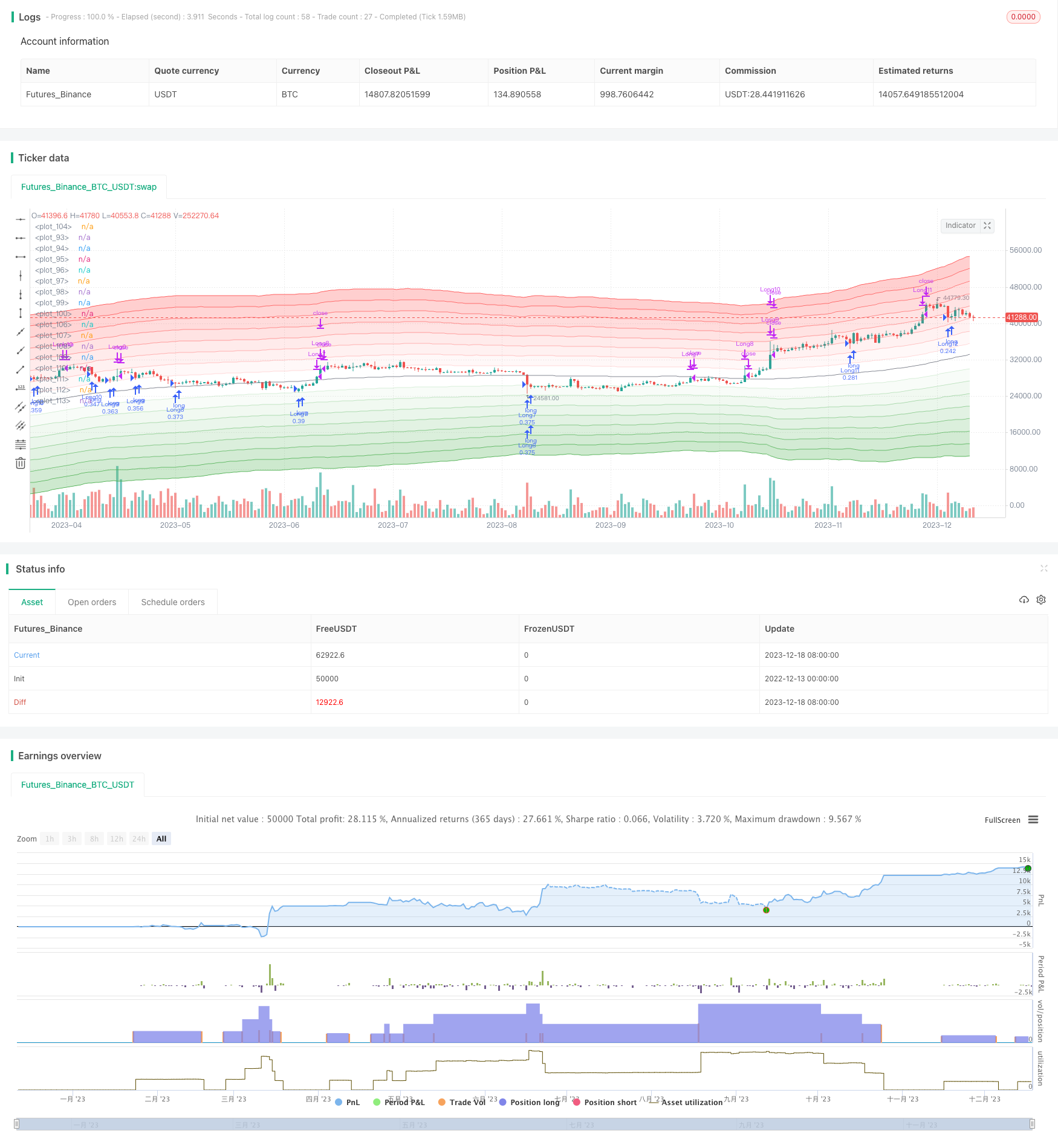

概述

该策略是一个利用移动均线的动态网格交易策略。它会根据设置的均线和波动幅度,在均线上下划定多个买卖区和卖区。当价格进入不同买卖区时,会发出不同数量的买入信号;当价格重新进入卖区时,会按顺序平仓。这样形成一个动态调整的网格交易策略。

策略原理

- 用户设置移动均线参数,决定主要交易中轴;

- 根据ATR和设置参数,在均线上下划分多个买入区和卖出区;

- 当价格进入不同买入区时,会触发对应数量的做多信号;

- 当价格重新回到相应的卖出区时,会按顺序平仓;

- 形成一个动态调整的网格交易机制。

策略优势

- 利用均线判断趋势方向,避免逆势建仓;

- ATR参数综合考虑市场波动性,使网格更加动态化;

- 多层次分批建仓,可控制风险;

- 按顺序分批止损,避免瀑布式亏损;

- 简单参数设置,易于操作。

策略风险

- 大幅震荡可能造成网格频繁触发亏损;

- 强势趋势中,止损点可能过于靠近,造成拉升后快速止损;

- 多重建仓增加交易次数,手续费负担重;

- 不适用于横盘震荡市或无明确趋势市场。

可通过适当放宽网格间距、优化ATR参数、减少建仓次数等方法降低风险。也可以根据不同市场设定趋势交易和震荡交易两种参数组合。

优化方向

- 可以加入现货指数指标判断大盘走势,区分多空市场;

- 可以添加量化指标筛选具有趋势特征的品种进行策略运用;

- 可以根据波动率实时调整ATR参数或网格间距;

- 可以添加止盈策略,跟踪趋势获取更多利润。

这样可以进一步优化,使策略更具有动态性和局部增强性。

总结

本策略整体是一个较为成熟简单的趋势跟踪网格策略。它利用均线判断大趋势,再建立动态网格进行分批交易。具有一定的风险控制能力。通过进一步量化优化,可以成为一个非常实用的量化工具。

策略源码

/*backtest

start: 2022-12-13 00:00:00

end: 2023-12-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Seungdori_

//@version=5

strategy("Grid Strategy with MA", overlay=true, initial_capital = 100000, default_qty_type = strategy.cash, default_qty_value = 10000, pyramiding = 10, process_orders_on_close = true, commission_type = strategy.commission.percent, commission_value = 0.04)

//Inputs//

length = input.int(defval = 100, title = 'MA Length', group = 'MA')

MA_Type = input.string("SMA", title="MA Type", options=['EMA', 'HMA', 'LSMA', 'RMA', 'SMA', 'WMA'],group = 'MA')

logic = input.string(defval='ATR', title ='Grid Logic', options = ['ATR', 'Percent'])

band_mult = input.float(2.5, step = 0.1, title = 'Band Multiplier/Percent', group = 'Parameter')

atr_len = input.int(defval=100, title = 'ATR Length', group ='parameter')

//Var//

var int order_cond = 0

var bool order_1 = false

var bool order_2 = false

var bool order_3 = false

var bool order_4 = false

var bool order_5 = false

var bool order_6 = false

var bool order_7 = false

var bool order_8 = false

var bool order_9 = false

var bool order_10 = false

var bool order_11 = false

var bool order_12 = false

var bool order_13 = false

var bool order_14 = false

var bool order_15 = false

/////////////////////

//Region : Function//

/////////////////////

getMA(source ,ma_type, length) =>

maPrice = ta.ema(source, length)

ema = ta.ema(source, length)

sma = ta.sma(source, length)

if ma_type == 'SMA'

maPrice := ta.sma(source, length)

maPrice

if ma_type == 'HMA'

maPrice := ta.hma(source, length)

maPrice

if ma_type == 'WMA'

maPrice := ta.wma(source, length)

maPrice

if ma_type == "RMA"

maPrice := ta.rma(source, length)

if ma_type == "LSMA"

maPrice := ta.linreg(source, length, 0)

maPrice

main_plot = getMA(ohlc4, MA_Type, length)

atr = ta.atr(length)

premium_zone_1 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*1), 5) : ta.ema((main_plot*(1+band_mult*0.01*1)), 5)

premium_zone_2 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*2), 5) : ta.ema((main_plot*(1+band_mult*0.01*2)), 5)

premium_zone_3 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*3), 5) : ta.ema((main_plot*(1+band_mult*0.01*3)), 5)

premium_zone_4 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*4), 5) : ta.ema((main_plot*(1+band_mult*0.01*4)), 5)

premium_zone_5 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*5), 5) : ta.ema((main_plot*(1+band_mult*0.01*5)), 5)

premium_zone_6 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*6), 5) : ta.ema((main_plot*(1+band_mult*0.01*6)), 5)

premium_zone_7 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*7), 5) : ta.ema((main_plot*(1+band_mult*0.01*7)), 5)

premium_zone_8 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*8), 5) : ta.ema((main_plot*(1+band_mult*0.01*8)), 5)

//premium_zone_9 = ta.rma(main_plot + atr*(band_mult*9), 5)

//premium_zone_10 = ta.rma(main_plot + atr*(band_mult*10), 5)

discount_zone_1 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*1), 5) : ta.ema((main_plot*(1-band_mult*0.01*1)), 5)

discount_zone_2 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*2), 5) : ta.ema((main_plot*(1-band_mult*0.01*2)), 5)

discount_zone_3 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*3), 5) : ta.ema((main_plot*(1-band_mult*0.01*3)), 5)

discount_zone_4 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*4), 5) : ta.ema((main_plot*(1-band_mult*0.01*4)), 5)

discount_zone_5 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*5), 5) : ta.ema((main_plot*(1-band_mult*0.01*5)), 5)

discount_zone_6 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*6), 5) : ta.ema((main_plot*(1-band_mult*0.01*6)), 5)

discount_zone_7 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*7), 5) : ta.ema((main_plot*(1-band_mult*0.01*7)), 5)

discount_zone_8 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*8), 5) : ta.ema((main_plot*(1-band_mult*0.01*8)), 5)

//discount_zon_9 = ta.sma(main_plot - atr*(band_mult*9), 5)

//discount_zone_10 =ta.sma( main_plot - atr*(band_mult*10), 5)

//Region End//

////////////////////

// Region : Plots//

///////////////////

dis_low1 = plot(discount_zone_1, color=color.new(color.green, 80))

dis_low2 = plot(discount_zone_2, color=color.new(color.green, 70))

dis_low3 = plot(discount_zone_3, color=color.new(color.green, 60))

dis_low4 = plot(discount_zone_4, color=color.new(color.green, 50))

dis_low5 = plot(discount_zone_5, color=color.new(color.green, 40))

dis_low6 = plot(discount_zone_6, color=color.new(color.green, 30))

dis_low7 = plot(discount_zone_7, color=color.new(color.green, 20))

dis_low8 = plot(discount_zone_8, color=color.new(color.green, 10))

//dis_low9 = plot(discount_zone_9, color=color.new(color.green, 0))

//dis_low10 = plot(discount_zone_10, color=color.new(color.green, 0))

plot(main_plot, color =color.new(color.gray, 10))

pre_up1 = plot(premium_zone_1, color=color.new(color.red, 80))

pre_up2 = plot(premium_zone_2, color=color.new(color.red, 70))

pre_up3 = plot(premium_zone_3, color=color.new(color.red, 60))

pre_up4 = plot(premium_zone_4, color=color.new(color.red, 50))

pre_up5 = plot(premium_zone_5, color=color.new(color.red, 40))

pre_up6 = plot(premium_zone_6, color=color.new(color.red, 30))

pre_up7 = plot(premium_zone_7, color=color.new(color.red, 20))

pre_up8 = plot(premium_zone_8, color=color.new(color.red, 10))

//pre_up9 = plot(premium_zone_9, color=color.new(color.red, 0))

//pre_up10 = plot(premium_zone_10, color=color.new(color.red, 0))

fill(dis_low1, dis_low2, color=color.new(color.green, 95))

fill(dis_low2, dis_low3, color=color.new(color.green, 90))

fill(dis_low3, dis_low4, color=color.new(color.green, 85))

fill(dis_low4, dis_low5, color=color.new(color.green, 80))

fill(dis_low5, dis_low6, color=color.new(color.green, 75))

fill(dis_low6, dis_low7, color=color.new(color.green, 70))

fill(dis_low7, dis_low8, color=color.new(color.green, 65))

//fill(dis_low8, dis_low9, color=color.new(color.green, 60))

//fill(dis_low9, dis_low10, color=color.new(color.green, 55))

fill(pre_up1, pre_up2, color=color.new(color.red, 95))

fill(pre_up2, pre_up3, color=color.new(color.red, 90))

fill(pre_up3, pre_up4, color=color.new(color.red, 85))

fill(pre_up4, pre_up5, color=color.new(color.red, 80))

fill(pre_up5, pre_up6, color=color.new(color.red, 75))

fill(pre_up6, pre_up7, color=color.new(color.red, 70))

fill(pre_up7, pre_up8, color=color.new(color.red, 65))

//fill(pre_up8, pre_up9, color=color.new(color.red, 60))

//fill(pre_up9, pre_up10, color=color.new(color.red, 55))

//Region End//

///////////////////////

//Region : Strategies//

///////////////////////

//Longs//

longCondition1 = ta.crossunder(low, discount_zone_7)

longCondition2 = ta.crossunder(low, discount_zone_6)

longCondition3 = ta.crossunder(low, discount_zone_5)

longCondition4 = ta.crossunder(low, discount_zone_4)

longCondition5 = ta.crossunder(low, discount_zone_3)

longCondition6 = ta.crossunder(low, discount_zone_2)

longCondition7 = ta.crossunder(low, discount_zone_1)

longCondition8 = ta.crossunder(low, main_plot)

longCondition9 = ta.crossunder(low, premium_zone_1)

longCondition10 = ta.crossunder(low, premium_zone_2)

longCondition11 = ta.crossunder(low, premium_zone_3)

longCondition12 = ta.crossunder(low, premium_zone_4)

longCondition13 = ta.crossunder(low, premium_zone_5)

longCondition14 = ta.crossunder(low, premium_zone_6)

longCondition15 = ta.crossunder(low, premium_zone_7)

if (longCondition1) and order_1 == false

strategy.entry("Long1", strategy.long)

order_1 := true

if (longCondition2) and order_2 == false

strategy.entry("Long2", strategy.long)

order_2 := true

if (longCondition3) and order_3 == false

strategy.entry("Long3", strategy.long)

order_3 := true

if (longCondition4) and order_4 == false

strategy.entry("Long4", strategy.long)

order_4 := true

if (longCondition5) and order_5 == false

strategy.entry("Long5", strategy.long)

order_5 := true

if (longCondition6) and order_6 == false

strategy.entry("Long6", strategy.long)

order_6 := true

if (longCondition7) and order_7 == false

strategy.entry("Long7", strategy.long)

order_7 := true

if (longCondition8) and order_8 == false

strategy.entry("Long8", strategy.long)

order_8 := true

if (longCondition9) and order_9 == false

strategy.entry("Long9", strategy.long)

order_9 := true

if (longCondition10) and order_10 == false

strategy.entry("Long10", strategy.long)

order_10 := true

if (longCondition11) and order_11 == false

strategy.entry("Long11", strategy.long)

order_11 := true

if (longCondition12) and order_12 == false

strategy.entry("Long12", strategy.long)

order_12 := true

if (longCondition13) and order_13 == false

strategy.entry("Long13", strategy.long)

order_13 := true

if (longCondition14) and order_14 == false

strategy.entry("Long14", strategy.long)

order_14 := true

if (longCondition15) and order_15 == false

strategy.entry("Long14", strategy.long)

order_15 := true

//Close//

shortCondition1 = ta.crossover(high, discount_zone_6)

shortCondition2 = ta.crossover(high, discount_zone_5)

shortCondition3 = ta.crossover(high, discount_zone_4)

shortCondition4 = ta.crossover(high, discount_zone_3)

shortCondition5 = ta.crossover(high, discount_zone_2)

shortCondition6 = ta.crossover(high, discount_zone_1)

shortCondition7 = ta.crossover(high, main_plot)

shortCondition8 = ta.crossover(high, premium_zone_1)

shortCondition9 = ta.crossover(high, premium_zone_2)

shortCondition10 = ta.crossover(high, premium_zone_3)

shortCondition11 = ta.crossover(high, premium_zone_4)

shortCondition12 = ta.crossover(high, premium_zone_5)

shortCondition13 = ta.crossover(high, premium_zone_6)

shortCondition14 = ta.crossover(high, premium_zone_7)

shortCondition15 = ta.crossover(high, premium_zone_8)

if (shortCondition1) and order_1 == true

strategy.close("Long1")

order_1 := false

if (shortCondition2) and order_2 == true

strategy.close("Long2")

order_2 := false

if (shortCondition3) and order_3 == true

strategy.close("Long3")

order_3 := false

if (shortCondition4) and order_4 == true

strategy.close("Long4")

order_4 := false

if (shortCondition5) and order_5 == true

strategy.close("Long5")

order_5 := false

if (shortCondition6) and order_6 == true

strategy.close("Long6")

order_6 := false

if (shortCondition7) and order_7 == true

strategy.close("Long7")

order_7 := false

if (shortCondition8) and order_8 == true

strategy.close("Long8")

order_8 := false

if (shortCondition9) and order_9 == true

strategy.close("Long9")

order_9 := false

if (shortCondition10) and order_10 == true

strategy.close("Long10")

order_10 := false

if (shortCondition11) and order_11 == true

strategy.close("Long11")

order_11 := false

if (shortCondition12) and order_12 == true

strategy.close("Long12")

order_12 := false

if (shortCondition13) and order_13 == true

strategy.close("Long13")

order_13 := false

if (shortCondition14) and order_14 == true

strategy.close("Long14")

order_14 := false

if (shortCondition15) and order_15 == true

strategy.close("Long15")

order_15 := false