The hand teaches you how to write a strategy -- to translate a strategy into my language.

Author: Inventors quantify - small dreams, Created: 2019-10-21 14:59:12, Updated: 2023-10-17 21:22:56

Hands that teach you how to write strategies and transplant a my language strategy

Recently, while talking with a friend about strategies, I learned that there are many problems with the flexibility of using my language writing strategies. In many cases, it is necessary to use the standard K-line cycle provided by the non-system, for example, the most commonly requested is the use of 4 hours of K-line.LinksHowever, in my language strategy, this problem is due to my language's highly encapsulated nature, which does not allow for flexible self-processing of data.

For trend strategy porting is very simple, we can use a sample code to fill in the data computation part of the code that drives the strategy, filling in the conditions for triggering the trade signal.

Reusable example code:

For example, the strategy used for OKEX futures.

// 全局变量

var IDLE = 0

var LONG = 1

var SHORT = 2

var OPENLONG = 3

var OPENSHORT = 4

var COVERLONG = 5

var COVERSHORT = 6

var BREAK = 9

var SHOCK = 10

var _State = IDLE

var Amount = 0 // 记录持仓数量

var TradeInterval = 500 // 轮询间隔

var PriceTick = 1 // 价格一跳

var Symbol = "this_week"

function OnTick(){

// 驱动策略的行情处理部分

// 待填充...

// 交易信号触发处理部分

// 待填充...

// 执行交易逻辑

var pos = null

var price = null

var currBar = records[records.length - 1]

if(_State == OPENLONG){

pos = GetPosition(PD_LONG)

// 判断是不是 满足状态,如果满足 修改状态

if(pos[1] >= Amount){

_State = LONG

Amount = pos[1] // 更新实际量

return

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(OPENLONG, price, Amount - pos[1], pos, PriceTick) // (Type, Price, Amount, CurrPos, PriceTick)

}

if(_State == OPENSHORT){

pos = GetPosition(PD_SHORT)

if(pos[1] >= Amount){

_State = SHORT

Amount = pos[1] // 更新实际量

return

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(OPENSHORT, price, Amount - pos[1], pos, PriceTick)

}

if(_State == COVERLONG){

pos = GetPosition(PD_LONG)

if(pos[1] == 0){

_State = IDLE

return

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1], pos, PriceTick)

}

if(_State == COVERSHORT){

pos = GetPosition(PD_SHORT)

if(pos[1] == 0){

_State = IDLE

return

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1], pos, PriceTick)

}

}

// 交易逻辑部分

function GetPosition(posType) {

var positions = _C(exchange.GetPosition)

var count = 0

for(var j = 0; j < positions.length; j++){

if(positions[j].ContractType == Symbol){

count++

}

}

if(count > 1){

throw "positions error:" + JSON.stringify(positions)

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == Symbol && positions[i].Type === posType) {

return [positions[i].Price, positions[i].Amount];

}

}

Sleep(TradeInterval);

return [0, 0];

}

function CancelPendingOrders() {

while (true) {

var orders = _C(exchange.GetOrders)

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id);

Sleep(TradeInterval);

}

if (orders.length === 0) {

break;

}

}

}

function Trade(Type, Price, Amount, CurrPos, OnePriceTick){ // 处理交易

if(Type == OPENLONG || Type == OPENSHORT){ // 处理开仓

exchange.SetDirection(Type == OPENLONG ? "buy" : "sell")

var pfnOpen = Type == OPENLONG ? exchange.Buy : exchange.Sell

var idOpen = pfnOpen(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idOpen) {

exchange.CancelOrder(idOpen)

} else {

CancelPendingOrders()

}

} else if(Type == COVERLONG || Type == COVERSHORT){ // 处理平仓

exchange.SetDirection(Type == COVERLONG ? "closebuy" : "closesell")

var pfnCover = Type == COVERLONG ? exchange.Sell : exchange.Buy

var idCover = pfnCover(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idCover){

exchange.CancelOrder(idCover)

} else {

CancelPendingOrders()

}

} else {

throw "Type error:" + Type

}

}

function main() {

// 设置合约

exchange.SetContractType(Symbol)

while(1){

OnTick()

Sleep(1000)

}

}

Example: Transplantation of the double equation strategy

I'm not going to say anything about it.

This is the code of the Ma language strategy:

MA5^^MA(C,5);

MA15^^MA(C,15);

CROSSUP(MA5,MA15),BPK;

CROSSDOWN(MA5,MA15),SPK;

Porting to JavaScript policy

The first step is to fill in the Market Acquisition, Indicator Calculation section of the reusable sample code:

// 驱动策略的行情处理部分

var records = _C(exchange.GetRecords)

if (records.length < 15) {

return

}

var ma5 = TA.MA(records, 5)

var ma15 = TA.MA(records, 15)

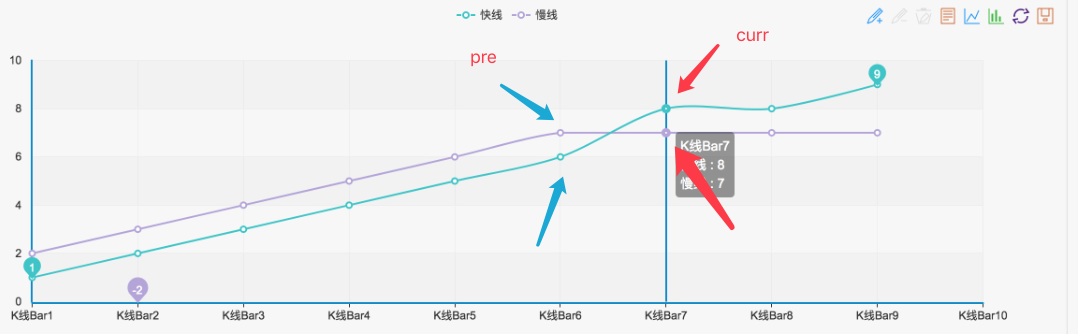

var ma5_pre = ma5[ma5.length - 3]

var ma15_pre = ma15[ma15.length - 3]

var ma5_curr = ma5[ma5.length - 2]

var ma15_curr = ma15[ma15.length - 2]

So you can see that the two-square strategy is very simple, just get the data from the k-line first.records, and then useTA函数库The uniform line functionTA.MACalculate the 5-day mean line, 15-day mean line (as you can see on the retest interface, the K-line cycle is set to the daily K-line, soTA.MA(records, 5)This is the average of five days.TA.MA(records, 15)This is the 15th day of the lunar calendar.

And then you getma5The second decimal point of the indicator datama5_curr(indicator value), the third decimal pointma5_pre(Indicator value)ma15The indicator data is symmetrical. The indicator data can then be used to judge the gold forks, as shown below: If this is the case, then it is a definite golden fork death fork.

If this is the case, then it is a definite golden fork death fork.

If you have a message that you want to send to the other person, then the part of the message that you want to send to the other person is:

if(_State == IDLE && ma5_pre < ma15_pre && ma5_curr > ma15_curr){

_State = OPENLONG

Amount = 1

}

if(_State == IDLE && ma5_pre > ma15_pre && ma5_curr < ma15_curr){

_State = OPENSHORT

Amount = 1

}

if(_State == LONG && ma5_pre > ma15_pre && ma5_curr < ma15_curr){

_State = COVERLONG

Amount = 1

}

if(_State == SHORT && ma5_pre < ma15_pre && ma5_curr > ma15_curr){

_State = COVERSHORT

Amount = 1

}

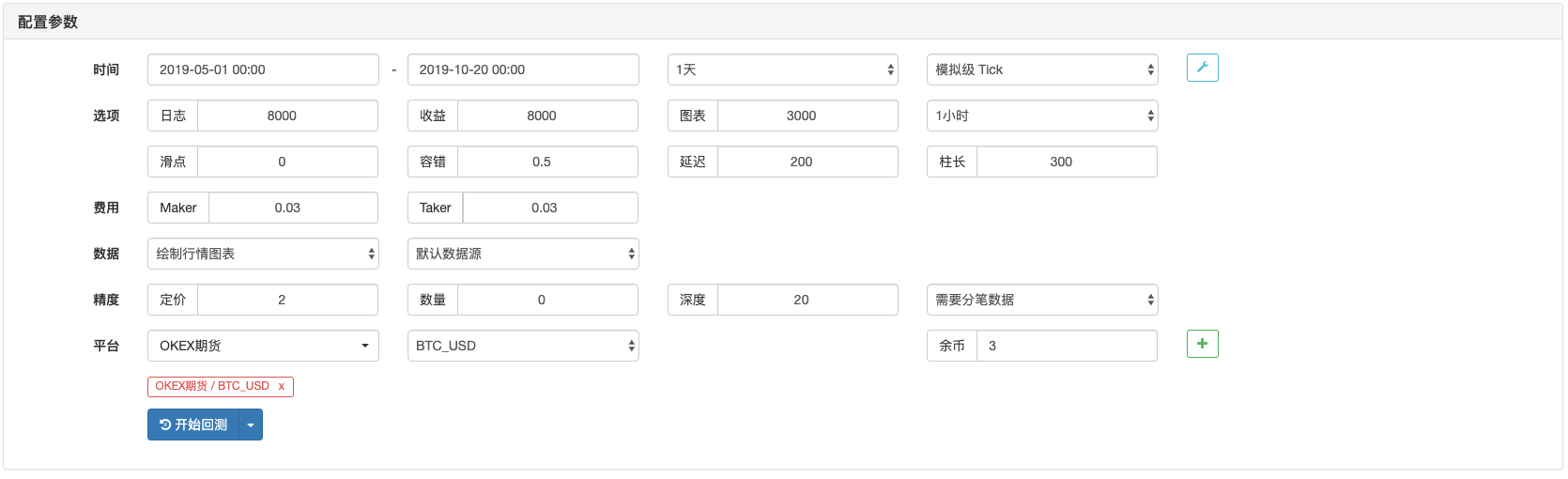

The transplant is OK, so you can go back and test:

Re-testing the JavaScript policy

Re-test the configuration:

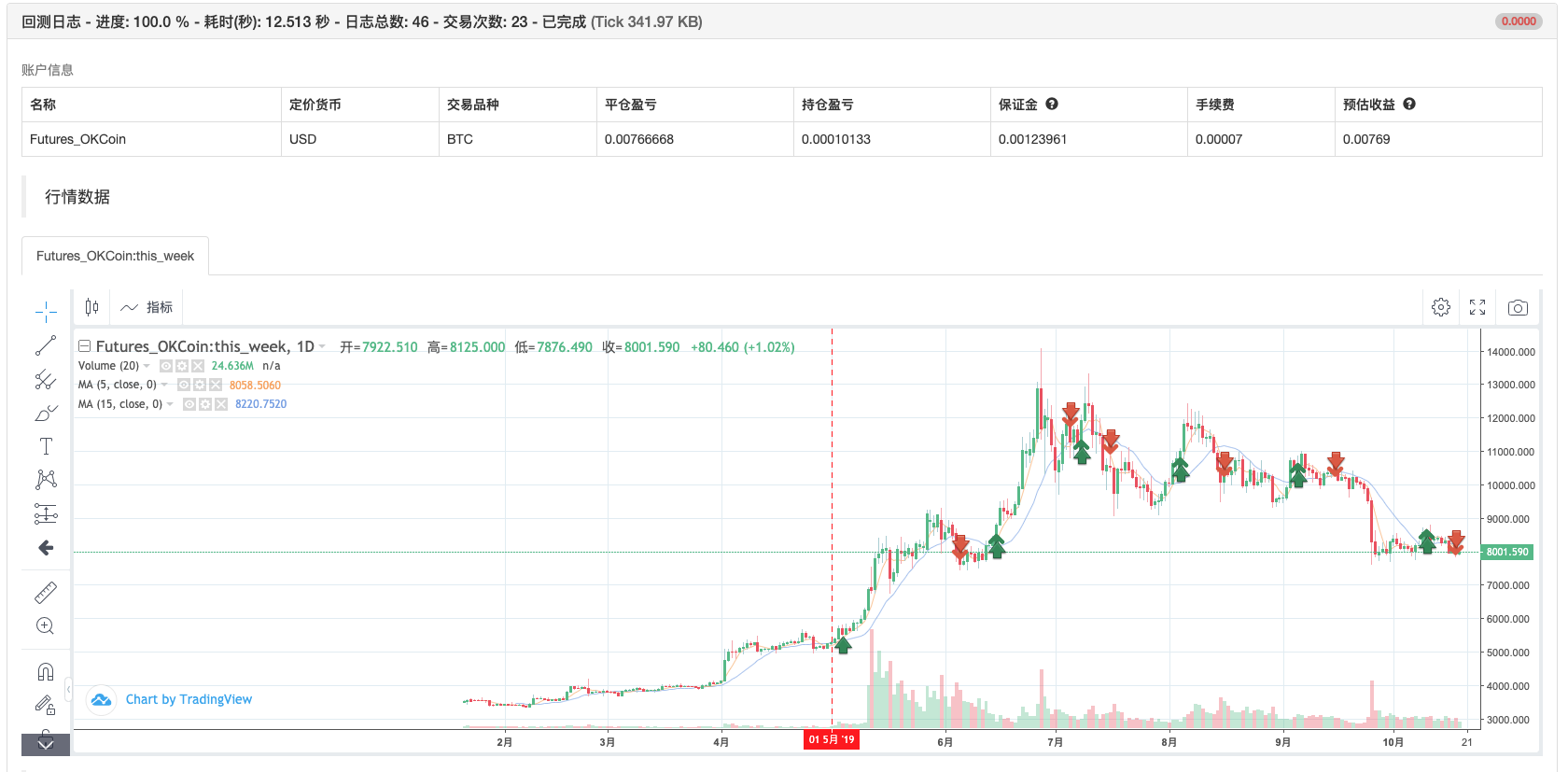

回测结果:

My language retest

The results of the retest are basically the same, so this is possible if you want to continue adding interactive features to the policy, adding data processing (e.g. K-line synthesis), adding custom graphic displays.

Students who are interested can try it.

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- Inventors quantify new functionality: Easily create HTTP services using the _Serve function

- FMZ Quant Trading Platform Custom Protocol Access Guide

- FMZ Funding Rate Acquisition and Monitoring Strategy

- FMZ funding rate acquisition and monitoring strategies

- A Strategy Template Allows You to Use WebSocket Market Seamlessly

- A policy template that allows you to use WebSocket seamlessly

- Inventors Quantified Exchange Platforms General Protocol Access Guide

- How to Build a Universal Multi-Currency Trading Strategy Quickly after FMZ Upgrade

- How to quickly build a universal multi-currency trading strategy after FMZ upgrade

- DCA Trading: A Widely Used Quantitative Strategy

- Modified Deribit futures API to accommodate options quantitative trading

- Use research environments to analyze the impact of triangular hedging details and royalty on hedgeable price differentials

- Introducing FMZ Quant data science research environment

The Little PrinceLearning