Preisdivergenzbasierte Trendhandelsstrategie

Schriftsteller:ChaoZhang, Datum: 2024-02-02 18:00:55Tags:

Übersicht

Dies ist eine Trendhandelsstrategie, die auf Preisdivergenzsignalen basiert. Sie verwendet mehrere Indikatoren wie RSI, MACD, Stochastics usw. um Preisdivergenzen zu erkennen und den Murray Math Oscillator zur Bestätigung. Sie tritt ein, wenn ein Preisdivergenzsignal angezeigt wird und der Oszillator die aktuelle Trendrichtung bestätigt.

Strategie Logik

Der Kern dieser Strategie ist die Preisdivergenztheorie. Wenn der Preis ein neues Höchststand erreicht, aber der Indikator nicht erreicht, wird er als bärische Divergenz betrachtet. Wenn der Preis ein neues Tief erreicht, aber der Indikator nicht erreicht, ist es eine bullische Divergenz. Dies signalisiert eine mögliche Trendwende. Die Strategie kombiniert Fraktalsignale mit einem Oszillator, um Handelssignale zu bestätigen.

Insbesondere sind die Einreisebedingungen:

- Regelmäßige/versteckte Preisdifferenzen erkennen

- Der Murray Math Oscillator befindet sich in der entsprechenden Trendzone

Ausgang, wenn der Oszillator die mittlere Linie überschreitet.

Analyse der Vorteile

Die Vorteile dieser Strategie sind:

- Ermittlung potenzieller Umkehrpunkte unter Verwendung von Abweichungen

- Bestätigen Sie den laufenden Trend mit dem Oszillator und vermeiden Sie falsche Ausbrüche

- Flexible Parameter und Indikatorenkombinationen

- Kombination von Trendverfolgung und Risikomanagement

- Klare Logikregeln, viel Optimierungsmöglichkeiten

Risikoanalyse

Die wichtigsten Risiken sind:

- Abweichungen könnten falsche Signale sein.

- Fehlende Oszillatorparameter können zu fehlenden Trades führen

- Übermäßige einseitige Positionen bergen ein hohes Verlustrisiko

- Erhöhte Handelshäufigkeit und Verschiebungskosten in Zeiten hoher Volatilität

Schlagen Sie Stop-Loss, Positionsgröße, Parameteroptimierung vor, um Risiken zu reduzieren.

Optimierungsrichtlinien

Einige weitere Optimierungen:

- Hinzufügen von Machine-Learning-Algorithmen für dynamische Parameteroptimierung

- Einführung fortgeschrittener Stop-Loss-Techniken wie Trailing Stop-Loss, Durchschnittliche True Range Stop usw.

- Mehr Indikatoren und Filter zur Verbesserung des Signal-Rausch-Verhältnisses

- Automatische Anpassung der Oszillatorparameter für eine bessere Trendbeurteilung

- Verbesserung des Risikomanagements, Festlegung von Höchstbetragsgrenzen usw.

Zusammenfassung

Diese Strategie integriert Preisdivergenz-Konzept mit Trendanalyse-Tools, um potenzielle Umkehrungen frühzeitig zu erkennen. Mit angemessenen Risikomanagement-Verbesserungen könnte es gute risikobereinigte Renditen erzielen. Weitere maschinelle Lern-basierte Optimierungen können zu einem stabileren Alpha führen.

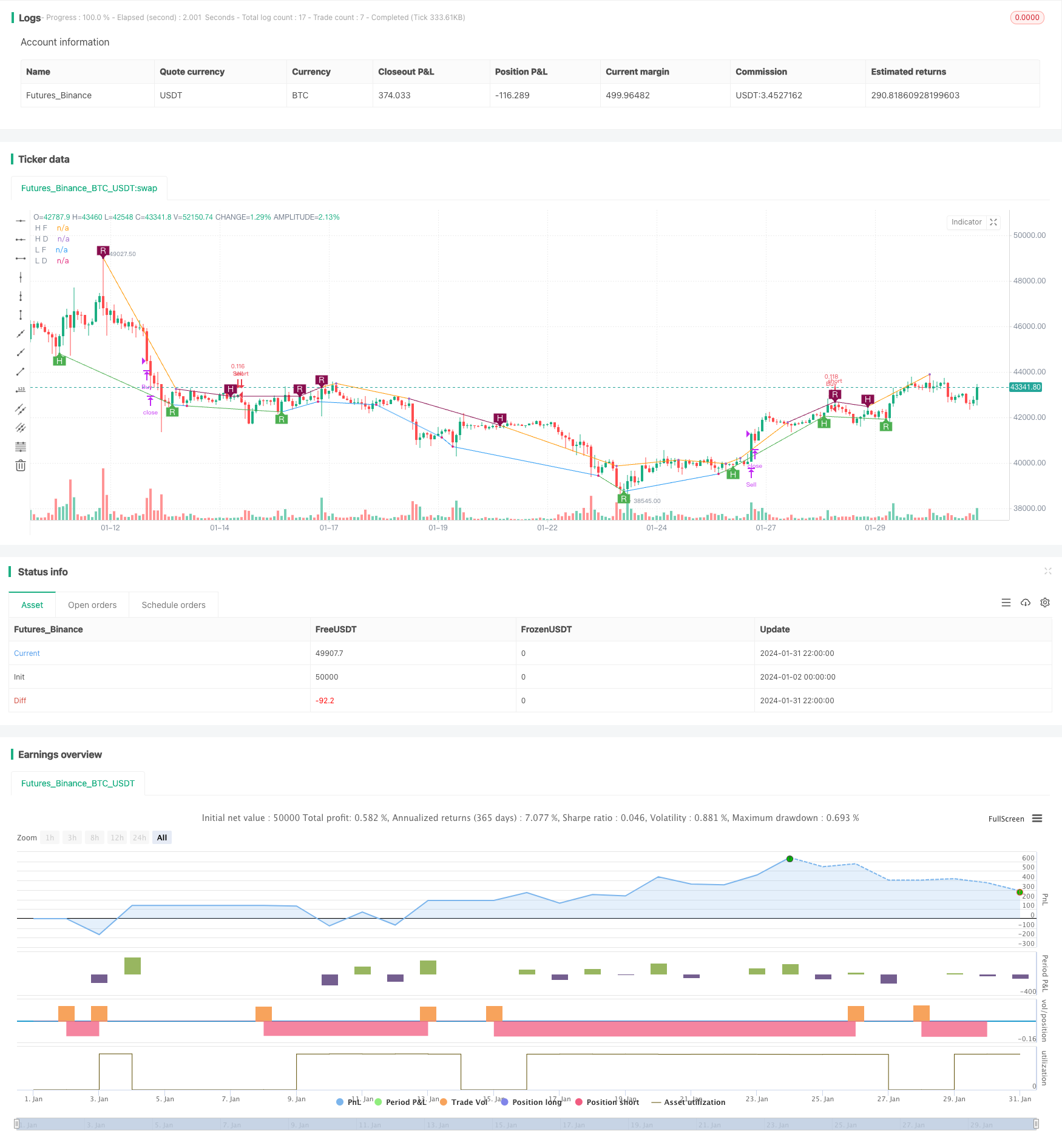

/*backtest

start: 2024-01-02 00:00:00

end: 2024-02-01 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//

// Title: [STRATEGY][UL]Price Divergence Strategy V1

// Author: JustUncleL

// Date: 23-Oct-2016

// Version: v1.0

//

// Description:

// A trend trading strategy the uses Price Divergence detection signals, that

// are confirmed by the "Murrey's Math Oscillator" (Donchanin Channel based).

//

// *** USE AT YOUR OWN RISK ***

//

// Mofidifications:

// 1.0 - original

//

// References:

// Strategy Based on:

// - [RS]Price Divergence Detector V2 by RicardoSantos

// - UCS_Murrey's Math Oscillator by Ucsgears

// Some Code borrowed from:

// - "Strategy Code Example by JayRogers"

// Information on Divergence Trading:

// - http://www.babypips.com/school/high-school/trading-divergences

//

strategy(title='[STRATEGY][UL]Price Divergence Strategy v1.0', pyramiding=0, overlay=true, initial_capital=10000, calc_on_every_tick=false,

currency=currency.USD,default_qty_type=strategy.percent_of_equity,default_qty_value=10)

// || General Input:

method = input(title='Method (0=rsi, 1=macd, 2=stoch, 3=volume, 4=acc/dist, 5=fisher, 6=cci):', defval=1, minval=0, maxval=6)

SHOW_LABEL = input(title='Show Labels', type=bool, defval=true)

SHOW_CHANNEL = input(title='Show Channel', type=bool, defval=false)

uHid = input(true,title="Use Hidden Divergence in Strategy")

uReg = input(true,title="Use Regular Divergence in Strategy")

// || RSI / STOCH / VOLUME / ACC/DIST Input:

rsi_smooth = input(title='RSI/STOCH/Volume/ACC-DIST/Fisher/cci Smooth:', defval=5)

// || MACD Input:

macd_src = input(title='MACD Source:', defval=close)

macd_fast = input(title='MACD Fast:', defval=12)

macd_slow = input(title='MACD Slow:', defval=26)

macd_smooth = input(title='MACD Smooth Signal:', defval=9)

// || Functions:

f_top_fractal(_src)=>_src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and _src[2] > _src[0]

f_bot_fractal(_src)=>_src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and _src[2] < _src[0]

f_fractalize(_src)=>f_top_fractal(_src) ? 1 : f_bot_fractal(_src) ? -1 : 0

// ||••> START MACD FUNCTION

f_macd(_src, _fast, _slow, _smooth)=>

_fast_ma = sma(_src, _fast)

_slow_ma = sma(_src, _slow)

_macd = _fast_ma-_slow_ma

_signal = ema(_macd, _smooth)

_hist = _macd - _signal

// ||<•• END MACD FUNCTION

// ||••> START ACC/DIST FUNCTION

f_accdist(_smooth)=>_return=sma(cum(close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume), _smooth)

// ||<•• END ACC/DIST FUNCTION

// ||••> START FISHER FUNCTION

f_fisher(_src, _window)=>

_h = highest(_src, _window)

_l = lowest(_src, _window)

_value0 = .66 * ((_src - _l) / max(_h - _l, .001) - .5) + .67 * nz(_value0[1])

_value1 = _value0 > .99 ? .999 : _value0 < -.99 ? -.999 : _value0

_fisher = .5 * log((1 + _value1) / max(1 - _value1, .001)) + .5 * nz(_fisher[1])

// ||<•• END FISHER FUNCTION

method_high = method == 0 ? rsi(high, rsi_smooth) :

method == 1 ? f_macd(macd_src, macd_fast, macd_slow, macd_smooth) :

method == 2 ? stoch(close, high, low, rsi_smooth) :

method == 3 ? sma(volume, rsi_smooth) :

method == 4 ? f_accdist(rsi_smooth) :

method == 5 ? f_fisher(high, rsi_smooth) :

method == 6 ? cci(high, rsi_smooth) :

na

method_low = method == 0 ? rsi(low, rsi_smooth) :

method == 1 ? f_macd(macd_src, macd_fast, macd_slow, macd_smooth) :

method == 2 ? stoch(close, high, low, rsi_smooth) :

method == 3 ? sma(volume, rsi_smooth) :

method == 4 ? f_accdist(rsi_smooth) :

method == 5 ? f_fisher(low, rsi_smooth) :

method == 6 ? cci(low, rsi_smooth) :

na

fractal_top = f_fractalize(method_high) > 0 ? method_high[2] : na

fractal_bot = f_fractalize(method_low) < 0 ? method_low[2] : na

high_prev = valuewhen(fractal_top, method_high[2], 1)

high_price = valuewhen(fractal_top, high[2], 1)

low_prev = valuewhen(fractal_bot, method_low[2], 1)

low_price = valuewhen(fractal_bot, low[2], 1)

regular_bearish_div = fractal_top and high[2] > high_price and method_high[2] < high_prev

hidden_bearish_div = fractal_top and high[2] < high_price and method_high[2] > high_prev

regular_bullish_div = fractal_bot and low[2] < low_price and method_low[2] > low_prev

hidden_bullish_div = fractal_bot and low[2] > low_price and method_low[2] < low_prev

plot(title='H F', series=fractal_top ? high[2] : na, color=regular_bearish_div or hidden_bearish_div ? maroon : not SHOW_CHANNEL ? na : silver, offset=-2)

plot(title='L F', series=fractal_bot ? low[2] : na, color=regular_bullish_div or hidden_bullish_div ? green : not SHOW_CHANNEL ? na : silver, offset=-2)

plot(title='H D', series=fractal_top ? high[2] : na, style=circles, color=regular_bearish_div or hidden_bearish_div ? maroon : not SHOW_CHANNEL ? na : silver, linewidth=3, offset=-2)

plot(title='L D', series=fractal_bot ? low[2] : na, style=circles, color=regular_bullish_div or hidden_bullish_div ? green : not SHOW_CHANNEL ? na : silver, linewidth=3, offset=-2)

plotshape(title='+RBD', series=not SHOW_LABEL ? na : regular_bearish_div ? high[2] : na, text='R', style=shape.labeldown, location=location.absolute, color=maroon, textcolor=white, offset=-2)

plotshape(title='+HBD', series=not SHOW_LABEL ? na : hidden_bearish_div ? high[2] : na, text='H', style=shape.labeldown, location=location.absolute, color=maroon, textcolor=white, offset=-2)

plotshape(title='-RBD', series=not SHOW_LABEL ? na : regular_bullish_div ? low[2] : na, text='R', style=shape.labelup, location=location.absolute, color=green, textcolor=white, offset=-2)

plotshape(title='-HBD', series=not SHOW_LABEL ? na : hidden_bullish_div ? low[2] : na, text='H', style=shape.labelup, location=location.absolute, color=green, textcolor=white, offset=-2)

// Code borrowed from UCS_Murrey's Math Oscillator by Ucsgears

// - UCS_MMLO

// Inputs

length = input(100, minval = 10, title = "MMLO Look back Length")

quad = input(2, minval = 1, maxval = 4, step = 1, title = "Mininum Quadrant for MMLO Support")

mult = 0.125

// Donchanin Channel

hi = highest(high, length)

lo = lowest(low, length)

range = hi - lo

multiplier = (range) * mult

midline = lo + multiplier * 4

oscillator = (close - midline)/(range/2)

a = oscillator > 0

b = oscillator > 0 and oscillator > mult*2

c = oscillator > 0 and oscillator > mult*4

d = oscillator > 0 and oscillator > mult*6

z = oscillator < 0

y = oscillator < 0 and oscillator < -mult*2

x = oscillator < 0 and oscillator < -mult*4

w = oscillator < 0 and oscillator < -mult*6

// Strategy: (Thanks to JayRogers)

// === STRATEGY RELATED INPUTS ===

//tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval = 0, title = "Take Profit Points", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss Points", minval = 0)

inpTrailStop = input(defval = 100, title = "Trailing Stop Loss Points", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset Points", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => ((uReg and regular_bullish_div) or (uHid and hidden_bullish_div)) and (quad==1? a[1]: quad==2?b[1]: quad==3?c[1]: quad==4?d[1]: false)// functions can be used to wrap up and work out complex conditions

exitLong() => oscillator <= 0

strategy.entry(id = "Buy", long = true, when = enterLong() )// use function or simple condition to decide when to get in

strategy.close(id = "Buy", when = exitLong() )// ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() => ((uReg and regular_bearish_div) or (uHid and hidden_bearish_div)) and (quad==1? z[1]: quad==2?y[1]: quad==3?x[1]: quad==4?w[1]: false)

exitShort() => oscillator >= 0

strategy.entry(id = "Sell", long = false, when = enterShort())

strategy.close(id = "Sell", when = exitShort() )

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Buy", from_entry = "Buy", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Sell", from_entry = "Sell", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

//EOF

- Strategie zur Erfassung des Trend Riding RSI Swing

- Bei der Bewertung der Bollinger-Band-Strategie wird der Wert der Bollinger-Band-Strategie auf der Basis der Bollinger-Band-Strategie angegeben.

- Triple Exponential Moving Average Profit Taking und Stop Loss Strategie

- Handelsstrategie für die Breite des Donchian-Kanals

- Optimierte Kreuzung von gleitenden Durchschnitten

- Isolationsband-Oszillationsverfolgungsstrategie

- Doppel Donchian Channel Breakout Strategie

- Strategie des gleitenden Durchschnitts

- Selbstanpassungsfähige Quantengitter-Handelsstrategie

- Multi-Timeframe Ichimoku, MACD und DMI kombinierte Strategie

- Supertrend Bitcoin Long Line-Strategie

- Trend nach Strategie mit gleitenden Durchschnitten und Kerzenmustern

- Quantitative Handelsstrategie auf Basis von Ichimoku Cloud Breakout und ADX Index

- Strategie zur Kombination von Bollinger-Bändern und gleitenden Durchschnitten

- Lazy Bear-Strategie für die Verringerung der Dynamik

- Trendprognose Doppel gleitender Durchschnittswert

- Strategie zur Umkehrung des doppelten gleitenden Durchschnitts

- Handelsstrategie mit doppeltem Durchbruch

- Blending Bolt Trend nach der Strategie

- VRSI und MARSI-Strategie