概述

本策略为经典MACD指标的改进版本,使用了11种不同类型的移动平均线来平滑价格曲线,以减少误导信号。指标由快线、慢线和柱线组成。快线和慢线分别采用价格的快速移动平均线和慢速移动平均线。柱线则表示快线和慢线之间的差值。当快线从下向上突破慢线时产生买进信号,相反产生卖出信号。

策略原理

计算快速移动平均线MA12。允许选择11种不同的移动平均线计算方法,默认为变化率线VAR。

计算慢速移动平均线MA26。允许选择11种不同的移动平均线计算方法,默认为变化率线VAR。

计算快慢线差值SRC2 = MA12 - MA26。

对SRC2计算触发线MATR,采用长度为9的移动平均线,可选择11种计算方法,默认为变化率线VAR。

计算MACD柱线HIST = SRC2 - MATR。当柱子由负数变为正数时产生买入信号,由正数变为负数时产生卖出信号。

优势分析

可选择11种不同的移动平均线来计算快慢线和触发线,大幅度减少了常见移动平均线的滞后性,提高了预测信号的准确性。

变化率线VAR可自动调整移动平均线的权重,从而更好地适应市场变化。

应用了缓冲区原理的双移动平均线可有效过滤市场噪音。

MACD柱线作为触发信号可克服传统MACD快慢线交叉时带来的滞后问题。

风险分析

MACD指标对趋势震荡行情的判断能力较弱。

移动平均线本身会产生一定的滞后。VAR变化率线可部分减轻但无法完全解决。

误差积累会导致出现错误信号或错过有效信号的情况。

优化方向

针对具体市场行情选择匹配的移动平均线计算方法。结合回测结果选择比较准确的组合。

优化快慢线和触发线的长度参数,寻找最佳参数组合以减少错误信号。

添加附加指标判断来确认买卖信号,可考虑RSI,布林带等指标。

总结

本策略为MACD经典指标的优化版本。采用多种移动平均线模式计算MACD的快慢线和柱线,大大增强了指标的实用性。同时也存在一定的局限性,需要根据实际情况针对性地不断优化,才能在交易中发挥最大效用。

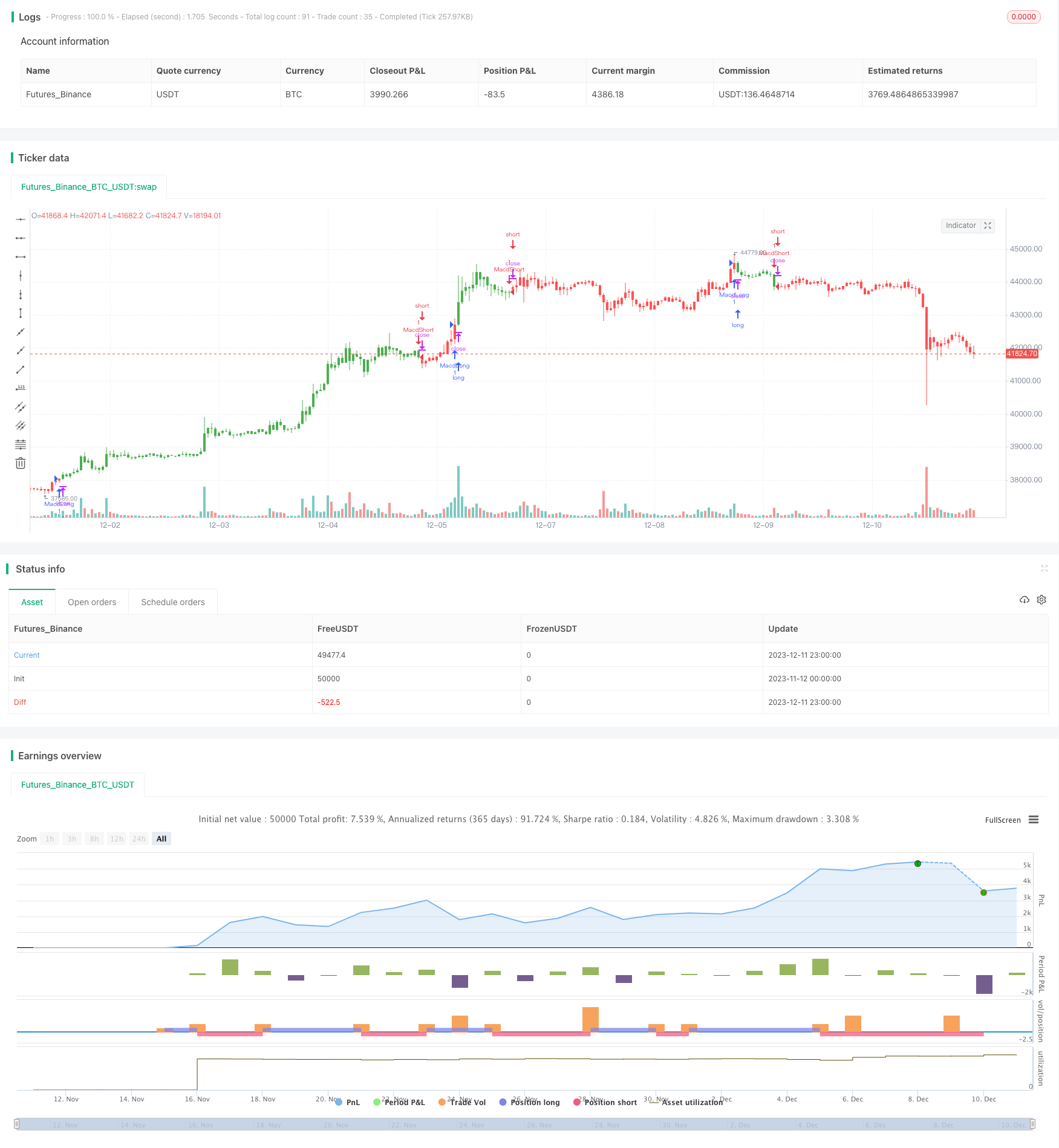

/*backtest

start: 2023-11-12 00:00:00

end: 2023-12-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

//developer: Gerald Appel

//author: @kivancozbilgic

strategy("MACD ReLoaded","MACDRe", overlay=true)

src = input(close, title="Source")

length=input(12, "Short Moving Average Length", minval=1)

length1=input(26, "Long Moving Average Length", minval=1)

length2=input(9, "Trigger Length", minval=1)

T3a1 = input(0.7, "TILLSON T3 Volume Factor", step=0.1)

barcoloring = input(title="Bar Coloring On/Off ?", type=input.bool, defval=true)

mav = input(title="Moving Average Type", defval="VAR", options=["SMA", "EMA", "WMA", "DEMA", "TMA", "VAR", "WWMA", "ZLEMA", "TSF", "HULL", "TILL"])

Var_Func(src,length)=>

valpha=2/(length+1)

vud1=src>src[1] ? src-src[1] : 0

vdd1=src<src[1] ? src[1]-src : 0

vUD=sum(vud1,9)

vDD=sum(vdd1,9)

vCMO=nz((vUD-vDD)/(vUD+vDD))

VAR=0.0

VAR:=nz(valpha*abs(vCMO)*src)+(1-valpha*abs(vCMO))*nz(VAR[1])

VAR=Var_Func(src,length)

DEMA = ( 2 * ema(src,length)) - (ema(ema(src,length),length) )

Wwma_Func(src,length)=>

wwalpha = 1/ length

WWMA = 0.0

WWMA := wwalpha*src + (1-wwalpha)*nz(WWMA[1])

WWMA=Wwma_Func(src,length)

Zlema_Func(src,length)=>

zxLag = length/2==round(length/2) ? length/2 : (length - 1) / 2

zxEMAData = (src + (src - src[zxLag]))

ZLEMA = ema(zxEMAData, length)

ZLEMA=Zlema_Func(src,length)

Tsf_Func(src,length)=>

lrc = linreg(src, length, 0)

lrc1 = linreg(src,length,1)

lrs = (lrc-lrc1)

TSF = linreg(src, length, 0)+lrs

TSF=Tsf_Func(src,length)

HMA = wma(2 * wma(src, length / 2) - wma(src, length), round(sqrt(length)))

T3e1=ema(src, length)

T3e2=ema(T3e1,length)

T3e3=ema(T3e2,length)

T3e4=ema(T3e3,length)

T3e5=ema(T3e4,length)

T3e6=ema(T3e5,length)

T3c1=-T3a1*T3a1*T3a1

T3c2=3*T3a1*T3a1+3*T3a1*T3a1*T3a1

T3c3=-6*T3a1*T3a1-3*T3a1-3*T3a1*T3a1*T3a1

T3c4=1+3*T3a1+T3a1*T3a1*T3a1+3*T3a1*T3a1

T3=T3c1*T3e6+T3c2*T3e5+T3c3*T3e4+T3c4*T3e3

getMA(src, length) =>

ma = 0.0

if mav == "SMA"

ma := sma(src, length)

ma

if mav == "EMA"

ma := ema(src, length)

ma

if mav == "WMA"

ma := wma(src, length)

ma

if mav == "DEMA"

ma := DEMA

ma

if mav == "TMA"

ma := sma(sma(src, ceil(length / 2)), floor(length / 2) + 1)

ma

if mav == "VAR"

ma := VAR

ma

if mav == "WWMA"

ma := WWMA

ma

if mav == "ZLEMA"

ma := ZLEMA

ma

if mav == "TSF"

ma := TSF

ma

if mav == "HULL"

ma := HMA

ma

if mav == "TILL"

ma := T3

ma

ma

MA12=getMA(src, length)

Var_Func1(src,length1)=>

valpha1=2/(length1+1)

vud11=src>src[1] ? src-src[1] : 0

vdd11=src<src[1] ? src[1]-src : 0

vUD1=sum(vud11,9)

vDD1=sum(vdd11,9)

vCMO1=nz((vUD1-vDD1)/(vUD1+vDD1))

VAR1=0.0

VAR1:=nz(valpha1*abs(vCMO1)*src)+(1-valpha1*abs(vCMO1))*nz(VAR1[1])

VAR1=Var_Func1(src,length1)

DEMA1 = ( 2 * ema(src,length1)) - (ema(ema(src,length1),length1) )

Wwma_Func1(src,length1)=>

wwalpha1 = 1/ length1

WWMA1 = 0.0

WWMA1 := wwalpha1*src + (1-wwalpha1)*nz(WWMA1[1])

WWMA1=Wwma_Func1(src,length1)

Zlema_Func1(src,length1)=>

zxLag1 = length1/2==round(length1/2) ? length1/2 : (length1 - 1) / 2

zxEMAData1 = (src + (src - src[zxLag1]))

ZLEMA1 = ema(zxEMAData1, length1)

ZLEMA1=Zlema_Func1(src,length1)

Tsf_Func1(src,length1)=>

lrc1 = linreg(src, length1, 0)

lrc11 = linreg(src,length1,1)

lrs1 = (lrc1-lrc11)

TSF1 = linreg(src, length1, 0)+lrs1

TSF1=Tsf_Func1(src,length1)

HMA1 = wma(2 * wma(src, length1 / 2) - wma(src, length1), round(sqrt(length1)))

T3e11=ema(src, length1)

T3e21=ema(T3e11,length1)

T3e31=ema(T3e21,length1)

T3e41=ema(T3e31,length1)

T3e51=ema(T3e41,length1)

T3e61=ema(T3e51,length1)

T3c11=-T3a1*T3a1*T3a1

T3c21=3*T3a1*T3a1+3*T3a1*T3a1*T3a1

T3c31=-6*T3a1*T3a1-3*T3a1-3*T3a1*T3a1*T3a1

T3c41=1+3*T3a1+T3a1*T3a1*T3a1+3*T3a1*T3a1

T31=T3c11*T3e61+T3c21*T3e51+T3c31*T3e41+T3c41*T3e31

getMA1(src, length1) =>

ma1 = 0.0

if mav == "SMA"

ma1 := sma(src, length1)

ma1

if mav == "EMA"

ma1 := ema(src, length1)

ma1

if mav == "WMA"

ma1 := wma(src, length1)

ma1

if mav == "DEMA"

ma1 := DEMA1

ma1

if mav == "TMA"

ma1 := sma(sma(src, ceil(length1 / 2)), floor(length1 / 2) + 1)

ma1

if mav == "VAR"

ma1 := VAR1

ma1

if mav == "WWMA"

ma1:= WWMA1

ma1

if mav == "ZLEMA"

ma1 := ZLEMA1

ma1

if mav == "TSF"

ma1 := TSF1

ma1

if mav == "HULL"

ma1 := HMA1

ma1

if mav == "TILL"

ma1 := T31

ma1

ma1

MA26=getMA1(src, length1)

src2=MA12-MA26

Var_Func2(src2,length2)=>

valpha2=2/(length2+1)

vud12=src2>src2[1] ? src2-src2[1] : 0

vdd12=src2<src2[1] ? src2[1]-src2 : 0

vUD2=sum(vud12,9)

vDD2=sum(vdd12,9)

vCMO2=nz((vUD2-vDD2)/(vUD2+vDD2))

VAR2=0.0

VAR2:=nz(valpha2*abs(vCMO2)*src2)+(1-valpha2*abs(vCMO2))*nz(VAR2[1])

VAR2=Var_Func2(src2,length2)

DEMA2 = ( 2 * ema(src2,length2)) - (ema(ema(src2,length2),length2) )

Wwma_Func2(src2,length2)=>

wwalpha2 = 1/ length2

WWMA2 = 0.0

WWMA2 := wwalpha2*src2 + (1-wwalpha2)*nz(WWMA2[1])

WWMA2=Wwma_Func2(src2,length2)

Zlema_Func2(src2,length2)=>

zxLag2 = length2/2==round(length2/2) ? length2/2 : (length2 - 1) / 2

zxEMAData2 = (src2 + (src2 - src2[zxLag2]))

ZLEMA2 = ema(zxEMAData2, length2)

ZLEMA2=Zlema_Func2(src2,length2)

Tsf_Func2(src2,length2)=>

lrc2 = linreg(src2, length2, 0)

lrc12 = linreg(src2,length2,1)

lrs2 = (lrc2-lrc12)

TSF2 = linreg(src2, length2, 0)+lrs2

TSF2=Tsf_Func2(src2,length2)

HMA2 = wma(2 * wma(src2, length2 / 2) - wma(src2, length2), round(sqrt(length2)))

T3e12=ema(src2, length2)

T3e22=ema(T3e12,length2)

T3e32=ema(T3e22,length2)

T3e42=ema(T3e32,length2)

T3e52=ema(T3e42,length2)

T3e62=ema(T3e52,length2)

T3c12=-T3a1*T3a1*T3a1

T3c22=3*T3a1*T3a1+3*T3a1*T3a1*T3a1

T3c32=-6*T3a1*T3a1-3*T3a1-3*T3a1*T3a1*T3a1

T3c42=1+3*T3a1+T3a1*T3a1*T3a1+3*T3a1*T3a1

T32=T3c12*T3e62+T3c22*T3e52+T3c32*T3e42+T3c42*T3e32

getMA2(src2, length2) =>

ma2 = 0.0

if mav == "SMA"

ma2 := sma(src2, length2)

ma2

if mav == "EMA"

ma2 := ema(src2, length2)

ma2

if mav == "WMA"

ma2 := wma(src2, length2)

ma2

if mav == "DEMA"

ma2 := DEMA2

ma2

if mav == "TMA"

ma2 := sma(sma(src2, ceil(length2 / 2)), floor(length2 / 2) + 1)

ma2

if mav == "VAR"

ma2 := VAR2

ma2

if mav == "WWMA"

ma2 := WWMA2

ma2

if mav == "ZLEMA"

ma2 := ZLEMA2

ma2

if mav == "TSF"

ma2 := TSF2

ma2

if mav == "HULL"

ma2 := HMA2

ma2

if mav == "TILL"

ma2 := T32

ma2

ma2

MATR=getMA2(MA12-MA26, length2)

hist = src2 - MATR

FromMonth = input(defval = 9, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 999)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 999)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

window() => time >= start and time <= finish ? true : false

buySignal = crossover(hist, 0)

if (crossover(hist, 0))

strategy.entry("MacdLong", strategy.long, comment="MacdLong")

sellSignal = crossunder(hist, 0)

if (crossunder(hist, 0))

strategy.entry("MacdShort", strategy.short, comment="MacdShort")

buy1= barssince(buySignal)

sell1 = barssince(sellSignal)

color1 = buy1[1] < sell1[1] ? color.green : buy1[1] > sell1[1] ? color.red : na

barcolor(barcoloring ? color1 : na)

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)