Mengenmäßige Handelsstrategie mit mehreren Indikatoren

Schriftsteller:ChaoZhang, Datum: 2024-01-26 16:19:47Tags:

Übersicht

Diese Strategie verwendet mehrere technische Indikatoren für den quantitativen Handel. Sie verwendet hauptsächlich Indikatoren wie EMA-Crossovers, SuperTrend, RSI, MACD usw. zur Erzeugung von Handelssignalen.

Strategie Logik

Die Kernlogik beruht auf folgenden Aspekten:

-

EMA-Crossover: Berechnet schnelle EMA1 und langsame EMA2. Wenn EMA1 über EMA2 überschreitet, erzeugt es ein Kaufsignal. Wenn EMA1 unter EMA2 überschreitet, erzeugt es ein Verkaufssignal.

-

VWMA: Berechnen Sie VWMA. Wenn der Preis über VWMA schließt, ist es ein Kaufsignal. Wenn der Preis unter VWMA schließt, ist es ein Verkaufssignal.

-

SuperTrend: Berechnet das obere und untere Band basierend auf ATR und dem Multiplikatorparameter. Bestimmt die Trendrichtung. Generiert Kaufsignale im Aufwärtstrend und Verkaufssignale im Abwärtstrend.

-

RSI: Berechnen Sie den RSI-Indikator. Wenn der RSI über dem Überkauf liegt, ist es ein Verkaufssignal. Wenn der RSI unter dem Überverkauf liegt, ist er ein Kaufsignal.

-

MACD: Berechnet MACD, Signallinie und Histogramm. Wenn MACD-Linie über Signallinie kreuzt, erzeugt kaufen. Wenn MACD-Linie unter Signallinie kreuzt, erzeugt verkaufen.

Nur wenn mehrere Indikatoren gleichzeitig ein Kauf-/Verkaufssignal ausstrahlen, wird ein endgültiges Handelssignal generiert.

Vorteile

Diese Strategie kombiniert mehrere Indikatoren, um den Markt zu filtern und falsche Signale zu vermeiden.

-

Die Kombination mehrerer Indikatoren verhindert Fehler eines einzigen Indikators.

-

Die Kombination von Trendindikator und Oszillator ermöglicht einen zusätzlichen Gewinn während der Trends.

-

Die Verwendung der Stop-Loss-Logik begrenzt den maximalen Verlust pro Handel.

-

Martingale-Logik bietet die Chance, nach Verlusten zu brechen.

Risiken

Hauptrisiken:

-

Eine zu konservative Indikatorkombination kann einige Handelschancen verpassen.

-

Die Martingale-Logik kann zu erheblichen Verlusten führen.

-

Eine falsche Verwendung von Stop-Loss kann zu unnötigen Stop-Out führen.

-

Eine falsche Einstellung der Parameter kann zu zu vielen falschen Signalen führen. Optimiere die Parameter, um die beste Kombination zu finden.

Optimierung

Die Strategie kann in folgenden Bereichen weiter optimiert werden:

-

Beurteilen Sie verschiedene Kombinationen von Indikatoren, bestimmen Sie die Gewichte.

-

Versuche für jeden Indikator verschiedene Parameter.

-

Hinzufügen einer adaptiven Stop-Loss-Logik.

-

Hinzufügen eines dynamischen Positionsgrößenmechanismus.

-

Maschinelles Lernen nutzen, um Parameter und Modelle zu optimieren.

Zusammenfassung

Zusammenfassend ist dies eine sehr praktische quantitative Handelsstrategie. Sie kombiniert die Stärke mehrerer klassischer technischer Indikatoren für die Marktanalyse. Weitere Parameter-Tuning und Modelloptimierung können zu besseren Ergebnissen führen.

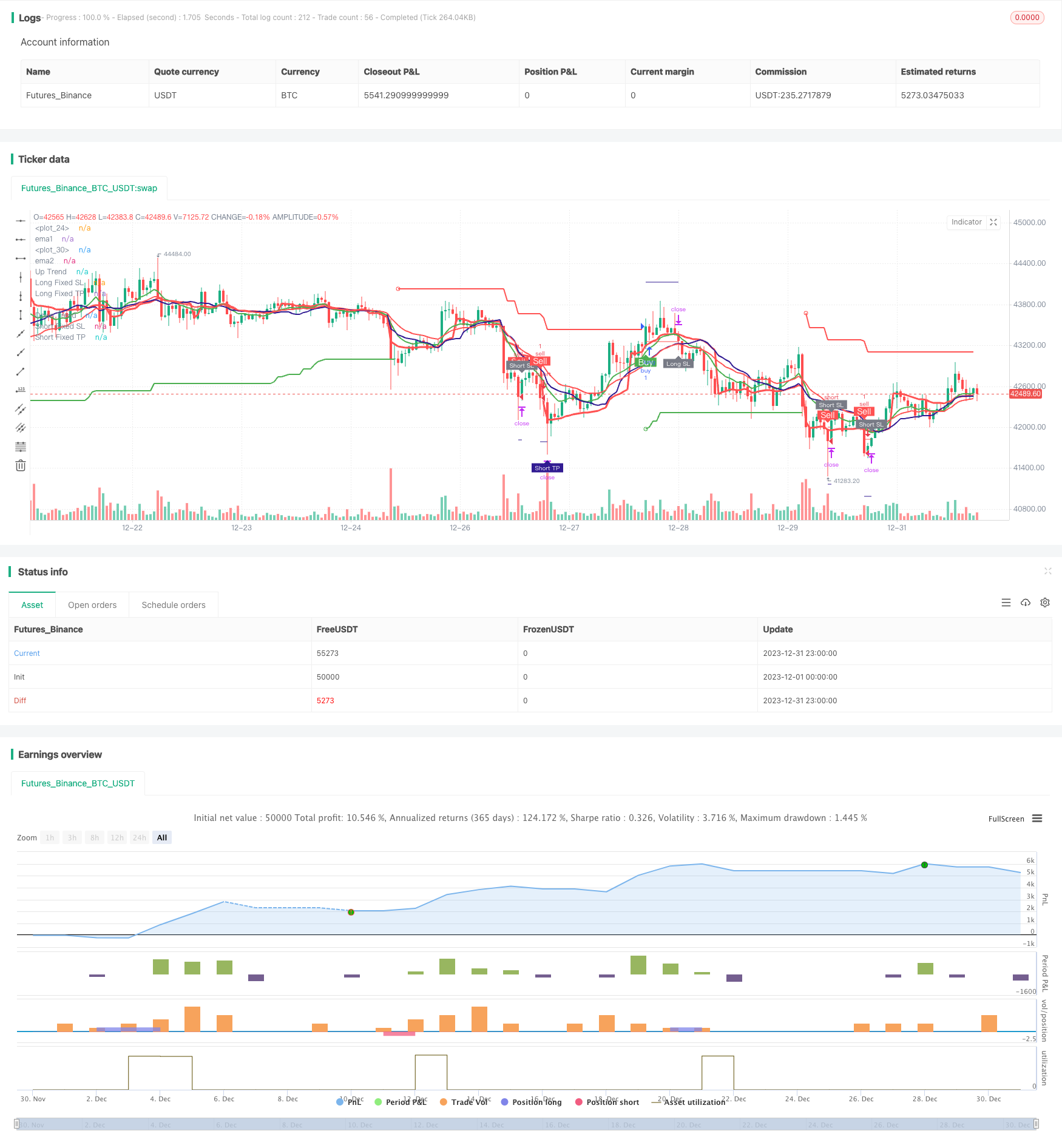

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Pinku Buy', overlay=true)

fromMonth = input.int(defval=1, title='From Month', minval=1, maxval=12)

fromDay = input.int(defval=1, title='From Day', minval=1, maxval=31)

fromYear = input.int(defval=2021, title='From Year', minval=1970)

thruMonth = input.int(defval=1, title='Thru Month', minval=1, maxval=12)

thruDay = input.int(defval=1, title='Thru Day', minval=1, maxval=31)

thruYear = input.int(defval=2112, title='Thru Year', minval=1970)

showDate = input(defval=true, title='Show Date Range')

start = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59)

window() => true

// ema crossover

length1 = input.int(10)

length2 = input.int(20)

ema1 = ta.ema(close , length1)

ema2 = ta.ema(close , length2)

//vwap

VWAP = ta.vwap(hlc3)

plot(VWAP, color=color.new(color.red, 0), linewidth=3)

buy_1 = close > VWAP

sell_1 = close < VWAP

//vwma

len = input.int(20, 'VWMA_len', minval=1)

ma = ta.vwma(close, len)

plot(ma, color=color.new(color.navy, 0), linewidth=2)

buy_2 = close > ma

sell_2 = close < ma

//super trend

//inputs

Periods = input(title='STR Period', defval=22)

Source = input(hl2, title='Source')

Multiplier = input.float(title='STR Multiplier', step=0.1, defval=5.0)

//Compute ATR Levels

atr = ta.atr(Periods)

//Creating Upper Channel

up = Source - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

//Creating Down Channel

dn = Source + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

//Compute the Trend Stream +1/-1

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

//Create Stoploss for Longs

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

//buy_a = close > upPlot

//Buy Signal

buy_3 = trend == 1 and trend[1] == -1

plotshape(buy_3 ? up : na, title='Go Long', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

//sell_a = close < dnPlot

//Sell Signal

sell_3 = trend == -1 and trend[1] == 1

plotshape(sell_3 ? dn : na, title='Go Short', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

// //paraboloic sar

// start = input(0.02)

// increment = input(0.02)

// maximum = input(0.2, 'Max Value')

// out = ta.sar(start, increment, maximum)

buy_4 = ema1 > ema2

//buy_4 = buy1 and not buy1[1]

//plotshape(buy_4 , color = color.green , text = "Buy" , location = location.belowbar , textcolor = color.white , style = shape.labelup , size = size.small)

sell_4 = close < ema2

//sell_4 = sell1 and not sell1[1]

//plotshape(sell_4, color = color.red , text = "Sell" , location = location.abovebar , textcolor = color.white , style = shape.labeldown , size = size.small)

plot(ema1, 'ema1', color=color.new(color.green, 0), linewidth=2)

plot(ema2, 'ema2', color=color.new(color.red, 0), linewidth=2)

// rsi

lenr = input(14, title='Rsi Period')

rs = ta.rsi(close, lenr)

over_sold = input(44)

over_bought = input(56)

buy_5 = rs > over_bought

sell_5 = rs < over_sold

// macd

slow_len_macd = input.int(12)

fast_len_macd = input.int(26)

signal_len_macd = input.int(9)

ema3 = ta.ema(close , slow_len_macd)

ema4 = ta.ema(close , fast_len_macd)

ema5 = ta.ema(close , signal_len_macd)

buy_6 = ema5 > ema4

sell_6 = ema5 < ema4

// adx

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

//plot(sig, color=color.red, title="ADX")

adx_Greater_than = input.int(25)

signal = sig > adx_Greater_than

// volume ema

volume_ema = input.int(10)

vema = ta.ema(volume,volume_ema)

signal_2 = volume > vema

//define buy sell

g = buy_1 and buy_2 and buy_4 and trend == 1 and buy_5 and buy_6 and signal and signal_2 and window()

r = sell_1 and sell_2 and sell_4 and trend == -1 and sell_5 and sell_6 and signal and signal_2 and window()

rg = 0

rg := r ? 1 : g ? 2 : nz(rg[1])

buy11 = 0

buy11 := r ? 0 : g ? 1 : nz(buy11[1])

sell11 = 0

sell11 := r ? 1 : g ? 0 : nz(sell11[1])

buy = buy11 and not buy11[1]

sell = sell11 and not sell11[1]

multiple_signals = input(true)

if multiple_signals

buy := g and not g[1] and window()

sell := r and not r[1] and window()

sell

else

buy := buy and window()

sell := sell and window()

sell

//plotshape(long , color = color.green , text = "Buy" , location = location.belowbar , textcolor = color.white , style = shape.labelup , size = size.small)

//plotshape(short , color = color.red , text = "Sell" , location = location.abovebar , textcolor = color.white , style = shape.labeldown , size = size.small)

Stop = input(0.5, title='StopLoss') / 100

ProfitPerc = input(defval=1.5, title='Profit') / 100

rev = input(1024,title = "Reverse Limit")

Averaging_position_ = input(true , title = "Averaging position ? ")

qn = 1

qn := nz(qn[1])

long_short = 0

long_last = buy and (nz(long_short[1]) == 0 or nz(long_short[1]) == -1)

short_last = sell and (nz(long_short[1]) == 0 or nz(long_short[1]) == 1)

long_short := long_last ? 1 : short_last ? -1 : long_short[1]

long_entered = false

long_entered := long_entered[1]

short_entered = false

short_entered := short_entered[1]

longPrice = ta.valuewhen(long_last, close, 0)

shortPrice = ta.valuewhen(short_last, close, 0)

longStop = longPrice * (1 - Stop)

shortStop = shortPrice * (1 + Stop)

longTake = longPrice * (1 + ProfitPerc)

shortTake = shortPrice * (1 - ProfitPerc)

plot(long_short == 1 ? longStop : na, style=plot.style_linebr, color=color.new(color.red, 0), linewidth=1, title='Long Fixed SL')

plot(long_short == -1 ? shortStop : na, style=plot.style_linebr, color=color.new(color.red, 0), linewidth=1, title='Short Fixed SL')

plot(long_short == 1 ? longTake : na, style=plot.style_linebr, color=color.new(color.navy, 0), linewidth=1, title='Long Fixed TP')

plot(long_short == -1 ? shortTake : na, style=plot.style_linebr, color=color.new(color.navy, 0), linewidth=1, title='Short Fixed TP')

longBar1 = ta.barssince(long_last)

longBar2 = longBar1 >= 1 ? true : false

shortBar1 = ta.barssince(short_last)

shortBar2 = shortBar1 >= 1 ? true : false

longSLhit = long_short == 1 and longBar2 and low < longStop

if long_entered and sell

longSLhit := true

longSLhit

plotshape(longSLhit and not(sell and not short_entered and long_entered), style=shape.labelup, location=location.belowbar, color=color.new(color.gray, 0), size=size.tiny, title='Stop Loss', text='Long SL', textcolor=color.new(color.white, 0))

shortSLhit = long_short == -1 and shortBar2 and high > shortStop

if short_entered and buy

shortSLhit := true

shortSLhit

plotshape(shortSLhit and not(buy and not long_entered and short_entered), style=shape.labeldown, location=location.abovebar, color=color.new(color.gray, 0), size=size.tiny, title='Stop Loss', text='Short SL', textcolor=color.new(color.white, 0))

longTPhit = long_short == 1 and longBar2 and high > longTake

plotshape(longTPhit, style=shape.labeldown, location=location.abovebar, color=color.new(color.navy, 0), size=size.tiny, title='Target', text='Long TP', textcolor=color.new(color.white, 0))

shortTPhit = long_short == -1 and shortBar2 and low < shortTake

plotshape(shortTPhit, style=shape.labelup, location=location.belowbar, color=color.new(color.navy, 0), size=size.tiny, title='Target', text='Short TP', textcolor=color.new(color.white, 0))

long_short := (long_short == 1 or long_short == 0) and longBar2 and (longSLhit or longTPhit) ? 0 : (long_short == -1 or long_short == 0) and shortBar2 and (shortSLhit or shortTPhit) ? 0 : long_short

if(shortSLhit or longSLhit or (long_entered[1] and sell) or (short_entered[1] and buy ))

qn := qn*2

if(longTPhit or shortTPhit or qn > rev)

qn := 1

if Averaging_position_

qn := 1

plotshape(buy and not long_entered, color=color.new(color.green, 0), style=shape.labelup, text='Buy', textcolor=color.new(color.white, 0), location=location.belowbar)

plotshape(sell and not short_entered, color=color.new(color.red, 0), style=shape.labeldown, text='Sell', textcolor=color.new(color.white, 0), location=location.abovebar)

// plotshape(buy and not(long_entered) and (short_entered), color = color.green , style = shape.labelup , text = "FA Buy" , textcolor = color.white , location = location.belowbar)

// plotshape(sell and not(short_entered) and (long_entered), color = color.red , style = shape.labeldown , text = "FA Sell" , textcolor = color.white , location = location.abovebar)

// alertcondition(condition=buy and not(long_entered) and (short_entered), title="Fully Algo Buy")

// alertcondition(condition=sell and not(short_entered) and (long_entered), title="Fully Algo sell")

alertcondition(condition=buy and not long_entered, title='Buy')

alertcondition(condition=sell and not short_entered, title='Sell')

if long_last

long_entered := true

short_entered := false

short_entered

if short_last

short_entered := true

long_entered := false

long_entered

alertcondition(condition=longSLhit and not(sell and not short_entered and long_entered), title='Long SL')

alertcondition(condition=shortSLhit and not(buy and not long_entered and short_entered), title='Short SL')

alertcondition(condition=longTPhit, title='Long TP')

alertcondition(condition=shortTPhit, title='Short TP')

if longSLhit or longTPhit

long_entered := false

long_entered

if shortSLhit or shortTPhit

short_entered := false

short_entered

// if buy

// strategy.entry('buy', strategy.long)

// strategy.exit('exit', 'buy', limit=longTake, stop=longStop)

// if sell

// strategy.entry('sell', strategy.short)

// strategy.exit('exit', 'sell', limit=shortTake, stop=shortStop)

if(buy)

strategy.entry("buy",strategy.long,qty = qn)

strategy.exit("Stop","buy",limit = longTake,stop = longStop)

if(sell)

strategy.entry("sell",strategy.short,qty = qn)

strategy.exit("Stop","sell",limit = shortTake,stop = shortStop)

strategy.close("buy",when = longTPhit or sell or longSLhit, comment = "Target")

strategy.close("sell",when = shortSLhit or shortTPhit or buy , comment = "Stop Loss")

strategy.cancel("buy",when = longTPhit or sell or longSLhit)

strategy.cancel("sell",when = shortSLhit or shortTPhit or buy )

- Quantitative Handelsstrategie auf Basis von RSI und MFI

- Multi-Indikator-Gesamthandelsstrategie

- Kurzfristige Handelsstrategie der Crossover EMA

- Trend nach Strategie auf Basis eines dynamischen Stop-Loss-Systems für den Dual-EMA-Crossover

- Auftritt des Bullenmarktes Darvas Box Kaufstrategie

- Die relative Dynamikstrategie

- Wellenentwicklung und VWMA-basierte Entwicklung nach Quant-Strategie

- Strategie zur Kombination von Doppel gleitenden Durchschnitten und Williams-Durchschnitten

- Adaptive Dreifach-Supertrend-Strategie

- Strategie für die Verlagerung des gleitenden Durchschnitts

- Market Cypher Welle B Automatische Handelsstrategie

- Wichtige Strategie zur Umkehrung von Backtests

- Die drei EMA Stochastic RSI Crossover Golden Cross-Strategie

- Strategie zur Umkehrung der Backtesting-Strategie

- Die RSI-Strategie wird von Ehlers-Smoothed angewendet.

- Swing-High-Low-Price-Channel-Strategie V.1

- Handelsstrategie zur Umkehrung der Dynamik

- Adaptive lineare Regressionskanalstrategie

- Strategie der gleitenden Durchschnittsdifferenz mit null Kreuz

- Mehrere Indikatoren folgen der Strategie