概述

这个策略是一个结合了多重指数移动平均线(EMA)交叉和斐波那契扩展水平的趋势跟踪系统。它利用不同周期的EMA之间的相互作用来识别潜在的趋势开始和结束,同时使用斐波那契扩展水平来确定利润目标。该策略还包含了具体的止损规则,以管理风险和保护利润。

策略原理

该策略的核心是利用多个时间框架的EMA交叉来捕捉趋势的起始和结束。具体来说,它使用了5周期、10周期和30周期的EMA。策略包含四个不同的入场条件,每个条件都旨在捕捉不同的市场情景:

当价格触及或低于30周期EMA,但随后收盘在其上方,同时10周期EMA高于5周期EMA,且30周期EMA比5周期EMA低1%时,触发第一个入场条件。

当5周期EMA上穿30周期EMA,且在过去6根K线内30周期EMA曾下穿5周期EMA时,触发第二个入场条件。

当前两根K线的最高价都低于各自的5周期EMA,且5周期EMA低于10周期EMA,10周期EMA又低于30周期EMA,同时前一根K线的最高价低于当前收盘价时,触发第三个入场条件。

当10周期EMA上穿30周期EMA,且在过去4根K线内5周期EMA曾上穿30周期EMA,同时10周期EMA和5周期EMA的当前值都高于它们的前一个值时,触发第四个入场条件。

对于止损,策略针对不同的入场条件设置了特定的规则:

- 对于第一个条件,如果30周期EMA上穿10周期EMA,则平仓。

- 对于其他条件,如果收盘价跌破前三根K线的最低点,则平仓。

利润目标是基于斐波那契扩展水平设置的,包括0.618、0.786、1.0和1.618水平。当价格达到这些水平时,策略会根据特定规则平仓。

此外,策略还包含了一个利润锁定条件:如果最近两根K线的最低价都高于5周期EMA,且EMA呈现上升排列(5 > 10 > 30),则平仓以锁定利润。

策略优势

多重确认:通过使用多个EMA和多个入场条件,策略能够更准确地识别趋势的开始和持续。这种多重确认机制可以减少假信号,提高交易的准确性。

适应性强:四种不同的入场条件使得策略能够适应不同的市场环境,无论是快速突破还是缓慢趋势形成,都能捕捉到交易机会。

风险管理:策略包含了具体的止损规则,这有助于控制每笔交易的风险。不同入场条件对应不同的止损策略,表明策略对风险管理的重视。

利润目标明确:使用斐波那契扩展水平作为利润目标,为交易者提供了清晰的退出点。这有助于避免过早获利了结或持有过久。

利润保护:利润锁定条件有助于在趋势可能反转时保护已获得的利润,这是许多趋势跟踪策略所忽视的重要方面。

技术指标结合:策略结合了EMA和斐波那契工具,利用了这两种广受欢迎的技术分析工具的优势。

策略风险

过度交易:多个入场条件可能导致过度交易,特别是在波动较大的市场中。这可能会增加交易成本,并可能导致更多的假信号。

参数敏感性:策略使用了多个固定的EMA周期和百分比阈值。这些参数可能需要根据不同的市场和时间框架进行调整,否则可能导致策略表现不佳。

趋势依赖:作为一个趋势跟踪策略,在横盘或者震荡市场中可能表现不佳。在这些市场环境中,可能会产生多次假信号和小幅度亏损。

滞后性:EMA本质上是滞后指标。在快速变化的市场中,策略可能无法及时捕捉到趋势的转折点。

复杂性:策略的多个条件和规则增加了其复杂性,这可能使得策略难以理解和维护,也增加了过度拟合的风险。

策略优化方向

动态参数调整:可以考虑引入自适应机制,根据市场波动性动态调整EMA周期和其他参数。这可以提高策略在不同市场环境下的适应性。

加入成交量指标:结合成交量分析可以提高入场和出场决策的准确性。例如,可以要求在入场时成交量增加,以确认趋势的强度。

市场环境过滤:引入市场环境识别机制,例如使用ATR(平均真实波幅)或者波动率指标,在不适合趋势跟踪的市场环境中暂停交易。

优化止损机制:可以考虑使用跟踪止损,而不是固定止损。这可以在保护利润的同时,允许利润继续增长。

加入时间过滤:限制特定时间段的交易,避开波动性较大或流动性较差的时间段,可以提高策略的稳定性。

引入机器学习:使用机器学习算法优化参数选择和入场决策,可以提高策略的适应性和性能。

多时间框架分析:结合更长时间框架的趋势分析,可以提高入场决策的准确性,避免在主趋势反向的情况下入场。

总结

这个多重EMA交叉结合斐波那契扩展的趋势跟踪策略展示了一个全面的交易系统,它结合了多个技术指标和交易理念。通过使用多个EMA和入场条件,策略试图在捕捉趋势和减少假信号之间取得平衡。斐波那契扩展水平的使用为利润目标设置提供了客观的基础,而具体的止损和利润锁定规则则体现了对风险管理的重视。

尽管策略具有多重确认和适应性强的优势,但其复杂性和对参数选择的敏感性也带来了一定的挑战。为了进一步提高策略的稳健性和性能,可以考虑引入动态参数调整、市场环境过滤和多时间框架分析等优化方向。

总的来说,这个策略为趋势跟踪提供了一个有趣的框架,但交易者在实际应用时需要进行充分的回测和参数优化,并根据特定的市场和交易风格进行适当的调整。通过持续的监控和优化,这个策略有潜力成为一个有效的趋势跟踪工具。

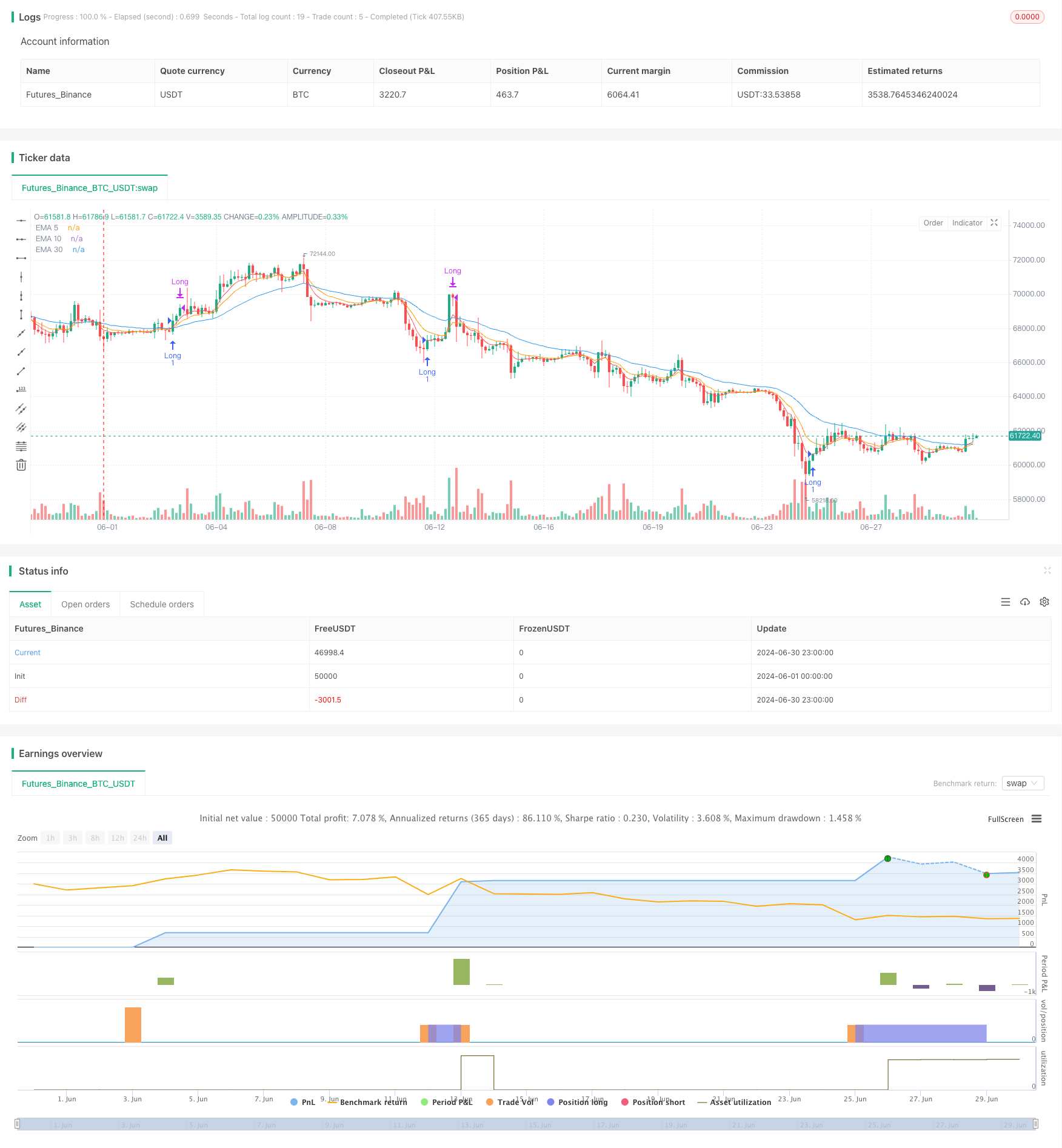

/*backtest

start: 2024-06-01 00:00:00

end: 2024-06-30 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Combined Strategy with Specific Stop Loss", overlay=true)

// Define the EMAs

ema30 = ta.ema(close, 30)

ema10 = ta.ema(close, 10)

ema5 = ta.ema(close, 5)

// Define the conditions for opening an order

open_condition1 = low <= ema30 and close > ema30 and ema10 > ema5 and ema30 * 1.01 < ema5

open_condition2 = ta.crossover(ema5, ema30) and (ta.crossover(ema30[1], ema5[1]) or ta.crossover(ema30[2], ema5[2]) or ta.crossover(ema30[3], ema5[3]) or ta.crossover(ema30[4], ema5[4]) or ta.crossover(ema30[5], ema5[5]) or ta.crossover(ema30[6], ema5[6]) )

open_condition3 = high[2] < ema5[2] and high[1] < ema5[1] and ema5 < ema10 and ema10 < ema30 and high[1] < close

open_condition4 = ta.crossover(ema10, ema30) and (ta.crossover(ema5[0], ema30[0]) or ta.crossover(ema5[1], ema30[1]) or ta.crossover(ema10[2], ema30[2]) or ta.crossover(ema10[3], ema30[3])) and ema10[1] < ema10 and ema5[1] <ema5

// Calculate the lowest low of the previous two bars

lowest_low_prev_two_bars = ta.lowest(low, 3)

// Track the entry price and the lowest low of the previous two bars for open_condition3

var float entry_price = na

var float low_entry_price = na

var float entry_lowest_low1 = na

var float entry_lowest_low2 = na

var float entry_lowest_low3 = na

var float entry_lowest_low4 = na

var bool order1 = false

var bool order2 = false

var bool order3 = false

var bool order4 = false

// Fibonacci extension levels based on the last significant swing

var float fib_extension_level_0_618 = na

var float fib_extension_level_0_786 = na

var float fib_extension_level_1 = na

var float fib_extension_level_1_618 = na

// Calculate Fibonacci extension levels

var float swing_low = na

var float swing_high = na

// Here we assume the latest swing low and swing high, adjust based on your logic

swing_low := ta.lowest(low, 20)

swing_high := ta.highest(high, 20)

// Open a long order when any of the conditions are met

if open_condition1 and not order2 and not order1 and not order3 and not order4

strategy.entry("Long", strategy.long, comment="<ema30")

entry_lowest_low1 := lowest_low_prev_two_bars

low_entry_price := low

fib_extension_level_0_618 := low_entry_price + (swing_high - swing_low) * 0.618

fib_extension_level_0_786:= low_entry_price + (swing_high - swing_low) * 0.786

fib_extension_level_1:= low_entry_price + (swing_high - swing_low) * 1

fib_extension_level_1:= low_entry_price + (swing_high - swing_low) * 1.618

entry_price := close

order1 := true

if open_condition2 and not order2 and not order1 and not order3 and not order4

strategy.entry("Long", strategy.long, comment="ema5xema30")

entry_lowest_low2 := lowest_low_prev_two_bars

low_entry_price := low

fib_extension_level_0_618 := low_entry_price + (swing_high - swing_low) * 0.618

fib_extension_level_0_786:= low_entry_price + (swing_high - swing_low) * 0.786

fib_extension_level_1:= low_entry_price + (swing_high - swing_low) * 1

fib_extension_level_1:= low_entry_price + (swing_high - swing_low) * 1.618

entry_price := close

order2 := true

if open_condition3 and not order2 and not order1 and not order3 and not order4

strategy.entry("Long", strategy.long, comment="high<ema5")

entry_price := close

low_entry_price := low

entry_lowest_low3 := lowest_low_prev_two_bars

fib_extension_level_0_618 := low_entry_price + (swing_high - swing_low) * 0.618

fib_extension_level_0_786:= low_entry_price + (swing_high - swing_low) * 0.786

fib_extension_level_1:= low_entry_price + (swing_high - swing_low) * 1

fib_extension_level_1:= low_entry_price + (swing_high - swing_low) * 1.618

order3 := true

if open_condition4 and not order2 and not order1 and not order3 and not order4

strategy.entry("Long", strategy.long, comment="high<ema5444")

entry_price := close

low_entry_price := low

entry_lowest_low4 := lowest_low_prev_two_bars

fib_extension_level_0_618 := low_entry_price + (swing_high - swing_low) * 0.618

fib_extension_level_0_786:= low_entry_price + (swing_high - swing_low) * 0.786

fib_extension_level_1:= low_entry_price + (swing_high - swing_low) * 1

fib_extension_level_1:= low_entry_price + (swing_high - swing_low) * 1.618

order4 := true

// Set a stop loss only if the order was opened with the specified conditions

if (not na(entry_price))

if order1

if ta.crossover(ema30,ema10)

strategy.close("Long", comment="stop loss1" )

entry_price := na

order1 := false

low_entry_price := na

if order2

if close < entry_lowest_low2

strategy.close("Long", comment="stop loss2" )

entry_price := na

order2 := false

low_entry_price := na

if order3

if close < entry_lowest_low3

strategy.close("Long", comment="stop loss3" )

entry_price := na

order3 := false

low_entry_price := na

if order4

if close < entry_lowest_low4

strategy.close("Long", comment="stop loss4" )

entry_price := na

order4 := false

low_entry_price := na

if low[1] > ema5[1] and low > ema5 and ema5 > ema10 and ema10 > ema30

strategy.close("Long", comment="profit low > ema5")

entry_price := na

order1 := false

order2 := false

order3 := false

order4 := false

low_entry_price := na

// Take profit at Fibonacci extension levels

if high >= fib_extension_level_0_618 and close <= fib_extension_level_0_618

strategy.close("Long", comment="at 0.618 Fib")

entry_price := na

order1 := false

order2 := false

order3 := false

order4 := false

low_entry_price := na

if high >= fib_extension_level_0_786 and close < fib_extension_level_0_786

strategy.close("Long", comment="at 0.786 Fib")

entry_price := na

order1 := false

order2 := false

order3 := false

order4 := false

low_entry_price := na

if high >= fib_extension_level_1 and close < fib_extension_level_1

strategy.close("Long", comment="at 1 Fib")

entry_price := na

order1 := false

order2 := false

order3 := false

order4 := false

low_entry_price := na

if high >= fib_extension_level_1_618

strategy.close("Long", comment="at 1 Fib")

entry_price := na

order1 := false

order2 := false

order3 := false

order4 := false

low_entry_price := na

// Plot the EMAs for visual reference

plot(ema30, color=color.blue, title="EMA 30")

plot(ema10, color=color.orange, title="EMA 10")

plot(ema5, color=color.red, title="EMA 5")