Strategie für geglättete gleitende Durchschnittsbänder

Überblick

Diese Strategie ist eine typische Trend-Following-Strategie, die durch die Verwendung von Gleitenden Moving Averages und die Integration mehrerer Gleitender Moving Averages eine Gleitende Preisspanne erstellt, um Trends in Echtzeit zu filtern.

Strategieprinzip

- Durch die Konstruktion von Gleitpreisstreifen wird der Preiswechsel mithilfe eines gleitenden Moving Averages nachvollzogen.

- Die Strategie unterstützt die Eingabe verschiedener Arten von Moving Averages als Berechnungsarten für glatte Moving Averages, wie EMA, SMMA, KAMA usw.

- Unterstützt wird ein 1- bis 5-faches Überlagerungsgleichmachen dieser Moving Averages, um eine glattere Preisspanne zu erhalten.

- Es wird auch die Verwendung von Brinks zwischen Preisen und Moving Averages unterstützt, um die Preisänderungen besser zu erfassen.

- Durch die Aktivierung des zusätzlichen Moving Average-Filters können Trends besser gefiltert werden. Der Filter unterstützt auch verschiedene Arten von Moving Averages.

- In Kombination mit Formalerkennungsindikatoren ermöglicht es die automatische Erkennung von Kauf- und Verkaufssignalen.

Die Strategie erfasst die Preisentwicklung durch die Konstruktion von Flachpreisbändern und integriert eine bewegliche Mittelfilter, um die Richtung der Tendenz zu bestätigen. Sie gehört zu den typischen Trend-Follow-Strategien. Durch die Anpassung der Parameter kann die Marktumgebung flexibel an unterschiedliche Sorten und unterschiedliche Perioden angepasst werden.

Strategische Vorteile

- Die Konstruktion von Preisstreifen ermöglicht eine glattere Verfolgung der Preisentwicklung und reduziert die Wahrscheinlichkeit, dass eine Gelegenheit verpasst wird.

- Unterstützung für mehrere Arten von Moving Averages, die geeignete Moving Averages für verschiedene Perioden und Sorten auswählen können, um die Anpassungsfähigkeit der Strategie zu verbessern.

- 1-5-fache Überlagerungsgleichmäßigkeit kann die Fähigkeit zur Verfolgung von Preisänderungen erheblich verbessern und die Trendwendepunkte genauer erfassen.

- Die Filter für die beweglichen Mittelwerte können die unwirksamen Signale wirksam reduzieren und die Gewinnrate erhöhen.

- Durch die Anpassung der Länge des Moving Averages kann die Strategie für unterschiedliche Zeiträume angepasst und sogar über mehrere Zeitrahmen verifiziert werden.

- Das Blackout-Display ermöglicht eine klare und intuitive Beobachtung der Kursbewegungen.

Strategisches Risiko

- Die langfristigen Trends sind stärker zu verfolgen, aber die kurzfristigen Schwankungen sind schlechter zu verfolgen und zu reagieren, was zu einer größeren Unwirksamkeit der Signale in einem wackligen Umfeld führt.

- In einem raschen Preiswechsel, bei dem es zu starken Abstürzen kommt, kann der glatte Moving Average eine gewisse Verzögerung aufweisen und möglicherweise die beste Einstiegsmomente verpassen.

- Ein überlappender Moving Average kann die Preisentwicklung zu sehr glätten, wodurch die Kauf- und Verkaufsposition nicht erkannt werden kann.

- Wenn die eingeschalteten Moving Average-Längen-Parameter falsch eingestellt sind, kann dies zu einer großen Anzahl von Falschsignalen führen.

Die Lösung:

- Die Länge der gleitenden Durchschnitte sollte entsprechend verkürzt werden, um schnell auf Preisänderungen reagieren zu können.

- Anpassung der Überlagerungen zur Verringerung der Wahrscheinlichkeit einer Überstrahlung.

- Optimieren und testen von Kombinationen von Moving Averages, um die besten Parameter auszuwählen.

- In Kombination mit anderen Indikatoren werden mehrere Zeitrahmen überprüft, um die Falschsignalrate zu reduzieren.

Richtung der Strategieoptimierung

- Tests zur Optimierung von Kombinationen von Moving Average-Typen, um die besten Parameter zu wählen.

- Tests zur Optimierung der Parameter für die Länge des gleitenden Durchschnitts für eine größere Bandbreite von Sorten und Zeiträumen.

- Versuchen Sie mit verschiedenen Überlagerungen, um die beste Balance zu finden.

- Versuchen Sie, die Brin-Streifen als Hilfsindikatoren hinzuzufügen.

- Verschiedene Additive Moving Averages werden als Filter getestet.

- Mehrfache Zeitrahmen-Verifizierung in Kombination mit anderen Indikatoren.

Zusammenfassen

Diese Strategie gehört zu den typischen Trend-Following-Strategien, die durch die Konstruktion von Gleitenden Moving Average-Bändern die Preisentwicklung kontinuierlich verfolgen und in Kombination mit Hilfsfiltern unwirksame Signale vermeiden. Der Vorteil der Strategie liegt in der Konstruktion von Gleitenden Preisbändern, die die Umkehrung der Preisentwicklung besser erfassen können. Gleichzeitig besteht ein gewisses Rückstandsrisiko. Die Effektivität der Strategie kann durch die Optimierung von Parametern und der Optimierung von Indikatoren kontinuierlich verbessert werden.

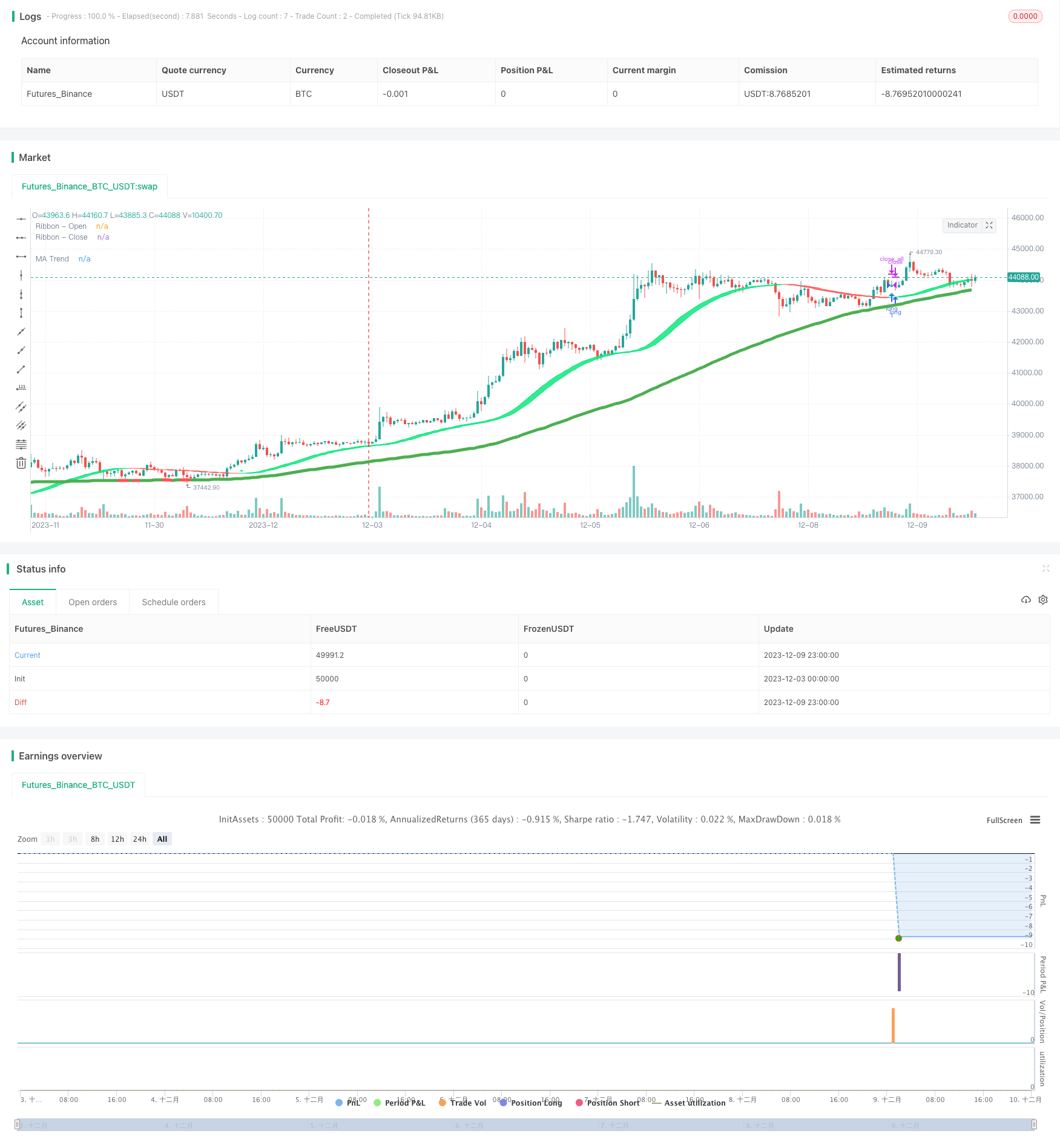

/*backtest

start: 2023-12-03 00:00:00

end: 2023-12-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Copyright (c) 2007-present Jurik Research and Consulting. All rights reserved.

// Copyright (c) 2018-present, Alex Orekhov (everget)

// Thanks to everget for code for more advanced moving averages

// Smooth Moving Average Ribbon [STRATEGY] @PuppyTherapy script may be freely distributed under the MIT license.

strategy( title="Smooth Moving Average Ribbon [STRATEGY] @PuppyTherapy", overlay=true )

// ---- CONSTANTS ----

lsmaOffset = 1

almaOffset = 0.85

almaSigma = 6

phase = 2

power = 2

// ---- GLOBAL FUNCTIONS ----

kama(src, len)=>

xvnoise = abs(src - src[1])

nfastend = 0.666

nslowend = 0.0645

nsignal = abs(src - src[len])

nnoise = sum(xvnoise, len)

nefratio = iff(nnoise != 0, nsignal / nnoise, 0)

nsmooth = pow(nefratio * (nfastend - nslowend) + nslowend, 2)

nAMA = 0.0

nAMA := nz(nAMA[1]) + nsmooth * (src - nz(nAMA[1]))

t3(src, len)=>

xe1_1 = ema(src, len)

xe2_1 = ema(xe1_1, len)

xe3_1 = ema(xe2_1, len)

xe4_1 = ema(xe3_1, len)

xe5_1 = ema(xe4_1, len)

xe6_1 = ema(xe5_1, len)

b_1 = 0.7

c1_1 = -b_1*b_1*b_1

c2_1 = 3*b_1*b_1+3*b_1*b_1*b_1

c3_1 = -6*b_1*b_1-3*b_1-3*b_1*b_1*b_1

c4_1 = 1+3*b_1+b_1*b_1*b_1+3*b_1*b_1

nT3Average_1 = c1_1 * xe6_1 + c2_1 * xe5_1 + c3_1 * xe4_1 + c4_1 * xe3_1

// The general form of the weights of the (2m + 1)-term Henderson Weighted Moving Average

getWeight(m, j) =>

numerator = 315 * (pow(m + 1, 2) - pow(j, 2)) * (pow(m + 2, 2) - pow(j, 2)) * (pow(m + 3, 2) - pow(j, 2)) * (3 * pow(m + 2, 2) - 11 * pow(j, 2) - 16)

denominator = 8 * (m + 2) * (pow(m + 2, 2) - 1) * (4 * pow(m + 2, 2) - 1) * (4 * pow(m + 2, 2) - 9) * (4 * pow(m + 2, 2) - 25)

denominator != 0

? numerator / denominator

: 0

hwma(src, termsNumber) =>

sum = 0.0

weightSum = 0.0

termMult = (termsNumber - 1) / 2

for i = 0 to termsNumber - 1

weight = getWeight(termMult, i - termMult)

sum := sum + nz(src[i]) * weight

weightSum := weightSum + weight

sum / weightSum

get_jurik(length, phase, power, src)=>

phaseRatio = phase < -100 ? 0.5 : phase > 100 ? 2.5 : phase / 100 + 1.5

beta = 0.45 * (length - 1) / (0.45 * (length - 1) + 2)

alpha = pow(beta, power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

variant(src, type, len ) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = 2 * v2 - ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v5 = wma(src, len) // Weighted

v6 = vwma(src, len) // Volume Weighted

v7 = na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len // Smoothed

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

v9 = linreg(src, len, lsmaOffset) // Least Squares

v10 = alma(src, len, almaOffset, almaSigma) // Arnaud Legoux

v11 = kama(src, len) // KAMA

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v13 = t3(src, len) // T3

v14 = ema1+(ema1-ema2) // Zero Lag Exponential

v15 = hwma(src, len) // Henderson Moving average thanks to @everget

ahma = 0.0

ahma := nz(ahma[1]) + (src - (nz(ahma[1]) + nz(ahma[len])) / 2) / len //Ahrens Moving Average

v16 = ahma

v17 = get_jurik( len, phase, power, src)

type=="EMA"?v2 : type=="DEMA"?v3 : type=="TEMA"?v4 : type=="WMA"?v5 : type=="VWMA"?v6 :

type=="SMMA"?v7 : type=="Hull"?v8 : type=="LSMA"?v9 : type=="ALMA"?v10 : type=="KAMA"?v11 :

type=="T3"?v13 : type=="ZEMA"?v14 : type=="HWMA"?v15 : type=="AHMA"?v16 : type=="JURIK"?v17 : v1

smoothMA(o, h, l, c, maLoop, type, len) =>

ma_o = 0.0

ma_h = 0.0

ma_l = 0.0

ma_c = 0.0

if maLoop == 1

ma_o := variant(o, type, len)

ma_h := variant(h, type, len)

ma_l := variant(l, type, len)

ma_c := variant(c, type, len)

if maLoop == 2

ma_o := variant(variant(o ,type, len),type, len)

ma_h := variant(variant(h ,type, len),type, len)

ma_l := variant(variant(l ,type, len),type, len)

ma_c := variant(variant(c ,type, len),type, len)

if maLoop == 3

ma_o := variant(variant(variant(o ,type, len),type, len),type, len)

ma_h := variant(variant(variant(h ,type, len),type, len),type, len)

ma_l := variant(variant(variant(l ,type, len),type, len),type, len)

ma_c := variant(variant(variant(c ,type, len),type, len),type, len)

if maLoop == 4

ma_o := variant(variant(variant(variant(o ,type, len),type, len),type, len),type, len)

ma_h := variant(variant(variant(variant(h ,type, len),type, len),type, len),type, len)

ma_l := variant(variant(variant(variant(l ,type, len),type, len),type, len),type, len)

ma_c := variant(variant(variant(variant(c ,type, len),type, len),type, len),type, len)

if maLoop == 5

ma_o := variant(variant(variant(variant(variant(o ,type, len),type, len),type, len),type, len),type, len)

ma_h := variant(variant(variant(variant(variant(h ,type, len),type, len),type, len),type, len),type, len)

ma_l := variant(variant(variant(variant(variant(l ,type, len),type, len),type, len),type, len),type, len)

ma_c := variant(variant(variant(variant(variant(c ,type, len),type, len),type, len),type, len),type, len)

[ma_o, ma_h, ma_l, ma_c]

smoothHA( o, h, l, c ) =>

hao = 0.0

hac = ( o + h + l + c ) / 4

hao := na(hao[1])?(o + c / 2 ):(hao[1] + hac[1])/2

hah = max(h, max(hao, hac))

hal = min(l, min(hao, hac))

[hao, hah, hal, hac]

// ---- Main Ribbon ----

haSmooth = input(true, title=" Use HA as source ? " )

length = input(11, title=" MA1 Length", minval=1, maxval=1000)

maLoop = input(3, title=" Nr. of MA1 Smoothings ", minval=1, maxval=5)

type = input("EMA", title="MA Type", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "Hull", "LSMA", "ALMA", "KAMA", "ZEMA", "HWMA", "AHMA", "JURIK", "T3"])

haSmooth2 = input(true, title=" Use HA as source ? " )

// ---- Trend ----

ma_use = input(true, title=" ----- Use MA Filter ( For Lower Timeframe Swings / Scalps ) ? ----- " )

ma_source = input(defval = close, title = "MA - Source", type = input.source)

ma_length = input(100,title="MA - Length", minval=1 )

ma_type = input("SMA", title="MA - Type", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "Hull", "LSMA", "ALMA", "KAMA", "ZEMA", "HWMA", "AHMA", "JURIK", "T3"])

ma_useHA = input(defval = false, title = "Use HA Candles as Source ?")

ma_rsl = input(true, title = "Use Rising / Falling Logic ?" )

// ---- BODY SCRIPT ----

[ ha_open, ha_high, ha_low, ha_close ] = smoothHA(open, high, low, close)

_open_ma = haSmooth ? ha_open : open

_high_ma = haSmooth ? ha_high : high

_low_ma = haSmooth ? ha_low : low

_close_ma = haSmooth ? ha_close : close

[ _open, _high, _low, _close ] = smoothMA( _open_ma, _high_ma, _low_ma, _close_ma, maLoop, type, length)

[ ha_open2, ha_high2, ha_low2, ha_close2 ] = smoothHA(_open, _high, _low, _close)

_open_ma2 = haSmooth2 ? ha_open2 : _open

_high_ma2 = haSmooth2 ? ha_high2 : _high

_low_ma2 = haSmooth2 ? ha_low2 : _low

_close_ma2 = haSmooth2 ? ha_close2 : _close

ribbonColor = _close_ma2 > _open_ma2 ? color.lime : color.red

p_open = plot(_open_ma2, title="Ribbon - Open", color=ribbonColor, transp=70)

p_close = plot(_close_ma2, title="Ribbon - Close", color=ribbonColor, transp=70)

fill(p_open, p_close, color = ribbonColor, transp = 40 )

// ----- FILTER

ma = 0.0

if ma_use == true

ma := variant( ma_useHA ? ha_close : ma_source, ma_type, ma_length )

maFilterShort = ma_use ? ma_rsl ? falling(ma,1) : ma_useHA ? ha_close : close < ma : true

maFilterLong = ma_use ? ma_rsl ? rising(ma,1) : ma_useHA ? ha_close : close > ma : true

colorTrend = rising(ma,1) ? color.green : color.red

plot( ma_use ? ma : na, title="MA Trend", color=colorTrend, transp=80, transp=70, linewidth = 5)

long = crossover(_close_ma2, _open_ma2 ) and maFilterLong

short = crossunder(_close_ma2, _open_ma2 ) and maFilterShort

closeAll = cross(_close_ma2, _open_ma2 )

plotshape( short , title="Short", color=color.red, transp=80, style=shape.triangledown, location=location.abovebar, size=size.small)

plotshape( long , title="Long", color=color.lime, transp=80, style=shape.triangleup, location=location.belowbar, size=size.small)

//* Backtesting Period Selector | Component *//

//* Source: https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

if testPeriod() and long

strategy.entry( "long", strategy.long )

if testPeriod() and short

strategy.entry( "short", strategy.short )

if closeAll

strategy.close_all( when = closeAll )