رفتار تلاش کرنے کی حکمت عملی

جائزہ

یہ حکمت عملی مارکیٹ کے کمپریشن اور ریلیز کا اندازہ لگانے کے لئے متعدد اشارے جیسے برن بینڈ ، کے سی چینل اور سلائیڈ کلر کا استعمال کرتی ہے ، اور اس کے ساتھ ساتھ اسٹیبلشمنٹ ٹرینڈ کی سمت کا اندازہ لگانے کے لئے مساوی لائن کی سمت کا استعمال کرتی ہے ، اور جب رجحان کی سمت میں تبدیلی ہوتی ہے تو اس پر عملدرآمد کرتی ہے۔

حکمت عملی کا اصول

برن بینڈ ◄ کا حساب لگائیں۔ برن بینڈ میں N دن کے اختتامی قیمت کے لئے سادہ منتقل اوسط ، اوپری ریل میں N دن کی اصل طول و عرض میں M گنا اور نچلے ریل میں N دن کی اصل طول و عرض میں M گنا۔

کے سی چینل کا حساب لگائیں۔ کے سی چینل میں میڈل ٹریک N دن کے اختتامی قیمت کا سادہ منتقل اوسط ہے ، اوپری ٹریک میڈل ٹریک + N دن کی اصل طول موج کا M گنا ہے ، اور نچلی ٹریک میڈل ٹریک - N دن کی اصل طول موج کا M گنا ہے۔

کمپریشن اور ریلیز کا تعین کریں۔ جب بورن بینڈ اپ ریل کے سی سی چینل اپ ریل سے کم ہو اور بورن بینڈ ڈاون ریل کے سی چینل ڈاون ریل سے زیادہ ہو تو کمپریشن ، جب بورن بینڈ اپ ریل کے سی چینل اپ ریل سے زیادہ ہو اور بورن بینڈ ڈاون ریل کے سی چینل ڈاون ریل سے کم ہو تو ریلیز کریں۔

اسٹیبلشمنٹ ٹرینڈ کا حساب لگائیں۔ N دن کی اختتامی قیمت - N دن کی اعلی ترین اور کم ترین قیمتوں کی اوسط قیمت کے طور پر ان پٹ ، N دن کی لکیری رجعت کا حساب لگائیں ، جس کی قدر 0 سے زیادہ اسٹیبلشمنٹ عروج کی طرف اشارہ کرتی ہے ، 0 سے کم اسٹیبلشمنٹ نیچے کی طرف اشارہ کرتی ہے۔

ٹریڈنگ سگنل 〇 جب قیام بڑھتا ہے تو ، شارٹ سن لائن اور ریلیز کو کثیر سگنل کے طور پر استعمال کیا جاتا ہے۔ جب قیام گرتا ہے تو ، شارٹ سن لائن اور کمپریشن کو خالی کرنے کا اشارہ دیا جاتا ہے۔

اسٹریٹجک فوائد

ایک سے زیادہ اشارے کا فیصلہ ، سگنل کی درستگی کو بہتر بنائیں۔ برن بینڈ ، کے سی چینلز اور فلیکس لائنوں کے ساتھ مل کر مارکیٹ کے رجحانات کا فیصلہ کریں ، غلط سگنل سے بچیں۔

اسٹیبلشمنٹ رجحانات کا تعین کریں ، رجحانات کے مطابق تجارت کریں۔ اسٹیبلشمنٹ کے فیصلوں کا استعمال کرتے ہوئے اہم رجحانات ، مخالف آپریشن سے بچیں۔

خود کار طریقے سے روکنے ، خطرے پر قابو پالیں۔ جب قیمت اسٹاپ نقصان کی لائن کو چھوتی ہے تو خود کار طریقے سے صفائی کی پوزیشن بند کردی جاتی ہے۔

اسٹریٹجک رسک

برین بینڈ اور کے سی چینل پیرامیٹرز کی غلط ترتیب ، جس سے کمپریشن اور ریلیز فیصلے میں غلطی ہوسکتی ہے۔

اسٹیبلشمنٹ کے رجحانات کی پیمائش میں تاخیر، اور ممکنہ طور پر رجحانات کے نقطہ نظر سے محروم.

اچانک ہونے والے واقعات کی وجہ سے بڑے پیمانے پر نقصانات کا سامنا کرنا پڑتا ہے ، جس سے نقصانات کا خطرہ زیادہ ہوتا ہے۔

اصلاح کا طریقہ: برن بینڈ اور کے سی چینل پیرامیٹرز کو ایڈجسٹ کریں ، ADX جیسے اشارے کے ساتھ معاون فیصلے کریں establishment establishment establishment اوسط لائن کا دورانیہ بروقت اپ ڈیٹ کریں ، تاخیر کو کم کریں buffer zone شامل کریں جب اسٹاپ نقصان کی لائن قائم کریں۔

حکمت عملی کی اصلاح کی سمت

مزید تکنیکی اشارے کے ساتھ مل کر ، گودام کی سگنل کی درستگی کو بہتر بنائیں۔ مثال کے طور پر کے ڈی جے ، ایم اے سی ڈی وغیرہ

اسٹیبلشمنٹ میڈین لائن کے لئے سائیکلنگ پیرامیٹرز کو بہتر بنائیں تاکہ یہ نئے رجحانات کو بہتر طریقے سے پکڑ سکے۔

ٹرانزیکشن حجم کے اشارے شامل کریں ، تاکہ جھوٹے توڑ سے بچا جاسکے۔ جیسے توانائی کی لہر کا اشارہ ، اکٹھا / تقسیم وغیرہ۔

ایک سے زیادہ وقت کی مدت کا فیصلہ کریں ، لمبی اور مختصر لائن سگنل میں فرق کریں۔ اس سے بچنے سے بچیں۔

AI اصلاحی پیرامیٹرز ، تلاش شدہ عددی اور تلاش شدہ بہترین پیرامیٹرز کا مجموعہ کم سے کم فٹ ہونا

خلاصہ کریں۔

اس حکمت عملی کا بنیادی نظریہ یہ ہے کہ: مارکیٹ میں کمپریشن اور ریلیز کا تعین کرنے کے لئے برن بینڈ کا استعمال کریں۔ اسٹیبلشمنٹ ٹرینڈ کا استعمال کرتے ہوئے اہم رجحان کی سمت کا تعین کرنے میں معاون؛ کمپریشن ریلیز کے موڑ کے مقام پر انسداد اسٹیبلشمنٹ کی سمت میں کام کرنا۔ حکمت عملی کا فائدہ سگنل کی درستگی ، اسٹاپ نقصان ، جھوٹے سگنل سے بچنا ہے۔ حکمت عملی کو بہتر بنانے کی سمت ہے: کثیر اشارے کا مجموعہ ، رجحان کا فیصلہ کرنے والے پیرامیٹرز کو بہتر بنانا ، توانائی کے اشارے میں شامل ہونا ، کثیر وقت کی مدت کا فیصلہ کرنا ، اے آئی کو فائدہ اٹھانا وغیرہ۔ مجموعی طور پر ، یہ حکمت عملی مارکیٹ کے خود سے مماثلت اور دورانی عمل کے قوانین پر مبنی ہے ، اشارے کے ذریعہ مارکیٹ کی رفتار میں تبدیلی کی عکاسی کرتی ہے ، جب مارکیٹ توانائی کے ذخیرہ سے توانائی کی رہائی کے اہم نقطہ پر تجارت کرتی ہے تو یہ ایک عام حساب کتاب کی حکمت عملی ہے۔

/*backtest

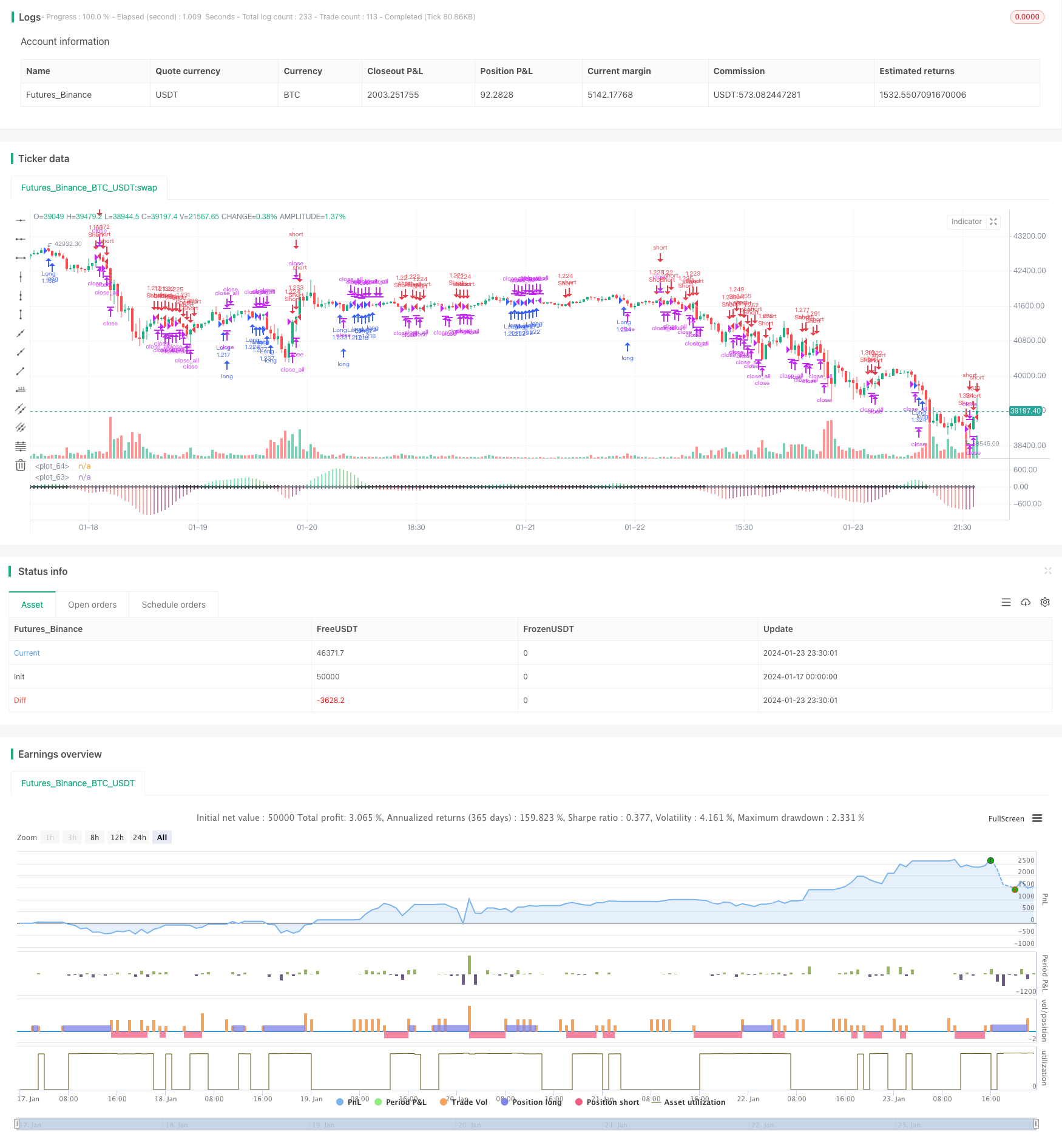

start: 2024-01-17 00:00:00

end: 2024-01-24 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2017

//@version=2

strategy(shorttitle = "Squeeze str 1.1", title="Noro's Squeeze Momentum Strategy v1.1", overlay = false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

lev = input(1, defval = 1, minval = 1, maxval = 100, title = "leverage")

length = input(20, title="BB Length")

mult = input(2.0,title="BB MultFactor")

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

useTrueRange = true

mode2 = input(true, defval = true, title = "Mode 2")

usecolor = input(true, defval = true, title = "Use color of candle")

usebody = input(true, defval = true, title = "Use EMA Body")

needbg = input(false, defval = false, title = "Show trend background")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

// Calculate BB

source = close

basis = sma(source, length)

dev = multKC * stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = sma(source, lengthKC)

range = useTrueRange ? tr : (high - low)

rangema = sma(range, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = (sqzOn == false) and (sqzOff == false)

val = linreg(source - avg(avg(highest(high, lengthKC), lowest(low, lengthKC)),sma(close,lengthKC)), lengthKC,0)

bcolor = iff( val > 0, iff( val > nz(val[1]), lime, green), iff( val < nz(val[1]), red, maroon))

scolor = noSqz ? blue : sqzOn ? black : gray

trend = val > 0 ? 1 : val < 0 ? -1 : 0

//Background

col = needbg == false ? na : trend == 1 ? lime : red

bgcolor(col, transp = 80)

//Body

body = abs(close - open)

abody = sma(body, 10) / 3

//Indicator

bcol = iff( val > 0, iff( val > nz(val[1]), lime, green), iff( val < nz(val[1]), red, maroon))

scol = noSqz ? blue : sqzOn ? black : gray

plot(val, color=bcol, style=histogram, linewidth=4)

plot(0, color=scol, style=cross, linewidth=2)

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

up1 = trend == 1 and (bar == -1 or usecolor == false) and (body > abody or usebody == false) and mode2 == false

dn1 = trend == -1 and (bar == 1 or usecolor == false) and (body > abody or usebody == false) and mode2 == false

up2 = trend == 1 and val < val[1] and mode2

dn2 = trend == -1 and val > val[1] and mode2

exit = (strategy.position_size > 0 and close > strategy.position_avg_price) or (strategy.position_size < 0 and close < strategy.position_avg_price) and mode2

//Trading

lot = strategy.position_size == 0 ? strategy.equity / close * lev : lot[1]

if up1 or up2

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot)

if dn1 or dn2

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot)

if exit

strategy.close_all()