What is leverage?

Author: Little white cabbage, Created: 2022-06-08 15:17:28, Updated:Welcome to the exchange of strategies, I mainly play in the digital currency circle, my usual research is more about the low risk, stable returns strategy of the digital currency market, which is a hedging strategy, an investment method with an annualization of at least 10%, I recently compiled some information to share.1. The principle of arbitrageThe simplest understanding is that two transactions are simultaneously related, opposite directions, equal in number, and profit and loss are matched. The profit of the trade is the price difference between the contract and the spot. More complex arbitrage also earns capital gains, entitlement gains, and leverage interest.

It can be simply understood as the effect of multiple double-open price offsets on earnings, sacrificing the ability to obtain high unilateral earnings, avoiding the risk of losses, and achieving stable access to small earnings.2. Features of the auction1. Multiple openings. 2. Earnings are not related to price declines. 3. Low risk. 4. Earnings are low but stable.

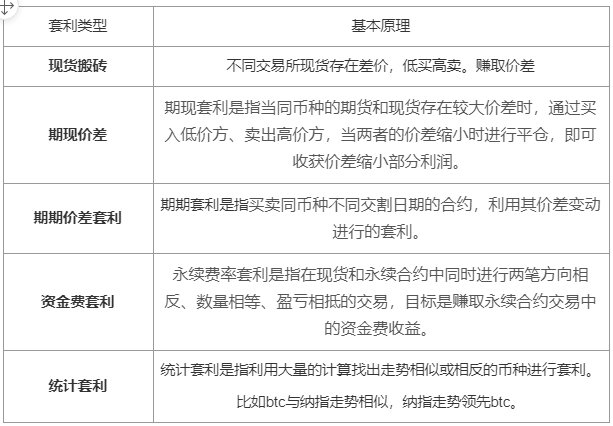

In the past, when interest rates were high, I made a one-time fee adjustment that can go up to 50% per annum and up to 20% per annum; that is, you can steady your income from 35U to 90U every 8 hours.3. Suitable objectsFriends who don't have the time or the willingness to take risks and want a steady income4. Type of interestThe following are the main types of leveraged trading on the cryptocurrency market: For example, the BTC is similar to the Nasdaq trend, with the Nasdaq trend leading the BTC.

The above types of suites are suitable for different users, and I will explain in detail the characteristics of each type and how to play, first of all, the short comparison of the spot movers.

**Supplied for large families**

1. The Principle

A simple move is when the same currency reaches a certain amount of price difference on different platforms, and can be bought low on platform A and sold high on platform B. Below is a simple example of buying BTC at a price of 30000U on platform A, and then selling BTC at 31000U on platform B.

For example, the BTC is similar to the Nasdaq trend, with the Nasdaq trend leading the BTC.

The above types of suites are suitable for different users, and I will explain in detail the characteristics of each type and how to play, first of all, the short comparison of the spot movers.

**Supplied for large families**

1. The Principle

A simple move is when the same currency reaches a certain amount of price difference on different platforms, and can be bought low on platform A and sold high on platform B. Below is a simple example of buying BTC at a price of 30000U on platform A, and then selling BTC at 31000U on platform B.

Before 17 years, the exchange was free of transaction fees. One of the big banks started to make cash transfer swaps at the end of 14 until the beginning of 17 years, from 200 yuan to 80 bitcoins in just three years. In the early years of the 17 bull market, there was also a lot of room for change, relying solely on manual transfer, when the price of BTC reached $ 20,000.2. Suitable for crowdsAs more and more people move, the quantity of trading teams in the coin circle increases, and the difference between the exchanges is currently smaller and smaller, there is basically no margin for the average person with a small amount of funds for those large houses that are suitable for the very low transaction fees of the exchange.

- There is a bear market, there is no strategy to run

- Interest on capital charges

- Today's laughing incident (transliterated)

- The telegraph cluster suddenly stopped going in.

- Civilian gamers, is there a balancing strategy written by God?

- What interface can be used to get the market value of the currencies?

- Is there anyone who can help?

- Sharing a trend strategy

- Foresight for the common man

- I hope FMZ officially publishes the project.

- Bin An's campaign strategy application

- Precision issues

- Is there a way to remove a table line?

- I've been getting no signals on the retest. Can you fix it?

- Inventors quantified the PINE language introductory tutorial

- Please ask how to draw the earnings chart for the multi-currency.

- Digital currency

- Currency value

- Can you see, the Mac language's strategy is that both the test and the hard drive are working properly, that is, the phone's hard drive is there and click on it to show an error, what's the situation?

- Retest visualization does not show the buy and sell icon