2.2 How to configure the FMZ Quant trading system

Author: Goodness, Created: 2019-04-15 14:48:05, Updated: 2019-04-17 10:55:47Summary

For the development of quantitative trading strategies, the first thing to do is the configuration of the trading tools. In this section we will take you through setting up exchanges, creating trading strategies, and creating robots, all of which are necessary prerequisites for quantitative trading.

The configuration learning part is divided into the simulation trading and the real market trading. We will mainly focus on cryptocurrency as trading target.

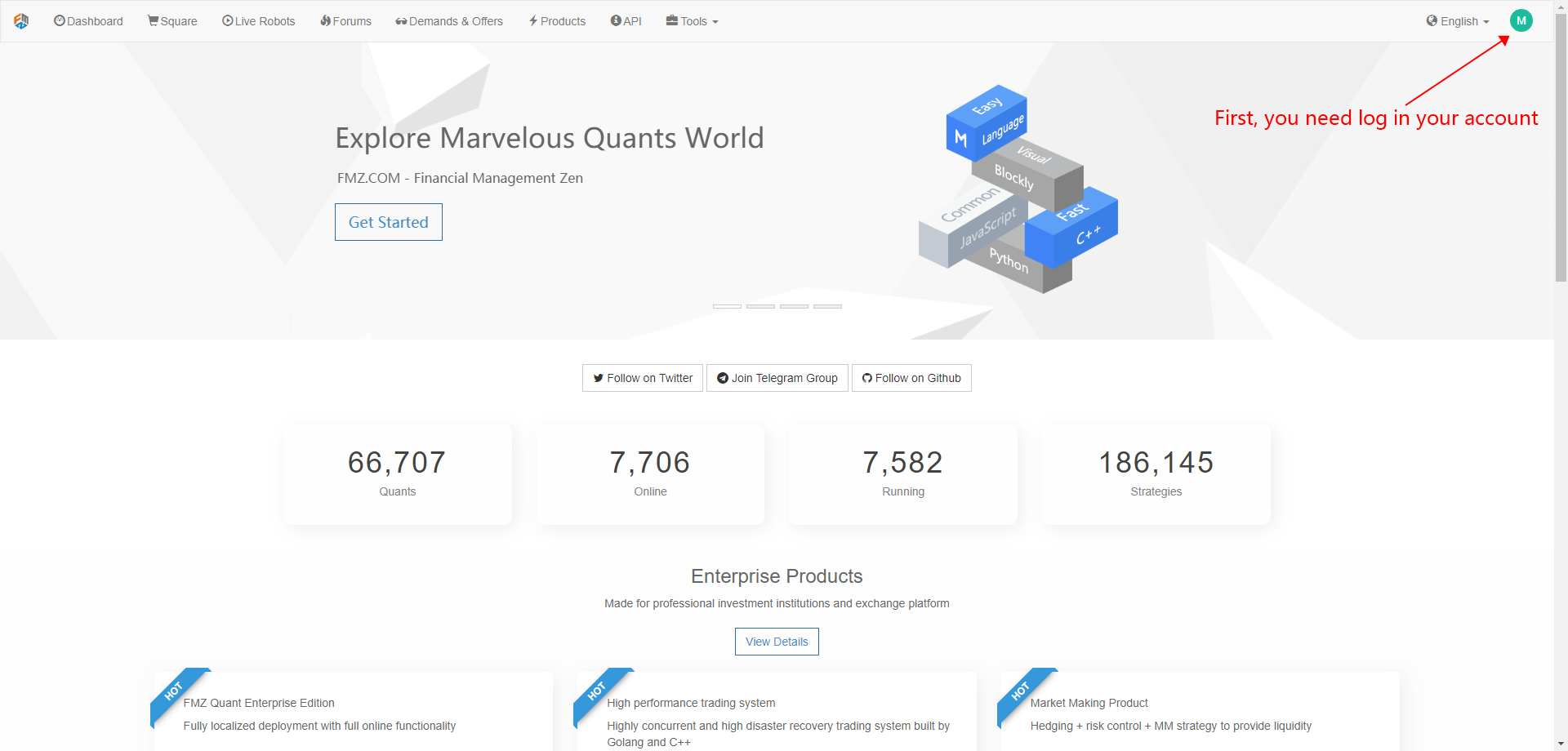

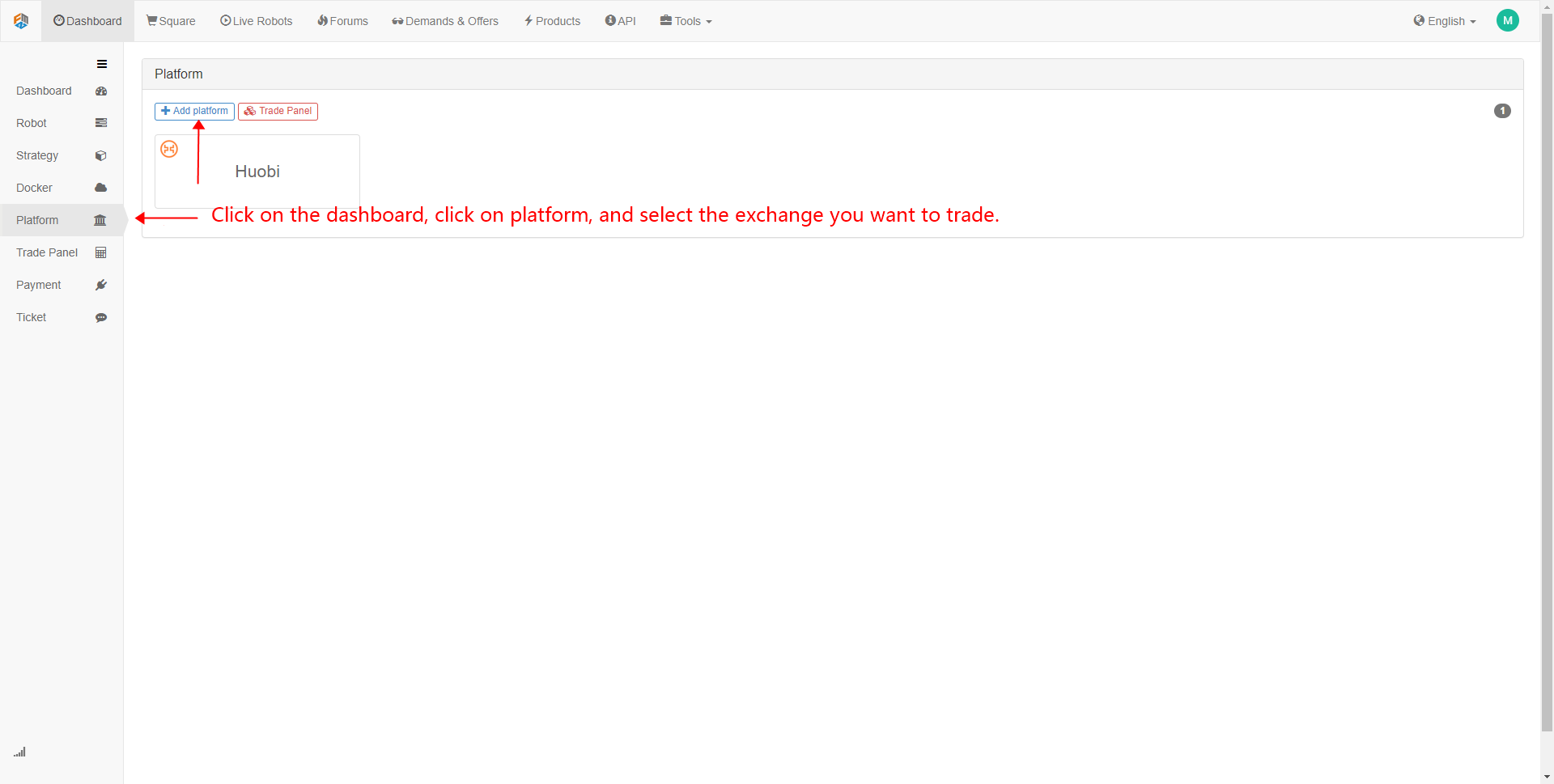

Add exchange

Adding an exchange is the first step in the entire configuration process. For the specific process, please see the screenshots below. It’s not a difficult step.

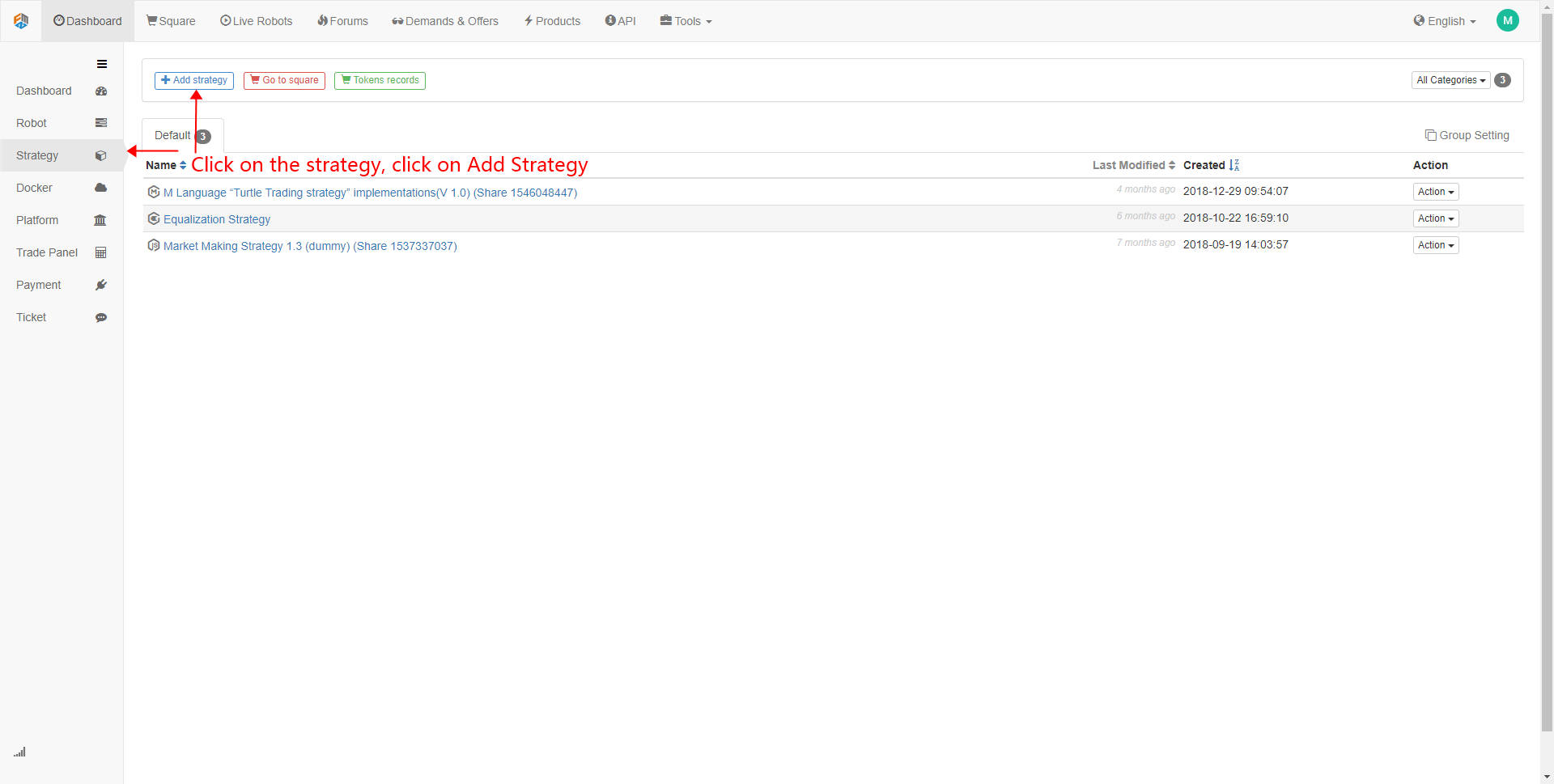

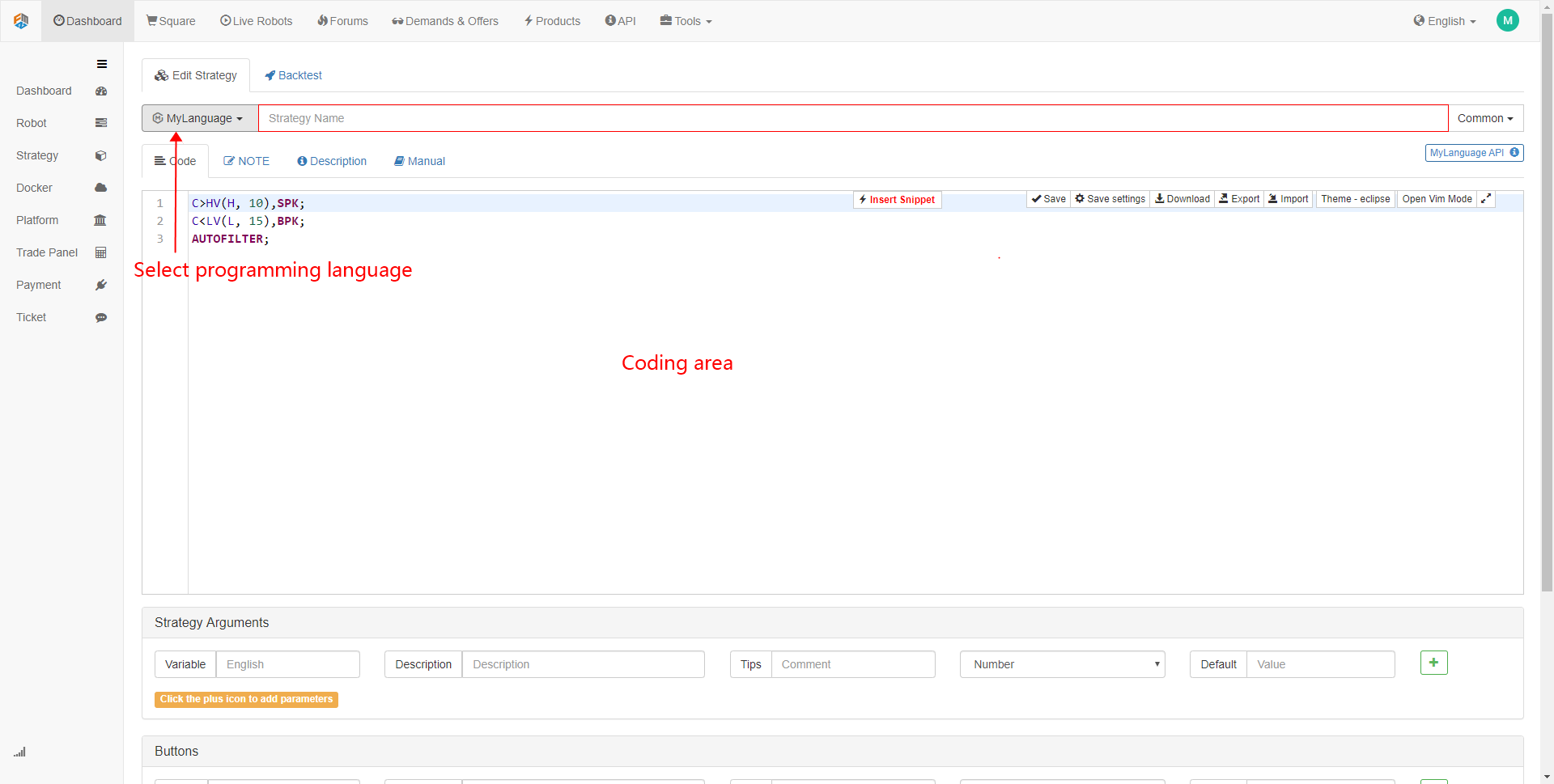

Strategy writing

Under the Dashboard page, click the strategy column. You will get the place where you stores all of your strategies. This page is mainly divided into two functions: strategy writing and simulation environment backtesting. The strategy writing area is the main working area of our future development of strategy (as shown below). If you already have a familiar coding editor, such as Emacs, Vim, Sublime Text or VS Code, you are feel free to continue to use them, after you done your coding, you can just copy and paste in this coding area. Many beginners are often confused by programming skills. Please don’t! allow me Emphasize this point again. Nowadays, Programming skills are tend to as easy as using a calculator. This page will also be used to debug the code during the development of the strategy. The debugging part will be explained in detail in the following chapters.

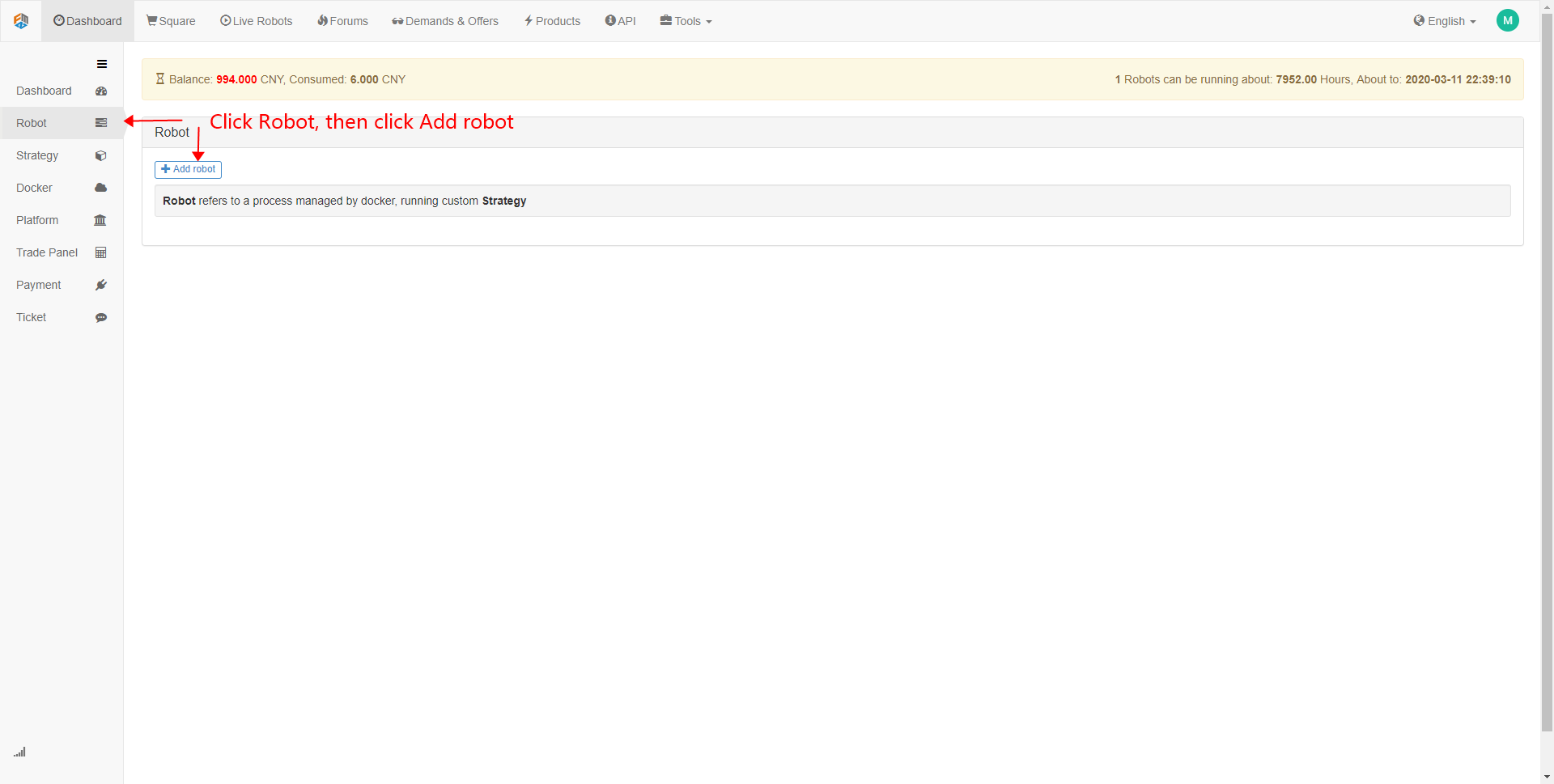

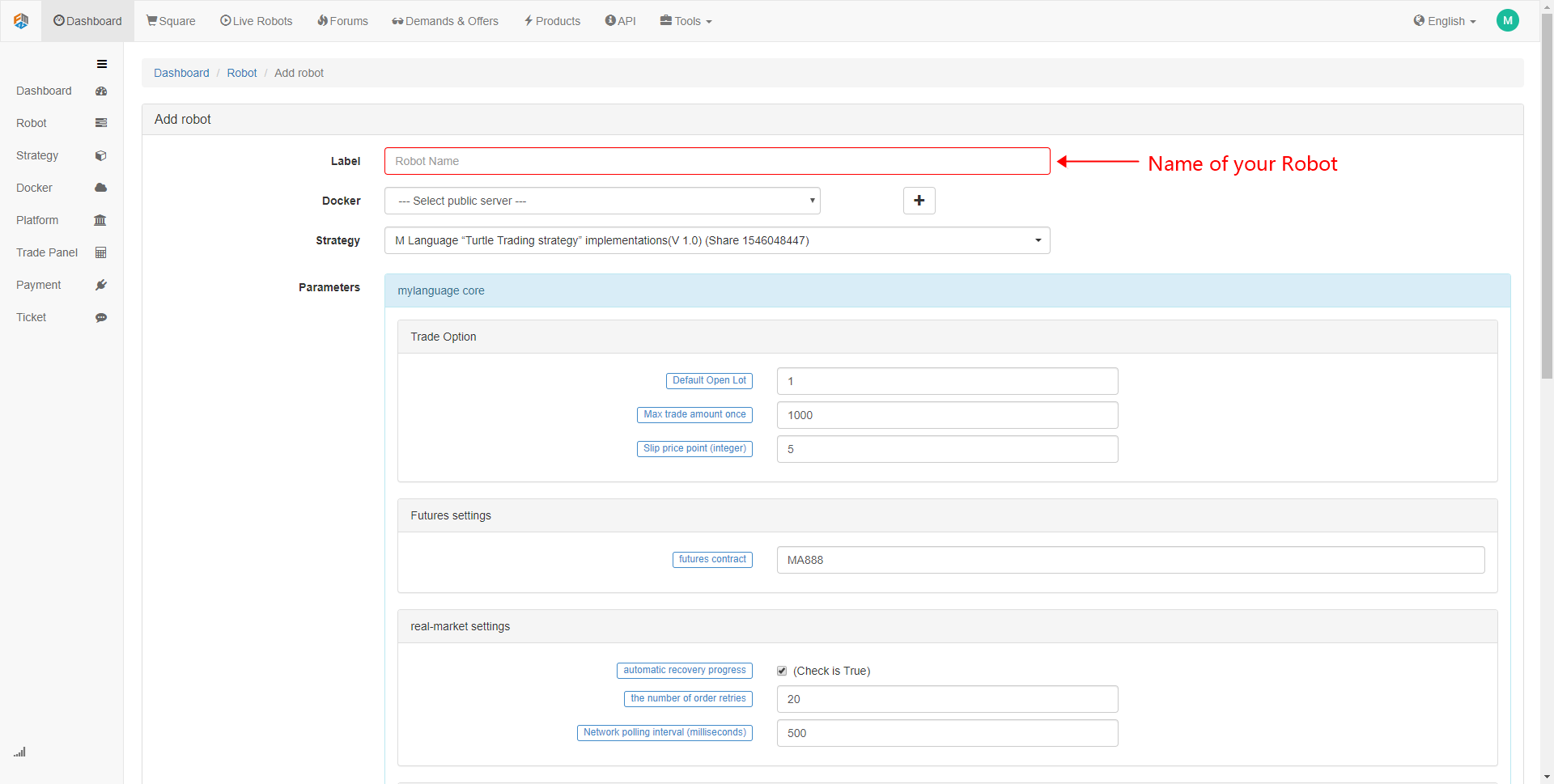

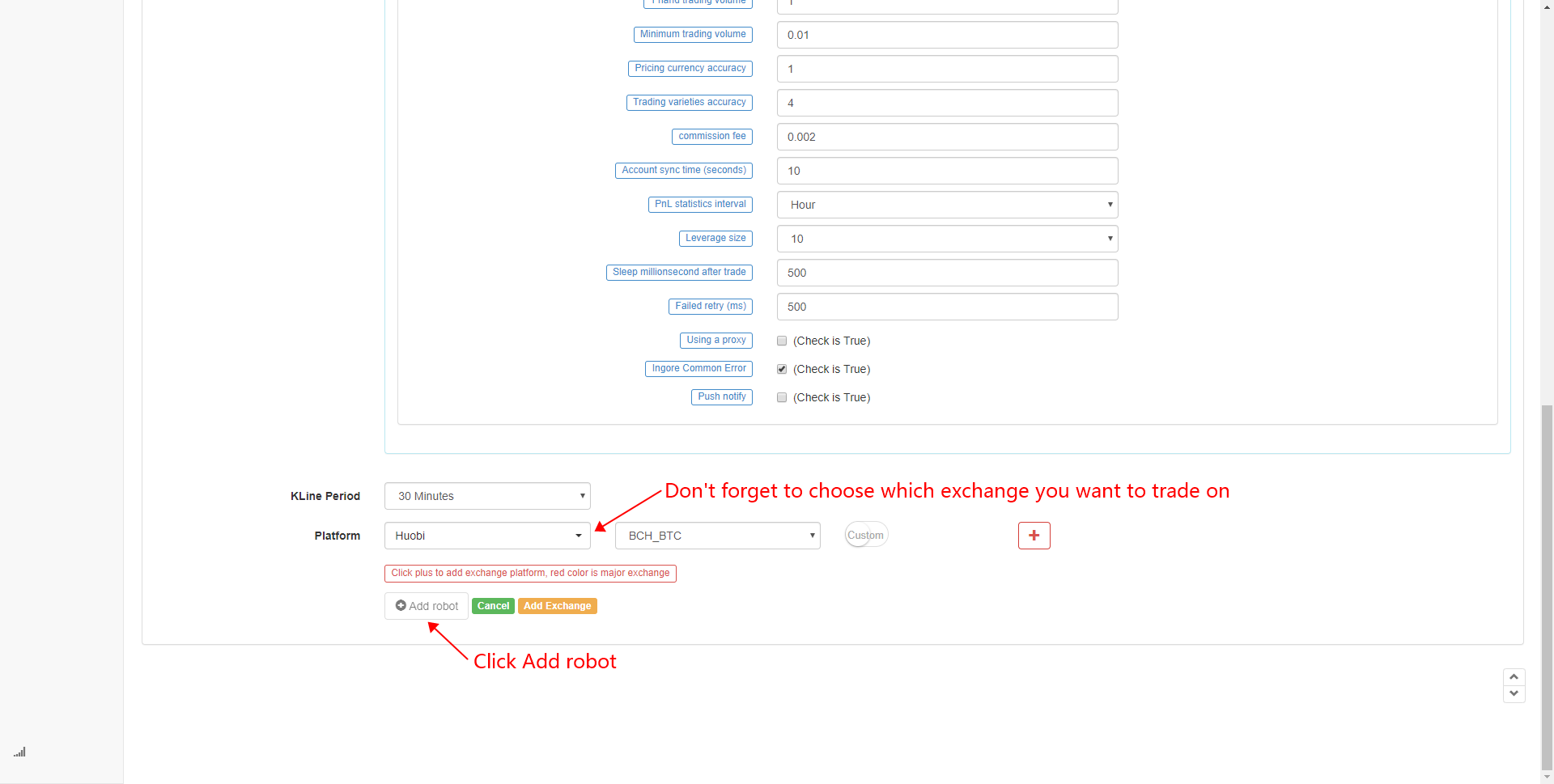

Create Robot

The Robot is the executor of the trading strategy. When the strategy is created, users will need create a robot, which can automatically execute each trading logic in the strategy code, as well as open, close positions and placing, withdraw orders. The specific steps to create a robot are as follows: On the Dashboard page, click on “Robot” and click on “Create Robot”. Next, Customize a name for the robot, then Click on the “+” sign to add the trading platform. at last, Click on “Create Robot”

To sum up

In the above process, in addition to the difference between the first step of selecting the real market and the simulation market, the subsequent step strategy writing and creating the robot are unified steps. After the entire trading tool is configured, the trading robot starts to run, the trading operation will perform according to the specific instruction of the strategy.

Next section notice

Although you only need a simple three-step process to achieve basic configuration and easy to add exchanges and create the robot, it is difficult to achieve a executable strategy.

In the next section, we will take you through the APIs commonly used in quantitative trading to prepare for a executable trading strategy. Because no matter which kind of quantitative trading tool, it must be inseparable from the API interface, it is an important function to achieve quantitative trading.

After-school exercises

- Try adding an exchange.

- Try to code the trading strategy in this section.

- FMZ intermediate tutorial

- Can robots that have already been started, modified strategies in the run, be effective?

- 3.2 Getting started with the M language

- Problems with writing API interface programs for bitmex market price cap stops and triggered post-placement

- 3.1 Quantitative trading programming language evaluation

- Make Post-Only order and bulk orders on BitMEX through IO

- Can I ask if the visualization strategy works with OK's permanent contract?

- Can a strategy be implemented for re-testing conditions on different cycles of the K-line?

- On how to list and order in bulk on BitMEX only passively (IO example)

- 2.4 How to write a trading strategy on FMZ Quant platform

- 2.3 Common API explanations

- Who has a copy of Gateio's Python contract sample code?

- 2.1 Introduction to the quantitative trading tool

- Calling the ribbon parameter to restart the interface, returning code 5, the parameter is incorrect, request ((PHP))

- 1.4 What are the elements of a complete strategy?

- HttpQuery returns what type if it fails?

- 1.3 What are needed for quantitative trading?

- Best practices for upgrading Linux hosts

- 1.2 Why choose quantitative trading

- 1.1 What is quantitative trading?