থার্মোস্ট্যাট কৌশল MyLanguage দ্বারা ক্রিপ্টো বাজারে ব্যবহার

লেখক:ভাল, তৈরিঃ 2020-08-21 19:19:20, আপডেটঃ 2023-10-10 21:15:32

কৌশল নামঃ উন্নত থার্মোস্ট্যাট কৌশল

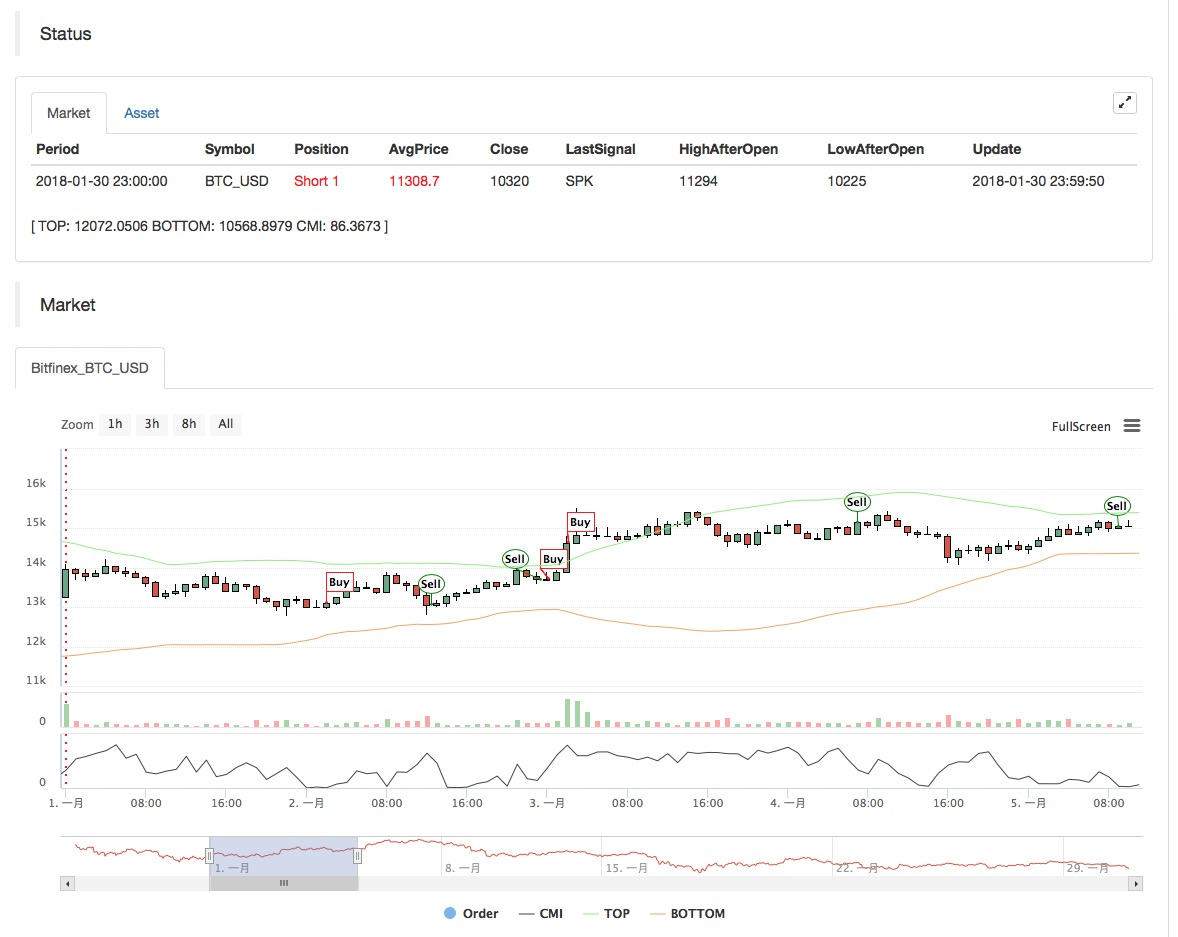

তথ্য চক্রঃ ১ ঘন্টা

সমর্থনঃ কমোডিটি ফিউচার, ডিজিটাল মুদ্রা ফিউচার, ডিজিটাল মুদ্রা স্পট

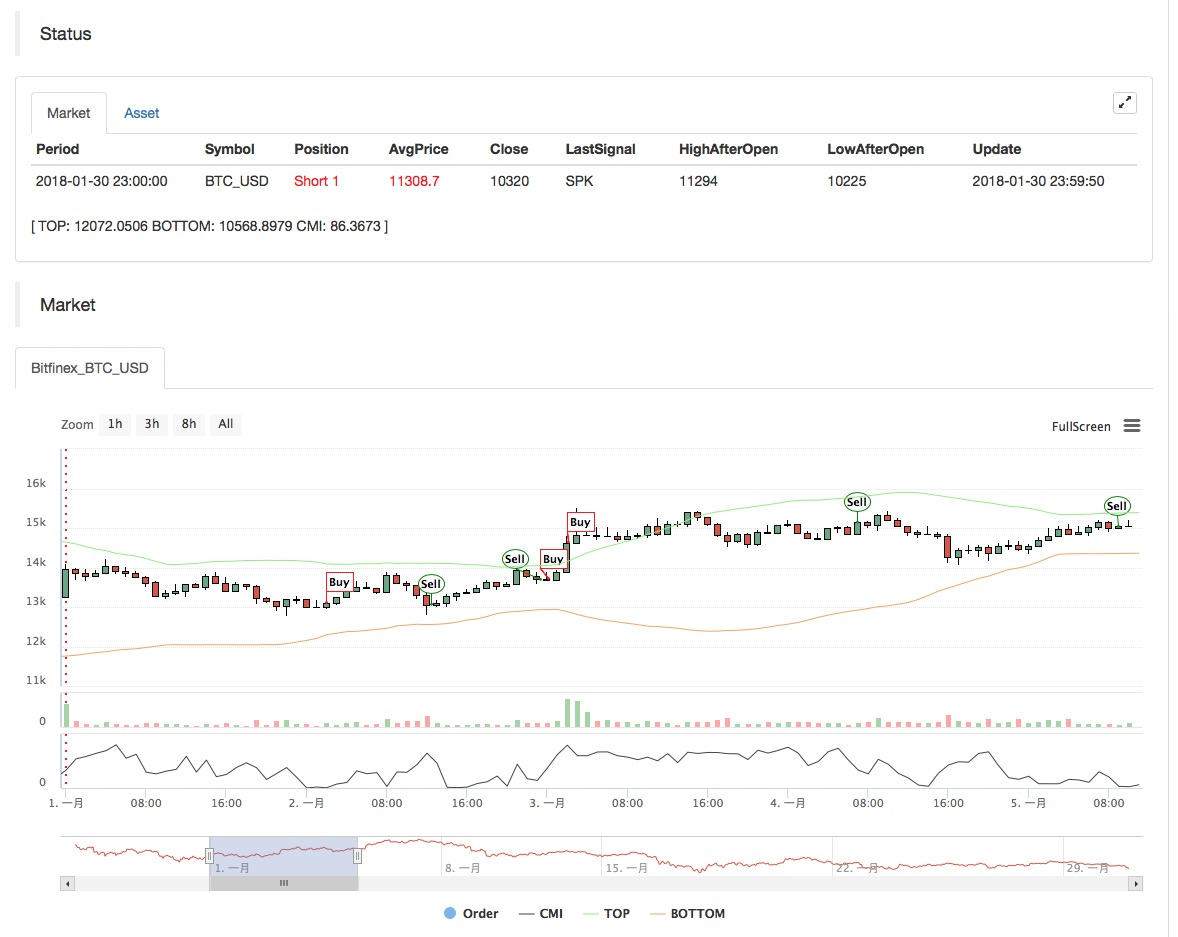

প্রধান চার্ট: উপরের ট্র্যাক, ফর্মুলাঃ TOP^^MAC+N_TMPTMP; / / বোলের উপরের ট্র্যাক নীচের ট্র্যাক, সূত্রঃ BOTTOM^^MAC-N_TMPTMP;//বোলের নীচের ট্র্যাক

সেকেন্ডারি চার্ট: CMI, সূত্রঃ CMI: ABS ((C-REF ((C,N_CMI-1))/(HHV ((H,N_CMI) -LLV ((L,N_CMI)) * 100; //0-100 মান যত বড়, প্রবণতা তত শক্তিশালী, সিএমআই <20 হল দোল, সিএমআই>20 হল প্রবণতা

সোর্স কোডঃ

(*backtest

start: 2018-11-06 00:00:00

end: 2018-12-04 00:00:00

period: 1h

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

*)

MAC:=MA(CLOSE,N);

TMP:=STD(CLOSE,N);

TOP^^MAC+N_TMP*TMP;// upper track of boll

BOTTOM^^MAC-N_TMP*TMP;// lower track of boll

BBOLL:=C>MAC;

SBOLL:=C<MAC;

N_CMI:=30;

CMI:ABS(C-REF(C,N_CMI-1))/(HHV(H,N_CMI)-LLV(L,N_CMI))*100;

//0-100 the larger the value, the stronger the trend, CMI <20 is oscillation mode, CMI>20 is the trend

N_KD:=9;

M1:=3;

M2:=3;

RSV:=(CLOSE-LLV(LOW,N_KD))/(HHV(HIGH,N_KD)-LLV(LOW,N_KD))*100;

//(1)closing price - the lowest of cycle N, (2)the highest of cycle N - the lowest of cycle N, (1)/(2)

K:=SMA(RSV,M1,1);//MA of RSV

D:=SMA(K,M2,1);//MA of K

MIND:=30;

BKD:=K>D AND D<MIND;

SKD:=K<D AND D>100-MIND;

//oscillation mode

BUYPK1:=CMI < 20 AND BKD;//if it's oscillation, buy to cover and buy long immediately

SELLPK1:=CMI < 20 AND SKD;//if it's oscillation, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY1:=REF(CMI,BARSBK) < 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND K<D;//if it's oscillation, long position take profit

BUYY1:=REF(CMI,BARSSK) < 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND K>D;//if it's oscillation, short position take profit

//trend mode

BUYPK2:=CMI >= 20 AND C > TOP;//if it's trend, buy to cover and buy long immediately

SELLPK2:=CMI >= 20 AND C < BOTTOM;//if it's trend, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY2:=REF(CMI,BARSBK) >= 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND SBOLL;//if it's trend, long position take profit

BUYY2:=REF(CMI,BARSSK) >= 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND BBOLL;//if it's trend, short position take profit

SELLS2:=REF(CMI,BARSBK) >= 20 AND C<BKPRICE*(1-0.01*STOPLOSS) AND SBOLL;//if it's trend, long position stop loss

BUYS2:=REF(CMI,BARSSK) >= 20 AND C>SKPRICE*(1+0.01*STOPLOSS) AND BBOLL;//if it's trend, short position stop loss

IF BARPOS>N THEN BEGIN

BUYPK1,BPK;

SELLPK1,SPK;

BUYPK2,BPK;

SELLPK2,SPK;

END

BUYY1,BP(SKVOL);

BUYY2,BP(SKVOL);

BUYS2,BP(SKVOL);

SELLY1,SP(BKVOL);

SELLY2,SP(BKVOL);

SELLS2,SP(BKVOL);

সোর্স কোডঃhttps://www.fmz.com/strategy/129086

সম্পর্কিত বিষয়বস্তু

- ডিইএক্স এক্সচেঞ্জের পরিমাণগত অনুশীলন (2) -- হাইপারলিকুইড ইউজার গাইড

- DEX এক্সচেঞ্জের পরিমাণগত অনুশীলন ((2) -- Hyperliquid ব্যবহারের নির্দেশিকা

- ডিইএক্স এক্সচেঞ্জের পরিমাণগত অনুশীলন (1) -- ডিওয়াইডিএক্স ভি৪ ব্যবহারকারী গাইড

- ক্রিপ্টোকারেন্সিতে লিড-লেগ আর্বিট্রেজের ভূমিকা (3)

- DEX এক্সচেঞ্জের পরিমাণগত অনুশীলন ((1)-- dYdX v4 ব্যবহারের নির্দেশিকা

- ডিজিটাল মুদ্রায় লিড-ল্যাগ স্যুটের ভূমিকা (3)

- ক্রিপ্টোকারেন্সিতে লিড-লেগ আর্বিট্রেজের ভূমিকা (2)

- ডিজিটাল মুদ্রায় লিড-ল্যাগ স্যুটের ভূমিকা (২)

- এফএমজেড প্ল্যাটফর্মের বাহ্যিক সংকেত গ্রহণ নিয়ে আলোচনাঃ কৌশলগতভাবে অন্তর্নির্মিত এইচটিটিপি পরিষেবা সহ সংকেত গ্রহণের জন্য একটি সম্পূর্ণ সমাধান

- এফএমজেড প্ল্যাটফর্মের বহিরাগত সংকেত গ্রহণের অন্বেষণঃ কৌশলগুলি অন্তর্নির্মিত এইচটিটিপি পরিষেবাগুলির সংকেত গ্রহণের সম্পূর্ণ সমাধান

- ক্রিপ্টোকারেন্সিতে লিড-লেগ আর্বিট্রেজের ভূমিকা (1)

আরও দেখুন

- পরিমাণগত লেনদেনে সার্ভারের ব্যবহার

- [Millennium War] মুদ্রা বিনিময় হার প্রায় কৌশল 3 প্রজাপতি হেক্সিং

- ভারসাম্য বজায় রাখার কৌশল (শিক্ষা কৌশল)

- RSI2 গড় বিপরীতমুখী কৌশল

- ফিউচার এবং ক্রিপ্টোকারেন্সি এপিআই ব্যাখ্যা

- অর্ধ-স্বয়ংক্রিয় পরিমাণগত ট্রেডিং সরঞ্জাম দ্রুত বাস্তবায়ন করুন

- অ্যারুন সূচক চালু করা হচ্ছে

- ডিজিটাল মুদ্রা বিকল্প কৌশল ব্যাকটেস্টিং উপর প্রাথমিক গবেষণা

- পরিমাণগত ট্রেডিং এবং বিষয়গত ট্রেডিংয়ের মধ্যে পার্থক্য

- এটিআর চ্যানেল কৌশল ক্রিপ্টো মার্কেটে বাস্তবায়িত

- hans123 ইনট্রা-ডেই ব্রকথ্রো কৌশল

- ডিজিটাল মুদ্রার বিকল্প কৌশল পুনরুদ্ধার

- ট্রেডিংভিউওয়েবহুক এলার্ম সরাসরি FMZ রোবটের সাথে সংযুক্ত

- ট্রেডিং কৌশল একটি অ্যালার্ম ঘড়ি যোগ করুন

- সি++ ব্যবহার করে ওকেএক্স ফিউচার কন্ট্রাক্ট হেজিং কৌশল

- সক্রিয় তহবিল প্রবাহের উপর ভিত্তি করে ট্রেডিং কৌশল

- ম্যানুয়াল ট্রেডিং সহজ করার জন্য ট্রেডিং টার্মিনাল প্লাগ-ইন ব্যবহার করুন

- পরিমাণগত টাইপিং হার ট্রেডিং কৌশল

- ভারসাম্য কৌশল এবং গ্রিড কৌশল

- মাল্টি-রোবট মার্কেট কোট শেয়ারিং সলিউশন