概述

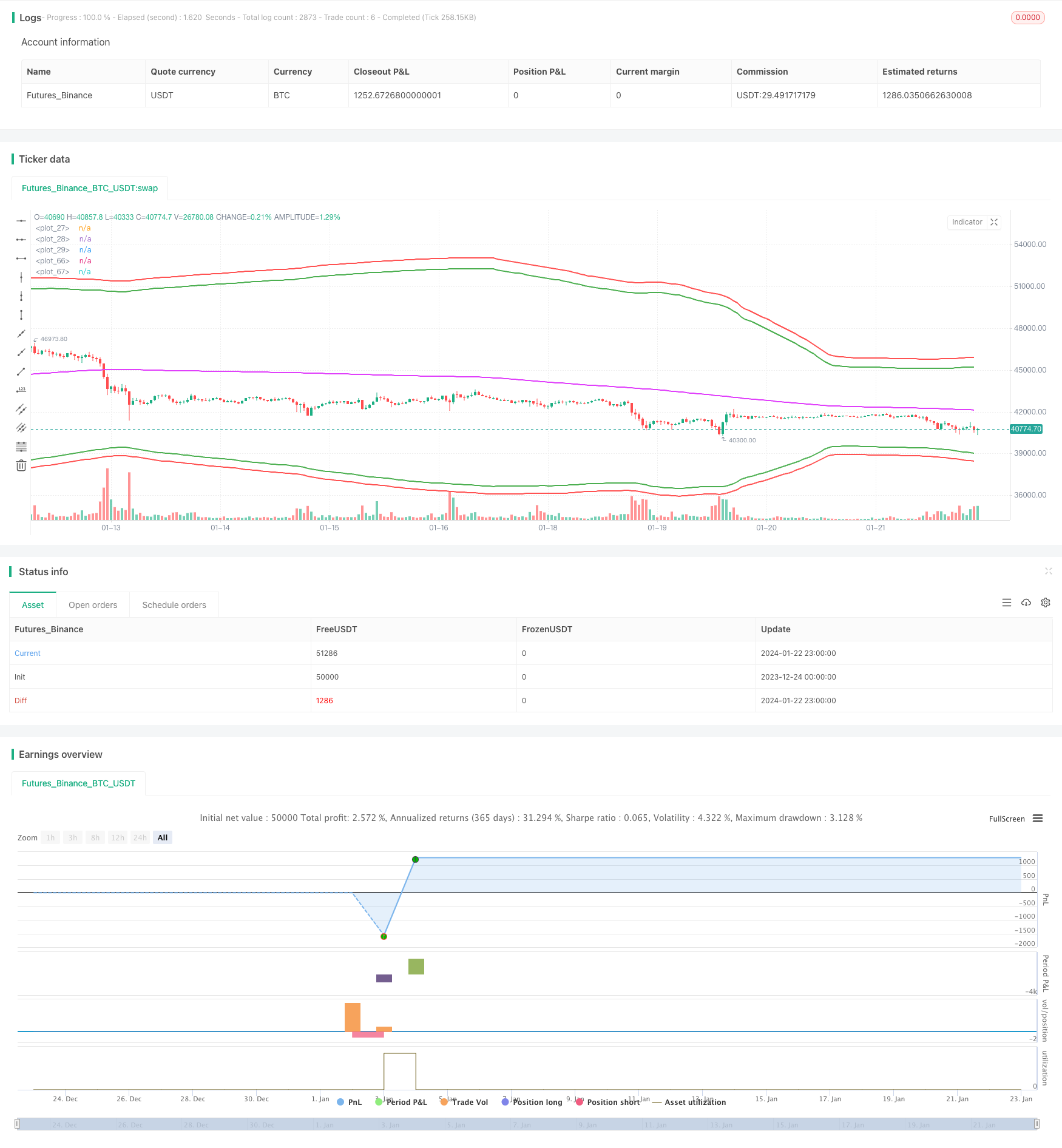

该策略是一个使用布林带作为entries,移动平均线作为close, 以及简单止损百分比作为止损的做市商策略。它在2022年6月份xtbtusd合约上获得了极高的盈利。

策略原理

该策略使用布林带的上下轨作为建仓的机会区域。具体来说,当价格低于下轨时,会开多单建仓;当价格高于上轨时,会开空单建仓。

此外,该策略还使用移动平均线作为平仓的基准。当持有多单时,如果价格高于移动平均线,会选择平仓;同样地,当持有空单时,如果价格低于移动平均线,也会选择平仓。

对于止损,该策略使用的是入场价乘以一定百分比这种简单的滚动止损方式。这可以有效避免单边行情下的巨额亏损。

优势分析

该策略的主要优势有以下几点:

- 使用布林带可以有效捕捉价格的波动性,在波动加剧时获得更多交易机会。

- 做市商策略可以通过双向交易获得买卖双方的手续费收入。

- 采用百分比止损可以主动控制风险,有效避免单边行情下的超大亏损。

风险分析

该策略也存在一些风险:

- 布林带并不总是一个可靠的入场指标,有时会发出错误信号。

- 做市商策略容易在震荡行情中被套牢。

- 百分比止损可能过于武断,无法灵活应对复杂行情。

为了降低这些风险,我们可以考虑结合其他指标进行过滤,优化止损策略的设定,或适当限制头寸规模。

优化方向

该策略还有进一步优化的空间:

- 可以测试不同参数组合找出最优参数。

- 可以加入更多过滤指标进行多因子验证。

- 可以使用机器学习方法自动优化参数。

- 可以考虑使用更精细的止损方式,如抛物线止损。

总结

该策略整体来说是一个非常赚钱的高频做市商策略。它利用布林带提供交易机会,同时控制风险。但我们也需要意识到它存在的问题与不足,并在实盘中谨慎验证。通过进一步优化,该策略有望产生更稳定的超高收益。

策略源码

/*backtest

start: 2023-12-24 00:00:00

end: 2024-01-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(shorttitle="BBL", title="BB limit", overlay = true)

length = input(200, minval=1)

src = input(hlc3, title="Source")

xmult = input(44, minval=0.001, maxval=5000, title = "bb mult (0.1%)")

s = input(title="Trend source", defval = "sma", options = ["ema", "sma", "rma", "wma"])

basis = s == "ema" ? ema(src, length) : s == "sma" ? sma(src, length) : s =="rma" ? rma(src, length) : wma(src, length)

sd = input(title="Dev source", defval = "stdev", options = ["stdev", "dev"])

mult = xmult / 10

dev = sd == "stdev" ? mult * stdev(src, length) : mult * dev(src, length)

diff = input(0.5, title = "Spread")

LongPrice(p) =>

LongPrice = diff == 0 ? p : floor(p / diff) * diff

ShortPrice(p) =>

ShortPrice = diff == 0 ? p : ceil(p / diff) * diff

pyr = input(1, title = "Pyramiding")

useStopLoss = input(true)

stoploss_xmult = input(15, minval=0.001, maxval=5000, title = "StopLoss 0.1%")

stopLoss_mult = sd == "simple" ? 1 + stoploss_xmult / 10 / 100 : stoploss_xmult / 10

dev2 = sd == "stdev" ? stopLoss_mult * stdev(src, length) : sd == "dev" ? stopLoss_mult * dev(src, length) : (stopLoss_mult - 1) * basis

upper = basis + (1*dev)

lower = basis - (1*dev)

plot(basis, color=fuchsia, linewidth=2)

plot(upper, color=green, linewidth=2)

plot(lower, color=green, linewidth=2)

strategy.cancel_all()

if strategy.position_size > 0 and close <= basis + diff * 2

strategy.order("Close long", strategy.short, strategy.position_size, limit = ShortPrice(basis))

else

if strategy.position_size < 0 and close >= basis - diff * 2

strategy.order("Close short", strategy.long, -strategy.position_size, limit = LongPrice(basis))

stopLossPrice1 = na

stopLossPrice2 = na

add = na

openOrderCondition = close > lower - 2 * diff and (strategy.opentrades < pyr or (strategy.position_size < 0 and strategy.position_avg_price > lower * (1 + stopLoss_mult / 100)))

if openOrderCondition

add := strategy.position_size > 0 ? -strategy.position_size : close >= basis - diff * 2 ? 0 : -strategy.position_size

strategy.order("Open long", strategy.long, strategy.equity / pyr / lower + add, limit = LongPrice(lower))

if useStopLoss and (strategy.position_size > 0 or openOrderCondition)

add = openOrderCondition ? strategy.equity / pyr / lower : 0

posPrice = strategy.position_size <= 0 ? lower : strategy.position_avg_price

posSize = strategy.position_size <= 0 ? 0 : strategy.position_size

stopLossPrice1 := posPrice * (1 - stopLoss_mult / 100)

strategy.order("StopLoss open short ", strategy.short, posSize + add + strategy.equity / pyr / stopLossPrice1, stop = ShortPrice(stopLossPrice1))

openOrderCondition := close < upper + 2 * diff and (strategy.opentrades < pyr or (strategy.position_size > 0 and strategy.position_avg_price * (1 + stopLoss_mult / 100) < upper))

if openOrderCondition

add := strategy.position_size < 0 ? strategy.position_size : close <= basis + diff * 2 ? 0 : strategy.position_size

strategy.order("Open short", strategy.short, strategy.equity / pyr / upper + add, limit = ShortPrice(upper))

if useStopLoss and (strategy.position_size < 0 or openOrderCondition)

add = openOrderCondition ? strategy.equity / pyr / upper : 0

posPrice = strategy.position_size >= 0 ? upper : strategy.position_avg_price

posSize = strategy.position_size >= 0 ? 0 : -strategy.position_size

stopLossPrice2 := posPrice * (1 + stopLoss_mult / 100)

strategy.order("StopLoss open long", strategy.long, posSize + add + strategy.equity / pyr / stopLossPrice2, stop = LongPrice(stopLossPrice2))

plot(not useStopLoss ? na : stopLossPrice1, color=red, linewidth=2)

plot(not useStopLoss ? na : stopLossPrice2, color=red, linewidth=2)

// === Backtesting Dates ===

testPeriodSwitch = input(false, "Custom Backtesting Dates")

testStartYear = input(2018, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testStartHour = input(0, "Backtest Start Hour")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,testStartHour,0)

testStopYear = input(2018, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(14, "Backtest Stop Day")

testStopHour = input(14, "Backtest Stop Hour")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,testStopHour,0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

isPeriod = testPeriodSwitch == true ? testPeriod() : true

// === /END

if not isPeriod

strategy.cancel_all()

strategy.close_all()