1.4 What are the elements of a complete strategy?

0

0

1240

1240

Summary

A complete strategy is actually a set of rules that traders give themselves. It includes all aspects of the trading, and does not leave a little room for subjective imagination. Every choices of buying and selling, the strategy will give an answer. It includes at least strategy selection, variety selection, fund management, order placing, extreme market situation response and so on.

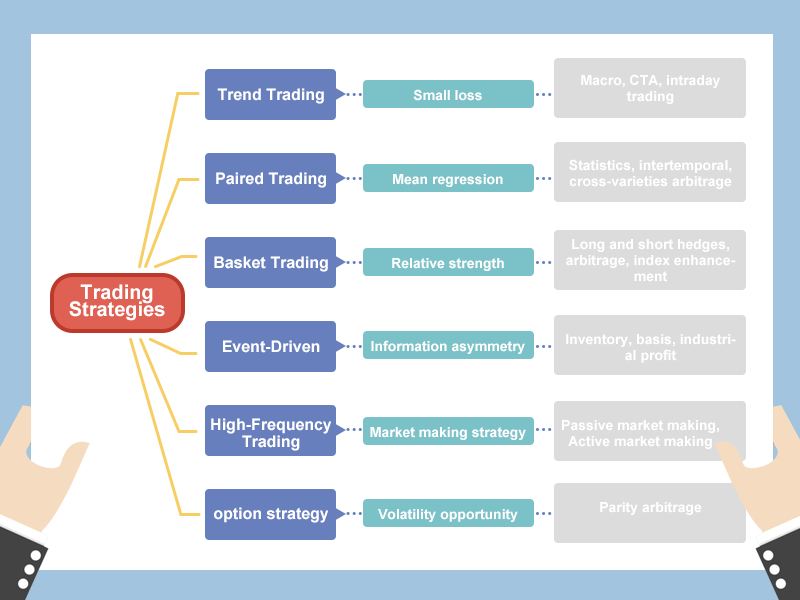

Strategy choosing

From the perspective of hedge funds, mainstream trading strategies can be divided into trend trading, paired trading, basket trading, event-driven, high-frequency trading, option strategy, etc., as shown below.

Of course, the way of strategy classification is not fixed. For the beginners, don’t worry about so many noun concepts, let’s start from the simplest. If only one type of quantitative trading strategy is recommended, it will be the trend trading, which is the most simple and effective. I believe that even if you don’t have a systematic knowledge of financial learning, you can still use it. And this strategy has been around for a long time. Among the early public-published trading strategies, it is still effective in many markets today, because human nature is difficult to change.

What to buy and sell

Those who have done trading should know that each variety has its own personality. Some varieties are very popular, with good liquidity, large fluctuations, and high volatility; some varieties are very “docile”, and they are oscillating within a certain range all year round, with low volatility.

Therefore, when choosing a trading variety, there must be a concept of volatility. Varieties with high volatility are often easy to get out of a good trend. For commodity futures, if it is a trend-tracking strategy, try to choose industrial products. In terms of variety attributes, industrial products tend to be more volatile than agricultural products. For crypto trading, choose those major coins, such as bitcoin, eth, eos and so on.

Different strategies adapt to different market conditions. Choosing a good trading variety, which is a very crucial beginning for the future trading project. In absolute terms, there are no absolutely good varieties and no absolutely bad varieties. Depending on the investment style and the risk tolerance, you need to adjust accordingly to your own standards.

How much to buy and sell

It is easy to loss money when trading. When the account fund loses 50%, the loss will require 100% profit to recover it. Even if you can earn 100% many times, you only need to lose 100% once, which will lose it all. So mature trading strategies should include money management.

In order to facilitate everyone’s understanding, here also use the average line strategy of the previous section to explain. In fact, many trading strategies built with traditional technical indicators have a maximum retracement rate of more than 50% or more. But is a risky strategy completely unusable?

Obviously not, the maximum retracement rate can be completely controlled by money management. If you cut the position by half, the overall risk will be reduced by half, and the maximum retracement rate will be 30%. If you reduce the position by half again, the maximum retracement rate will become 15%. Finally, we get a maximum retracement rate at around 15%. This is a simple and easy method of money management. Many people know that they can’t go all in, but they don’t know why. The answer is here.

When to buy and sell

A good jump in point is very important, and it allows you to get out of the cost zone quickly. But there will never be anyone who can tell you that it is right at this point, and it is wrong at that point. Opening a position is not the core of the trading. The core of the trading is how to optimize the position after opening the position.

Whether it is a short-term strategy or a long-term strategy, it doesn’t matter how long the position will be holding, the important is the risk-to-profit ratio. In other words, the final result that affects the performance of the strategy is how to play and when to cash out. The cash out method can be divided into two types: stop loss and take profit. Both of these parts are necessary for any trading system and are an important watershed for the success or failure of trading strategies.

How to buy

1, Type and method of order placement: There are many types and methods of placing orders, such as: queuing limit orders, opponent price, latest price, over price, daily limit price, buying one price, buying two price, selling one price, selling two price. or use the queue price first, then use the over-price, sending batch order, or split the big order into small orders, or simply place the order directly.

2, Withdraw order If there are unexecuted orders, whether continue waiting or withdraw the order. The condition for the withdrawal is based on the time. For example, there is no transaction within 10 seconds. The price has been 10 units away from the order price, whether to continue waiting, withdrawing or chasing the new price.

3, chase the price When the order is unexecuted, whether to chase the price. If chasing the price, it is to chase according to the latest price, or the opponent price, or the limit price? If the order is still not executed, whether continue to pursue the latest price.

4, the price limit When the order signal appears, it happens to be the limit price. Whether should to queue up the price.

5, set bidding Do we need to participate in the market opening stage, how to participate.

6, night-time market Some commodity futures varieties are from 21:00 to 02:30 the next day and all crypto trading are 27⁄7. Do we need participate these time period. Manually or automatically?

7, Major holidays Before a long holiday, do we need clear all position or reduce some of them.

Extreme market situation

1, Short-term price fluctuations The price of the price suddenly huge rises and falls (black swan situation) etc., how to deal with these situations (as shown in the figure, the Swiss franc black swan event).

2, Liquidity risk If the other side of trading direction order depth does not have the amount you want to execute, but you need to execute immediately. especially if the non-main commodity future contract is very rare, it is easy to make a price jump to the market. How to deal with it when the price slippage is large.

3, Variety trading rules change Commodity futures varieties are added to the night-time market and the crypto trading is 24⁄7. the margin ratio is raised, and the commission fee is raised, especially the short-term trading strategy, which is very sensitive to these changes.

4, Trading environment risk For example: sudden power failure, network disconnection, computer failure, software downtime, suspension of bank transfer, natural disasters, etc., how to deal with it when it occurs.

In the above case, the probability of occurrence is small, or almost impossible. But if things can happen, it will happen. It is very necessary to make these assumptions and prevent them.

Psychological construction

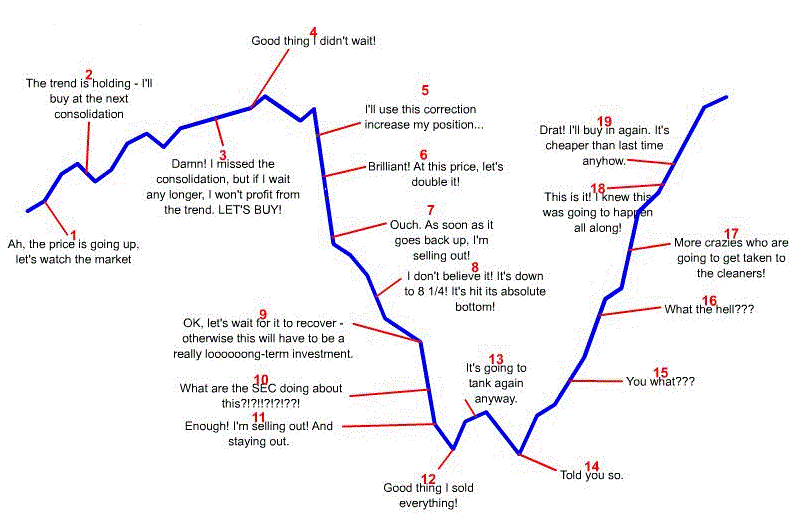

The three main psychological emotions commonly in trading are greed, fear and lucky. Investors need a strong trading psychology system to control and even use the above three emotions at different stages.

There must be an overall expectation for the future before you placing an order, including market expectations and variety psychological expectations. Market expectations have a clearer target for the location and future direction of the market. Variety expectations refer to the trading opportunities and risk profiles of the variety at its current location. Without the above psychological foundation, nothing can be done.

The whole process of real market trading is the process of continuous analysis, correction and execution. During the trading period, there are not many transactions, and more is tracking and endurance. This is a process of comprehensively examining the state of mind and testing human nature. The various habits of traders will be revealed and enlarged during the transaction process. Only by continuously learning and summarizing lessons after lessons, can we overcome the commonalities and psychological weaknesses of human nature.

To sum up

In summary, the so-called trading strategy is actually like this. When it has its perfect side and when it is incomplete, we can measure whether a trading strategy is reasonable. We can’t just look at his perfect side, and can’t just look at his broken side. On the one hand, it is more important to analyze the integrity of the strategy.

Finally, according to the characteristics of the strategy, combined with trader’s own personality and financial situation to measure whether the strategy is suitable for themselves, if it is suitable for themselves, it is necessary to fully assess how likely it is to persist, the worst results must be planned in advance, if the most You have thought about the miserable side happens, you still can take it, then the possibility of implementation is relatively large.

Remember, in trading, confidence comes from your inner recognition, and confidence comes from the right trading philosophy!

Next section notice

This article is the last one of the first chapter. In the next chapter, we will focus on quantitative trading tools for further explanation, including: a comprehensive introduction to quantitative tools, how to configure quantitative trading systems, common API explanations, and how to quantify a trading systems. Write a strategy on it.

After-school exercises

- Should a trend-based trading strategy choose a high volatility or a low volatility?

- What are the types of trading orders?

- FMZ intermediate tutorial

- FMZ beginer tutorial

- 请问可视化策略能用ok的永续合约吗?

- 请问能否实现一个策略不同周期K线条件的回测?

- 关于如何在BitMEX挂仅被动成交做市单和批量下单(IO范例)

- 2.4 How to write a trading strategy on FMZ Quant platform

- 2.3 Common API explanations

- 2.2 How to configure the FMZ Quant trading system

- 谁有 gateio的 合约 python示例代码?

- 2.1 Introduction to the quantitative trading tool

- 调用带参数重启接口,一直返回code5, 参数不正确,求教(PHP)

- HttpQuery 返回如果失败,会是什么类型?

- 1.3 What are needed for quantitative trading?

- Linux托管者最佳升级实践

- 1.2 Why choose quantitative trading

- 1.1 What is quantitative trading?

- Quantitative trading quick start

- 请求交易所API,偶尔出现 Timeout

- Implementing MACD in Python

- OKEX get depth 报错