概述

该策略基于超级趋势指标和价格通道指标,结合均线信号进行交易。其核心思想是利用价格通道判断当前价格是否处于异常状态,超级趋势判断当前趋势方向,并与均线信号组合产生交易信号。

策略原理

计算超级趋势指标。其中上轨线和下轨线分别为当前价格加/减去ATR指标的N倍。当价格高于上轨时为看涨,价格低于下轨时为看跌。

计算价格通道指标。其中价格通道线为价格的N日内标准差的M倍。价格高于/低于通道线视为异常状态。

计算均线。分别取开盘价、收盘价和超级趋势的平均线。

产生交易信号:

买入信号:收盘价上穿超级趋势线且高于开盘价均线

卖出信号:收盘价下穿超级趋势线且低于开盘价均线

设置止损止盈价格通道。

策略优势分析

结合多个指标,避免假信号。

利用价格通道判断价格异常状态,可过滤掉一些不理想的入场点。

均线结合判断趋势方向,避免逆势操作。

设置止损止盈范围,控制风险。

风险分析

参数设置过于主观,需要优化。

止损止盈范围可能设置过大过小。

价格通道参数可能不适合全部品种,需要根据不同品种分别测试。

在趋势剧烈变化时,可能产生较大亏损。

优化方向

对参数进行测试优化,找到最佳参数组合。

测试不同的均线周期,选取最优参数。

对多种品种进行回测,根据表现分别选择参数。

优化止损策略,避免单次损失过大。

总结

本策略综合多种指标判断价格异常和趋势方向,在理论上可以过滤掉一定假信号。但参数设置依然比较主观,有一定优化空间。此外在具体实盘中,还需要考虑手续费、滑点等交易成本的影响。总体来说,本策略作为趋势跟踪策略较为适合,但需要针对不同品种进行参数优化调整。

策略源码

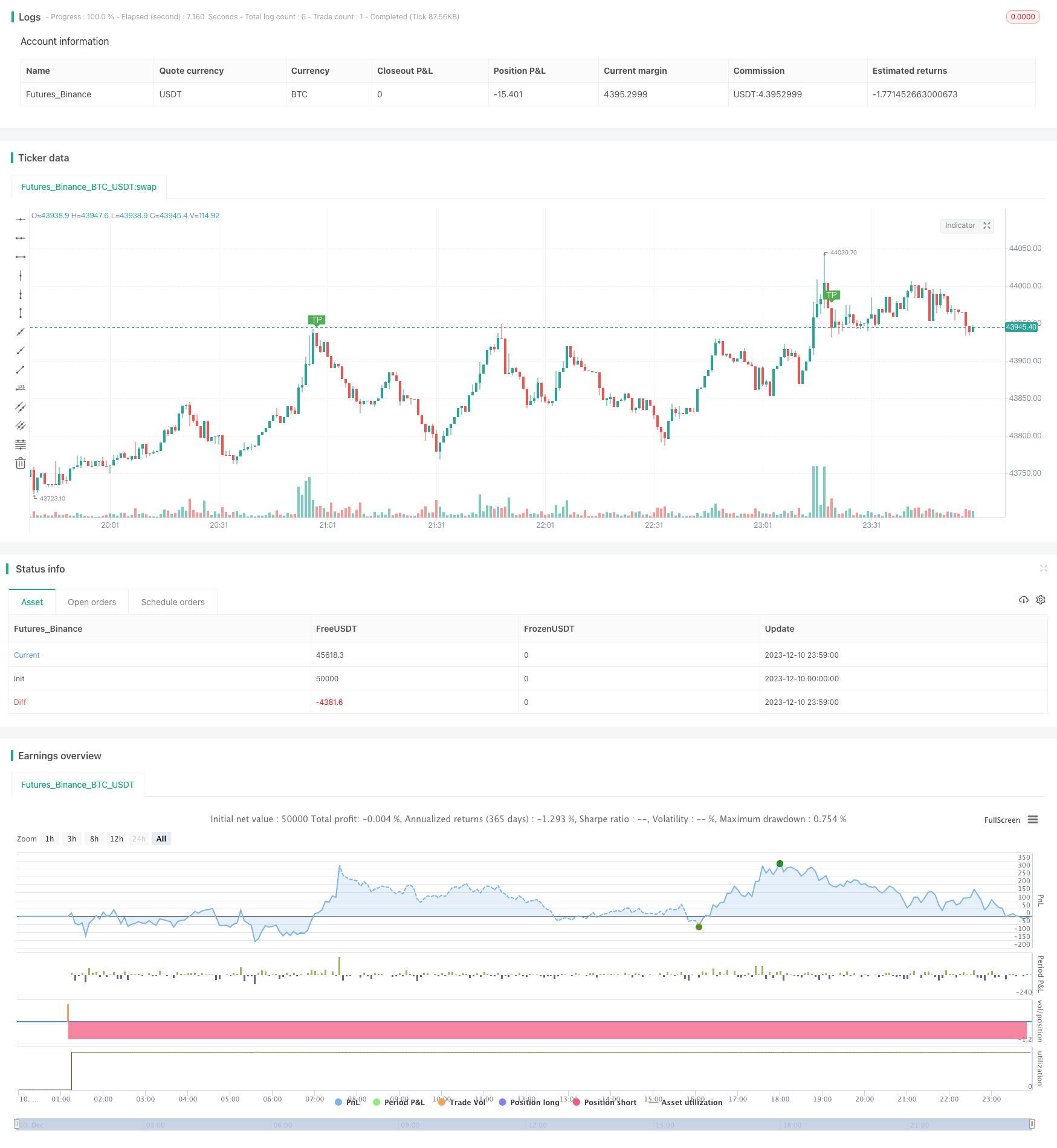

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-11 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Vol ST VM", overlay=true)

source = close

hilow = ((high - low)*100)

openclose = ((close - open)*100)

vol = (volume / hilow)

spreadvol = (openclose * vol)

VPT = spreadvol + cum(spreadvol)

window_len = 28

v_len = 14

price_spread = stdev(high-low, window_len)

v = spreadvol + cum(spreadvol)

smooth = sma(v, v_len)

v_spread = stdev(v - smooth, window_len)

shadow = (v - smooth) / v_spread * price_spread

out = shadow > 0 ? high + shadow : low + shadow

//

src = out

src1=open

src2=low

src3=high

tf =input(720)

len = timeframe.isintraday and timeframe.multiplier >= 1 ?

tf / timeframe.multiplier * 7 :

timeframe.isintraday and timeframe.multiplier < 60 ?

60 / timeframe.multiplier * 24 * 7 : 7

c = ema(src, len)

plot(c,color=color.red)

o = ema(src1,len)

plot(o,color=color.blue)

//h = ema(src3,len)

//l=ema(src2,len)

//

col=c > o? color.lime : color.orange

vis = true

vl = c

ll = o

m1 = plot(vl, color=col, linewidth=1, transp=60)

m2 = plot(vis ? ll : na, color=col, linewidth=2, transp=80)

fill(m1, m2, color=col, transp=70)

//

vpt=ema(out,len)

// INPUTS //

st_mult = input(1, title = 'SuperTrend Multiplier', minval = 0, maxval = 100, step = 0.01)

st_period = input(10, title = 'SuperTrend Period', minval = 1)

// CALCULATIONS //

up_lev = vpt - (st_mult * atr(st_period))

dn_lev = vpt + (st_mult * atr(st_period))

up_trend = 0.0

up_trend := close[1] > up_trend[1] ? max(up_lev, up_trend[1]) : up_lev

down_trend = 0.0

down_trend := close[1] < down_trend[1] ? min(dn_lev, down_trend[1]) : dn_lev

// Calculate trend var

trend = 0

trend := close > down_trend[1] ? 1: close < up_trend[1] ? -1 : nz(trend[1], 1)

// Calculate SuperTrend Line

st_line = trend ==1 ? up_trend : down_trend

// Plotting

plot(st_line[1], color = trend == 1 ? color.green : color.red , style = plot.style_cross, linewidth = 2, title = "SuperTrend")

buy=crossover( close, st_line) and close>o

sell=crossunder(close, st_line) and close<o

//plotshape(crossover( close, st_line), location = location.belowbar, color = color.green,size=size.tiny)

//plotshape(crossunder(close, st_line), location = location.abovebar, color = color.red,size=size.tiny)

plotshape(buy, title="buy", color=color.green, style=shape.arrowup, location=location.belowbar, size=size.normal, textcolor=color.white, transp=0) //plot for buy icon

plotshape(sell, title="sell", color=color.red, style=shape.arrowdown, location=location.abovebar, size=size.normal, textcolor=color.white, transp=0) //plot for sell icon

//

multiplier = input(title="TP", type=input.float, defval=2, minval=1)

src5 = close

len5 = input(title="TP length", defval=150, minval=1)

offset = 0

calcSlope(src5, len5) =>

sumX = 0.0

sumY = 0.0

sumXSqr = 0.0

sumXY = 0.0

for i = 1 to len5

val = src5[len5-i]

per = i + 1.0

sumX := sumX + per

sumY := sumY + val

sumXSqr := sumXSqr + per * per

sumXY := sumXY + val * per

slope = (len5 * sumXY - sumX * sumY) / (len5 * sumXSqr - sumX * sumX)

average = sumY / len5

intercept = average - slope * sumX / len5 + slope

[slope, average, intercept]

var float tmp = na

[s, a, i] = calcSlope(src5, len5)

vwap1=(i + s * (len5 - offset))

sdev = stdev(close, len5)

dev = multiplier * sdev

top=vwap1+dev

bott=vwap1-dev

//

z1 = vwap1 + dev

x1 = vwap1 - dev

low1 = crossover(close, x1)

high1 = crossunder(close, z1)

plotshape(low1, title="low", text="TP", color=color.red, style=shape.labelup, location=location.belowbar, size=size.small, textcolor=color.white, transp=0) //plot for buy icon

plotshape(high1, title="high", text="TP", color=color.green, style=shape.labeldown, location=location.abovebar, size=size.small, textcolor=color.white, transp=0) //plot for sell icon

strategy.entry(id="Enter Long MA", long=true, comment="Buy", when=high1)

strategy.entry(id="Short Entry MA", long=false, comment="Sell", when=low1)

/////// Alerts /////

alertcondition(buy,title="buy")

alertcondition(sell,title="sell")

alertcondition(low1,title="sell tp")

alertcondition(high1,title="buy tp")