1.1 What is quantitative trading?

Author: Goodness, Created: 2019-04-09 16:01:03, Updated:Summary

As a product of the combination of science and machine, quantitative trading is changing the pattern of modern financial markets. Many investors have turned their attention to this field. How to minimize risk and achieve the best possible return? It is also the purpose of this series of courses. As the first part of the opening ceremony, we will briefly explain “What is quantitative trading”.

Overview

Many retail investors get the feeling of “high-level” and “getting rich overnight” when they hear the words “quantitative trading.” In the era of artificial intelligence, with the rise of advanced technologies such as deep learning, big data, and cloud computing, it has given it a mysterious color. It seems that as long as you use quantitative trading, you can build a “perfect” trading strategy.

In fact, to a certain extent, quantitative trading has been overrated. Putting aside the trading part, “quantitative” is actually using a computer, statistical methods, mathematics and other tools, through a scientific investment system, to find a set of positive expected trading signal system. This signal system tells us when to buy and sell.

Quantitative trading history and development

Tracing back to its source, the first to use quantitative methods to analyze data changes, and find out the market price rise and fall laws, not the origin of the stock of the Dutch, nor the British who carry forward modern finance, nor the symbiosis with the financial development of the country American, but a Frenchman.

As early as the 18th century, French stockbroker assistant Jules Regnault proposed a modern theory of stock price changes, followed by the book <<Probability Computing and Stock Trading Philosophy>>, and elaborated on the market ups and downs that he discovered. (Normal distribution): “The deviation of price is proportional to the square root of time”, and finally the trading success is obtained by rational quantitative investment decision.

Nowadays, in the era of Internet + big data + cloud computing + artificial intelligence, quantitative tradings have also developed rapidly. Once in the global financial hinterland, London Canary Wharf has long since become a distribution center for IT companies. The world’s top investment banks are also cultivating their own quantitative teams, trying to get into the financial battle of “mathematic models are everything”. These IT teams that develop trading models are also called Quant Team. In terms of scale, the United States, which started earlier, already has a large number of powerful quantitative hedge funds.

Quantitative trading characteristics

-

• Scientific verification: Imagine that when you have a trading system, if you use an simulated trading to test its effectiveness, you may have to pay a huge time cost. If you take the test in the real market directly, you may lose real money. However, the backtesting function in the quantitative trading can be utilized to verify the trading system in a scientific way through a large amount of historical data. What works, what doesn’t work, let the data speak, not people.

-

• Objective and accurate: In the trading, our real enemy is ourselves. Mentality management is easier said than done. Greedy, fear, luck and other human weaknesses will multiply in the trading market. Quantitative trading can help us overcome these weaknesses and make better decisions in trading.

-

• Timely and efficient: Subjective tradings, people’s speed of response can not be faster than the computer, and people’s physical strength and energy can not run 24 hours, in the high speed running trading market, quantitative trading can completely replace subjective tradings, looking for tradings Opportunity to track market changes in a timely and fast manner.

-

• Risk control: Quantitative tradings can not only extract historical rules that may be repeated in the future from historical data, but these historical laws are strategies for winning with greater probability. You can also build a variety of different portfolios to reduce systemic risk and smooth the capital profit curve.

What are the classic trading strategies for quantitative trading?

Opening price breakthrough strategy

Opening for half an hour can often determine the trend of the day. This strategy’s logic is determined by half an hour after the opening of the market, weather the first 30-minutes candle graphic is positive line or negative line, as a criterion for judging the trend of the day. If it is a positive line, open a position to buy, if it is a negative line, vice versa. closing all position within a few minutes before the market close. This is a very simple trading strategy.

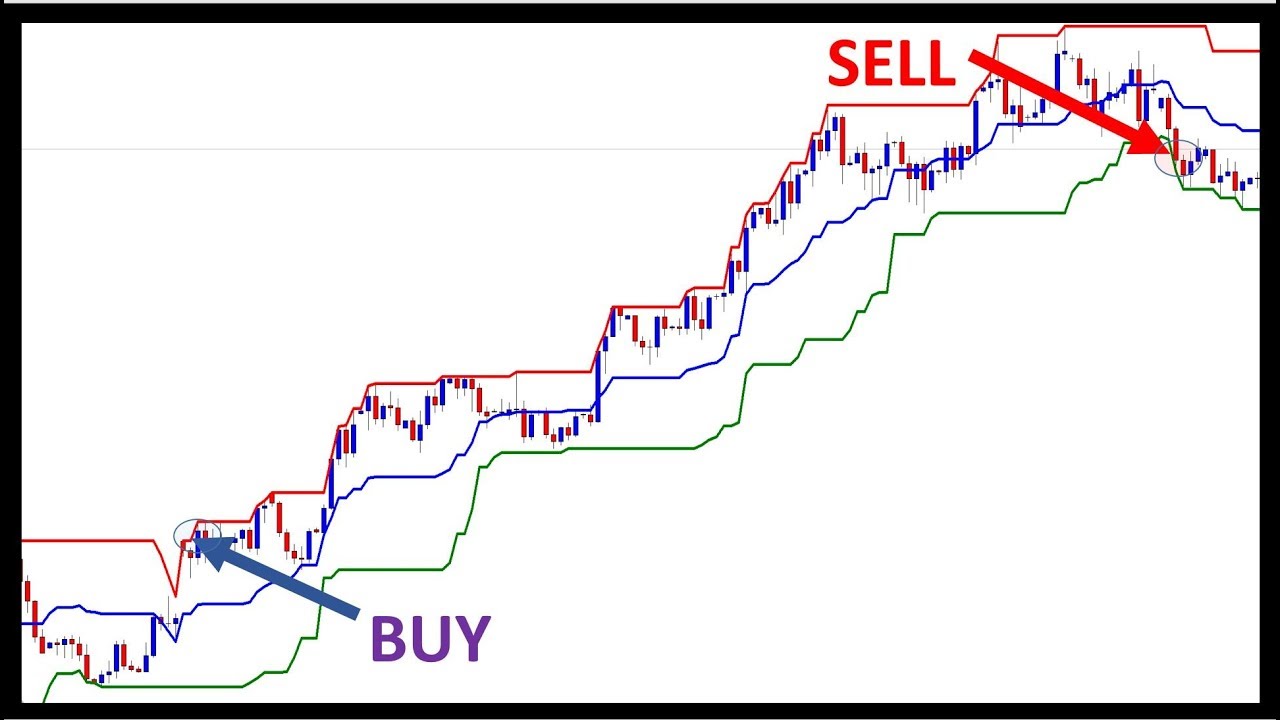

Donchian Channel Strategy

Donchian channel strategy can be called the originator of intraday trading. The rule is: if the current price is higher than the highest price of the previous number of N K-line, buying long; if the current price is lower than the lowest price of the previous number of N K-line, selling short. The famous “Turtle Trading Strategy” was using the revised version of it.

Donchian channel strategy can be called the originator of intraday trading. The rule is: if the current price is higher than the highest price of the previous number of N K-line, buying long; if the current price is lower than the lowest price of the previous number of N K-line, selling short. The famous “Turtle Trading Strategy” was using the revised version of it.

Intertemporal arbitrage strategy

Intertemporal arbitrage is the most common type of arbitrage trading. It is based on the same trading variety and the price of different delivery month contracts. If there is a large price difference between the two prices, you can buy and sell futures contracts at the same time. Assume that the spread between the main contract and the sub-primary contract is maintained at around -50~50 for a long time. If the spread reaches 70 on a certain day, we expect the spread to return to 50 at some time in the future. Then you can sell the main contract and buy the sub-primary contract at the same time to short the spread. vice versa.

To sum up

Above, we briefly introduced the related concepts of quantitative trading from the definition, development, characteristics and some classic trading strategies for quantitative trading.

Understanding quantitative trading is an important stepping stone on the road to Quant. Finally, I wish you all enrich yourself in the bear market and realize cognitive increment as soon as possible! Remember, you are only one bull market away from financial freedom ^_^

Next section notice What is the difference between quantitative trading and traditional trading? In real market trading, do you choose traditional trading or quantitative trading? In the next section, we will take with these two questions to learn more about quantitative trading.

After-school exercises

- In one sentence, what is quantitative trading?

- What are the characteristics of quantitative trading?

- FMZ intermediate tutorial

- FMZ beginer tutorial

- BitMEX exchange API note

- 2.2 How to configure the FMZ Quant trading system

- Who has a copy of Gateio's Python contract sample code?

- 2.1 Introduction to the quantitative trading tool

- Calling the ribbon parameter to restart the interface, returning code 5, the parameter is incorrect, request ((PHP))

- 1.4 What are the elements of a complete strategy?

- HttpQuery returns what type if it fails?

- 1.3 What are needed for quantitative trading?

- Best practices for upgrading Linux hosts

- 1.2 Why choose quantitative trading

- Quantitative trading quick start

- Request an exchange API, occasionally with a timeout

- Implementing MACD in Python

- OKEX get depth error reported

- Please review the question.

- ZBG exchange not available

- A small question, how do you program blockly to visualize market price listings?

- Inventor of the digital currency quantification platform websocket user guide (Details after the Dial function upgrade)