Strategie zur Umkehrung des Trendes der drei Kerzen

Schriftsteller:ChaoZhang, Datum: 2024-02-18 09:48:28Tags:

Übersicht

Die Three Candle Reversal Trend Strategy ist eine kurzfristige Handelsstrategie, die Umkehrungen in kurzfristigen Trends identifiziert, indem drei aufeinanderfolgende bullische oder bärische Kerzen nachgewiesen werden, gefolgt von einer verschlungenen Kerze in der entgegengesetzten Richtung, kombiniert mit mehreren technischen Indikatoren, um Eingangssignale zu filtern.

Strategie Logik

Die Kernlogik dieser Strategie besteht darin, das Muster von drei aufeinanderfolgenden bullischen oder bärischen Kerzen auf dem Chart zu identifizieren, was normalerweise eine bevorstehende Umkehr des kurzfristigen Trends impliziert. Wenn drei bärische Kerzen erkannt werden, warten Sie, bis die nächste schwelende bullische Kerze lang geht. Umgekehrt, wenn drei bullische Kerzen erkannt werden, warten Sie, bis die nächste schwelende bärische Kerze kurz geht. Dies ermöglicht es, umkehrende Chancen in kurzfristigen Trends rechtzeitig zu erfassen.

Darüber hinaus werden mehrere technische Indikatoren eingeführt, um Einstiegssignale zu filtern. Zwei SMA-Linien mit unterschiedlichen Parameter-Einstellungen werden übernommen, und die Einstiegspositionen werden nur berücksichtigt, wenn die schnellere SMA die langsamere Linie überquert. Außerdem wird der lineare Regressionsindikator verwendet, um zu beurteilen, ob der Markt im Bereich oder im Trend ist, und die Trades werden nur unter Trendbedingungen durchgeführt. Es gibt auch die Möglichkeit, das Kerzenmuster mit SMA-Goldkreuzen für zusätzliche Einstiegssignale zu kombinieren. Durch die umfassenden Urteile dieser Indikatoren kann der größte Teil des Rausches herausgefiltert und die Einstiegsgenauigkeit verbessert werden.

Für Stop-Loss und Take-Profit erfordert die Strategie ein Mindest-Risiko-Rendite-Verhältnis von 1: 3. Der ATR-Indikator basiert auf der Preisschwankung der letzten N-Kerzen und wird verwendet, um die Stop-Loss-Ebene mit einem Offset-Prozentsatz zu bestimmen.

Vorteile

Die Trendumkehrstrategie der drei Kerzen hat folgende Vorteile:

- Identifizieren von Umkehrungen kurzfristiger Trends für zeitnahe Chancen

- Verbesserte Eingangsgenauigkeit über mehrere Indikatorfilter

- Ein angemessenes Risiko-Rendite-Profil mit angemessenem Stop-Loss- und Take-Profit-Verhältnis

- Einfache Parameter für einfaches Verstehen und Betrieb

Risiken

Für diese Strategie sind auch einige Risiken zu beachten:

- Kurzfristige Umkehrungen bedeuten nicht unbedingt eine langfristige Trendumkehrung. Höhere Zeitrahmentrends sollten überwacht werden. Längere Zeiträume können als Filter hinzugefügt werden.

- Einzelne Kerzenmuster können falsche Signale erzeugen.

- Die Stop-Loss-Einstellungen könnten zu aggressiv sein.

- Unzureichende Backtestdaten führen zu Unsicherheiten in Bezug auf die tatsächlichen Handelsergebnisse.

Anweisungen zur Verbesserung

Die Strategie kann in folgenden Aspekten verbessert werden:

- Anpassung der Parameter für gleitende Durchschnitte und lineare Regression, um Trends besser zu erkennen.

- Hinzufügen anderer Indikatoren wie Stoch zur zusätzlichen Signalbestätigung.

- Optimierung der ATR-Parameter und Stop-Loss-Prozentsatz, um Risiko und Rendite auszugleichen.

- Einführung von Mechanismen zur Nachverfolgung von Trendbruchs zur Verbesserung der Rentabilität.

- Einführung robuster Kapitalmanagementsysteme zur Kontrolle von Handelsrisiken.

Schlussfolgerung

Zusammenfassend ist die Three Candle Reversal Trend Strategy eine einfache kurzfristige Handelsstrategie, die auf Preismuster und mehrere Indikatoren setzt, um umgekehrte Chancen zu erfassen, die auf einem ausgeglichenen Risiko-Rendite-Profil basieren. Sie liefert respektable Ergebnisse mit relativ geringer Komplexität und ist Investoren Aufmerksamkeit und Test wert.

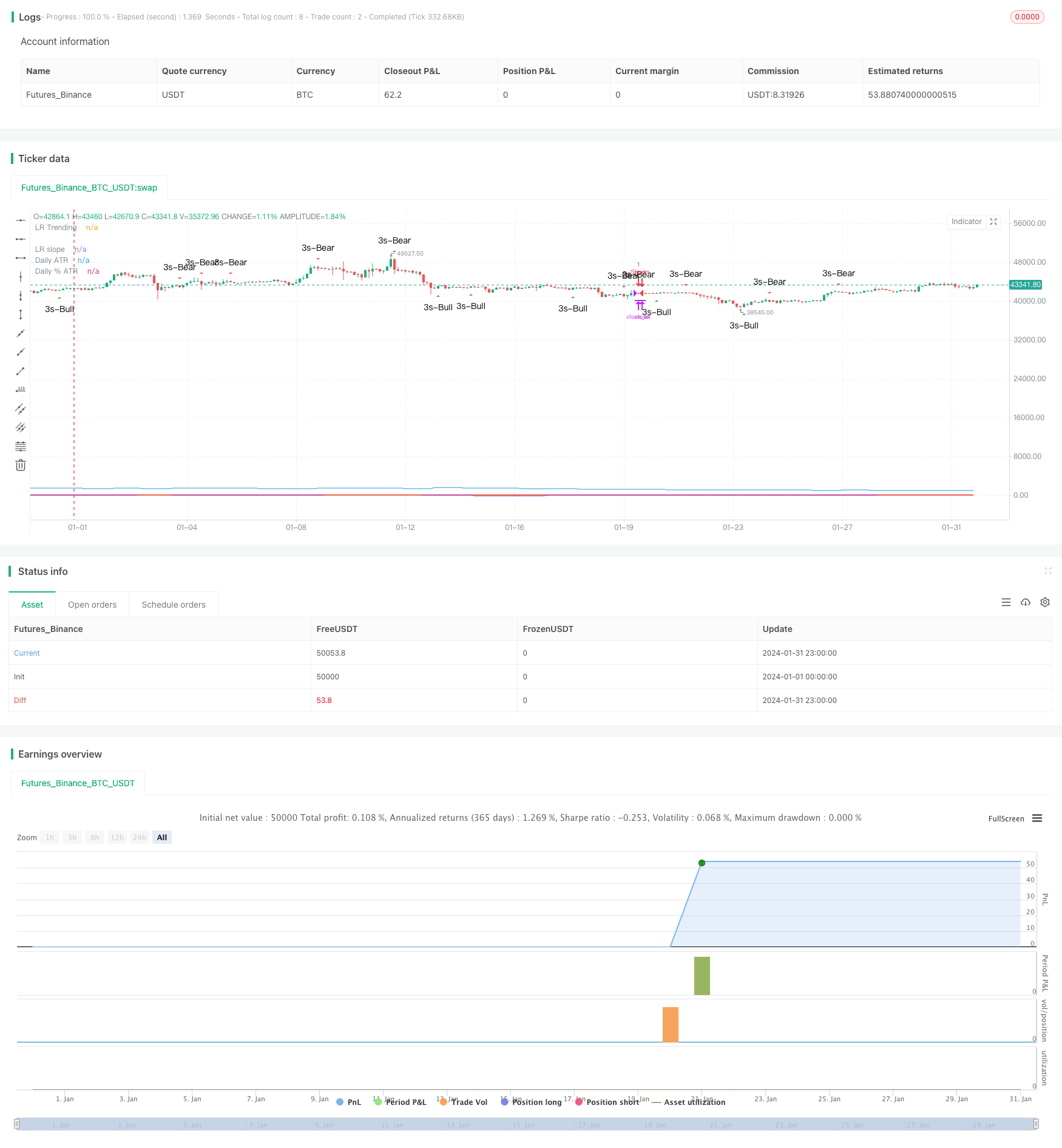

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © platsn

//

// Mainly developed for SPY trading on 1 min chart. But feel free to try on other tickers.

// Basic idea of this strategy is to look for 3 candle reversal pattern within trending market structure. The 3 candle reversal pattern consist of 3 consecutive bullish or bearish candles,

// followed by an engulfing candle in the opposite direction. This pattern usually signals a reversal of short term trend. This strategy also uses multiple moving averages to filter long or short

// entries. ie. if the 21 smoothed moving average is above the 50, only look for long (bullish) entries, and vise versa. There is option change these moving average periods to suit your needs.

// I also choose to use Linear Regression to determine whether the market is ranging or trending. It seems the 3 candle pattern is more successful under trending market. Hence I use it as a filter.

// There is also an option to combine this strategy with moving average crossovers. The idea is to look for 3 canddle pattern right after a fast moving average crosses over a slow moving average.

// By default , 21 and 50 smoothed moving averages are used. This gives additional entry opportunites and also provides better results.

// This strategy aims for 1:3 risk to reward ratio. Stop losses are calculated using the closest low or high values for long or short entries, respectively, with an offset using a percentage of

// the daily ATR value. This allows some price flucuation without being stopped out prematurely. Price target is calculated by multiplying the difference between the entry price and the stop loss

// by a factor of 3. When price target is reach, this strategy will set stop loss at the price target and wait for exit considion to maximize potential profit.

// This strategy will exit an order if an opposing 3 candle pattern is detected, this could happend before stop loss or price target is reached, and may also happen after price target is reached.

// *Note that this strategy is designed for same day SPY option scalping. I haven't determined an easy way to calculate the # of contracts to represent the equivalent option values. Plus the option

// prices varies greatly depending on which strike and expiry that may suits your trading style. Therefore, please be mindful of the net profit shown. By default, each entry is approxiately equal

// to buying 10 of same day or 1 day expiry call or puts at strike $1 - $2 OTM. This strategy will close all open trades at 3:45pm EST on Mon, Wed, and Fri.

// **Note that this strategy also takes into account of extended market data.

// ***Note pyramiding is set to 2 by default, so it allows for multiple entries on the way towards price target.

// Remember that market conditions are always changing. This strategy was only able to be backtested using 1 month of data. This strategy may not work the next month. Please keep that in mind.

// *****************************************************************************************************************************************************************************************************

//@version=5

strategy("3 Candle Strike Stretegy", overlay=true, pyramiding=2, initial_capital=5000, commission_type=strategy.commission.cash_per_contract, commission_value = 0.01)

// ******************** Period **************************************

startY = input(title='Start Year', defval=2011, group = "Trading window")

startM = input.int(title='Start Month', defval=1, minval=1, maxval=12, group = "Trading window")

startD = input.int(title='Start Day', defval=1, minval=1, maxval=31, group = "Trading window")

finishY = input(title='Finish Year', defval=2050, group = "Trading window")

finishM = input.int(title='Finish Month', defval=12, minval=1, maxval=12, group = "Trading window")

finishD = input.int(title='Finish Day', defval=31, minval=1, maxval=31, group = "Trading window")

timestart = timestamp(startY, startM, startD, 00, 00)

timefinish = timestamp(finishY, finishM, finishD, 23, 59)

t1 = time(timeframe.period, "0930-1545:23456")

window = true

// *****************************************************

isSPY = input.bool(defval=true,title="SPY trading only", group = "Trading Options")

SPY_option = input.int(defval=10,title="# of SPY options per trade", group = "Trading Options")

reinvest = input.bool(defval=false,title="reinvest profit?", group = "Trading Options")

src = close

// ***************************************************************************************************** Daily ATR *****************************************************

// Inputs

atrlen = input.int(14, minval=1, title="ATR period", group = "Daily ATR")

iPercent = input.float(5, minval=1, maxval=100, step=0.1, title="% ATR to use for SL / PT", group = "Daily ATR")

// PTPercent = input.int(100, minval=1, title="% ATR for PT")

// Logic

percentage = iPercent * 0.01

datr = request.security(syminfo.tickerid, "1D", ta.rma(ta.tr, atrlen))

datrp = datr * percentage

// datrPT = datr * PTPercent * 0.01

plot(datr,"Daily ATR")

plot(datrp, "Daily % ATR")

// ***************************************************************************************************************** Moving Averages ************************

len0 = input.int(8, minval=1, title='Fast EMA', group= "Moving Averages")

ema1 = ta.ema(src, len0)

len1 = input.int(21, minval=1, title='Fast SMMA', group= "Moving Averages")

smma1 = 0.0

sma_1 = ta.sma(src, len1)

smma1 := na(smma1[1]) ? sma_1 : (smma1[1] * (len1 - 1) + src) / len1

len2 = input.int(50, minval=1, title='Slow SMMA', group= "Moving Averages")

smma2 = 0.0

sma_2 = ta.sma(src, len2)

smma2 := na(smma2[1]) ? sma_2 : (smma2[1] * (len2 - 1) + src) / len2

len3 = input.int(200, minval=1, title='Slow SMMA', group= "Moving Averages")

smma3 = 0.0

sma_3 = ta.sma(src, len3)

smma3 := na(smma3[1]) ? sma_3 : (smma3[1] * (len3 - 1) + src) / len3

ma_bull = smma1 > smma2 and smma1 > smma1[1]

ma_bear = smma1 < smma2 and smma1 < smma1[1]

ma_bull_macro = smma1 > smma3 and smma2 > smma3

ma_bear_macro = smma1 < smma3 and smma2 < smma3

// plot(ma_bull? 1 : 0, "MA bull")

// plot(ma_bear? 1 : 0 , "MA bear")

// **************************************************************************************************************** Linear Regression *************************

//Input

clen = input.int(defval = 50, minval = 1, title = "Linear Regression Period", group = "Linear Regression")

slen = input.int(defval=50, minval=1, title="LR Slope Period" , group = "Linear Regression")

glen = input.int(defval=14, minval=1, title="LR Signal Period", group = "Linear Regression")

LR_thres = input.float(0.03, minval=0, step=0.001, title="LR Threshold for Ranging vs Trending" , group = "Linear Regression")

//Linear Regression Curve

lrc = ta.linreg(src, clen, 0)

//Linear Regression Slope

lrs = (lrc-lrc[1])/1

//Smooth Linear Regression Slope

slrs = ta.ema(lrs, slen)

//Signal Linear Regression Slope

alrs = ta.sma(slrs, glen)

up_accel = lrs > alrs and lrs > 0

down_accel = lrs < alrs and lrs < 0

LR_ranging = math.abs(slrs) <= LR_thres

LR_trending = math.abs(slrs) > LR_thres

plot(slrs, "LR slope")

plot(LR_trending?1:0, "LR Trending")

// *********************************************************************************************************************************** Candle conditions **************************

bull_3s = close[3] <= open[3] and close[2] <= open[2] and close[1] <= open[1] and close > open[1]

bear_3s = close[3] >= open[3] and close[2] >= open[2] and close[1] >= open[1] and close < open[1]

plotshape(bull_3s, style=shape.triangleup, color=color.new(color.green, 0), location=location.belowbar, size=size.small, text='3s-Bull', title='3 Line Strike Up')

plotshape(bear_3s, style=shape.triangledown, color=color.new(color.red, 0), location=location.abovebar, size=size.small, text='3s-Bear', title='3 Line Strike Down')

// ***************************************************************************************************************************************** SL & PT ***********************************

RR = input.float(3.0, minval = 1, step = 0.1, title="Reward to Risk Ratio", group = "Trading Options")

barsSinceLastEntry()=>

strategy.opentrades > 0 ? (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades-1)) : na

last_high = math.max(high, high[1], high[2], high[3])

last_low = math.min(low, low[1], low[2], low[3])

long_SL = last_low - datrp

short_SL = last_high + datrp

long_PT = last_high

short_PT = last_low

last_entry = strategy.opentrades.entry_price(strategy.opentrades-1)

risk = last_entry - long_SL

if strategy.opentrades > 0

long_SL := math.min(long_SL[barsSinceLastEntry()], last_low)

short_SL := math.max(short_SL[barsSinceLastEntry()], last_high)

risk := last_entry - long_SL

long_PT := last_entry + (last_entry - long_SL) * RR

short_PT := last_entry - (short_SL - last_entry) * RR

else

long_PT := open + (open - long_SL) * RR

short_PT := open - (short_SL - open) * RR

// plot(short_SL,title = "Short SL", color=color.new(color.purple,30))

// plot(long_SL,title = "Long SL", color=color.new(color.purple,30))

// plot(long_PT,title = "Long PT", color=color.new(color.white,50))

// plot(short_PT,title = "Short PT", color=color.new(color.white,50))

// plot(last_entry, title = "Last entry")

// plot(risk, title = "Risk")

// **************************************************************************************************************************************** Trade Pauses ****************************************

bool trade_pause = false

bool trade_pause2 = false

if high - low > datr*0.3

trade_pause := true

else

trade_pause := false

no_longat10 = input.bool(true, title="No long entry between 10 - 10:30 (Avoid 10 am dump)", group = "Trading Options")

// ************************************************************************************************************************************ Entry conditions **************************

trade_3s = input.bool(title='Trade 3s candle pattern', defval=true, group = "Trading Options")

L_entry1 = bull_3s and ma_bull and LR_trending

S_entry1 = bear_3s and ma_bear and LR_trending

trade_ma_reversal = input.bool(title='Trade MA Cross Reversal Signal', defval=true, group = "Trading Options")

L_entry2 = ma_bear_macro and ema1 > smma1 and bull_3s and ta.barssince(ta.cross(ema1,smma1)) < 10

S_entry2 = ma_bull_macro and ema1 < smma1 and bear_3s and ta.barssince(ta.cross(ema1,smma1)) < 10

// ************************************************************************************************************************************** Exit Conditions ********************************

// bsle_thres = input.int(0, "Bar since entry threshold")

// exit0 = barsSinceLastEntry() >= bsle_thres

exit0 = true

L_exit1 = bear_3s

S_exit1 = bull_3s

// ************************************************************************************************************************************ Entry and Exit orders *****************************

strategy.initial_capital = 50000

trade_amount = math.floor(strategy.initial_capital / close)

if isSPY

if strategy.netprofit > 0 and reinvest

trade_amount := math.floor((strategy.initial_capital + strategy.netprofit) * 0.2 / 600) * 10 * SPY_option

else

trade_amount := math.floor(strategy.initial_capital * 0.2 / 600) * 10 * SPY_option

if not(trade_pause) and not(trade_pause2) and time(timeframe.period, "0930-1540:23456")

if trade_3s

if not(time(timeframe.period, "1000-1030:23456")) and no_longat10

strategy.entry("Long", strategy.long, 1, when = L_entry1 and window, comment="Long 3s" + " SL=" + str.tostring(math.round(long_SL,2)) + " PT=" + str.tostring(math.round(long_PT,2)))

strategy.entry("Short", strategy.short, 1, when = S_entry1 and window, comment = "Short 3s" + " SL=" + str.tostring(math.round(short_SL,2)) + " PT=" + str.tostring(math.round(short_PT,2)))

if trade_ma_reversal

strategy.entry("Long", strategy.long, 1, when = L_entry2 and window, comment="Long MA cross" + " SL=" + str.tostring(math.round(long_SL,2)) + " PT=" + str.tostring(math.round(long_PT,2)))

strategy.entry("Short", strategy.short, 1, when = S_entry2 and window, comment = "Short MA corss" + " SL=" + str.tostring(math.round(short_SL,2)) + " PT=" + str.tostring(math.round(short_PT,2)))

if high > long_PT

long_SL := low[1]

strategy.exit("Exit", "Long", when = exit0 and low < long_PT, stop= long_SL, comment = "Exit Long SL/PT hit")

strategy.close("Long", when = L_exit1, comment = "Exit on Bear Signal")

if low < short_PT

short_SL := high[1]

strategy.exit("Exit", "Short", when= exit0 and high > short_PT, stop= short_SL, comment = "Exit Short SL/PT hit")

strategy.close("Short", when = S_exit1, comment = "Exit on Bull Signal")

if time(timeframe.period, "1545-1600:246")

strategy.close_all()

- 3 Strategie zur Umkehrung des gleitenden Durchschnitts-Swing-Intervalls

- Momentumdurchschnittliche Umkehrung der Pullback-Strategie

- Mehrzeitrahmen-Trendjäger-Strategie

- DCCI-Ausbruchstrategie

- Zweimal zuverlässige Preisschwankung Quant Strategie

- Strategie zur Verfolgung von Volatilitätstrends

- Quantifizierte Umkehrverfolgungsstrategie mit zwei Treibern

- Überlagerung von Trendsignalen

- Swing Points Breakouts Langfristige Strategie

- Die quantitative Handelsstrategie auf Basis eines dynamischen gleitenden Durchbruchsdurchschnitts

- Adaptive Handelsstrategie mit doppeltem Durchbruch

- Quantitative Handelsstrategie für eine Rückkehr nach unten

- Kombinationsstrategie zur Optimierung des Momentumtrends

- Strategie für mehrere Bollinger-Bänder für gleitende Durchschnittswerte

- Strategie für den Durchbruch des gleitenden Durchschnitts

- SuperTrend Trailing Stop Strategie basierend auf Heikin Ashi

- Doppel gleitender Durchschnitt mit Momentum-Breakout-Strategie

- Bollinger-Band-Breakout-Strategie auf Basis von VWAP

- Fibonacci-Retracement Dynamische Stop-Loss-Strategie

- Dynamische EMA- und MACD-Kreuzungstrategie