概述

多层波动带交易策略是一种基于价格波动性的量化交易方法。该策略利用多个波动带来识别市场的超买和超卖区域,并在价格触及这些区域时进行交易。策略的核心思想是在价格偏离均值时建立头寸,并在价格回归时获利。这种方法借鉴了均值回归理论,同时结合了马丁格尔策略的理念,通过在不利走势中增加头寸来提高盈利机会。

策略原理

均线计算:策略使用可选的均线类型(SMA、EMA、SMMA、WMA、VWMA)计算基准线。

波动带设置:在基准线基础上,使用标准差乘以倍数来设置多层波动带。

斐波那契水平:利用斐波那契回撤水平(23.6%, 38.2%, 50%, 61.8%)来细分波动带,创建更多的交易机会。

动态调整:可选择使用动态倍数,根据ATR(平均真实波幅)来自动调整波动带宽度。

入场逻辑:当价格触及或穿越某一波动带时,策略在该方向上建立头寸。

加仓机制:如果价格继续朝不利方向移动,策略会在更远的波动带水平增加头寸,体现马丁格尔策略思想。

出场逻辑:当价格回归到基准线时,可选择平仓获利。也可设置在价格穿越基准线时平仓。

策略优势

多层次入场:通过设置多个波动带和斐波那契水平,策略提供了更多的交易机会,可以在不同价格水平捕捉市场波动。

灵活性强:策略允许用户选择不同的均线类型、周期和参数,以适应不同的市场环境和交易品种。

动态适应:可选的动态倍数功能使策略能够根据市场波动性自动调整,提高了策略的适应性。

风险管理:通过在不利走势中增加头寸,策略试图降低平均入场价格,提高最终盈利的可能性。

均值回归思想:策略基于价格终将回归均值的理念,这在许多市场和时间框架中都表现良好。

可定制性:用户可以根据自己的风险偏好和交易风格调整参数,如股数、斐波那契水平等。

策略风险

连续亏损风险:在强趋势市场中,价格可能持续突破多个波动带,导致连续加仓并累积大量亏损。

资金管理压力:马丁格尔式的加仓策略可能导致资金需求急剧增加,超出账户承受能力。

过度交易:多层波动带可能在震荡市场中产生过多的交易信号,增加交易成本。

参数敏感性:策略性能高度依赖于参数设置,不当的参数可能导致策略表现不佳。

滑点和流动性风险:在波动剧烈的市场中,可能面临严重的滑点,尤其是在加仓时。

回撤风险:虽然策略旨在通过加仓来降低平均成本,但在极端市场条件下仍可能面临大幅回撤。

策略优化方向

引入趋势过滤器:可以添加长期趋势指标,仅在趋势方向上开仓,避免在强趋势中频繁逆势交易。

动态仓位管理:根据账户规模和市场波动性动态调整每次交易的股数,以更好地控制风险。

优化出场机制:可以考虑引入trailing stop或基于波动率的动态止损,以更好地锁定利润和控制风险。

增加时间过滤:添加交易时间窗口限制,避开波动性较大或流动性较差的时段。

整合市场情绪指标:结合诸如VIX等波动率指标,在高波动期间调整策略参数或暂停交易。

引入机器学习:使用机器学习算法动态优化参数,提高策略对市场变化的适应性。

增加基本面过滤:结合基本面数据,在特定的基本面条件下才允许交易,提高交易质量。

总结

多层波动带交易策略是一种结合了技术分析、概率论和风险管理的复杂交易系统。它通过多层次的入场点和马丁格尔式的加仓方法,试图在价格波动中捕捉利润。策略的优势在于其灵活性和对均值回归的利用,但同时也面临着在强趋势市场中的风险。

要成功应用这一策略,交易者需要深入理解市场特性,谨慎设置参数,并实施严格的风险管理。通过持续的优化和回测,结合对市场的洞察,这一策略有潜力成为一个有效的交易工具。然而,鉴于其复杂性和潜在风险,建议在实盘交易前进行充分的模拟测试和风险评估。

总的来说,多层波动带交易策略为量化交易者提供了一个有趣且富有挑战性的框架,它的成功应用需要技术分析能力、风险管理技巧和持续的策略优化。

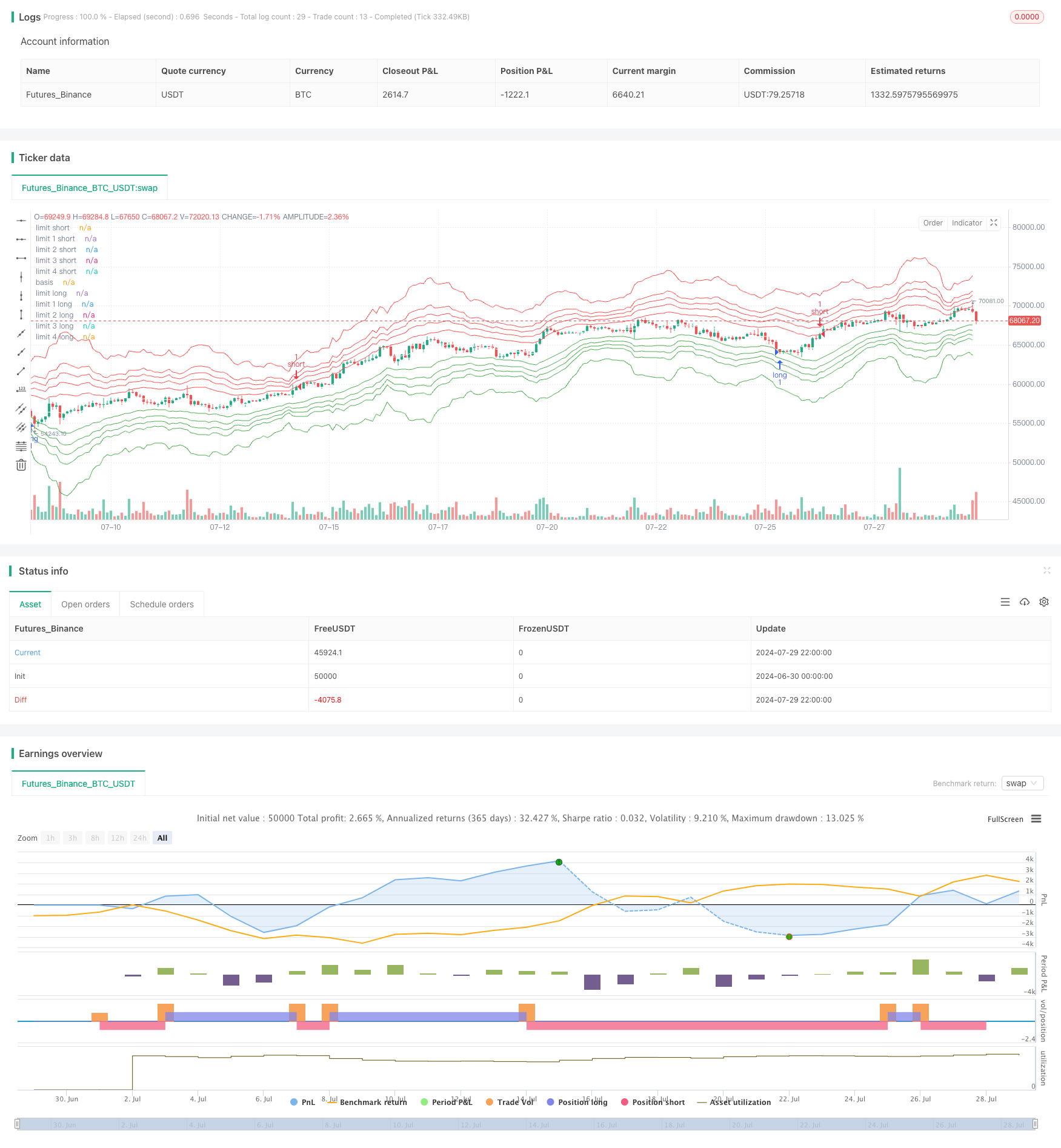

/*backtest

start: 2024-06-30 00:00:00

end: 2024-07-30 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © abtov

//@version=5

strategy("Spider Strategy", overlay=true)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

stdev = input.int(56, "STDEV", group="Stdev")

mult = input.float(2.3, "Multiplier", group="Stdev")

ma_len = input.int(230, "Basis Length", group="Stdev")

ma_type = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="Stdev")

auto_mult = input.bool(true, "Dynamic Mult.", group="Stdev")

basis_exit = input.bool(false, "Basis Exit", group="Stdev")

col_int = input.int(12, "Collective Value", group="Collective")

col_input = input.bool(true, "Collective Input", group="Collective")

fib1 = input.float(0.236, "Fibonacci Level 1", group = "Fibonacci")

fib2 = input.float(0.382, "Fibonacci Level 2", group = "Fibonacci")

fib3 = input.float(0.5, "Fibonacci Level 3", group = "Fibonacci")

fib4 = input.float(0.618, "Fibonacci Level 4", group = "Fibonacci")

atr_len = input.int(30, "ATR", group="ATR")

atr_bias = input.float(0.72, "Bias", group="ATR")

shares = input.int(1, "Shares Amount", group="Strategy")

if(col_input == true)

stdev := col_int

ma_len := col_int

atr_len := col_int

if(auto_mult == true)

mult := ma(ta.tr(true), atr_len, ma_type) * atr_bias

basis = ma(close, ma_len, ma_type)

lower = basis - stdev * mult

upper = basis + stdev * mult

lower2 = basis - stdev * mult * fib1

upper2 = basis + stdev * mult * fib1

lower3 = basis - stdev * mult * fib2

upper3 = basis + stdev * mult * fib2

lower4 = basis - stdev * mult * fib3

upper4 = basis + stdev * mult * fib3

lower5 = basis - stdev * mult * fib4

upper5 = basis + stdev * mult * fib4

var lowerAct = false

var lower2Act = false

var lower3Act = false

var lower4Act = false

var lower5Act = false

var upperAct = false

var upper2Act = false

var upper3Act = false

var upper4Act = false

var upper5Act = false

plot(upper, "limit short", color.red)

plot(upper2, "limit 1 short", color.red)

plot(upper3, "limit 2 short", color.red)

plot(upper4, "limit 3 short", color.red)

plot(upper5, "limit 4 short", color.red)

plot(basis, "basis", color.white)

plot(lower, "limit long", color.green)

plot(lower2, "limit 1 long", color.green)

plot(lower3, "limit 2 long", color.green)

plot(lower4, "limit 3 long", color.green)

plot(lower5, "limit 4 long", color.green)

if(lowerAct == false)

if(close < lower)

strategy.entry("long", strategy.long, shares)

lowerAct := true

else

if(low > basis)

lowerAct := false

if(lower2Act == false)

if(close < lower2)

strategy.entry("long", strategy.long, shares)

lower2Act := true

else

if(low > basis)

lower2Act := false

if(lower3Act == false)

if(close < lower3)

strategy.entry("long", strategy.long, shares)

lower3Act := true

else

if(low > basis)

lower3Act := false

if(lower4Act == false)

if(close < lower4)

strategy.entry("long", strategy.long, shares)

lower4Act := true

else

if(low > basis)

lower4Act := false

if(lower5Act == false)

if(close < lower5)

strategy.entry("long", strategy.long, shares)

lower5Act := true

else

if(low > basis)

lower5Act := false

if(upperAct == false)

if(close > upper)

strategy.entry("short", strategy.short, shares)

upperAct := true

else

if(high < basis)

upperAct := false

if(upper2Act == false)

if(close > upper2)

strategy.entry("short", strategy.short, shares)

upper2Act := true

else

if(high < basis)

upper2Act := false

if(upper3Act == false)

if(close > upper3)

strategy.entry("short", strategy.short, shares)

upper3Act := true

else

if(high < basis)

upper3Act := false

if(upper4Act == false)

if(close > upper4)

strategy.entry("short", strategy.short, shares)

upper4Act := true

else

if(high < basis)

upper4Act := false

if(upper5Act == false)

if(close > upper5)

strategy.entry("short", strategy.short, shares)

upper5Act := true

else

if(high < basis)

upper5Act := false

if((ta.crossover(close, basis) and basis_exit == true))

strategy.close("short")

strategy.close("long")