ক্রডলের সুপার ট্রেন্ড

লেখক:চাওঝাং, তারিখ: ২০২২-০৫-১৩ ১৭ঃ৩৮ঃ৩৪ট্যাগঃএসএমএইএমএএসএমএমএডব্লিউএমএভিডব্লিউএমএ

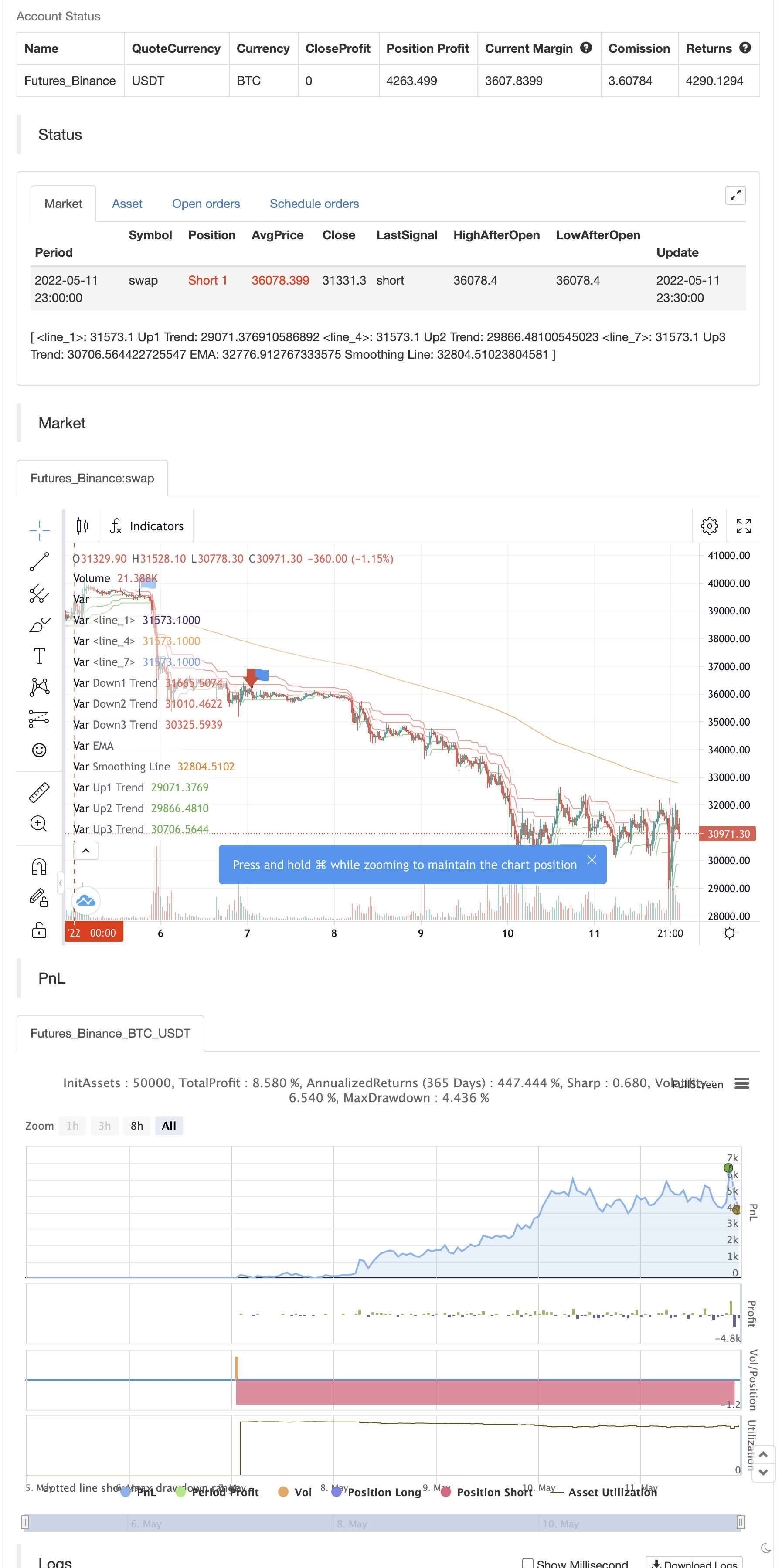

এই সূচকটি সুপারট্রেন্ড ব্যবহার করে যা 3 টি বিভিন্ন ইনপুট সহ নিশ্চিতকরণ এবং 200 EMA যা আমাদের একটি আপ বা ডাউন ট্রেন্ডের তথ্য দেবে। তারপর এটি স্টকের সূচক খুঁজছে যদি লং জন্য 30 এর নিচে এবং শর্ট জন্য 70 এর উপরে একটি ক্রস আছে তা নিশ্চিত করার জন্য।

ব্যাকটেস্ট

/*backtest

start: 2022-05-05 00:00:00

end: 2022-05-11 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Visit Crodl.com for our Premium Indicators

// https://tradingbot.crodl.com to use our free tradingview bot to automate any indicator.

//@version=5

indicator("Crodl's Supertrend", overlay=true, timeframe="", timeframe_gaps=true)

atrPeriod1 = input(12, "ATR1 Length")

factor1 = input.float(3.0, "Factor1", step = 0.01)

[supertrend1, direction1] = ta.supertrend(factor1, atrPeriod1)

bodyMiddle1 = plot((open + close) / 2, display=display.none)

upTrend1 = plot(direction1 < 0 ? supertrend1 : na, "Up1 Trend", color = color.green, style=plot.style_linebr)

downTrend1 = plot(direction1 < 0? na : supertrend1, "Down1 Trend", color = color.red, style=plot.style_linebr)

atrPeriod2 = input(11, "ATR2 Length")

factor2 = input.float(2.0, "Factor2", step = 0.01)

[supertrend2, direction2] = ta.supertrend(factor2, atrPeriod2)

bodyMiddle2 = plot((open + close) / 2, display=display.none)

upTrend2 = plot(direction2 < 0 ? supertrend2 : na, "Up2 Trend", color = color.green, style=plot.style_linebr)

downTrend2 = plot(direction2 < 0? na : supertrend2, "Down2 Trend", color = color.red, style=plot.style_linebr)

atrPeriod3 = input(10, "ATR3 Length")

factor3 = input.float(1.0, "Factor3", step = 0.01)

[supertrend3, direction3] = ta.supertrend(factor3, atrPeriod3)

bodyMiddle3 = plot((open + close) / 2, display=display.none)

upTrend3 = plot(direction3 < 0 ? supertrend3 : na, "Up3 Trend", color = color.green, style=plot.style_linebr)

downTrend3 = plot(direction3 < 0? na : supertrend3, "Down3 Trend", color = color.red, style=plot.style_linebr)

len = input.int(200, minval=1, title="Length")

src = input(close, title="Source")

offset = input.int(title="Offset", defval=0, minval=-500, maxval=500)

out = ta.ema(src, len)

plot(out, title="EMA", color=color.white,linewidth=2, offset=offset)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

typeMA = input.string(title = "Method", defval = "SMA", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="Smoothing")

smoothingLength = input.int(title = "Length", defval = 5, minval = 1, maxval = 100, group="Smoothing")

smoothingLine = ma(out, smoothingLength, typeMA)

plot(smoothingLine, title="Smoothing Line", color=#f37f20, offset=offset, display=display.none)

//////

l = input(13, title='Length')

l_ma = input(7, title='MA Length')

t = math.sum(close > close[1] ? volume * (close - close[1]) : close < close[1] ? volume * (close - close[1]) : 0, l)

m = ta.sma(t, l_ma)

//////

periodK = input.int(14, title="%K Length", minval=1)

smoothK = input.int(1, title="%K Smoothing", minval=1)

periodD = input.int(3, title="%D Smoothing", minval=1)

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

stochbuy= float(k) < 30 and ta.crossover(k,d)

stochsell=float(k) > 70 and ta.crossover(d,k)

long =(( ((direction1 < 0 and direction2 < 0 ) or (direction2 < 0 and direction3 < 0 ) and (direction1 < 0 or direction3 < 0 ) )and open > out) and t > 0) and stochbuy

short=(( ((direction1 > 0 and direction2 > 0 ) or (direction2 > 0 and direction3 > 0 ) and (direction1 > 0 or direction3 > 0 ) )and open < out) and t < 0) and stochsell

plotshape(long, title = "Long Signal", location=location.belowbar, style=shape.labelup, color=color.green, textcolor=color.white, size=size.small, text="Long")

plotshape(short, title = "Short Signal", location=location.abovebar, style=shape.labeldown, color=color.red, textcolor=color.white, size=size.small, text="Short")

alertcondition(long, title='Long Signal', message=' Buy')

alertcondition(short, title='Short Signal', message=' Sell')

if long

strategy.entry("Enter Long", strategy.long)

else if short

strategy.entry("Enter Short", strategy.short)

সম্পর্কিত বিষয়বস্তু

- এসএসএস

- ব্রিনব্যান্ডের ট্রেডিং ট্র্যাকিং কৌশল

- মাল্টি-লেভেল ভোল্টেবল ব্যান্ড ট্রেডিং কৌশল

- আরএসআই পিভট, বিবি, এসএমএ, ইএমএ, এসএমএমএ, ডব্লিউএমএ, ভিডব্লিউএমএ এর সাথে বিপরীত

- দ্বি-সমতল ক্রস গতি ট্র্যাকিং পরিমাণগত কৌশল

- মাল্টি-ইউনিভার্সাল ক্রস-ট্রেন্ড ট্র্যাকিং এবং ভোল্টেজ ফিল্টারিং কৌশল

- বহু-চক্রীয় সমতল ক্রস ট্রেন্ড ট্র্যাকিং কৌশল

- স্বনির্ধারিত গতিশীল গড়ের ক্রসিং কৌশল

- ওসিসি কৌশল R5.1

- 2 চলমান গড় রঙের দিক সনাক্তকরণ

আরও দেখুন

- বিয়ার মার্কেটে স্বাগতম [30 মিনিট]

- সিডবস

- পিভট পয়েন্ট উচ্চ নিম্ন মাল্টি টাইম ফ্রেম

- ভূত প্রবণতা ট্র্যাকিং কৌশল ডাটাবেস

- ভূত প্রবণতা কৌশলগত ট্রেসিং ব্যবসা পুস্তিকা

- ভূত ট্রেন্ড ট্র্যাকিং কৌশল

- রেইনবো ওসিলেটর

- ইকুইটি কার্ভ পজিশন সাইজিংয়ের উদাহরণ

- KLineChart-এর একটি ডেমো

- ভিলা ডায়নামিক পিভট সুপারট্রেন্ড কৌশল

- zdmre দ্বারা RSI

- FTL - পরিসীমা ফিল্টার X2 + EMA + UO

- ব্রাহ্মস্ত্রা

- মোবো ব্যান্ড

- SAR + 3SMMA SL & TP সহ

- এসএসএস

- চাঁদ উৎক্ষেপণ সতর্কতা টেমপ্লেট [সূচক]

- HALFTREND + HEMA + SMA (মিথ্যা সংকেতের কৌশল)

- আরএসআই পিভট, বিবি, এসএমএ, ইএমএ, এসএমএমএ, ডব্লিউএমএ, ভিডব্লিউএমএ এর সাথে বিপরীত

- আরএসআই এবং বিবি এবং একই সাথে ওভারসোল্ড