تصور دوہری سپر ٹرینڈ

مصنف:چاؤ ژانگ، تاریخ: 2022-05-17 14:40:40ٹیگز:ایس ایم اےاے ٹی آر

سادہ سپر ٹرینڈ اشارے آپ کو ایک ہی اسکرپٹ پر دو سپر ٹرینڈس کو ظاہر کرنے کے علاوہ اضافی حسب ضرورت خصوصیات کا اختیار فراہم کرتا ہے۔ انکم شارکس سے متاثر ڈبل سیٹ اپ

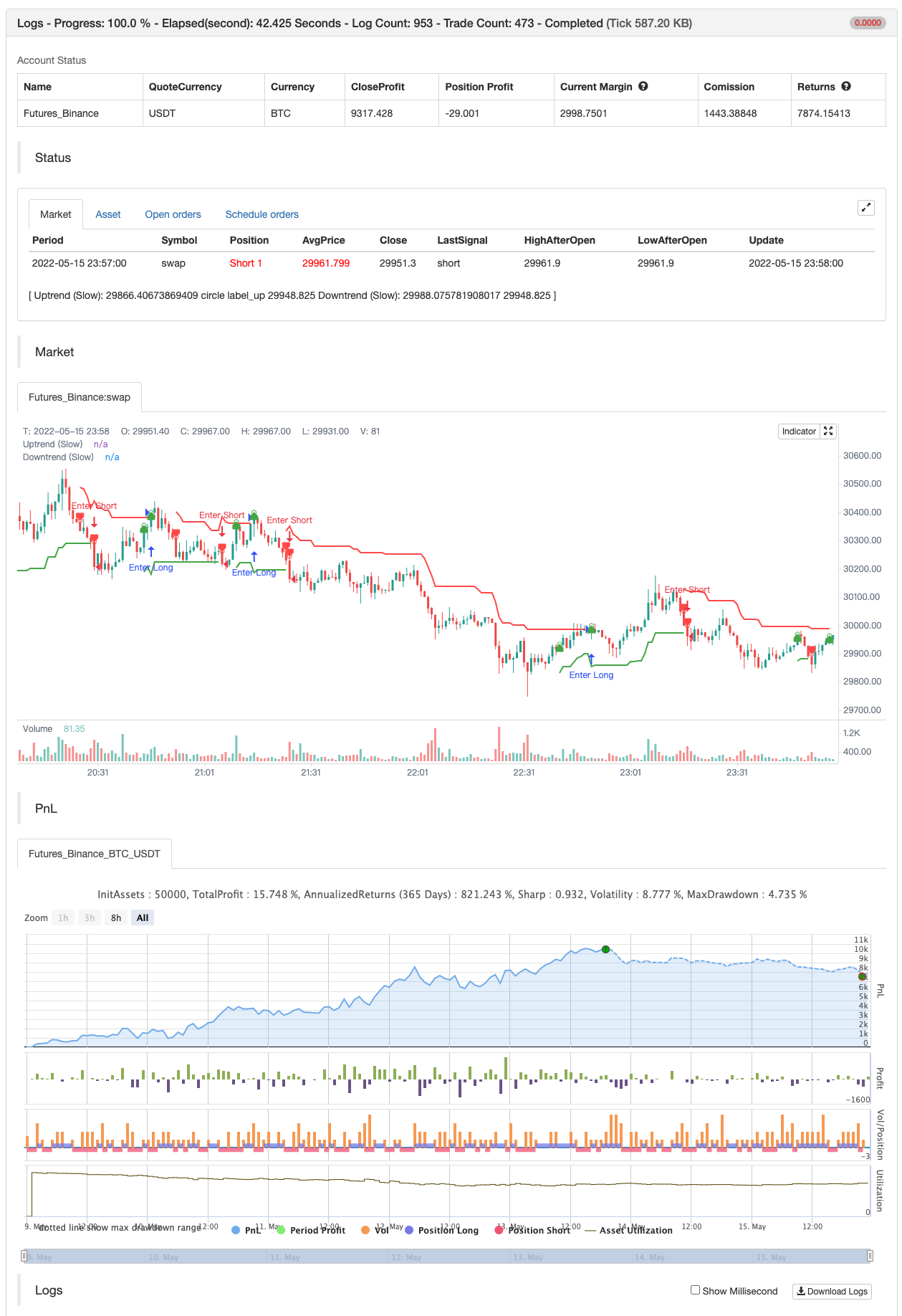

بیک ٹسٹ

/*backtest

start: 2022-05-09 00:00:00

end: 2022-05-15 23:59:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

indicator(title='Concept Dual SuperTrend', shorttitle='ConceptDST', overlay=true, format=format.price, precision=2, timeframe='')

src = input(hl2, title='Source')

multiplier = input.float(title='ATR Multiplier (Fast)', step=0.1, defval=2)

multiplier2 = input.float(title='ATR Multiplier (Slow)', step=0.1, defval=3)

periods = input(title='ATR Period (Fast)', defval=10)

periods2 = input(title='ATR Period (Slow)', defval=10)

transp_st = input.float(title='Line Transparency', step=1, minval=0, maxval=100, defval=70)

transp_hl = input.float(title='Shading Transparency', step=1, minval=0, maxval=100, defval=90)

changeATR = input(title='Change ATR Calculation Method?', defval=true)

highlighting = input(title='Show Shading? (Fast)', defval=true)

highlighting2 = input(title='Show Shading? (Slow)', defval=true)

showlabels = input(title='Show Buy/Sell Labels?', defval=true)

//------------------------------------------------

// Calculations (Fast)

atrA = ta.sma(ta.tr, periods)

atr = changeATR ? ta.atr(periods) : atrA

up = src - multiplier * atr

upA = nz(up[1], up)

up := close[1] > upA ? math.max(up, upA) : up

dn = src + multiplier * atr

dnA = nz(dn[1], dn)

dn := close[1] < dnA ? math.min(dn, dnA) : dn

// Trend (Fast)

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dnA ? 1 : trend == 1 and close < upA ? -1 : trend

upPlot = plot(trend == 1 ? up : na, title='Uptrend (Slow)', style=plot.style_linebr, linewidth=2, color=color.new(color.green, transp_st))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='Uptrend Start (Slow)', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, transp_st))

plotshape(buySignal and showlabels ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Downtrend (Slow)', style=plot.style_linebr, linewidth=2, color=color.new(color.red, transp_st))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='Downtrend Start (Slow)', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, transp_st))

plotshape(sellSignal and showlabels ? dn : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, color=na)

longFillColor = highlighting ? trend == 1 ? color.green : color.black : color.black

shortFillColor = highlighting ? trend == -1 ? color.red : color.black : color.black

fill(mPlot, upPlot, title='Uptrend Shading (Slow)', color=color.new(longFillColor, transp_hl))

fill(mPlot, dnPlot, title='Downtrend Shading (Slow)', color=color.new(shortFillColor, transp_hl))

//------------------------------------------------

// Calculations (Slow)

atrA2 = ta.sma(ta.tr, periods2)

atr2 = changeATR ? ta.atr(periods2) : atrA2

up2 = src - multiplier2 * atr2

upA2 = nz(up2[1], up2)

up2 := close[1] > upA2 ? math.max(up2, upA2) : up2

dn2 = src + multiplier2 * atr2

dnA2 = nz(dn2[1], dn2)

dn2 := close[1] < dnA2 ? math.min(dn2, dnA2) : dn2

// Trend (Slow)

trend2 = 1

trend2 := nz(trend2[1], trend2)

trend2 := trend2 == -1 and close > dnA2 ? 1 : trend2 == 1 and close < upA2 ? -1 : trend2

upPlot2 = plot(trend2 == 1 ? up2 : na, title='Uptrend (Slow)', style=plot.style_linebr, linewidth=2, color=color.new(color.green, transp_st))

buySignal2 = trend2 == 1 and trend2[1] == -1

plotshape(buySignal2 ? up2 : na, title='Uptrend Start (Slow)', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, transp_st))

plotshape(buySignal2 and showlabels ? up2 : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot2 = plot(trend2 == 1 ? na : dn2, title='Downtrend (Slow)', style=plot.style_linebr, linewidth=2, color=color.new(color.red, transp_st))

sellSignal2 = trend2 == -1 and trend2[1] == 1

plotshape(sellSignal2 ? dn2 : na, title='Downtrend Start (Slow)', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, transp_st))

plotshape(sellSignal2 and showlabels ? dn2 : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

mPlot2 = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, color=na)

longFillColor2 = highlighting2 ? trend2 == 1 ? color.green : color.black : color.black

shortFillColor2 = highlighting2 ? trend2 == -1 ? color.red : color.black : color.black

fill(mPlot2, upPlot2, title='Uptrend Shading (Slow)', color=color.new(longFillColor2, transp_hl))

fill(mPlot2, dnPlot2, title='Downtrend Shading (Slow)', color=color.new(shortFillColor2, transp_hl))

if buySignal2

strategy.entry("Enter Long", strategy.long)

else if sellSignal2

strategy.entry("Enter Short", strategy.short)

متعلقہ

- متحرک اتار چڑھاؤ فلٹر کے ساتھ کثیر مدت کی اوسط چلتی کراس اوور حکمت عملی

- اے ٹی آر سٹاپ نقصان کے نظام کے ساتھ کثیر ایس ایم اے سپورٹ لیول غلط بریک آؤٹ حکمت عملی

- اے ٹی آر اور حجم کو یکجا کرنے کی حکمت عملی کے بعد متحرک سگنل لائن رجحان

- الفا ٹرینڈ

- خطرہ کنٹرول کے ساتھ دوہری حرکت پذیر اوسط ریورسنگ کی حکمت عملی

- Ichimoku کلاؤڈ اور ATR حکمت عملی

- لائن اشارے پر عمل کریں

- سپر ٹرینڈ+4متحرک

- دن کے اندر قابل پیمانے پر اتار چڑھاؤ ٹریڈنگ کی حکمت عملی

- اے ٹی آر اوسط بریک آؤٹ حکمت عملی

مزید

- فوکوز رجحان

- جانی کی BOT

- ایس ایس ایل ہائبرڈ

- لوڈشیلڈر باہر نکلیں

- ریسوٹو

- ای ایم اے کلاؤڈ انٹرا ڈے حکمت عملی

- پییوٹ پوائنٹ سپر ٹرینڈ

- سپر ٹرینڈ+4متحرک

- رفتار پر مبنی زگ زگ

- VuManChu Cipher B + Divergences حکمت عملی

- سپر اسکیلپر

- بیک ٹسٹنگ- اشارے

- ٹرینڈیلیوس

- ایس ایم اے بی ٹی سی قاتل

- ایم ایل انتباہات کا نمونہ

- وقفے کے ساتھ فبونیکی ترقی

- RSI MTF Ob+Os

- Fukuiz Octa-EMA + Ichimoku

- سی سی آئی ایم ٹی ایف او بی + او

- زیادہ ذہین MACD