Quantitative Trendstrategie auf der Grundlage von mehreren Faktoren

Schriftsteller:ChaoZhang, Datum: 2024-01-12 11:09:40Tags:

Übersicht

Diese Strategie berücksichtigt umfassend Faktoren wie Handelsvolumen, Volatilität, Schlusskursposition, Trend usw., um Handelschancen zu identifizieren.

Strategieprinzip

Die Kernidee dieser Strategie besteht darin, Ein- und Ausstiegspunkte zu ermitteln, indem man abnormale Durchbrüche im Handelsvolumen, der Schlussposition, dem Volatilitätsbereich und anderen Faktoren kombiniert.

Insbesondere berechnet die Strategie das durchschnittliche Handelsvolumen über einen bestimmten Zeitraum. Wenn das Handelsvolumen des laufenden Zeitraums einen signifikanten abnormalen Durchbruch zeigt, kann dies auf eine Trendwende hinweisen. Darüber hinaus impliziert der Schlusskurs, wenn er in der Nähe der oberen oder unteren Grenze der Volatilitätsspanne liegt, auch eine mögliche Trendwende. Durch die Kombination von Handelsvolumen und Schlussposition können zunächst potenzielle Einstiegs- und Ausstiegspunkte beurteilt werden.

Um die Handelssignale zu überprüfen, berücksichtigt diese Strategie auch die Volatilitätsspanne. Wenn die aktuelle Volatilität über einen Zeitraum das Durchschnittsniveau durchbricht, bildet sie die erste Bedingung für Handelssignale. Wenn dann der Schlusskurs eines Up-Bars mit zunehmendem Volumen in die untere Hälfte der Volatilitätsspanne fällt, wird ein Verkaufssignal generiert. Im Gegenteil, wenn der Schlusskurs eines Down-Bars in der oberen Hälfte der Volatilitätsspanne mit sinkendem Volumen liegt, wird ein Kaufsignal erzeugt.

Darüber hinaus verwendet diese Strategie auch gleitende Durchschnitte, um den Gesamttrend zu bestimmen.

Durch die Integration der oben genannten Indikatoren kann diese Strategie die Marktein- und -ausgangspunkte effektiv identifizieren.

Vorteile

Der größte Vorteil dieser Strategie besteht darin, dass bei der Entscheidungsfindung mehrere Faktoren berücksichtigt werden, wodurch die Handelssignale zuverlässiger werden.

- Anzeichen einer Trendumkehr frühzeitig durch abnormales Handelsvolumen erkennen.

- Bestimmung des realen Trends anhand des Volatilitätsbereichs und der Schlussposition, wobei kurzfristige Geräusche vermieden werden.

- Sicherstellen, dass die Strategie mit dem wichtigsten Trend übereinstimmt, indem der gleitende Mittelwert auf mittlere und lange Sicht überprüft wird.

- Verluste reduzieren, indem Signale aus mehreren Aspekten überprüft werden.

Risiken

Diese Strategie birgt außerdem mehrere Risiken:

- Komplex, um Parameter mit mehreren Faktoren zu optimieren.

- Unmöglich, falsche Signale zu vermeiden.

- Eine falsche Beurteilung der wichtigsten Trends kann sich negativ auf die Gesamtleistung auswirken.

- Die Volatilitätsparameter müssen unter unterschiedlichen Marktbedingungen angepasst werden.

Optimierungsrichtlinien

Die wichtigsten Aspekte, an denen diese Strategie optimiert werden kann:

- Verwenden Sie maschinelle Lernmodelle, um die Parameter automatisch einzustellen.

- Hinzufügen von Stop-Loss-Mechanismen zur Risikokontrolle.

- Integrieren Sie mehr Faktoren wie Geldströme, um die wichtigsten Trends zu bestimmen.

- Konstruktion eines adaptiven Volatilitätsparameters

Schlussfolgerung

Diese Strategie identifiziert Handelschancen unter Berücksichtigung verschiedener Faktoren. Die Vorteile liegen in umfassenden Signalmechanismen und stabiler Leistung, während die Hauptrisiken aus Parameter-Tuning und ungenauer Haupttrendvorhersage stammen.

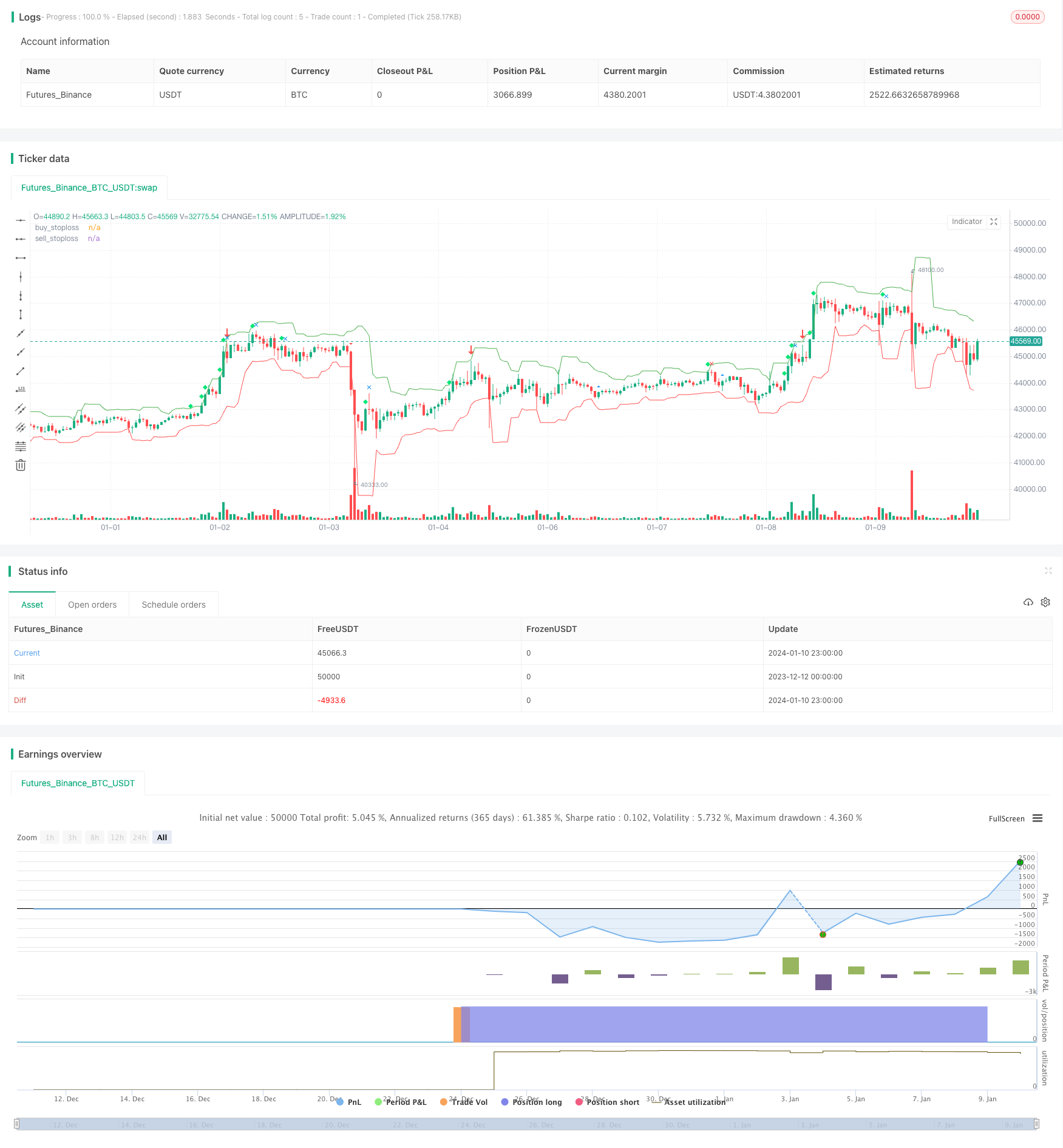

/*backtest

start: 2023-12-12 00:00:00

end: 2024-01-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("volume spread analysis ", overlay=true)

volavg = sma(volume,40)

c= close

l=low

h=high

v=volume

volmean = stdev(volavg,30)

volupband3 = volavg + 3*volmean

volupband2 = volavg + 2*volmean

volupband1 = volavg + 1*volmean

voldnband1 = volavg -1*volmean

voldnband2 = volavg -2*volmean

midprice = (high+low)/2

spread = (high-low)

avgspread = sma(spread,80)

avgspreadbar = spread > avgspread

widerangebar = spread>(1.5*avgspread)

narrowrangebar = spread<(0.7*avgspread)

lowvolume = volume<volume[1] and volume<volume[2]

upbar = close>close[1]

downbar = close<close[1]

highvolume = volume>volume[1] and volume[1]>volume[2]

closefactor = close-low

clsposition = spread/closefactor

closeposition = iff(closefactor==0,avgspread,clsposition)

vb = volume>volavg or volume>volume[1]

upclose = close>=((spread*0.7)+low)// close is above 70% of the bar

downclose = close<=((spread*0.3)+low)// close is below the 30% of the bar

aboveclose = close>((spread*0.5)+low)// close is between 50% and 70% of the bar

belowclose = close<((spread*0.5)+low)// close is between 50% and 30% of the bar

midclose = close>((spread*0.3)+low) and c<((spread*0.7)+l)// close is between 30% and 70% of the bar

verylowclose = closeposition>4//close is below 25% of the bar

veryhighclose = closeposition<1.35// close is above 80% of the bar

closepos = iff(close<=((spread*0.2)+low),1,iff(close<=((spread*0.4)+low),2,iff(close<=((spread*0.6)+low),3,iff(close<=((spread*0.8)+low),4,5))))

// 1 = downclose, 2 = belowclose, 3 = midclose, 4 = aboveclose, 5 = upclose

volpos = iff(volume>volavg*2,1,iff(volume>volavg*1.3,2,iff(volume>volavg,3,iff(volume<volavg and volume>volavg*0.7,4,5))))

//// 1 = very high, 2 = high, 3 = above average, 4 = less than average, 5 = low

freshgndhi = close > highestbars(h,5)

freshgndlo = close < lowestbars(l,5)

//========================trend estimation =========================

//jtrend=sma(close,5)

//trendlongterm = linreg(jtrend,40)

//trendmediumterm = linreg(jtrend,10)

//trendshortterm = linreg(jtrend,3)

//tls=linreg(jtrend,3)

minperiodsrwist = input(title="short term min periods", defval=2, minval=1)

maxperiodsrwist = input(title="short term max periods", defval=8, minval=1)

minperiodsrwilt = input(title="long term min periods", defval=10, minval=1)

maxperiodsrwilt = input(title="long term max periods", defval=40, minval=1)

rwhmins = (high - nz(low[minperiodsrwist])) / (atr(minperiodsrwist) * sqrt(minperiodsrwist))

rwhmaxs = (high - nz(low[maxperiodsrwist])) / (atr(maxperiodsrwist) * sqrt(maxperiodsrwist))

rwhs = max( rwhmins, rwhmaxs )

rwlmins = (nz(high[minperiodsrwist]) - low) / (atr(minperiodsrwist) * sqrt(minperiodsrwist))

rwlmaxs = (nz(high[maxperiodsrwist]) - low) / (atr(maxperiodsrwist) * sqrt(maxperiodsrwist))

rwls = max( rwlmins, rwlmaxs )

rwhminl = (high - nz(low[minperiodsrwilt])) / (atr(minperiodsrwilt) * sqrt(minperiodsrwilt))

rwhmaxl = (high - nz(low[maxperiodsrwilt])) / (atr(maxperiodsrwilt) * sqrt(maxperiodsrwilt))

rwhl = max( rwhminl, rwhmaxl )

rwlminl = (nz(high[minperiodsrwilt]) - low) / (atr(minperiodsrwilt) * sqrt(minperiodsrwilt))

rwlmaxl = (nz(high[maxperiodsrwilt]) - low) / (atr(maxperiodsrwilt) * sqrt(maxperiodsrwilt))

rwll = max( rwlminl, rwlmaxl )

ground = rwhs

sky = rwls

j = rwhs-rwls

k = rwhl-rwll

j2 = rwhl

k2 = rwll

ja = cross(j,1)

jb = cross(1,j)

jc = cross(-1,j)

jd = cross(j,-1)

j2a = cross(j2,1)

j2b = cross(1,j2)

k2a = cross(k2,1)

k2b = cross(1,k2)

upmajoron = j > 1 and ja[1]

upmajoroff = j < 1 and jb[1]

upminoron = j2 > 1 and j2a[1]

upminoroff = j2 < 1 and j2b[1]

dnmajoron = j < -1 and jc[1]

dnmajoroff = j > -1 and jd[1]

dnminoron = k2 > 1 and k2a[1]

dnminoroff = k2 < 1 and k2b[1]

upimd = iff(ground > 1, 1,0)

dnimd = iff(sky > 1, 1, 0)

upmajor = iff(j>1,1,iff(j<(-1),-1,0))

upminor = iff(j2>1,1,-1)

dnminor = iff(k2>1,1,-1)

//======================================================================|

Buy_stop = lowest(low[1],5) - atr(20)[1]

plot(Buy_stop, color=red, title="buy_stoploss")

Sell_stop = highest(high[1],5) + atr(20)[1]

plot(Sell_stop, color=green, title="sell_stoploss")

//======================================================================|

//upthrustbar = widerangebar and downclose and upimd==1 and high>high[1] //wrb and uhs and fresh ground

nut = widerangebar and downclose and freshgndhi and highvolume // new signal

bc = widerangebar and aboveclose and volume == highest(volume,60) and upmajor==1 // new signal

upthrustbar = widerangebar and (closepos==1 or closepos==2) and upminor>0 and high>high[1] and (upimd>0or upmajor>0) and volpos <4// after minor up trend

upthrustbartrue = widerangebar and closepos==1 and upmajor>0 and high>high[1] and volpos <4//occurs after a major uptrend

upthrustcond1 = upthrustbar[1] and downbar and not narrowrangebar

upthrustcond2 = upthrustbar[1] and downbar and volpos == 2

upthrustcond3 = upthrustbar and volpos ==1

toprevbar = volume[1]>volavg and upbar[1] and widerangebar[1] and downbar and downclose and widerangebar and upmajor>0 and high==highest(high,10)

pseudoupthrust = upbar[1] and high>high[1] and volume[1]>1.5*volavg and downbar and downclose and not upthrustbar

pseudoutcond = pseudoupthrust[1] and downbar and downclose and not upthrustbar

trendchange = upbar[1] and high==highest(high,5) and downbar and (downclose or midclose) and volume>volavg and upmajor>0 and upimd>0 and not widerangebar and not pseudoupthrust

nodemandbarut = upbar and narrowrangebar and lowvolume and closepos> 3 and ((upminor>0 and upimd>0)or (upminor<0 and upminor>0))//in a up market

nodemandbardt = upbar and narrowrangebar and lowvolume and closepos> 3 and (upminor<=0or upimd<=0)// in a down or sidewayss market

nosupplybar = downbar and narrowrangebar and lowvolume and closepos<3 and ((upminor<1 and upimd<1)or (upminor>0 and upimd<1))

lowvoltest = low==lowest(low,5) and upclose and lowvolume//lowvolume and l<low[1] and upclose

lowvoltest1 = low==lowest(low,5) and volume<volavg and low<low[1] and upclose and upminor>0 and upmajor>0// and widerangebar

lowvoltest2 = lowvoltest[1] and upbar and upclose

sellcond1 = (upthrustcond1 or upthrustcond2 or upthrustcond3)

sellcond2 = sellcond1[1]==0

sellcond = sellcond1 and sellcond2

strengthdown0 = upmajor<0 and volpos<4 and downbar[1] and upbar and closepos>3 and upminor<0 and upimd<=0// strength after a long down trend

strengthdown = volpos<4 and downbar[1] and upbar and closepos>3 and upimd<=00 and upminor<0// strength after a down trend

strengthdown1 = upmajor<0 and volume>(volavg*1.5) and downbar[1] and upbar and closepos>3 and upminor<0 and upimd<=0//strength after downtrend . high volume

strengthdown2 = upimd<=0 and volume[1]<volavg and upbar and veryhighclose and volpos<4

buycond1 = strengthdown or strengthdown1

buycond = upbar and buycond1[1]

stopvolume = low==lowest(low,5) and (upclose or midclose) and v>1.5*volavg and upmajor<0

revupthrust = upmajor<0 and upbar and upclose and volume>volume[1] and volume>volavg and widerangebar and downbar[1] and downclose[1] and upminor<0

effortup = high>high[1] and low>low[1] and close>close[1] and close>=((high-low)*0.7+low) and spread>avgspread and volpos<4//and open<=((high-low)*0.3+low)

effortupfail = effortup[1] and (upthrustbar or upthrustcond1 or upthrustcond2 or upthrustcond3 or (downbar and avgspreadbar))

effortdown = high<high[1] and low<low[1] and close<close[1] and close<=((high-low)*0.25+low) and widerangebar and volume>volume[1]//o>=((high-low)*0.75+

effortdownfail = effortdown[1] and ((upbar and avgspreadbar)or revupthrust or buycond1)

upflag = (sellcond or buycond or effortup or effortupfail or stopvolume or effortdown or effortdownfail or revupthrust or nodemandbardt or nodemandbarut or nosupplybar or lowvoltest or lowvoltest1 or lowvoltest2 or bc)

bullbar = (volume>volavg or volume>volume[1]) and closeposition <2 and upbar and not upflag

bearbar = vb and downclose and downbar and spread>avgspread and not upflag

buy = (upbar and revupthrust[1])or lowvoltest2

burely = strengthdown1 and stopvolume[1]or (upbar and revupthrust[1])or lowvoltest2

//buy = effortup and lowvoltest2[1]

//sell = upthrustbartrue

sell = effortup[1] and effortupfail and upthrustcond3 and upthrustbartrue and toprevbar

strategy.entry("simpleBuy", strategy.long, when= (upbar and revupthrust[1])or lowvoltest2 )

strategy.close("simpleBuy",when=upthrustbartrue )

//strategy.entry("simpleSell", strategy.short,when= upthrustbartrue )

//strategy.close("simpleSell",when= (upbar and revupthrust[1])or lowvoltest2)

//|============================================================================================|

//data = close >= open

//plotshape(true, style=shape.flag, color=data ? green : red)

plotshape((upthrustbar or upthrustbartrue) ,title="upthrustbaro" ,style=shape.arrowdown ,size=size.huge,color=red )

//plotshape(toprevbar ,title="toprevbar" ,style=shape.flag ,size=size.small,color=blue )

//plotshape((pseudoupthrust) ,title="(pseudoupthrus" ,style=shape.circle ,size=size.small,color=blue )

//plotshape((upthrustcond1 or upthrustcond2) ,title="upthrustcond1" ,style=shape.triangleup ,size=size.small,color=red )

plotshape(trendchange ,title="trendchange" ,style=shape.xcross ,size=size.small,color=red )

//plotshape((nodemandbardt) ,title="(nodemandbardt" ,style=shape.square ,size=size.small,color=orange )

//plotshape(nosupplybar ,title="nosupplybar" ,style=shape.cross ,size=size.small,color=blue)

plotshape(revupthrust ,title="revupthrust" ,style=shape.arrowup ,size=size.huge,color=green )

//plotshape((upthrustbar or upthrustbartrue) ,title="upthrustbaro" ,style=shape.cross ,size=size.small,color=red )

//plotshape((upthrustcond1 or upthrustcond2) ,title="upthrustcond1" ,style=shape.triangledown ,size=size.small,color=white )

//plotshape((pseudoupthrust) ,title="(pseudoupthrus" ,style=shape.arrowup ,size=size.small,color=blue )

//plotshape(nodemandbarut ,title="nodemandbarut" ,style=shape.labelup ,size=size.small,color=orange )

//plotshape(nodemandbarut ,title="nodemandbarut" ,style=shape.labeldown ,size=size.small,color=yellow )

//plotshape(nodemandbardt ,title="nodemandbardt" ,style=shape.diamond ,size=size.small,color=yellow )

//plotshape(nosupplybar ,title="nosupplybar" ,style=shape.xcross ,size=size.small,color=blue )

plotshape(lowvoltest ,title="lowvoltest" ,style=shape.triangleup ,size=size.small,color=blue )

//plotshape(lowvoltest2 ,title="lowvoltest2" ,style=shape.triangledown ,size=size.small,color=yellow )

//plotshape(strengthdown ,title="strengthdown" ,style=shape.flag ,size=size.small,color=green)

//plotshape(strengthdown ,title="strengthdown" ,style=shape.circle ,size=size.small,color=lime )

//plotshape(strengthdown2 ,title="strengthdown2" ,style=shape.arrowup ,size=size.small,color=silver )

//plotshape(strengthdown2 ,title="strengthdown2" ,style=shape.arrowdown ,size=size.small,color=red )

//plotshape(stopvolume ,title="stopvolume" ,style=shape.labelup ,size=size.small,color=green )

//plotshape(stopvolume ,title="stopvolume" ,style=shape.labeldown ,size=size.small,color=yellow )

plotshape(effortup ,title="effortup" ,style=shape.diamond ,size=size.small,color=lime )

plotshape(effortupfail ,title="effortupfail" ,style=shape.xcross ,size=size.small,color=blue )

//plotshape(effortupfail ,title="effortupfail" ,style=shape.cross ,size=size.small,color=white )

plotshape(effortdown ,title="effortdown" ,style=shape.triangledown ,size=size.small,color=red )

plotshape(effortdownfail ,title="effortdownfail" ,style=shape.xcross ,size=size.small,color=green )

//plotshape(effortdownfail ,title="effortdownfail" ,style=shape.flag ,size=size.small,color=white )

//plotshape(buycond ,title="buycond" ,style=shape.circle ,size=size.small,color=green )

//plotshape(sellcond ,title="sellcond" ,style=shape.arrowup ,size=size.small,color=orange )

//plotshape((nut) ,title="(nut)" ,style=shape.arrowdown ,size=size.small,color=lime )

//plotshape((bc ) ,title="(bc" ,style=shape.labelup ,size=size.small,color=red )

//plotshape(buy ,title="buy" ,style=shape.labeldown ,size=size.small,color=white )

- Bull Power Handelsstrategie

- Tägliche gleitende Durchschnittsverfolgungsstrategie für den Goldwert

- Mehrzeitrahmen gleitender Durchschnitt in Kombination mit Handelszeiten Quantitative Handelsstrategie

- Multi-Timeframe-Handelsstrategie auf Basis des MACD

- Strategie zur Verfolgung der Bärenkraft

- Trend nach einer auf mehreren Indikatoren basierenden Handelsstrategie

- Swing-Handelsstrategie mit 20/50 EMA Cross

- Dynamische Trendverfolgungsstrategie optimiert

- Strategie für einen doppelten gleitenden Durchschnitt in Kombination mit einem Stochastikindikator

- Trendverfolgungsstrategie auf Basis des gleitenden Durchschnitts und des realen Durchschnittsbereichs

- Derivatenbasierte Handelsstrategie

- MACD-Strategie nur lang

- Strategie für den Trend des gleitenden Durchschnitts

- Mengenmäßige Handelsstrategie auf Basis von SMA-Crossover

- Strategie zur Verhinderung von Verlusten

- Unterstützungs- und Widerstandsstrategie mit Volumenbruch und Trailing Stop Loss

- Bewegung der Stop-Loss-Strategie basierend auf Punkten Gewinn und Stop-Loss

- Prozentsatz der Stop-Loss-Strategie

- Strategie zur Kombination von doppeltem gleitendem Durchschnitt und Bull Bear Power Balance

- Einfache Strategie des Inhabers