Quantitative trading strategies with a trade index weighting

Author: Goodness, Created: 2019-07-27 10:49:26, Updated: 2023-10-23 17:36:14

What is the trade weighted index?

A trade-weighted index is an investment index in which the volume of each investment affects the index proportionally to the volume of each of its indices. The volume of each investment added to the index determines the value of the index in addition to the total number of investments. Investments with higher volume of transactions will be given more weight than those with lower volume of transactions and therefore have a greater say in the performance of the index.

Details of the transaction weighted index

In a volume-weighted index, investments from $110 to $120 will have a greater impact on the index than investments from $10 to $20, even if these increases are not as large as the increases at low prices. Investments with higher volumes have a greater impact on the index or overall direction.

For example, the Dow Jones Industrial Average (DIJA) is one of the most popular transaction-weighted investments and is composed of 30 different investments or components. In this index, the higher-trading index has a higher volume of transactions than the lower-trading index, hence it is called the transaction-weighted designation.

Other weighted indices

In addition to the trade weighted index, other basic types of weighted indices include value weighted and unweighted indices. For value weighted indices, such as those in the MSCI Strategic Index series, the number of issued indices is a factor. To determine the weight of each indice in the trade weighted index, the trade weight of the investment indices is multiplied by the number of issued indices. For example, if investment A has 5,000,000 shares issued and traded at $15, its weight in the index is $750,000,000.

In an unweighted index, all investments have the same effect on the index, regardless of their number of investments or the volume of transactions. Any change in transactions in the index is based on the percentage of return for each component. For example, if investment A rises by 30%, investment B rises by 20%, investment C rises by 10%, index rises by 20%, or 30 + 20 + 10/3, i.e. the number of investment tokens in the index.

Another type of weighted index is the market value weighted index, in which the share of each index is based on the market value of the index that has been issued. Other types of weighted indices include income weighted, basic weighted and floating adjustment.

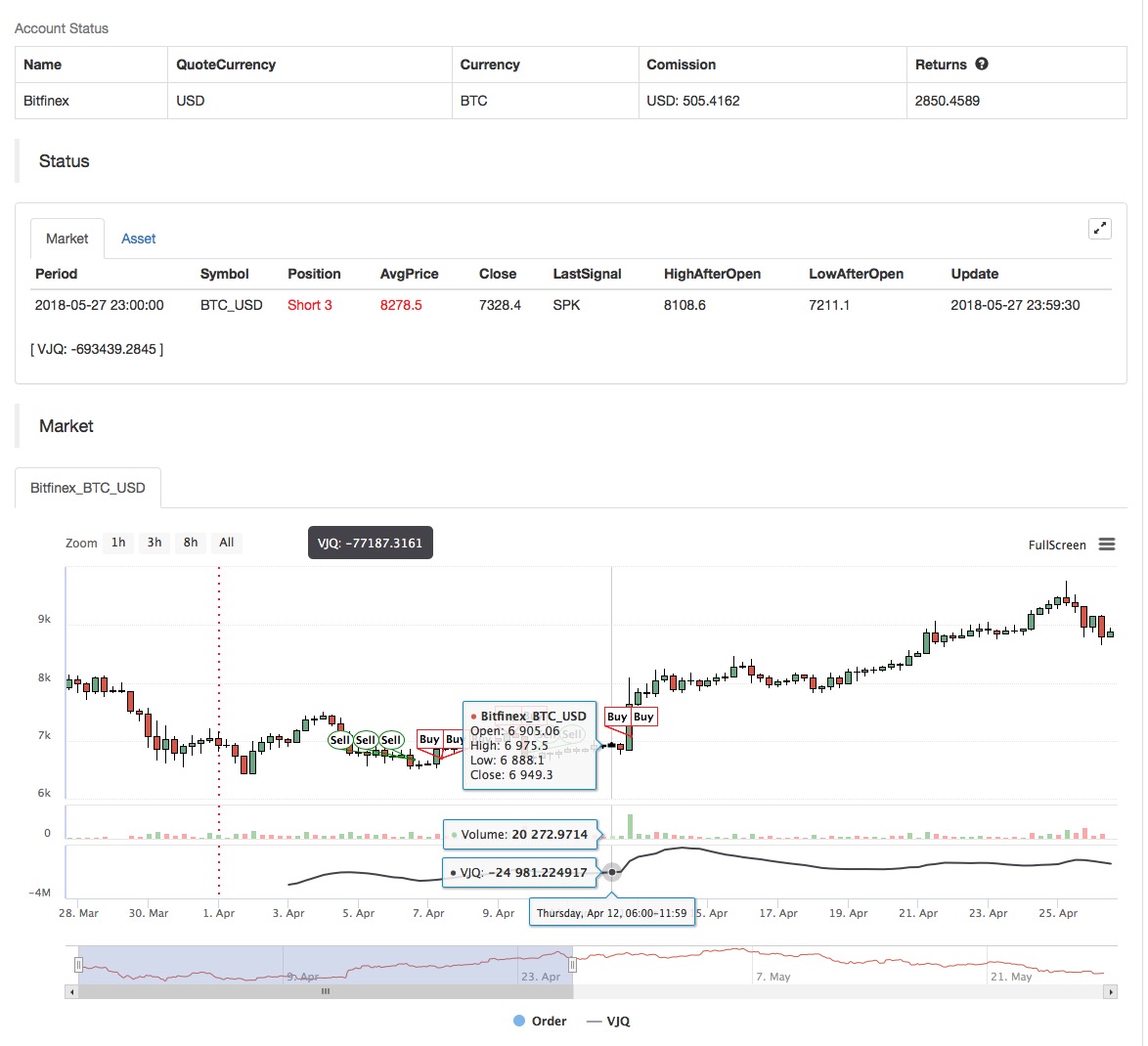

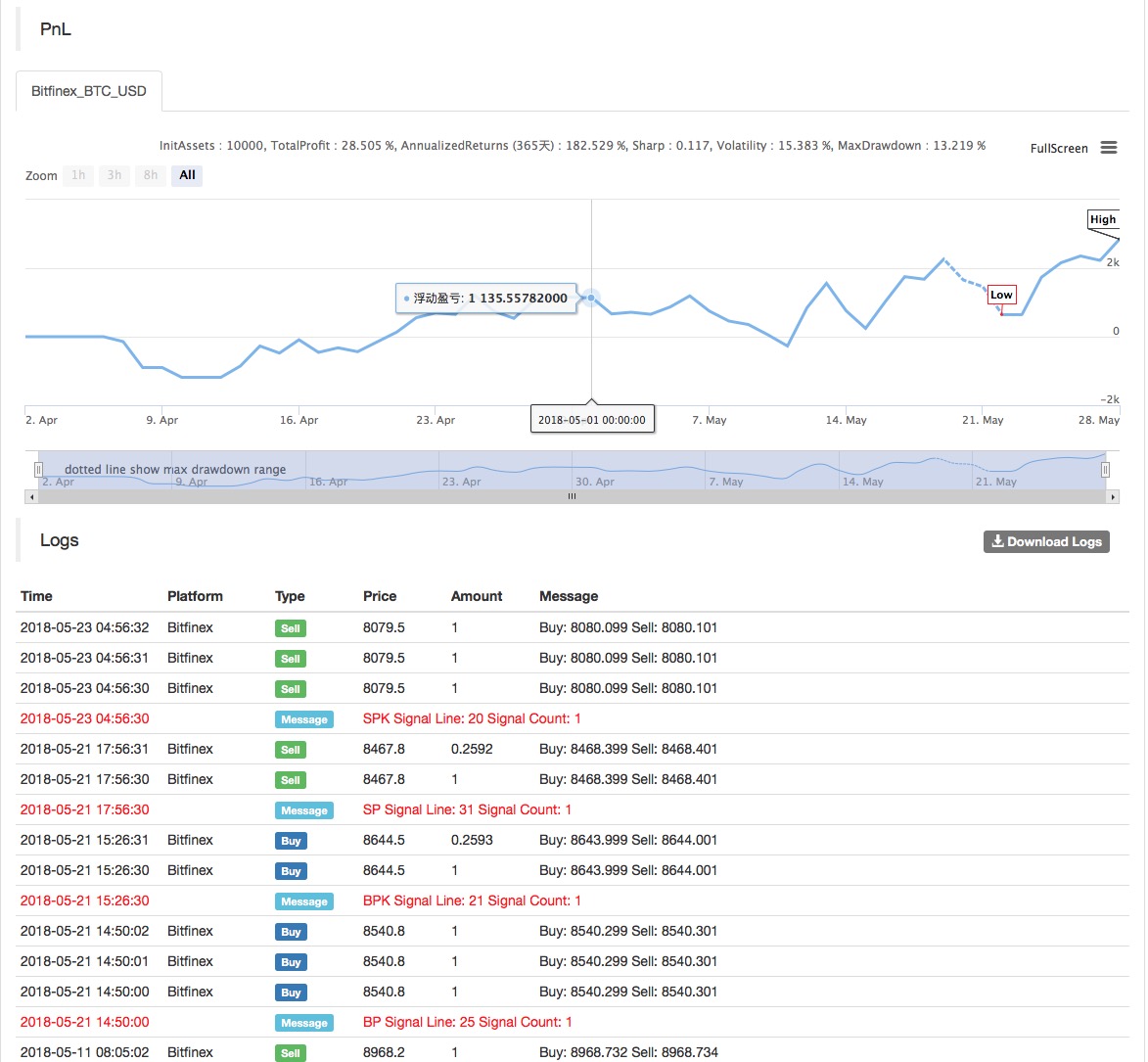

Use of inventor-quantified platforms in trade index weighting strategies

Based on the basic concepts above, we probably already understand the basic principles and mechanisms of this strategy. Next, we will deploy it to the inventor quantification platform to implement this strategy in the digital currency market. We still program using the simple and easy-to-use My language.

Data cycle: Multiple cycles

The index is backed by OKEX futures.

Contract type: this_week

MAN^^MA(C,N);

B_MA:=C>MAN;

S_MA:=C<MAN;

S_K1:=SUM((H-C)*V,N)/SUM((H-L)*V,N)>0.5;

B_K1:=SUM((C-L)*V,N)/SUM((H-L)*V,N)>0.5;

CO:=IF(C>O,C-O,0);

OC:=IF(C<O,O-C,0);

S_K2:=SUM(OC*V,N)/SUM(ABS(C-O)*V,N)>0.5;

B_K2:=SUM(CO*V,N)/SUM(ABS(C-O)*V,N)>0.5;

B_K1 AND B_K2 AND B_MA AND H>=HHV(H,N),BPK;

S_K1 AND S_K2 AND S_MA AND L<=LLV(L,N),SPK;

STOPLOSS:=M*MA(H-L,N);

C<BKPRICE-STOPLOSS,SP(BKVOL);

C>SKPRICE+STOPLOSS,BP(SKVOL);

S_MA AND BKHIGH>BKPRICE+STOPLOSS,SP(BKVOL);

B_MA AND SKLOW<SKPRICE-STOPLOSS,BP(SKVOL);

For the source code of the policy, please see:https://www.fmz.com/strategy/128125

- Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

- DEX exchange quantitative practices ((2) -- Hyperliquid user guide

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- The experience of developing trading strategies

- Calculation and application of DMI indicators

- Detailed usage and practical skills of energy tide(OBV) indicator in quantitative trading

- The development of CTA strategies and the inventor quantification platform standard library

- The use of a combination strategy for the strength and weakness of the RSI versus the straight line

- Upgrade Edition of Keltner Channel trading Strategy

- Neural network and digital currency quantitative trading series ((2)) Deep reinforcement learning training Bitcoin trading strategies

- Implementation and application of the inventor quantified platform in the fall line trading strategy

- Visualizing modules to build trading strategies - out

- KENTNA channel upgraded version of the KENTNA kingkeltner strategy

- Introducing the Aroon indicator

- The relative strengths and weaknesses of price-based quantitative trading strategies

- Introducing the adaptive moving average KAMA

- Implementation of Dual Thrust trading algorithms using My language on the inventor's quantification platform

- Introduction to RangeBreak Strategy

- Trading strategy based on box theory

- Trading strategies based on box theory that support commodity futures and digital currencies

- Thermometer strategies in the practice and application of inventor quantization platforms

- The strategic framework for the indicators

- 6 simple strategies and practices for beginners in quantitative digital currency trading