概述

本策略通过组合使用不同周期的移动平均线来确定趋势方向,并利用有限差分法近似导数来预测可能的反转点。该策略适用于小时级别的低波动性货币对。

策略原理

该策略同时使用20期、40期和80期的简单移动平均线。当收盘价高于这3条移动平均线时,定义为上升趋势;当收盘价低于这3条移动平均线时,定义为下降趋势。只有当最低价高于或最高价低于这3条移动平均线时,才确认趋势。

为了预测可能的反转点,策略利用3期中项移动平均线的有限差分法近似第一导数。当第一导数为正时,表示上升趋势稳定;当第一导数为负时,表示下降趋势稳定。

具体交易规则是:

当快速线高于中线,中线高于慢速线,并且第一导数>0时,做多;

当快速线低于中线,中线低于慢速线,并且第一导数时,做空;

多头止损当第一导数<=0时;

空头止损当第一导数>=0时。

优势分析

该策略具有以下优势:

使用多组移动平均线组合判断趋势,使趋势判断更可靠;

利用导数预测反转点,可以及时止损,回撤更小;

策略逻辑简单清晰,容易理解实现,适合新手学习;

只做趋势后的反转,避免被套,胜率较高。

风险分析

该策略也存在一些风险:

在震荡行情中,移动平均线组合可能发出错误信号;

导数反转信号可能滞后,无法完全避免损失;

止损点设定不当可能扩大损失。

针对这些风险,我们可以通过优化移动平均线的参数,调整止损位置,结合其他指标等方法来改进。

优化方向

该策略可以从以下几个方面进行优化:

优化移动平均线的周期,使其更符合不同市场的特点;

尝试不同类型的移动平均线,如指数移动平均线;

利用波动率指标设定动态止损;

结合其他指标进行確認,避免错误信号。

总结

该移动平均线组合趋势策略,利用多组移动平均线判断趋势方向,并用导数预测反转点,可以有效控制风险,适合中短线操作。策略简单易用,容易优化,是非常适合新手学习实践的趋势跟踪策略。通过进一步优化,可以使策略参数更加适应不同品种,从而获得更好的效果。

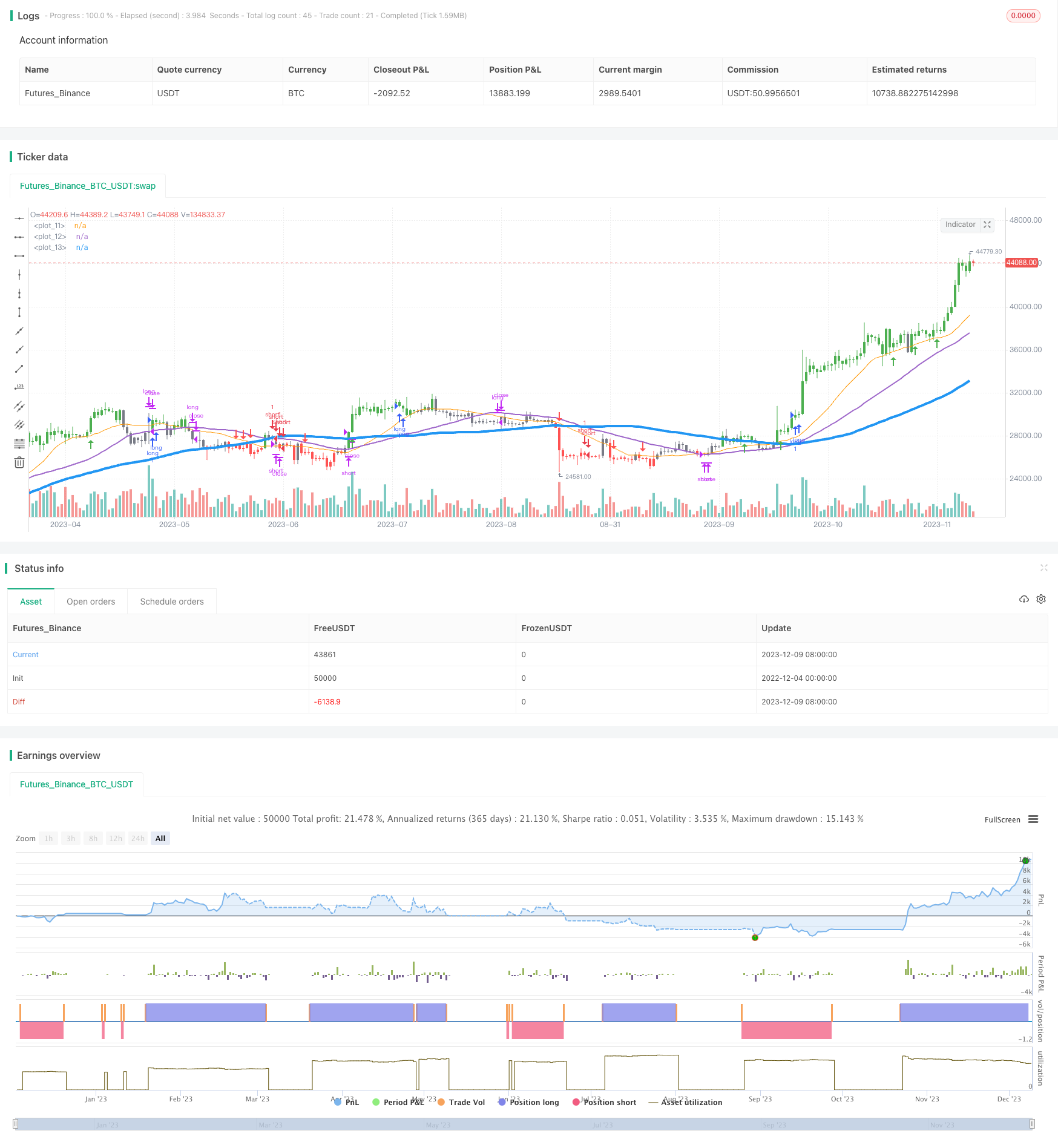

/*backtest

start: 2022-12-04 00:00:00

end: 2023-12-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Big 3",overlay=true, default_qty_type=strategy.percent_of_equity)

// enter on Arrows

// take profit on touch with 80 SMA, gray, or at discretion

fast = sma(close,20)

mid = sma(close,40)

slow = sma(close,80)

plot(fast,linewidth=1)

plot(mid,linewidth=2)

plot(slow,linewidth=4)

isUptrend = close > fast and close > mid and close > slow

isDowntrend = close < fast and close < mid and close < slow

confirmed = (low > fast and low > mid and low > slow) or (high < fast and high < mid and high < slow)

deriv = 3 * mid[0] - 4 * mid[1] + mid[2]

stableUptrend = (fast > mid) and (mid > slow) and (deriv > 0)

stableDowntrend = (fast < mid) and (mid < slow) and (deriv < 0)

barcolor(isUptrend ? green : isDowntrend ? red : gray)

plotshape(not confirmed[1] and confirmed and isUptrend ? close : na,style=shape.arrowup,location=location.belowbar,color=green)

plotshape(not confirmed[1] and confirmed and isDowntrend ? close : na,style=shape.arrowdown,location=location.abovebar,color=red)

stop = na

//stop = input(1000, "Stop")

strategy.entry("long", strategy.long, when=(stableUptrend), stop=stop)

strategy.close("long", when=(deriv <= 0))

strategy.entry("short", strategy.short, when=(stableDowntrend), stop=stop)

strategy.close("short", when=(deriv >= 0))