry Message", group = "Alerts")

//i_alert_txt_exit_long = input.text_area(defval = "", title = "Long Exit Message", group = "Alerts")

//i_alert_txt_exit_short = input.text_area(defval = "", title = "Short Exit Message", group = "Alerts")

i_broker_mode = input.string("DEMO", title = "Use Demo or Live Broker", options=["DEMO", "LIVE"], group = "Automation")

i_broker_name = input.string("Tradovate", title = "Broker Name", options=["Tradovate", "AscendEX", "Binance", "Binance Futures", "Binance US", "Binance Delivery", "Kraken", "Deribit", "Poloniex", "Okcoin", "Bitfinex", "Oanda", "Kucoin", "Okex", "Bybit", "FTX", "Bitmex", "Alpaca", "Gemini"], group = "Automation")

i_enable_trades = input.bool(true, title = "Enable trades?", group = "Automation", tooltip = "If not enabled, disables live trades, but more importantly, it will output what Autoview is going to do when you go live.")

i_account_name = input.string("*", title = "Account Name", group = "Automation")

i_symbol_name = input.string("btcusd_perp", title = "Symbol Name", group = "Automation")

nb_contracts = input.int(2, title = "Nb Contracts", group = "Automation")

use_delay = input.bool(false, title = "Use Delay between orders", group = "Automation", inline = "delay")

i_delay_qty = input.int(1, title = "Delay in seconds", group = "Automation", inline = "delay")

i_use_borrow_repay = input.bool(false, title = "Use Borrow/Repay Mode?", group = "Binance Automation")

i_asset_borrow_repay = input.string("BTC", title = "Asset to Borrow/Repay", group = "Binance Automation")

i_qty_borrow_repay = input.float(1., title = "Quantity of assets to borrow?", group = "Binance Automation")

// # ========================================================================= #

// # ========================================================================= #

// # || Dates Range Filtering ||

// # ========================================================================= #

// # ========================================================================= #

DateFilter = input(false, "Date Range Filtering", group="Date")

// ————— Syntax coming from https://www.tradingview.com/blog/en/new-parameter-for-date-input-added-to-pine-21812/

i_startTime = input(defval = timestamp("01 Jan 2019 13:30 +0000"), title = "Start Time", group="Date")

i_endTime = input(defval = timestamp("30 Dec 2021 23:30 +0000"), title = "End Time", group="Date")

TradeDateIsAllowed() => true

// # ========================================================================= #

// # | Custom Exits |

// # ========================================================================= #

//use_custom_exit = input.bool(true, title = "Use Custom Exits?", group = "Custom Exits")

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

use_sl = input.string("None", title = "Select Stop Loss Mode", options=["None", "Percent", "Price"], group = "Stop Loss")

sl_input_perc = input.float(3, minval = 0, title = "Stop Loss (%)", group = "Stop Loss (%)") * 0.01

sl_input_pips = input.float(30, minval = 0, title = "Stop Loss (USD)", group = "Stop Loss (USD)")

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

use_tp = input.string("None", title = "Select Take Profit Mode", options=["None", "Percent", "Price"], group = "Take Profit")

tp_input_perc = input.float(3, minval = 0, title = "Take Profit (%)", group = "Take Profit (%)") * 0.01

tp_input_pips = input.float(30, minval = 0, title = "Take Profit (USD)", group = "Take Profit (USD)")

// # ========================================================================= #

// # | Consolidated Entries |

// # ========================================================================= #

bull = close > open and close > math.max(close[2], open[2]) and low[1] < low[2] and high[1] < high[2] // low < low[1] and low[1] < low[2]

bear = close < open and close < math.min(close[2], open[2]) and low[1] > low[2] and high[1] > high[2] // low < low[1] and low[1] < low[2]

// # ========================================================================= #

// # | Entry Price |

// # ========================================================================= #

entry_long_price = ta.valuewhen(condition=bull and strategy.position_size[1] <= 0, source=close, occurrence=0)

entry_short_price = ta.valuewhen(condition=bear and strategy.position_size[1] >= 0, source=close, occurrence=0)

var float entry_price = 0.

if bull

entry_price := entry_long_price

if bear

entry_price := entry_short_price

// # ========================================================================= #

// # || Global Trend Variables ||

// # ========================================================================= #

T1_sinceUP = ta.barssince(bull)

T1_sinceDN = ta.barssince(bear)

T1_nUP = ta.crossunder(T1_sinceUP,T1_sinceDN)

T1_nDN = ta.crossover(T1_sinceUP,T1_sinceDN)

T1_sinceNUP = ta.barssince(T1_nUP)

T1_sinceNDN = ta.barssince(T1_nDN)

T1_BuyTrend = T1_sinceDN > T1_sinceUP

T1_SellTrend = T1_sinceDN < T1_sinceUP

T1_SellToBuy = T1_BuyTrend and T1_SellTrend[1]

T1_BuyToSell = T1_SellTrend and T1_BuyTrend[1]

T1_ChangeTrend = T1_BuyToSell or T1_SellToBuy

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

var float final_SL_Long = 0.

var float final_SL_Short = 0.

if use_sl == "Percent"

final_SL_Long := entry_long_price * (1 - sl_input_perc)

final_SL_Short := entry_short_price * (1 + sl_input_perc)

else if use_sl == "Price"

final_SL_Long := entry_long_price - (sl_input_pips)

final_SL_Short := entry_short_price + (sl_input_pips)

plot(strategy.position_size > 0 and use_sl != "None" ? final_SL_Long : na, title = "SL Long", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

plot(strategy.position_size < 0 and use_sl != "None" ? final_SL_Short : na, title = "SL Short", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

var float final_TP_Long = 0.

var float final_TP_Short = 0.

if use_tp == "Percent"

final_TP_Long := entry_long_price * (1 + tp_input_perc)

final_TP_Short := entry_short_price * (1 - tp_input_perc)

else if use_tp == "Price"

final_TP_Long := entry_long_price + (tp_input_pips)

final_TP_Short := entry_short_price - (tp_input_pips)

plot(strategy.position_size > 0 and use_tp != "None" ? final_TP_Long : na, title = "TP Long", color = color.orange, linewidth=2, style=plot.style_linebr)

plot(strategy.position_size < 0 and use_tp != "None" ? final_TP_Short : na, title = "TP Short", color = color.orange, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | AutoView Calls |

// # ========================================================================= #

float quantity = nb_contracts

string product_type_ticker = i_symbol_name

var string broker_mode = ""

if i_broker_mode == "DEMO"

broker_mode := switch i_broker_name

"Tradovate" => "tradovatesim"

"Ascendex" => "ascendex-sandbox"

"Binance Futures" => "binancefuturestestnet"

"Binance Delivery" => "binancedeliverytestnet"

"Oanda" => "oandapractice"

"Bitmex" => "bitmextestnet"

"Bybit" => "bybittestnet"

"Alpaca" => "alpacapaper"

"Kucoin" => "kucoinsandbox"

"Deribit" => "deribittestnet"

"Gemini" => "gemini-sandbox"

=> i_broker_name

else // "LIVE"

broker_mode := switch i_broker_name

"Tradovate" => "tradovate"

"Ascendex" => "ascendex"

"Binance Futures" => "binancefutures"

"Binance Delivery" => "binancedelivery"

"Binance" => "binance"

"Oanda" => "oanda"

"Kraken" => "kraken"

"Deribit" => "deribit"

"Bitfinex" => "bitfinex"

"Poloniex" => "poloniex"

"Bybit" => "bybit"

"Okcoin" => "okcoin"

"Kucoin" => "kucoin"

"FTX" => "ftx"

"Bitmex" => "bitmex"

"Alpaca" => "alpaca"

"Gemini" => "gemini"

=> i_broker_name

enable_trades = i_enable_trades ? "" : " d=1"

string delay_qty = use_delay ? " delay=" + str.tostring(i_delay_qty) : ""

i_alert_txt_entry_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=short c=position t=market" +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty

i_alert_txt_entry_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=long c=position t=market" +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty

var string temp_txt_SL_long = ""

var string temp_txt_SL_short = ""

var string temp_txt_TP_long = ""

var string temp_txt_TP_short = ""

if use_sl == "Percent"

temp_txt_SL_long := "sl=-" + str.tostring(sl_input_perc * 100) + "%"

temp_txt_SL_short := "sl=" + str.tostring(sl_input_perc * 100) + "%"

else if use_sl == "Price"

temp_txt_SL_long := "fsl=" + str.tostring(final_SL_Long)

temp_txt_SL_short := "fsl=" + str.tostring(final_SL_Short)

if use_tp == "Percent"

temp_txt_TP_long := "p=" + str.tostring(tp_input_perc * 100) + "%"

temp_txt_TP_short := "p=-" + str.tostring(tp_input_perc * 100) + "%"

else if use_tp == "Price"

temp_txt_TP_long := "fpx=" + str.tostring(final_TP_Long)

temp_txt_TP_short := "fpx=" + str.tostring(final_TP_Short)

i_alert_txt_exit_SL_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long c=position t=market " + temp_txt_SL_long + enable_trades

i_alert_txt_exit_SL_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short c=position t=market " + temp_txt_SL_short + enable_trades

i_alert_txt_exit_TP_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long c=position t=market " + temp_txt_TP_long + enable_trades

i_alert_txt_exit_TP_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short c=position t=market " + temp_txt_TP_short + enable_trades

string final_alert_txt_entry_long = i_alert_txt_entry_long

string final_alert_txt_entry_short = i_alert_txt_entry_short

if i_use_borrow_repay and i_broker_name == "Binance"

final_alert_txt_entry_long := "a=" + i_account_name + " e=" + broker_mode + "y=borrow w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=short c=position t=market" + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + "y=repay w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades

final_alert_txt_entry_short := "a=" + i_account_name + " e=" + broker_mode + "y=borrow w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=long c=position t=market" + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + "y=repay w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades

//i_alert_txt_entry_long := final_alert_txt_entry_long

//i_alert_txt_entry_short := final_alert_txt_entry_short

if show_alerts_debug and barstate.islastconfirmedhistory

var label lblTest = na

label.delete(lblTest)

string label_txt = i_alert_txt_entry_long

if use_sl != "None"

label_txt := label_txt + "\n" + i_alert_txt_exit_SL_long

if use_tp != "None"

label_txt := label_txt + "\n" + i_alert_txt_exit_TP_long

t = time + (time - time[1]) * 25

lblTest := label.new(

x = t,

y = ta.highest(50),

text = label_txt,

xloc = xloc.bar_time,

yloc = yloc.price,

color = color.new(color = color.gray, transp = 0),

style = label.style_label_left,

textcolor = color.new(color = color.white, transp = 0),

size = size.large

)

// # ========================================================================= #

// # | Strategy Calls and Alerts |

// # ========================================================================= #

if bull and TradeDateIsAllowed()

strategy.entry(id = "Long", direction = strategy.long, comment = "Long", alert_message = i_alert_txt_entry_long, qty = nb_contracts)

alert(i_alert_txt_entry_long, alert.freq_once_per_bar)

else if bear and TradeDateIsAllowed()

strategy.entry(id = "Short", direction = strategy.short, comment = "Short", alert_message = i_alert_txt_entry_short, qty = nb_contracts)

alert(i_alert_txt_entry_short, alert.freq_once_per_bar)

//quantity := quantity * 2

strategy.exit(id = "Exit Long", from_entry = "Long", stop = (use_sl != "None") ? final_SL_Long : na, comment_loss = "Long Exit SL", alert_loss = (use_sl != "None") ? i_alert_txt_exit_SL_long : na, limit = (use_tp != "None") ? final_TP_Long : na, comment_profit = "Long Exit TP", alert_profit = (use_tp != "None") ? i_alert_txt_exit_TP_long : na)

strategy.exit(id = "Exit Short", from_entry = "Short", stop = (use_sl != "None") ? final_SL_Short : na, comment_loss = "Short Exit SL", alert_loss = (use_sl != "None") ? i_alert_txt_exit_SL_short : na, limit = (use_tp != "None") ? final_TP_Short : na, comment_profit = "Short Exit TP", alert_profit = (use_tp != "None") ? i_alert_txt_exit_TP_short : na)

if strategy.position_size > 0 and low < final_SL_Long and use_sl != "None"

alert(i_alert_txt_exit_SL_long, alert.freq_once_per_bar)

else if strategy.position_size < 0 and high > final_SL_Short and use_sl != "None"

alert(i_alert_txt_exit_SL_short, alert.freq_once_per_bar)

if strategy.position_size > 0 and high > final_TP_Long and use_tp != "None"

alert(i_alert_txt_exit_TP_long, alert.freq_once_per_bar)

else if strategy.position_size < 0 and low < final_TP_Short and use_tp != "None"

alert(i_alert_txt_exit_TP_short, alert.freq_once_per_bar)

// # ========================================================================= #

// # | Reset Variables |

// # ========================================================================= #