EMA + AROON + ASH

Schriftsteller:ChaoZhang, Datum: 2022-05-10 10:34:06Tags:EMAAROONAsche

Ich bin ein guter Mann. Kredit für jeden Indikator gehört zu ihnen, ich habe sie nur modifiziert, um einige zusätzliche Optionen, Einstellungen usw. hinzuzufügen, auch aktualisiert den gesamten Code zu PineScript 5.

Die Strategie Die Standard-Einstellungen sind bereits so wie von TRADE KING verlangt, so dass Sie nichts ändern müssen. Für LONGS (grüner Hintergrund zeigt LONG-Einträge).

- Der Preis muss über der EMA liegen.

- Ein bullischer Aroon-Crossover.

- Die histogrammierte Absolute Stärke muss oberhalb der Bärenlinie liegen.

Für Kurzfilme (roter Hintergrund zeigt Kurzfilme).

- Der Preis muss unterhalb der EMA liegen.

- Ein niedriger Aroon Crossover.

- Die histogrammierte Absolute Stärke muss oberhalb der Bollstrecke liegen.

Bitte besuchen Sie den YouTube-Kanal von TRADE KING für weitere Informationen.

=== Allgemeine Verbesserungen === Upgrade auf PineScript 5. Einige Leistungsverbesserungen.

=== Persönliche Notizen === Der Autor dieser Strategie empfiehlt 5M-Charts, jedoch zeigt sich 4H als die beste.

Nochmals vielen Dank an die Autoren der Indikatoren, aus denen dieses Skript besteht, und an TRADE KING für die Entwicklung dieser Strategie.

Zurückprüfung

/*backtest

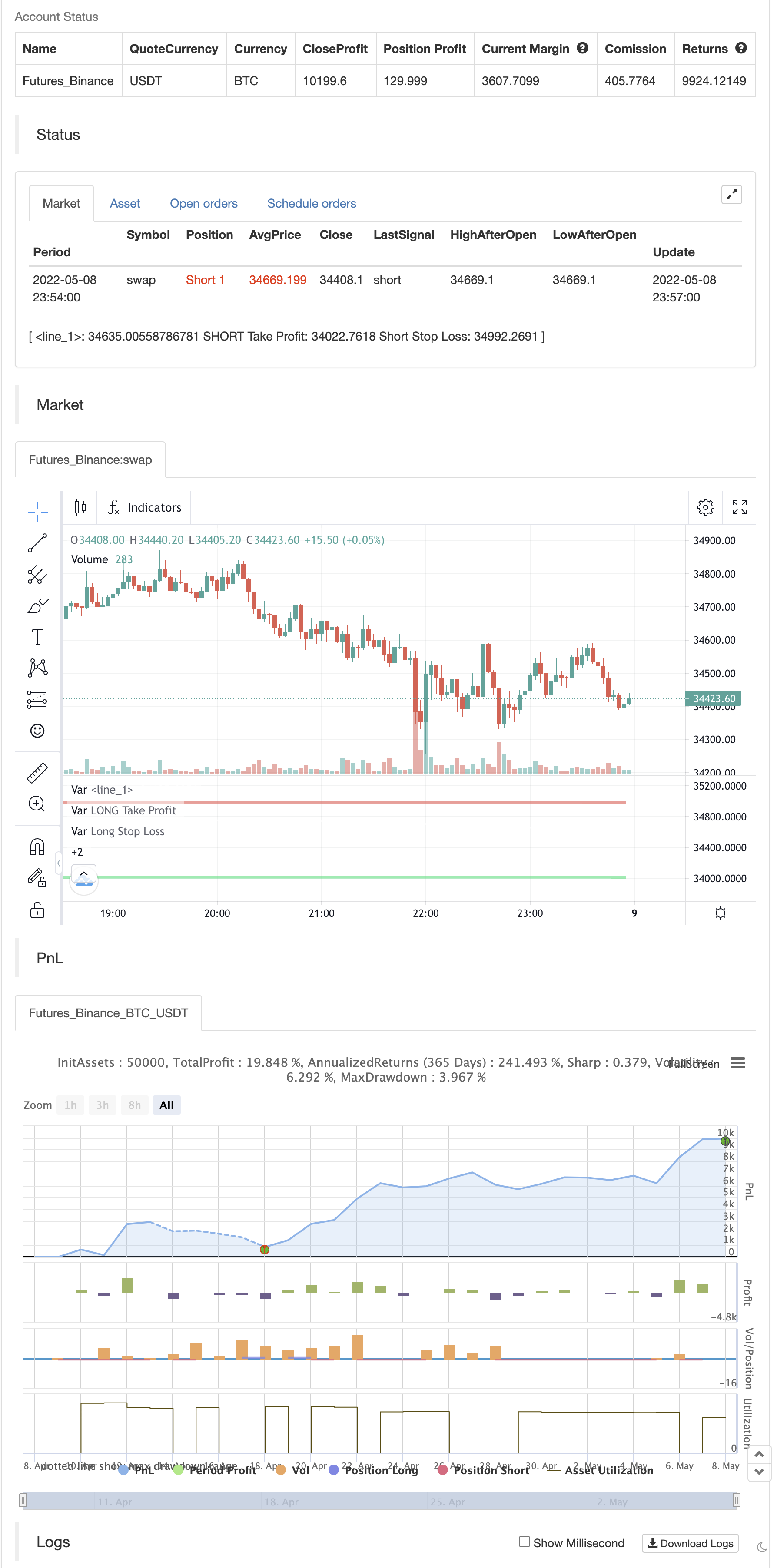

start: 2022-04-09 00:00:00

end: 2022-05-08 23:59:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © JoseMetal

//@version=5

//

//== Constantes

c_verde_radiactivo = color.rgb(0, 255, 0, 0)

c_verde = color.rgb(0, 128, 0, 0)

c_verde_oscuro = color.rgb(0, 80, 0, 0)

c_rojo_radiactivo = color.rgb(255, 0, 0, 0)

c_rojo = color.rgb(128, 0, 0, 0)

c_rojo_oscuro = color.rgb(80, 0, 0, 0)

//== Funciones

//== Declarar estrategia y período de testeo

//strategy("EMA + AROON + ASH (TRADE KING's STRATEGY)", shorttitle="EMA + AROON + ASH (TRADE KING's STRATEGY)", overlay=true, initial_capital=10000, pyramiding=0, default_qty_value=10, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.00075, max_labels_count=500, max_bars_back=1000)

//fecha_inicio = input.time(timestamp("1 Jan 2000"), title="• Start date", group="Test period", inline="periodo_de_pruebas")

vela_en_fecha = true

posicion_abierta = strategy.position_size != 0

LONG_abierto = strategy.position_size > 0

SHORT_abierto = strategy.position_size < 0

//== Condiciones de entrada y salida de estrategia

GRUPO_P = "Positions"

P_permitir_LONGS = input.bool(title="¿LONGS?", group=GRUPO_P, defval=true)

P_permitir_SHORTS = input.bool(title="¿SHORTS?", group=GRUPO_P, defval=true)

GRUPO_TPSL = "TP y SL"

TPSL_TP_pivot_lookback = input.int(title="• SL lookback for pivot / Mult. TP", group=GRUPO_TPSL, defval=20, minval=1, step=1, inline="tp_sl")

TPSL_SL_mult = input.float(title="", group=GRUPO_TPSL, defval=2.0, minval=0.1, step=0.2, inline="tp_sl")

//== Inputs de indicadores

// EMA

GRUPO_EMA = "Exponential Moving Average (EMA)"

EMA_length = input.int(200, minval=1, title="Length", group=GRUPO_EMA)

EMA_src = input(close, title="Source", group=GRUPO_EMA)

EMA = ta.ema(EMA_src, EMA_length)

// Aroon

GRUPO_Aroon = "Aroon"

Aroon_length = input.int(title="• Length", group=GRUPO_Aroon, defval=20, minval=1)

Aroon_upper = 100 * (ta.highestbars(high, Aroon_length+1) + Aroon_length) / Aroon_length

Aroon_lower = 100 * (ta.lowestbars(low, Aroon_length+1) + Aroon_length) / Aroon_length

// ASH

GRUPO_ASH = "Absolute Strength Histogram v2 | jh"

ASH_Length = input(9, title='Period of Evaluation', group=GRUPO_ASH)

ASH_Smooth = input(3, title='Period of Smoothing', group=GRUPO_ASH)

ASH_src = input(close, title='Source')

ASH_Mode = input.string(title='Indicator Method', defval='RSI', options=['RSI', 'STOCHASTIC', 'ADX'])

ASH_ma_type = input.string(title='MA', defval='WMA', options=['ALMA', 'EMA', 'WMA', 'SMA', 'SMMA', 'HMA'])

ASH_alma_offset = input.float(defval=0.85, title='* Arnaud Legoux (ALMA) Only - Offset Value', minval=0, step=0.01)

ASH_alma_sigma = input.int(defval=6, title='* Arnaud Legoux (ALMA) Only - Sigma Value', minval=0)

_MA(type, src, len) =>

float result = 0

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'SMMA' // Smoothed

w = ta.wma(src, len)

result := na(w[1]) ? ta.sma(src, len) : (w[1] * (len - 1) + src) / len

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'ALMA' // Arnaud Legoux

result := ta.alma(src, len, ASH_alma_offset, ASH_alma_sigma)

result

result

Price1 = _MA('SMA', ASH_src, 1)

Price2 = _MA('SMA', ASH_src[1], 1)

// RSI

Bulls0 = 0.5 * (math.abs(Price1 - Price2) + Price1 - Price2)

Bears0 = 0.5 * (math.abs(Price1 - Price2) - (Price1 - Price2))

// STOCHASTIC

Bulls1 = Price1 - ta.lowest(Price1, ASH_Length)

Bears1 = ta.highest(Price1, ASH_Length) - Price1

// ADX

Bulls2 = 0.5 * (math.abs(high - high[1]) + high - high[1])

Bears2 = 0.5 * (math.abs(low[1] - low) + low[1] - low)

Bulls = ASH_Mode == 'RSI' ? Bulls0 : ASH_Mode == 'STOCHASTIC' ? Bulls1 : Bulls2

Bears = ASH_Mode == 'RSI' ? Bears0 : ASH_Mode == 'STOCHASTIC' ? Bears1 : Bears2

AvgBulls = _MA(ASH_ma_type, Bulls, ASH_Length)

AvgBears = _MA(ASH_ma_type, Bears, ASH_Length)

SmthBulls = _MA(ASH_ma_type, AvgBulls, ASH_Smooth)

SmthBears = _MA(ASH_ma_type, AvgBears, ASH_Smooth)

difference = math.abs(SmthBulls - SmthBears)

//== Cálculo de condiciones

EMA_alcista = close > EMA

EMA_bajista = close < EMA

Aroon_cruce_alcista = ta.crossover(Aroon_upper, Aroon_lower)

Aroon_cruce_bajista = ta.crossunder(Aroon_upper, Aroon_lower)

ASH_alcista = SmthBulls > SmthBears

ASH_bajista = SmthBulls < SmthBears

//== Entrada (deben cumplirse todas para entrar)

longCondition1 = EMA_alcista

longCondition2 = Aroon_cruce_alcista

longCondition3 = ASH_alcista

long_conditions = longCondition1 and longCondition2 and longCondition3

entrar_en_LONG = P_permitir_LONGS and long_conditions and vela_en_fecha and not posicion_abierta

shortCondition1 = EMA_bajista

shortCondition2 = Aroon_cruce_bajista

shortCondition3 = ASH_bajista

short_conditions = shortCondition1 and shortCondition2 and shortCondition3

entrar_en_SHORT = P_permitir_SHORTS and short_conditions and vela_en_fecha and not posicion_abierta

var LONG_stop_loss = 0.0

var LONG_take_profit = 0.0

var SHORT_stop_loss = 0.0

var SHORT_take_profit = 0.0

//psl = ta.pivotlow(TPSL_TP_pivot_lookback, TPSL_TP_pivot_lookback)

//psh = ta.pivothigh(TPSL_TP_pivot_lookback, TPSL_TP_pivot_lookback)

psl = ta.lowest(TPSL_TP_pivot_lookback)

psh = ta.highest(TPSL_TP_pivot_lookback)

if (entrar_en_LONG)

LONG_stop_loss := psl - close*0.001

LONG_take_profit := close + ((close - LONG_stop_loss) * TPSL_SL_mult)

strategy.entry("+ Long", strategy.long)

strategy.exit("- Long", "+ Long", limit=LONG_take_profit, stop=LONG_stop_loss)

if (entrar_en_SHORT)

SHORT_stop_loss := psh + close*0.001

SHORT_take_profit := close - ((SHORT_stop_loss - close) * TPSL_SL_mult)

strategy.entry("+ Short", strategy.short)

strategy.exit("- Short", "+ Short", limit=SHORT_take_profit, stop=SHORT_stop_loss)

//== Ploteo en pantalla

// EMA

plot(EMA, color=color.white, linewidth=2)

// Símbolo de entrada (entre o no en compra)

bgcolor = color.new(color.black, 100)

if (entrar_en_LONG or entrar_en_SHORT)

bgcolor := color.new(color.green, 90)

bgcolor(bgcolor)

// Precio de compra, Take Profit, Stop Loss y relleno

avg_position_price_plot = plot(series=posicion_abierta ? strategy.position_avg_price : na, color=color.new(color.white, 25), style=plot.style_linebr, linewidth=2, title="Precio Entrada")

LONG_tp_plot = plot(LONG_abierto and LONG_take_profit > 0.0 ? LONG_take_profit : na, color=color.new(color.lime, 25), style=plot.style_linebr, linewidth=3, title="LONG Take Profit")

LONG_sl_plot = plot(LONG_abierto and LONG_stop_loss > 0.0 ? LONG_stop_loss : na, color=color.new(color.red, 25), style=plot.style_linebr, linewidth=3, title="Long Stop Loss")

fill(avg_position_price_plot, LONG_tp_plot, color=color.new(color.olive, 85))

fill(avg_position_price_plot, LONG_sl_plot, color=color.new(color.maroon, 85))

SHORT_tp_plot = plot(SHORT_abierto and SHORT_take_profit > 0.0 ? SHORT_take_profit : na, color=color.new(color.lime, 25), style=plot.style_linebr, linewidth=3, title="SHORT Take Profit")

SHORT_sl_plot = plot(SHORT_abierto and SHORT_stop_loss > 0.0 ? SHORT_stop_loss : na, color=color.new(color.red, 25), style=plot.style_linebr, linewidth=3, title="Short Stop Loss")

fill(avg_position_price_plot, SHORT_tp_plot, color=color.new(color.olive, 85))

fill(avg_position_price_plot, SHORT_sl_plot, color=color.new(color.maroon, 85))

- Z-Score-Trend nach Strategie

- CM-Schleudersystem

- Dynamische Buy-Entry-Strategie, die EMA-Crossing und Candle Body Penetration kombiniert

- Dreifache EMA mit dynamischer Unterstützungs-/Widerstandshandelsstrategie

- 3EMA

- - Ich weiß.

- Das Kreuz spielen

- Range Filter Kauf und Verkauf 5min [Strategie]

- Kauf/Verkauf von Strat

- EMA-Trend-Folgende automatisierte Handelsstrategie

- BB-RSI-ADX-Eingangspunkte

- Hull-4ema

- Winkel Angriff Linie Anzeige folgen

- KijunSen Linie mit Kreuz

- AMACD - Divergenz aller gleitenden Durchschnittskonvergenzen

- MA HYBRID von RAJ

- Diamanttrend

- Nik Stoch

- Stoch supertrd ATR 200mA

- MTF-RSI und STOCH-Strategie

- Momentum 2.0

- EHMA-Bereichsstrategie

- Beweglicher durchschnittlicher Kauf-Verkauf

- Midas Mk. II - Der ultimative Krypto-Swing

- TMA-Legacy

- TV-Hoch-Niedrig-Strategien

- Beste TradingView-Strategie

- Der Wert des Wertpapiers ist der Wert des Wertpapiers, der für den Wertpapiermarkt verwendet wird.

- Chande Kroll Stopp

- CCI + EMA mit RSI-Kreuzstrategie