概述

最佳ATR停损倍数策略是一种趋势跟踪策略,它使用平均真实波幅(ATR)的倍数来设置止损点,动态调整风险。当价格趋势变化时,它可以及时止损,避免巨额亏损。

策略原理

该策略首先计算快速SMA周期和慢速SMA周期的简单移动平均线,当快速SMA上穿慢速SMA时做多,当快速SMA下穿慢速SMA时做空。

入场后,它会实时监控ATR的数值。ATR表示过去一定周期内的平均波动幅度。该策略允许我们设置ATR的周期长度(默认14)和倍数(默认2)。系统会在入场时计算ATR值,然后乘以设置的倍数,作为止损距离。

例如,如果入场后ATR为50点,倍数设定为2,则止损距离为100点。如果价格随后运行超过100点,止损单会被触发。这可以及时止损,避免过大损失。

该策略同时考虑了趋势判断,只有当买入信号匹配趋势为上涨时,才会启用长仓止损。做空信号则与下跌趋势匹配时启用。

止损线会在图表上绘制,我们可以实时验证。当止损条件触发时,对应头寸也会被系统自动平仓。

优势分析

该策略最大的优势是动态调整止损距离,可以根据市场波动率变化自动修改风险敞口。当波动率扩大时,止损距离也会拉大,减小了止损被突破的概率。而低波动市场中,止损距离也会缩小。

相比固定止损距离,该方式可以在跟踪趋势的同时,有效控制单笔损失。它既保证了盈利空间,也注意了风险管理。

此外,结合趋势判断,这样的止损方式可以减少在盘整区域因震荡而被踢出的情况。

风险分析

该策略的主要风险在于,持仓期间价格短线拉回,触发止损单的风险。尤其是ATR周期过短时,止损距离无法完全过滤短期波动的影响。

另一个风险在于,在剧烈行情中,价格跳空运动可能直接突破止损线。这时需要设置更大的止损倍数,但也意味着减小了盈利空间。

最后,该策略并没有考虑夜盘和盘前交易对ATR值的影响。这可能导致在开盘或收盘时,策略计算的ATR数据不准确。

优化方向

该策略可以从以下几个方面进行优化:

优化ATR周期参数,测试不同市场下的最佳参数组合

比较固定倍数和动态变化倍数设置的收益率

结合夜盘和盘前数据计算ATR,减小开盘价格跳空的影响

设置ATR条件:仅在ATR达到一定水平后启用,可以避免低波动率市场的不必要止损

结合更多过滤条件:例如大级别趋势、量能指标等信息

总结

最佳ATR停损倍数策略通过动态调整止损距离,实现了趋势跟踪和风险控制之间的有效平衡。相比固定止损距离,它可以在保证盈利空间的同时,有效限制单笔损失。

当然,仍需要注意一些潜在风险,比如价格跳空、止损过于灵敏等情况。我们可以从多种层面继续优化,提升策略的稳定性和收益率。

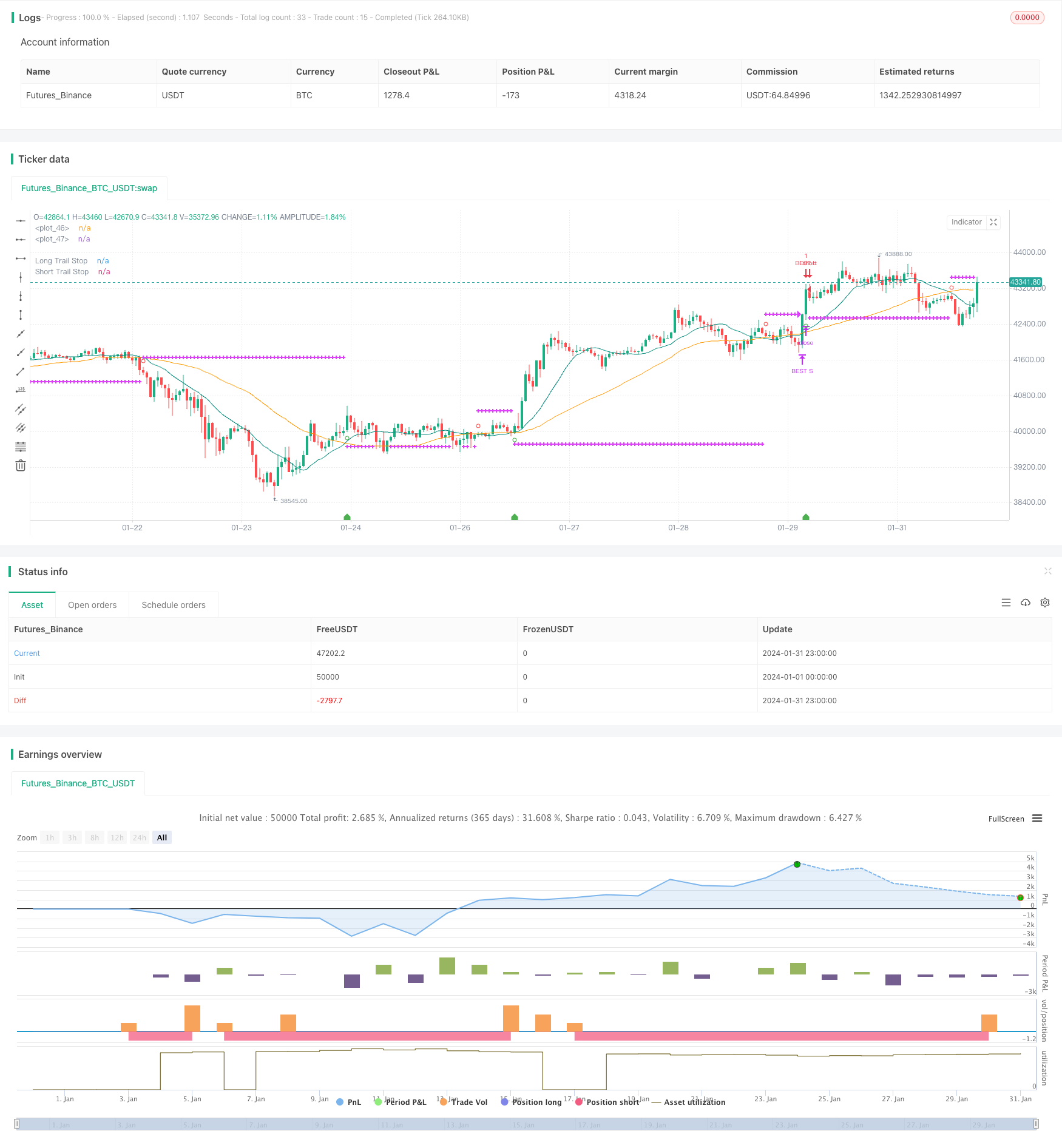

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//@author=Daveatt

//This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

SystemName = "BEST ATR Stop Multiple Strategy"

TradeId = "BEST"

InitCapital = 100000

InitPosition = 100

InitCommission = 0.075

InitPyramidMax = 1

CalcOnorderFills = true

CalcOnTick = true

DefaultQtyType = strategy.fixed

DefaultQtyValue = strategy.fixed

Precision = 2

Overlay=true

strategy(title=SystemName, shorttitle=SystemName, overlay=Overlay )

fastSMAperiod = input(defval=15, title='Fast SMA', type=input.integer, minval=2, step=1)

slowSMAperiod = input(defval=45, title='Slow SMA', type=input.integer, minval=2, step=1)

src = close

// Calculate moving averages

fastSMA = sma(src, fastSMAperiod)

slowSMA = sma(src, slowSMAperiod)

// Calculate trading conditions

enterLong = crossover(fastSMA, slowSMA)

enterShort = crossunder(fastSMA, slowSMA)

// trend states

since_buy = barssince(enterLong)

since_sell = barssince(enterShort)

buy_trend = since_sell > since_buy

sell_trend = since_sell < since_buy

is_signal = enterLong or enterShort

// get the entry price

entry_price = valuewhen(enterLong or enterShort, src, 0)

// Plot moving averages

plot(series=fastSMA, color=color.teal)

plot(series=slowSMA, color=color.orange)

// Plot the entries

plotshape(enterLong, style=shape.circle, location=location.belowbar, color=color.green, size=size.small)

plotshape(enterShort, style=shape.circle, location=location.abovebar, color=color.red, size=size.small)

///////////////////////////////

//======[ Trailing STOP ]======//

///////////////////////////////

// use SL?

useSL = input(true, "Use stop Loss")

// ATR multiple Stop

stop_atr_length = input(14,title="ATR Length", minval=1, type=input.integer)

stop_atr_mult = input(2,title="ATR Multiple", minval=0.05, step=0.1, type=input.float)

// Global STOP

stop_price = 0.0, stop_price := nz(stop_price[1])

// STOP ATR

var stop_atr = 0.0

var entry_stop_atr = 0.0

stop_atr := nz(atr(stop_atr_length))

if enterLong or enterShort

entry_stop_atr := stop_atr * stop_atr_mult

// display the ATR value multiple

plotshape(enterLong, title='ATR Long Stop value', style=shape.labelup,

location=location.bottom, color=color.green, transp=0, text='', textcolor=color.navy, editable=true, size=size.small, show_last=1, size=size.small)

// var label atr_long_label = na

// var label atr_short_label = na

lapos_y_entry_up = lowest(30)

lapos_y_entry_dn = highest(30)

// text_label = "ATR value: " + tostring(stop_atr, '#.#') + "\n\nATR Multiple value: " + tostring(entry_stop_atr, '#.#')

// if enterLong

// label.delete(atr_long_label)

// atr_long_label := label.new(bar_index, lapos_y_entry_up, text=text_label,

// xloc=xloc.bar_index, yloc=yloc.price, color=color.green, style=label.style_labelup, textcolor=color.white,

// size=size.normal)

// if enterShort

// label.delete(atr_short_label)

// atr_short_label := label.new(bar_index, lapos_y_entry_dn, text=text_label,

// xloc=xloc.bar_index, yloc=yloc.price, color=color.red, style=label.style_labeldown, textcolor=color.black,

// size=size.normal)

// Determine trail stop loss prices

longStopPrice = 0.0, shortStopPrice = 0.0

longStopPrice := if useSL and buy_trend

stopValue = entry_price - entry_stop_atr

else

0

shortStopPrice := if useSL and sell_trend

stopValue = entry_price + entry_stop_atr

else

999999

//////////////////////////////////////////////////////////////////////////////////////////

//*** STOP LOSS HIT CONDITIONS TO BE USED IN ALERTS ***//

//////////////////////////////////////////////////////////////////////////////////////////

cond_long_stop_loss_hit = useSL and buy_trend and crossunder(low, longStopPrice[1])

cond_short_stop_loss_hit = useSL and sell_trend and crossover(high, shortStopPrice[1])

// Plot stop loss values for confirmation

plot(series=useSL and buy_trend and low >= longStopPrice

? longStopPrice : na,

color=color.fuchsia, style=plot.style_cross,

linewidth=2, title="Long Trail Stop")

plot(series=useSL and sell_trend and high <= shortStopPrice

? shortStopPrice : na,

color=color.fuchsia, style=plot.style_cross,

linewidth=2, title="Short Trail Stop")

close_long = cond_long_stop_loss_hit

close_short = cond_short_stop_loss_hit

// Submit entry orders

strategy.entry(TradeId + " L", long=true, when=enterLong)

strategy.close(TradeId + " L", when=close_long)

//if (enterShort)

strategy.entry(TradeId + " S", long=false, when=enterShort)

strategy.close(TradeId + " S", when=close_short)