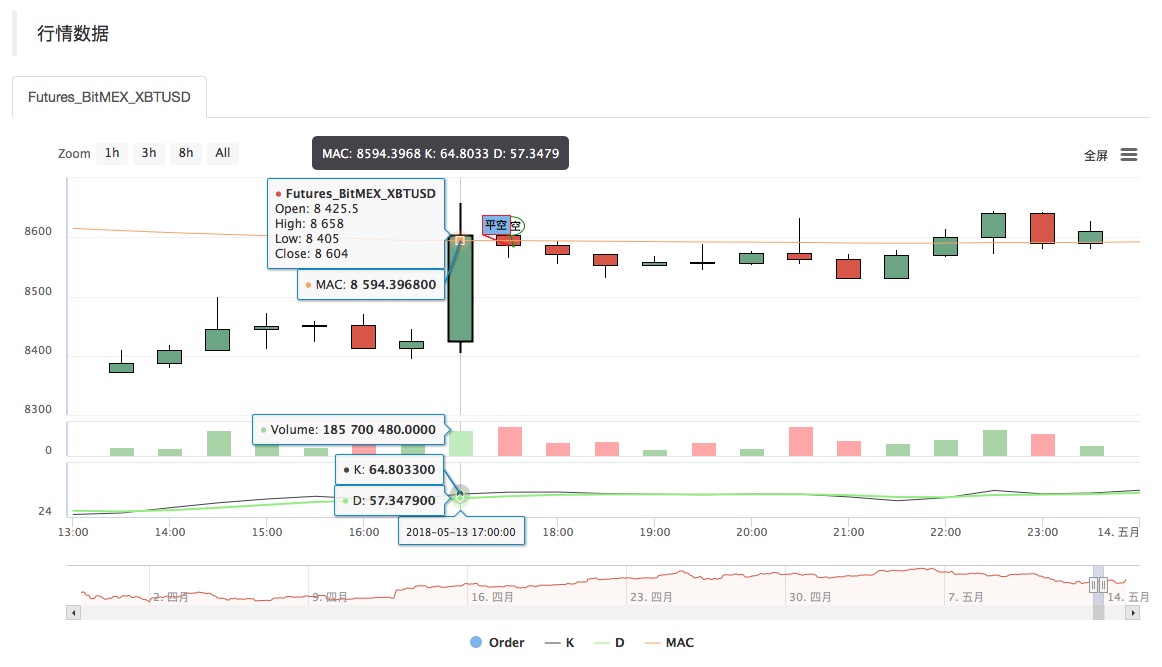

- 策略名称:传统均线指标与KD指标的交易策略

- 数据周期:15M,30M等

- 支持:商品期货、数字货币

- 指标使用了EMA,KD线,其中KD线使用的是默认参数(指标参数固定3,3,9)

- 官方网站:www.quantinfo.com

主图 EMA均线,公式:MAC^^EMA(C,N);

副图

KD线中的K线,公式:K:SMA(RSV,M1,1);//RSV的移动平均值 KD线中的D线,公式:D:SMA(K,M2,1);//K的移动平均值

策略源码

(*backtest

start: 2018-04-01 00:00:00

end: 2018-05-15 00:00:00

period: 30m

exchanges: [{"eid":"Futures_BitMEX","currency":"XBT_USD"}]

args: [["TradeAmount",100,126961],["ContractType","XBTUSD",126961]]

*)

MAC^^EMA(C,N);

NKD:=9;

M1:=3;

M2:=3;

RSV:=(CLOSE-LLV(LOW,NKD))/(HHV(HIGH,NKD)-LLV(LOW,NKD))*100; //收盘价与NKD周期最低值做差,NKD周期最高值与NKD周期最低值做差,两差之间做比值。

// (1)closing price minus the lowest value in NKD cycle,

// (2)the highest value in NKD cycle minus the lowest value in NKD cycle, then (1) divided by (2).

K:SMA(RSV,M1,1); // RSV的移动平均值

// MA of RSV

D:SMA(K,M2,1); // K的移动平均值

// MA of K

BARPOS>N AND C>MAC AND K<D,BK;

BARPOS>N AND C<MAC AND K>D,SK;

C<=BKPRICE*(1-SLOSS*0.01),SP(BKVOL);

C>=SKPRICE*(1+SLOSS*0.01),BP(SKVOL);

C>=BKPRICE*(1+SLOSS*0.01) AND C<MAC,SP(BKVOL);

C<=SKPRICE*(1-SLOSS*0.01) AND C>MAC,BP(SKVOL);

相关推荐