Trendfolgestrategie basierend auf gleitenden Durchschnitten

Überblick

Die Strategie ist eine einfache Trend-Follow-Strategie, die auf einem Moving Average basiert. Sie beurteilt die aktuelle Trendrichtung und die Dauer des Trends, indem sie die Größenverhältnisse von Moving Averages aus verschiedenen Perioden vergleicht. Die Strategie macht einen Plus, wenn die kurzfristige Durchschnittslinie von unten nach oben durch die langfristige Durchschnittslinie geht, und macht einen Nullpunkt, wenn die kurzfristige Durchschnittslinie von oben nach unten durch die langfristige Durchschnittslinie geht.

Strategieprinzip

Die Strategie verwendet vier bewegliche Durchschnitte mit unterschiedlichen Perioden: die 5-Tage-Linie, die 10-Tage-Linie, die 15-Tage-Linie und die 25-Tage-Linie. Diese vier Mittellinien werden als MA1, MA2, MA3 und MA4 bezeichnet.

Wenn MA1>MA2>MA3>MA4 bedeutet, dass der Preis im Aufwärtstrend ist, dann machen Sie mehr; wenn MA1

Die Aufnahme von Overs und Downs erfordert auch die Einhaltung des ATR-Stopp-Loss-Filters, d.h. der ATR-Wert ist größer als der ATR-40-Zyklus-Simple-Moving-Average, was verhindert, dass ein falsches Signal nach Stunden von Preisschwankungen ausgegeben wird.

Strategische Vorteile

Diese Strategie hat folgende Vorteile:

- Die Idee ist einfach zu verstehen und umzusetzen.

- Die Verwendung von mehreren Gruppen von beweglichen Durchschnitten kann eine zuverlässige Tendenzbestimmung ermöglichen.

- Ein Stop-Stop-Loss-Punkt ermöglicht eine effektive Kontrolle des maximalen Verlusts eines einzelnen Handels.

- ATR-Stopp-Filter verhindern, dass nach einer Stunde ein falsches Signal ausgelöst wird.

Risikoanalyse

Die Strategie birgt auch folgende Risiken:

- In einem stark bewegten Markt kann es zu falschen Signalen kommen.

- Unkorrekte Parameter-Einstellungen (z.B. Durchschnittliche Periodizität) können zu schlechten Effekten führen.

- Die Auswirkungen von Grundlagen und wichtigen Nachrichten auf die Preise werden nicht berücksichtigt.

Um diese Risiken zu verringern, können die Parameter entsprechend optimiert oder andere Filterbedingungen hinzugefügt werden, um die Strategie-Stabilität zu verbessern.

Optimierungsrichtung

Die Optimierung der Strategie richtet sich nach folgenden Punkten:

- Verschiedene Kombinationen von Moving-Average-Perioden-Parametern werden getestet, um die besten Parameter zu finden.

- Hinzufügen von Filtern für andere technische Indikatoren wie MACD, KDJ und andere, um die Signalzuverlässigkeit zu beurteilen.

- Erhöhung der Filterung des Transaktionsvolumens, der nur dann erfolgt, wenn der Transaktionsvolumen größer ist.

- Optimierung der Parameter in Abhängigkeit von den Parameterunterschieden der verschiedenen Sorten.

- Das ist ein weiterer wichtiger Aspekt, der die Autoren der Studie beeinflusst.

Zusammenfassen

Die Strategie insgesamt ist eine relativ einfache Trend-Follow-Strategie, die die Trendrichtung durch bewegliche Durchschnitte beurteilt und einen angemessenen Stop-Loss-Satz setzt, um das Risikoniveau zu kontrollieren. Die Strategie kann noch optimiert werden. Die Strategie kann durch Anpassung der Parameter und das Hinzufügen von Filtern und andere Mittel zur weiteren Steigerung der Strategie-Stabilität und Profitabilität verbessert werden.

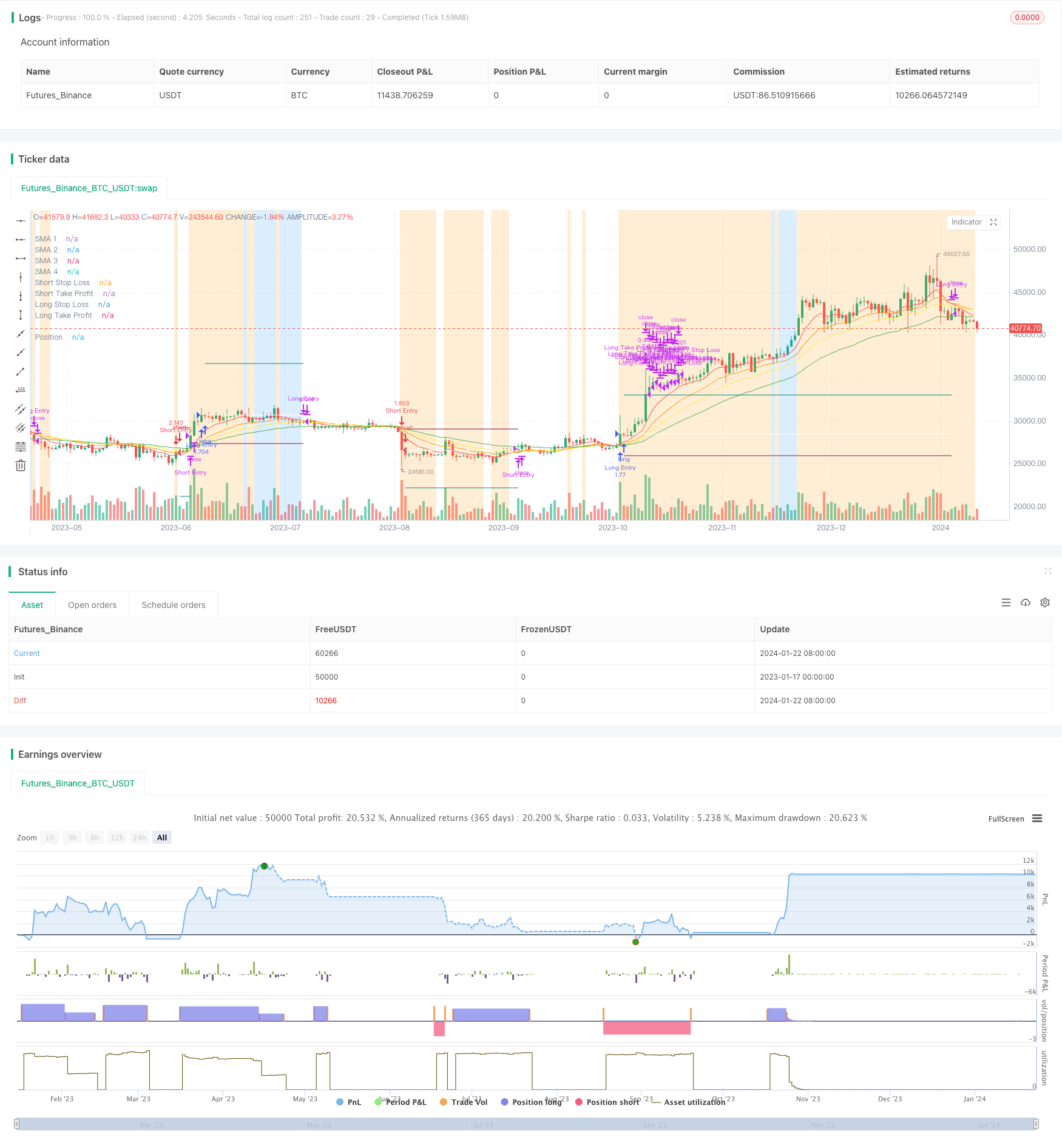

/*backtest

start: 2023-01-17 00:00:00

end: 2024-01-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © fpemehd

// @version=5

// # ========================================================================= #

// # | STRATEGY |

// # ========================================================================= #

strategy(title = 'MA Simple Strategy with SL & TP & ATR Filters',

shorttitle = 'MA Strategy',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

commission_type = strategy.commission.percent,

commission_value = 0.1,

initial_capital = 100000,

max_lines_count = 150,

max_labels_count = 300)

// # ========================================================================= #

// # Inputs

// # ========================================================================= #

// 1. Time

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

c_timeCond = true

// 2. Inputs for direction: Long? Short? Both?

i_longEnabled = input.bool(defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "Long / Short", group = "Long / Short" )

i_shortEnabled = input.bool(defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "Long / Short", group = "Long / Short" )

// 3. Use Filters? What Filters?

i_ATRFilterOn = input.bool(defval = true , title = "ATR Filter On?", tooltip = "ATR Filter On?", inline = "ATR Filter", group = "Filters")

i_ATRSMALen = input.int(defval = 40 , title = "SMA Length for ATR SMA", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ATR should be bigger than this", inline = "ATR Filter", group = "Filters")

// 3. Shared inputs for Long and Short

//// 3-1. Inputs for Stop Loss Type: normal? or trailing?

//// If trailing, always trailing or trailing after take profit order executed?

i_useSLTP = input.bool(defval = true, title = "Enable SL & TP?", tooltip = "", inline = "Enable SL & TP & SL Type", group = "Shared Inputs")

i_tslEnabled = input.bool(defval = false , title = "Enable Trailing SL?", tooltip = "Enable Stop Loss & Take Profit? \n\Enable Trailing SL?", inline = "Enable SL & TP & SL Type", group = "Shared Inputs")

// i_tslAfterTP = input.bool(defval = true , title = "Enable Trailing SL after TP?", tooltip = "Enable Trailing SL after TP?", inline = "Trailing SL Execution", group = "Shared Inputs")

i_slType = input.string(defval = "ATR", title = "Stop Loss Type", options = ["Percent", "ATR"], tooltip = "Stop Loss based on %? ATR?", inline = "Stop Loss Type", group = "Shared Inputs")

i_slATRLen = input.int(defval = 14, title = "ATR Length", minval = 1 , maxval = 200 , step = 1, inline = "Stop Loss ATR", group = "Shared Inputs")

i_tpType = input.string(defval = "R:R", title = "Take Profit Type", options = ["Percent", "ATR", "R:R"], tooltip = "Take Profit based on %? ATR? R-R ratio?", inline = "Take Profit Type", group = "Shared Inputs")

//// 3-2. Inputs for Quantity

i_tpQuantityPerc = input.float(defval = 50, title = 'Take Profit Quantity %', minval = 0.0, maxval = 100, step = 1.0, tooltip = '% of position when tp target is met.', group = 'Shared Inputs')

// 4. Inputs for Long Stop Loss & Long Take Profit

i_slPercentLong = input.float(defval = 3, title = "SL Percent", tooltip = "", inline = "Percent > Long Stop Loss / Take Profit Percent", group = "Long Stop Loss / Take Profit")

i_tpPercentLong = input.float(defval = 3, title = "TP Percent", tooltip = "Long Stop Loss && Take Profit Percent?", inline = "Percent > Long Stop Loss / Take Profit Percent", group = "Long Stop Loss / Take Profit")

i_slATRMultLong = input.float(defval = 3, title = "SL ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "Long Stop Loss / Take Profit ATR", group = "Long Stop Loss / Take Profit")

i_tpATRMultLong = input.float(defval = 3, title = "TP ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "ATR > Long Stop Loss && Take Profit ATR Multiplier? \n\Stop Loss = i_slATRMultLong * ATR (i_slATRLen) \n\Take Profit = i_tpATRMultLong * ATR (i_tpATRLen)", inline = "Long Stop Loss / Take Profit ATR", group = "Long Stop Loss / Take Profit")

i_tpRRratioLong = input.float(defval = 1.8, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "R:R Ratio", group = "Long Stop Loss / Take Profit")

// 5. Inputs for Short Stop Loss & Short Take Profit

i_slPercentShort = input.float(defval = 3, title = "SL Percent", tooltip = "", inline = "Percent > Short Stop Loss / Take Profit Percent", group = "Short Stop Loss / Take Profit")

i_tpPercentShort = input.float(defval = 3, title = "TP Percent", tooltip = "Short Stop Loss && Take Profit Percent?", inline = "Percent > Short Stop Loss / Take Profit Percent", group = "Short Stop Loss / Take Profit")

i_slATRMultShort = input.float(defval = 3, title = "SL ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "ATR > Short Stop Loss / Take Profit ATR", group = "Short Stop Loss / Take Profit")

i_tpATRMultShort = input.float(defval = 3, title = "TP ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "ATR > Short Stop Loss && Take Profit ATR Multiplier? \n\Stop Loss = i_slATRMultShort * ATR (i_slATRLen) \n\Take Profit = i_tpATRMultShort * ATR (i_tpATRLen)", inline = "ATR > Short Stop Loss / Take Profit ATR", group = "Short Stop Loss / Take Profit")

i_tpRRratioShort = input.float(defval = 1.8, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "R:R Ratio", group = "Short Stop Loss / Take Profit")

// 6. Inputs for logic

i_MAType = input.string(defval = "RMA", title = "MA Type", options = ["SMA", "EMA", "WMA", "HMA", "RMA", "VWMA", "SWMA", "ALMA", "VWAP"], tooltip = "Choose MA Type", inline = "MA Type", group = 'Strategy')

i_MA1Len = input.int(defval = 5, title = 'MA 1 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA2Len = input.int(defval = 10, title = 'MA 2 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA3Len = input.int(defval = 15, title = 'MA 3 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA4Len = input.int(defval = 25, title = 'MA 4 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_ALMAOffset = input.float(defval = 0.7 , title = "ALMA Offset Value", tooltip = "The Value of ALMA offset", inline = "ALMA Input", group = 'Strategy')

i_ALMASigma = input.float(defval = 7 , title = "ALMA Sigma Value", tooltip = "The Value of ALMA sigma", inline = "ALMA Input", group = 'Strategy')

// # ========================================================================= #

// # Entry, Close Logic

// # ========================================================================= #

bool i_ATRFilter = ta.atr(length = i_slATRLen) >= ta.sma(source = ta.atr(length = i_slATRLen), length = i_ATRSMALen) ? true : false

// calculate Technical Indicators for the Logic

getMAValue (source, length, almaOffset, almaSigma) =>

switch i_MAType

'SMA' => ta.sma(source = source, length = length)

'EMA' => ta.ema(source = source, length = length)

'WMA' => ta.wma(source = source, length = length)

'HMA' => ta.hma(source = source, length = length)

'RMA' => ta.rma(source = source, length = length)

'SWMA' => ta.swma(source = source)

'ALMA' => ta.alma(series = source, length = length, offset = almaOffset, sigma = almaSigma)

'VWMA' => ta.vwma(source = source, length = length)

'VWAP' => ta.vwap(source = source)

=> na

float c_MA1 = getMAValue(close, i_MA1Len, i_ALMAOffset, i_ALMASigma)

float c_MA2 = getMAValue(close, i_MA2Len, i_ALMAOffset, i_ALMASigma)

float c_MA3 = getMAValue(close, i_MA3Len, i_ALMAOffset, i_ALMASigma)

float c_MA4 = getMAValue(close, i_MA4Len, i_ALMAOffset, i_ALMASigma)

// Logic: 정배열 될 떄 들어가

var ma1Color = color.new(color.red, 0)

plot(series = c_MA1, title = 'SMA 1', color = ma1Color, linewidth = 1, style = plot.style_line)

var ma2Color = color.new(color.orange, 0)

plot(series = c_MA2, title = 'SMA 2', color = ma2Color, linewidth = 1, style = plot.style_line)

var ma3Color = color.new(color.yellow, 0)

plot(series = c_MA3, title = 'SMA 3', color = ma3Color, linewidth = 1, style = plot.style_line)

var ma4Color = color.new(color.green, 0)

plot(series = c_MA4, title = 'SMA 4', color = ma4Color, linewidth = 1, style = plot.style_line)

bool openLongCond = (c_MA1 >= c_MA2 and c_MA2 >= c_MA3 and c_MA3 >= c_MA4)

bool openShortCond = (c_MA1 <= c_MA2 and c_MA2 <= c_MA3 and c_MA3 <= c_MA4)

bool openLong = i_longEnabled and openLongCond and (not i_ATRFilterOn or i_ATRFilter)

bool openShort = i_shortEnabled and openShortCond and (not i_ATRFilterOn or i_ATRFilter)

openLongCondColor = openLongCond ? color.new(color = color.blue, transp = 80) : na

bgcolor(color = openLongCondColor)

ATRFilterColor = i_ATRFilter ? color.new(color = color.orange, transp = 80) : na

bgcolor(color = ATRFilterColor)

bool enterLong = openLong and not (strategy.opentrades.size(strategy.opentrades-1) > 0)

bool enterShort = openShort and not (strategy.opentrades.size(strategy.opentrades-1) < 0)

bool closeLong = i_longEnabled and (c_MA1[1] >= c_MA2[1] and c_MA2[1] >= c_MA3[1] and c_MA3[1] >= c_MA4[1]) and not (c_MA1 >= c_MA2 and c_MA2 >= c_MA3 and c_MA3 >= c_MA4)

bool closeShort = i_shortEnabled and (c_MA1[1] <= c_MA2[1] and c_MA2[1] <= c_MA3[1] and c_MA3[1] <= c_MA4[1]) and not (c_MA1 <= c_MA2 and c_MA2 <= c_MA3 and c_MA3 <= c_MA4)

// # ========================================================================= #

// # Position, Status Conrtol

// # ========================================================================= #

// longisActive: New Long || Already Long && not closeLong, short is the same

bool longIsActive = enterLong or strategy.opentrades.size(strategy.opentrades - 1) > 0 and not closeLong

bool shortIsActive = enterShort or strategy.opentrades.size(strategy.opentrades - 1) < 0 and not closeShort

// before longTPExecution: no trailing SL && after longTPExecution: trailing SL starts

// longTPExecution qunatity should be less than 100%

bool longTPExecuted = false

bool shortTPExecuted = false

// # ========================================================================= #

// # Long Stop Loss Logic

// # ========================================================================= #

float openAtr = ta.valuewhen(enterLong or enterShort, ta.atr(i_slATRLen), 0)

f_getLongSL (source) =>

switch i_slType

'Percent' => source * (1 - (i_slPercentLong/100))

'ATR' => source - i_slATRMultLong * openAtr

=> na

var float c_longSLPrice = na

c_longSLPrice := if (longIsActive)

if (enterLong)

f_getLongSL(close)

else

c_stopPrice = f_getLongSL(i_tslEnabled ? high : strategy.opentrades.entry_price(trade_num = strategy.opentrades - 1))

math.max(c_stopPrice, nz(c_longSLPrice[1]))

else

na

// # ========================================================================= #

// # Short Stop Loss Logic

// # ========================================================================= #

f_getShortSL (source) =>

switch i_slType

'Percent' => source * (1 + (i_slPercentShort)/100)

'ATR' => source + i_slATRMultShort * openAtr

=> na

var float c_shortSLPrice = na

c_shortSLPrice := if (shortIsActive)

if (enterShort)

f_getShortSL (close)

else

c_stopPrice = f_getShortSL(i_tslEnabled ? low : strategy.opentrades.entry_price(strategy.opentrades - 1))

math.min(c_stopPrice, nz(c_shortSLPrice[1], 999999.9))

else

na

// # ========================================================================= #

// # Long Take Profit Logic

// # ========================================================================= #

f_getLongTP () =>

switch i_tpType

'Percent' => close * (1 + (i_tpPercentLong/100))

'ATR' => close + i_tpATRMultLong * openAtr

'R:R' => close + i_tpRRratioLong * (close - f_getLongSL(close))

=> na

var float c_longTPPrice = na

c_longTPPrice := if (longIsActive and not longTPExecuted)

if (enterLong)

f_getLongTP()

else

nz(c_longTPPrice[1], f_getLongTP())

else

na

longTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) > 0 and (longTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) < strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and high >= c_longTPPrice)

// # ========================================================================= #

// # Short Take Profit Logic

// # ========================================================================= #

f_getShortTP () =>

switch i_tpType

'Percent' => close * (1 - (i_tpPercentShort/100))

'ATR' => close - i_tpATRMultShort * openAtr

'R:R' => close - i_tpRRratioShort * (close - f_getLongSL(close))

=> na

var float c_shortTPPrice = na

c_shortTPPrice := if (shortIsActive and not shortTPExecuted)

if (enterShort)

f_getShortTP()

else

nz(c_shortTPPrice[1], f_getShortTP())

else

na

shortTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) < 0 and (shortTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) > strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and low <= c_shortTPPrice)

// # ========================================================================= #

// # Make Orders

// # ========================================================================= #

if (c_timeCond)

if (enterLong)

strategy.entry(id = "Long Entry", direction = strategy.long , comment = 'Long(' + syminfo.ticker + '): Started', alert_message = 'Long(' + syminfo.ticker + '): Started')

if (enterShort)

strategy.entry(id = "Short Entry", direction = strategy.short , comment = 'Short(' + syminfo.ticker + '): Started', alert_message = 'Short(' + syminfo.ticker + '): Started')

if (closeLong)

strategy.close(id = 'Long Entry', comment = 'Close Long', alert_message = 'Long: Closed at market price')

if (closeShort)

strategy.close(id = 'Short Entry', comment = 'Close Short', alert_message = 'Short: Closed at market price')

if (longIsActive and i_useSLTP)

strategy.exit(id = 'Long Take Profit / Stop Loss', from_entry = 'Long Entry', qty_percent = i_tpQuantityPerc, limit = c_longTPPrice, stop = c_longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Long Stop Loss', from_entry = 'Long Entry', stop = c_longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Stop Loss executed')

if (shortIsActive and i_useSLTP)

strategy.exit(id = 'Short Take Profit / Stop Loss', from_entry = 'Short Entry', qty_percent = i_tpQuantityPerc, limit = c_shortTPPrice, stop = c_shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Short Stop Loss', from_entry = 'Short Entry', stop = c_shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Stop Loss executed')

// # ========================================================================= #

// # Plot

// # ========================================================================= #

var posColor = color.new(color.white, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr)

var stopLossColor = color.new(color.maroon, 0)

plot(series = c_longSLPrice, title = 'Long Stop Loss', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 1)

plot(series = c_shortSLPrice, title = 'Short Stop Loss', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 1)

longTPExecutedColor = longTPExecuted ? color.new(color = color.green, transp = 80) : na

//bgcolor(color = longTPExecutedColor)

shortTPExecutedColor = shortTPExecuted ? color.new(color = color.red, transp = 80) : na

//bgcolor(color = shortTPExecutedColor)

// isPositionOpenedColor = strategy.opentrades.size(strategy.opentrades-1) != 0 ? color.new(color = color.yellow, transp = 90) : na

// bgcolor(color = isPositionOpenedColor)

var takeProfitColor = color.new(color.teal, 0)

plot(series = c_longTPPrice, title = 'Long Take Profit', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 1)

plot(series = c_shortTPPrice, title = 'Short Take Profit', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 1)