Стратегия SuperTrend Trailing Stop, основанная на Хайкине Аши

Автор:Чао Чжан, Дата: 2024-02-06 14:43:14Тэги:

Обзор стратегии

Эта стратегия объединяет свечи Хайкина Аши и индикатор SuperTrend в следующую стратегию тренда с отслеживанием стоп-лосса.

Логика стратегии

- Вычислите свечи Хайкина Аши: открытые, закрытые, высокие, низкие цены.

- Вычислить индикатор SuperTrend: верхняя и нижняя полосы на основе ATR и цены.

- Определить направление тренда, сочетая группы Heikin Ashi Close и SuperTrend.

- Когда закрытие Heikin Ashi приближается к верхней полосе SuperTrend, это сигнализирует о восходящем тренде; когда закрытие Heikin Ashi приближается к нижней полосе SuperTrend, это сигнализирует о нисходящем тренде.

- Использовать верхнюю полосу SuperTrend в качестве последующей стоп-лосс в восходящих тенденциях и нижнюю полосу в нисходящих тенденциях.

Преимущества

- Хайкин Аши отфильтровывает ложные сигналы, что приводит к более надежным сигналам.

- СуперТренд как динамическая стоп-лосс блокирует прибыль вдоль тренда, чтобы избежать огромных снижений.

- Сочетание временных рамок подтверждает высокие/низкие более точно.

- Планированный выход избегает иррациональных движений в определенное время.

Риски

- Склонность к остановке при изменении тренда.

- Неправильная настройка параметров SuperTrend может привести к слишком широкой или слишком узкой стоп-потере.

- Игнорирует размер позиции, должен установить правильный размер ставки.

- Игнорирует расходы на торговлю.

Возможности для расширения

- Оптимизируйте параметры SuperTrend для лучшей производительности.

- Добавьте управление размером позиции.

- Учитывайте такие расходы, как комиссионные и сдвиг.

- Гибко регулировать стоп-лосс на основе силы тренда.

- Добавьте фильтры с другими индикаторами к сигналам входа.

Заключение

Эта стратегия сочетает в себе сильные стороны Хайкина Аши и СуперТренда для определения направлений тренда и автоматического отслеживания тренда с динамической остановкой потери для блокировки прибыли. Основные риски возникают из-за обратного движения тренда и настройки параметров. Дальнейшая оптимизация этих двух аспектов может улучшить эффективность стратегии. В целом эта стратегия демонстрирует, как интеграция индикаторов может повысить стабильность и прибыльность торговых систем.

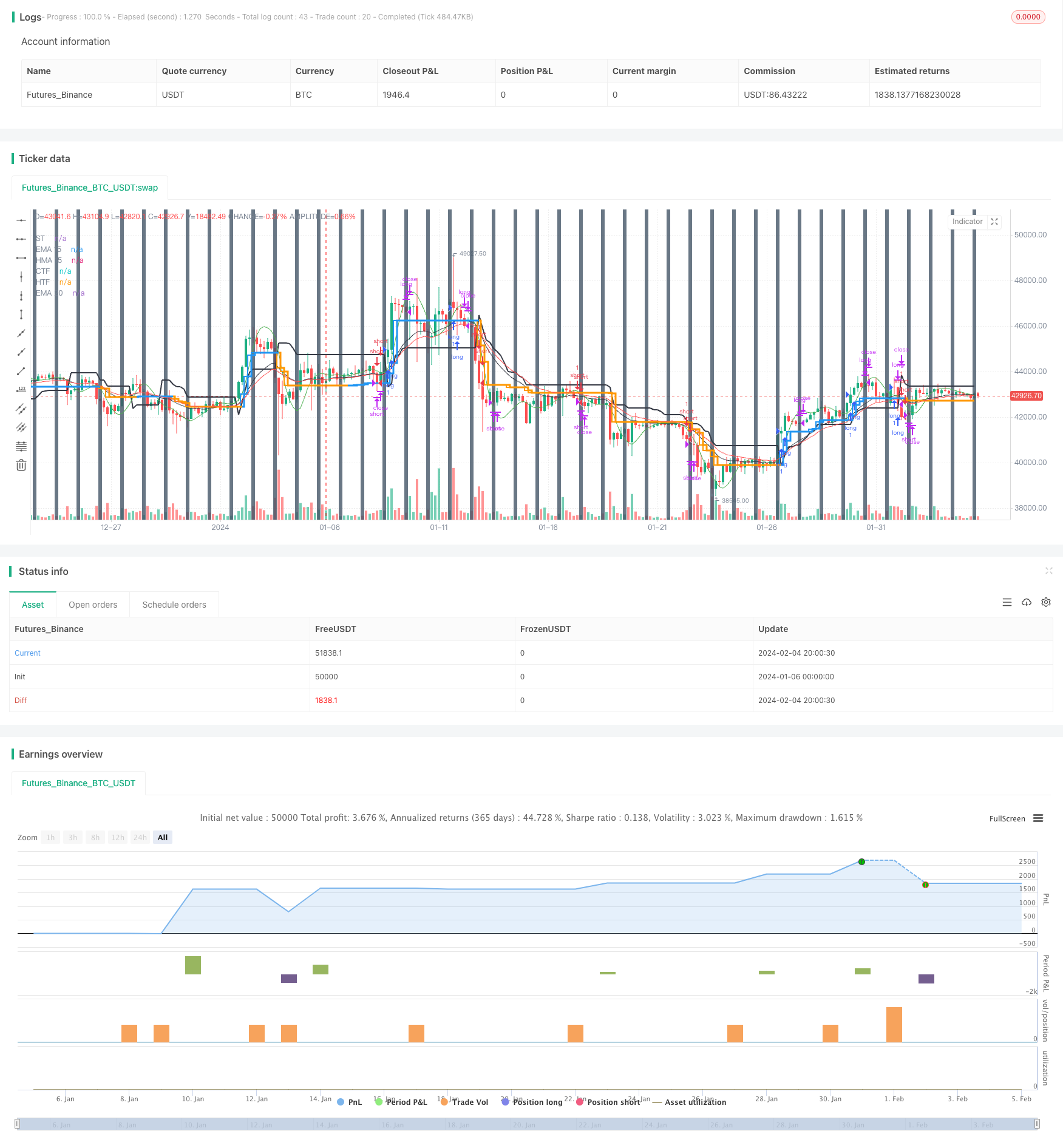

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ringashish

//@version=4

strategy("sa-strategy with HTF-TSL", overlay=true)

Pd = input(title="ATR Period", type=input.integer, defval=4)

Factor = input(title="ATR Multiplier", type=input.float, step=0.1, defval=2)

ST= supertrend(Factor, Pd)

heikinashi_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

heikinashi_low = security(heikinashi(syminfo.tickerid), timeframe.period, low)

heikinashi_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

heikinashi_high = security(heikinashi(syminfo.tickerid), timeframe.period, high)

heikinashi_close30 = security(heikinashi(syminfo.tickerid), "30", close)

//res1 = input("30", type=input.resolution, title="higher Timeframe")

//CCI TSL

res = input("240",type=input.resolution,title = "Higher Time Frame")

CCI = input(20)

ATR = input(5)

Multiplier=input(1,title='ATR Multiplier')

original=input(false,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

calcx()=>

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x = 0.0

x := thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

x

tempx = calcx()

calcswap() =>

swap = 0.0

swap := tempx>tempx[1]?1:tempx<tempx[1]?-1:swap[1]

swap

tempswap = calcswap()

swap2=tempswap==1?color.blue:color.orange

swap3=thisCCI >=0 ?color.blue:color.orange

swap4=original?swap3:swap2

//display current timeframe's Trend

plot(tempx,"CTF",color=swap4,transp=0,linewidth=2, style = plot.style_stepline)

htfx = security(syminfo.tickerid,res,tempx[1],lookahead = barmerge.lookahead_on)

htfswap4 = security(syminfo.tickerid,res,swap4[1],lookahead = barmerge.lookahead_on)

plot(htfx,"HTF",color=htfswap4,transp=0,linewidth=3,style = plot.style_stepline)

//supertrend

Supertrend(Factor, Pd) =>

Up=hl2-(Factor*atr(Pd))

Dn=hl2+(Factor*atr(Pd))

TrendUp = 0.0

TrendUp := heikinashi_close[1]>TrendUp[1] ? max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := heikinashi_close[1]<TrendDown[1]? min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := heikinashi_close > TrendDown[1] ? 1: heikinashi_close< TrendUp[1]? -1: nz(Trend[1],1)

Tsl = Trend==1? TrendUp: TrendDown

S_Buy = Trend == 1 ? 1 : 0

S_Sell = Trend != 1 ? 1 : 0

[Trend, Tsl]

[Trend,Tsl] = Supertrend(Factor, Pd)

// Security

//ST1_Trend_MTF = security(syminfo.tickerid, res1, Tsl,barmerge.lookahead_on)

//plot(ST1_Trend_MTF, "higher ST")

crossdn = crossunder(heikinashi_close,Tsl) or crossunder(heikinashi_close[1],Tsl) or crossunder(heikinashi_close[2],Tsl) or heikinashi_close < Tsl

crossup = crossover(heikinashi_close,Tsl) or crossover(heikinashi_close[1],Tsl) or crossover(heikinashi_close[2],Tsl) or heikinashi_close > Tsl

plot(Tsl,"ST",color = color.black,linewidth =2)

plot(ema(heikinashi_close,20),"EMA 20",color=color.red)

plot(hma(heikinashi_close,15),"HMA 15",color=color.green)

plot(ema(heikinashi_close,15),"EMA 15",color=color.black)

closedown = (heikinashi_close < hma(heikinashi_close,15) and heikinashi_high > hma(heikinashi_close,15)) or(heikinashi_close < ema(heikinashi_close,20) and heikinashi_high > ema(heikinashi_close,20))

closeup = (heikinashi_close > hma(heikinashi_close,15) and heikinashi_low < hma(heikinashi_close,15)) or (heikinashi_close > ema(heikinashi_close,20) and heikinashi_low < ema(heikinashi_close,20))

buy = heikinashi_open == heikinashi_low and closeup and crossup and close > htfx

//buy = heikinashi_open == heikinashi_low and heikinashi_close > ema(close,20) and heikinashi_low < ema(close,20) and crossup

buyexit = cross(close,tempx) //heikinashi_open == heikinashi_high //and heikinashi_close < ema(close,15) and heikinashi_high > ema(close,15)

//if heikinashi_close30[1] < ST1_Trend_MTF

//sell = heikinashi_open == heikinashi_high and heikinashi_close < ema(close,20) and heikinashi_high > ema(close,20) and rsi(close,14)<60 and crossdn

sell = heikinashi_open == heikinashi_high and closedown and rsi(close,14)<55 and crossdn and close < htfx

sellexit = cross(close,tempx) //heikinashi_open == heikinashi_low //and heikinashi_close > ema(close,15) and heikinashi_low < ema(close,15)

rg = 0

rg := buy ? 1 : buyexit ? 2 : nz(rg[1])

longLogic = rg != rg[1] and rg == 1

longExit = rg != rg[1] and rg == 2

//plotshape(longExit,"exit buy",style = shape.arrowup,location = location.belowbar,color = color.red, text ="buy exit", textcolor = color.red)

//plotshape(longLogic,"BUY",style = shape.arrowup,location = location.belowbar,color = color.green, text ="buy", textcolor= color.green)

nm = 0

nm := sell ? 1 : sellexit ? 2 : nz(nm[1])

shortLogic = nm != nm[1] and nm == 1

shortExit = nm != nm[1] and nm == 2

//plotshape(shortExit,"exit sell",style = shape.arrowup,location = location.belowbar,color = color.red, text ="sell exit", textcolor = color.red)

//plotshape(shortLogic,"SELL",style = shape.arrowup,location = location.belowbar,color = color.green, text ="sell", textcolor= color.green)

//Exit at particular time

ExitHour = input(title="Exit Hour Of Day", type=input.integer, defval=15, step = 5, maxval = 24, minval = 0)

ExitMint = input(title="Exit Minute Of Day", type=input.integer, defval=15, step = 5, maxval = 24, minval = 0)

bgc = input(title="Highlight Background Color?", type=input.bool, defval=true)

mRound(num,rem) => (floor(num/rem)*rem)

exitTime = (hour(time) >= ExitHour and (minute == mRound(ExitMint, timeframe.multiplier))) ? 1 : 0

exitTime := exitTime == 0 ? (hour(time) >= ExitHour and (minute + timeframe.multiplier >= ExitMint)) ? 1 : 0 : exitTime

MarketClose = exitTime and not exitTime[1]

alertcondition(exitTime and not exitTime[1], title="Intraday Session Close Time", message="Close All Positions")

bgcolor(exitTime and not exitTime[1] and bgc ? #445566 : na, transp =40)

longCondition = longLogic

if (longCondition)

strategy.entry("long", strategy.long)

shortCondition = shortLogic

if (shortCondition)

strategy.entry("short", strategy.short)

strategy.close("short", when =cross(close,tempx) or MarketClose)

strategy.close( "long", when =cross(close,tempx) or MarketClose )

Больше

- Стратегия отслеживания квантового обратного движения с двумя драйверами

- Стратегия наложения сигналов тренда

- Swing Points Breakouts Долгосрочная стратегия

- Количественная стратегия торговли, основанная на прорыве в динамическом скользящем среднем

- Три стратегии обратного тренда

- Адаптивная стратегия двойного прорыва

- Количественная стратегия торговли для перехода на нижний уровень

- Стратегия комбинации оптимизации тренда импульса

- Стратегия многократных скользящих средних полос Боллинджера

- Стратегия пересечения скользящей средней

- Двойная скользящая средняя со стратегией прорыва

- Стратегия прорыва Bollinger Band на основе VWAP

- Фибоначчи-ретракцион Динамическая стратегия стоп-лосса

- Динамическая стратегия перекрестного использования EMA и MACD

- Индекс двойного импульса и гибридная стратегия реверсии

- Секвентная двунаправленная стратегия торговли S/R TD

- СуперТренд Количественная стратегия торговли для Биткойна

- Краткосрочная стратегия, объединяющая индикатор RSI и прорыв цены

- Торговая стратегия Ричарда

- Динамическая линия тренда на склоне