Dynamische Stop Loss Bollinger Bands-Strategie

Schriftsteller:ChaoZhang, Datum: 2024-02-01 10:48:52Tags:

Übersicht

Diese Strategie nutzt die oberen und unteren Schienen der Bollinger Bands, um dynamischen Stop-Loss zu implementieren. Sie geht kurz, wenn der Preis durch die oberen Schienen bricht und lang, wenn der Preis durch die unteren Schienen bricht. Und sie setzt dynamischen Stop-Loss, um die Preisbewegung zu verfolgen.

Grundsätze

Der Kern dieser Strategie liegt in den oberen und unteren Schienen der Bollinger Bands. Die mittlere Schiene ist der gleitende Durchschnitt für n Tage. Die obere Schiene ist die mittlere Schiene + kn-Tage Standardabweichung. Die untere Schiene ist die mittlere Schiene − kn-Tage Standardabweichung. Wenn der Preis von der unteren Schiene aufspringt, gehen Sie lang. Wenn der Preis von der oberen Schiene zurückfällt, gehen Sie kurz. Gleichzeitig setzt die Strategie einen Stop-Loss-Punkt und passt ihn während der Preisbewegung dynamisch an, um einen Gewinnpunkt zu setzen, um eine umsichtige Risikokontrolle zu implementieren.

Vorteile

- Bollinger-Bänder

mit starker Regression auf die mittlere Schiene nutzen, um mittelfristige und langfristige Trends zu erfassen; - Klarer langer und kurzer Signal, einfach zu bedienen;

- Einrichtung dynamischer Schiebe-Stop-Loss, um die Gewinnabsperrung zu maximieren und Risiken zu kontrollieren;

- Anpassungsfähige Parameter an unterschiedliche Marktbedingungen.

Risiken und Lösungen

- Bollinger-Bänder können mehrere lange und kurze Signale während von Range-gebundenen Märkten erzeugen, was dazu führt, dass Benutzer in Whipsaws gefangen werden.

- Die Lösung besteht darin, die Parameter für verschiedene Produkte angemessen zu optimieren.

Optimierungsrichtlinien

- Optimierung der gleitenden Durchschnittsparameter, um sie den Merkmalen des Produkts anzupassen;

- Hinzufügen einer Trendfilterung, um einen Bereichsgebundenen Markt zu vermeiden;

- Kombination mit anderen Indikatoren als Filterbedingungen zur Verbesserung der Strategie-Stabilität.

Schlussfolgerung

Diese Strategie nutzt Bollinger Bands

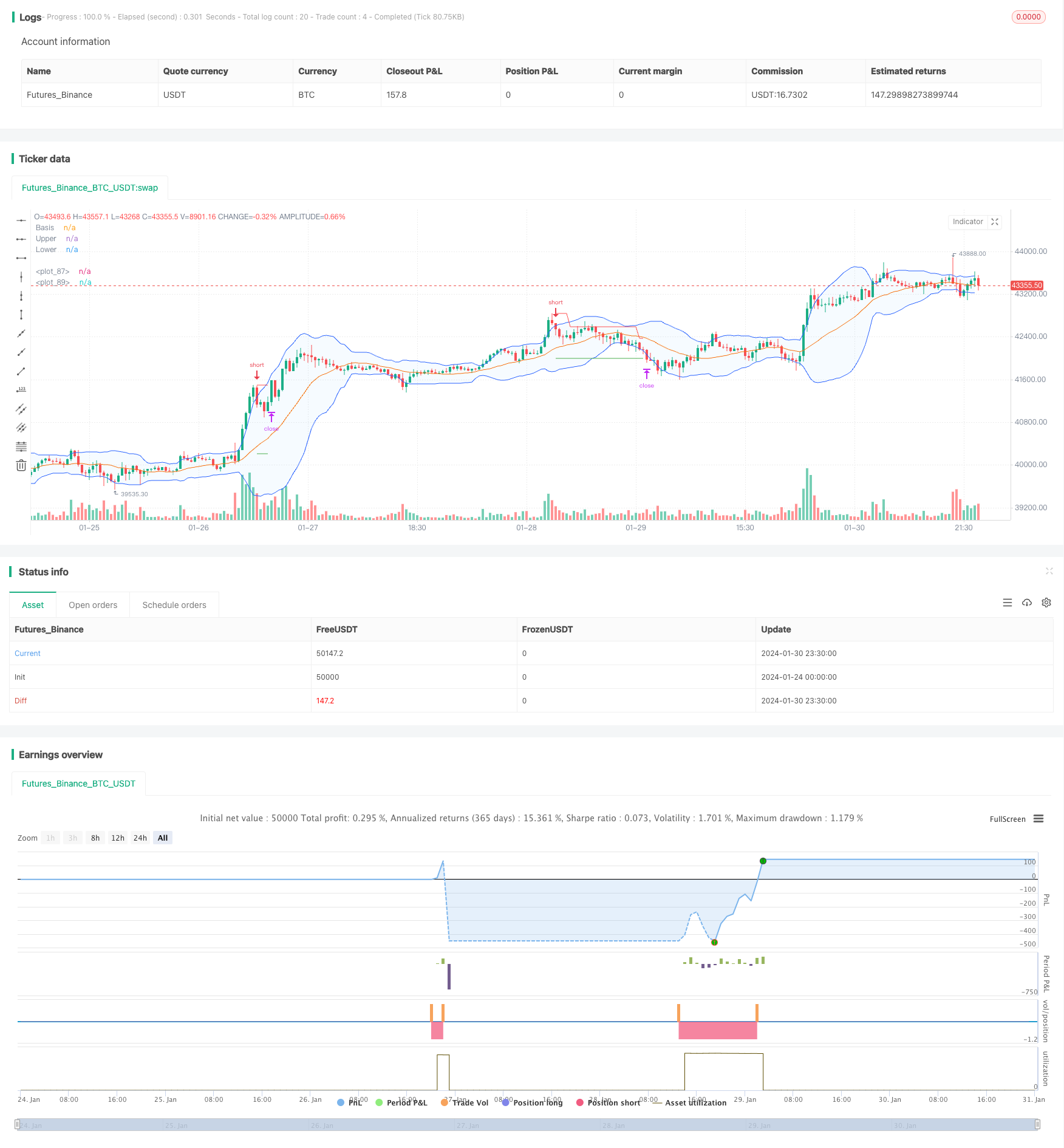

/*backtest

start: 2024-01-24 00:00:00

end: 2024-01-31 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(shorttitle="BB Strategy", title="Bollinger Bands Strategy", overlay=true)

length = input.int(20, minval=1, group = "Bollinger Bands")

maType = input.string("SMA", "Basis MA Type", options = ["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group = "Bollinger Bands")

src = input(close, title="Source", group = "Bollinger Bands")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev", group = "Bollinger Bands")

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500, group = "Bollinger Bands")

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

lo = input.bool(true, "Long", group = "Strategy")

sh = input.bool(true, "Short", group = "Strategy")

x = input.float(3.0, "Target Multiplier (X)", group = "Strategy", minval = 1.0, step = 0.1)

token = input.string(defval = "", title = "Token", group = "AUTOMATION")

Buy_CE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(1) + '"}'

Buy_PE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(2) + '"}'

Exit_CE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(-1) + '"}'

Exit_PE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(-2) + '"}'

Exit_PE_CE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(2.5) + '"}'

Exit_CE_PE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(1.5) + '"}'

long = high < lower

short = low > upper

var sl_b = 0.0

var tar_b = 0.0

var sl_s = 0.0

var tar_s = 0.0

var static_sl = 0.0

entry = strategy.opentrades.entry_price(strategy.opentrades - 1)

if long and lo and strategy.position_size == 0

strategy.entry("Long", strategy.long, alert_message = Buy_CE, stop = high)

strategy.exit("LX", "Long", profit = (math.abs(high - low) * x)/syminfo.mintick, stop = low, alert_message = Exit_CE)

sl_b := low

tar_b := high + (math.abs(high - low) * x)

static_sl := math.abs(low - high)

if short and sh and strategy.position_size == 0

strategy.entry("Short", strategy.short, alert_message = Buy_PE, stop = low)

strategy.exit("SX", "Short", profit = (math.abs(high - low) * x)/syminfo.mintick, stop = high, alert_message = Exit_PE)

sl_s := high

tar_s := low - (math.abs(high - low) * x)

static_sl := math.abs(high - low)

// if long and strategy.position_size < 0

// strategy.entry("Long", strategy.long, alert_message = Exit_PE_CE, stop = high)

// strategy.exit("LX", "Long", profit = (math.abs(high - low) * x)/syminfo.mintick, stop = low, alert_message = Exit_CE)

// sl_b := low

// tar_b := high + (math.abs(high - low) * x)

// if short and strategy.position_size > 0

// strategy.entry("Short", strategy.short, alert_message = Exit_CE_PE, stop = low)

// strategy.exit("SX", "Short", profit = (math.abs(high - low) * x)/syminfo.mintick, stop = high, alert_message = Exit_PE)

// sl_s := math.max(high[1], high)

// tar_s := low - (math.abs(high - low) * x)

if ta.change(dayofmonth) or (long[1] and not long[2])

strategy.cancel("Long")

if ta.change(dayofmonth) or (short[1] and not short[2])

strategy.cancel("Short")

var count = 1

if strategy.position_size != 0

if strategy.position_size > 0

if close > (entry + (static_sl * count))

strategy.exit("LX", "Long", limit = tar_b, stop = sl_b, alert_message = Exit_CE)

sl_b := entry + (static_sl * (count - 1))

count += 1

else

if close < (entry - (static_sl * count))

strategy.exit("SX", "Short", limit = tar_s, stop = sl_s, alert_message = Exit_PE)

sl_s := entry - (static_sl * (count - 1))

count += 1

// label.new(bar_index, high, str.tostring(static_sl))

if strategy.position_size == 0

count := 1

plot(strategy.position_size > 0 ? sl_b : na, "", color.red, style = plot.style_linebr)

plot(strategy.position_size < 0 ? sl_s : na, "", color.red, style = plot.style_linebr)

plot(strategy.position_size > 0 ? tar_b : na, "", color.green, style = plot.style_linebr)

plot(strategy.position_size < 0 ? tar_s : na, "", color.green, style = plot.style_linebr)

- Strategie des gleitenden Durchschnitts und des stochastischen RSI

- Ichimoku-Wolken-Trend folgt der Strategie

- Langfristige Handelsstrategie auf Basis von Bollinger-Bändern %B Indikator

- Die Dreifachschwingende Durchschnittskanalstrategie für geduldiges Mining von wertvollen Informationen aus Kerzenlinien

- Die Strategie des Hinhängenden

- Strategie zur Verringerung des Prozentsatzes der Verluste

- Dreifach gleitender Durchschnittswert nach Strategie

- Nachverfolgung der Stop-Loss-Strategie für den gleitenden Durchschnitt

- Durchschnittliche Umkehrtrend nach Strategie

- Dynamischer Preiskanal mit Stop-Loss-Tracking-Strategie

- Umkehrung Breakout Bandpass Combo Strategie

- Dynamischer gleitender Durchschnittsvergleich

- EMA-Überschreitende Entwicklung nach Strategie

- Kurzfristige Handelsstrategie auf Basis von RSI und SMA

- Momentum-Breakout-Tradingstrategie für den Intraday-Handel

- KDJ Golden Cross Langzeitstrategie

- Strategie für den Rückschritt in den Sturm in verborgenen Möglichkeiten

- Strategie für die Zeitframe-Verfolgung von Momentum

- Beweglicher Durchschnittstrend nach Strategie

- Pivot-Supertrend-Strategie für mehrere Zeitrahmen