Balancing strategy and grid strategy explained

Author: The grass, Created: 2020-07-23 11:12:04, Updated: 2024-12-10 10:08:19

If the price of Bitcoin in the future is the same as it is now, what strategy will you take to get a return? The easy way to think about it is to sell quickly, fall and buy, and then wait for the price to recover, to take advantage of the intermediate difference.

The strategy is simple.

The principle of the balancing strategy is simple: the strategy holds only a fixed proportion of coins, such as 50%, and sells when the value of the coin is more than 50%, and buys, and the value of the coin held is always maintained around 50%. If the price of the coin continues to rise, it continues to sell, but always holds a certain coin that will not be sold. If the price of the coin rises first and then falls back to the starting price, the strategy increases both the coin and the money because of the high selling price.

The grid strategy is a fixed price buy and sell strategy, which can set up multiple sets of buy and sell ranges, such as 8000-8500, 8500-9000. The strategy will buy 0.1 coin at 8000 yuan, sell 0.1 coin at 8500, continue to rise to 9000 sell 0.1 coin, fall to 8500 and buy 0.1 coin. Note that the net only deals at one end of the range, the price of the other end will hang.

The two strategies are very similar, but also very different. The balance strategy always has a money buy and sell, the grid strategy has a certain range, if it exceeds the range, it may not be possible to continue buying, or it may have sold all the coins.

How to Measure Benefits

Before re-evaluating a strategy, we need to first establish a criterion for evaluating returns. Most people think of returns as absolute returns, i.e. returns = current total capital - initial total capital. But this method does not reflect the returns of the strategy's active actions if the initial coin is held.

For example, if the initial account has a balance of 10,000 yuan, 1 coin, a coin price of 8,000, total capital = 10,000 + 1 * 8000 = 18000 yuan. After running the strategy for a while, the current account balance is 2000 u, 2 coins, coin price 9000, total capital = 2000 + 2 * 9000 = 20,000 yuan. Absolute income = 20,000-18000 = 2000 yuan. But if the initial account has already held a coin, even if the strategy is not running, there is also a final income of 1,000, so the income from the strategy is only 1,000 yuan. This method of calculation is floating income, floating income = current balance + current currency * current price - initial balance + initial coin * current price).

In the next section, we'll look at the results of retesting these two strategies.

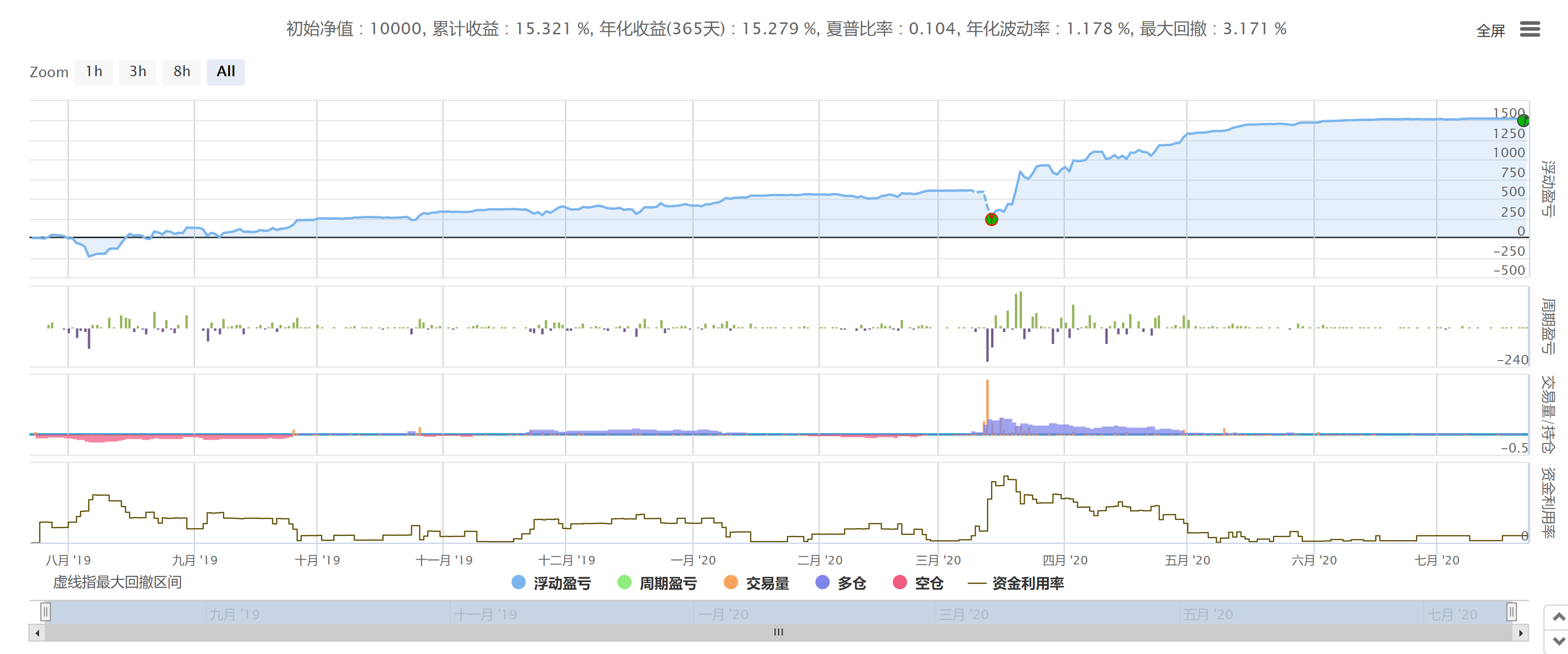

Reassessment of the balancing strategy

A balancing strategy requires two parameters, a holding value ratio and an adjustment ratio. The holding value is set to 0.5, i.e. holding half the money and half the coin, and the adjustment ratio is set to 0.01, i.e. selling 1% of the coin when the value ratio caused by the coin's rise in price exceeds 51%, falling the same.

The results of the tests:

The profit curve:

As the price of Bitcoin has been fluctuating over the past year, the strategy has made steady gains.

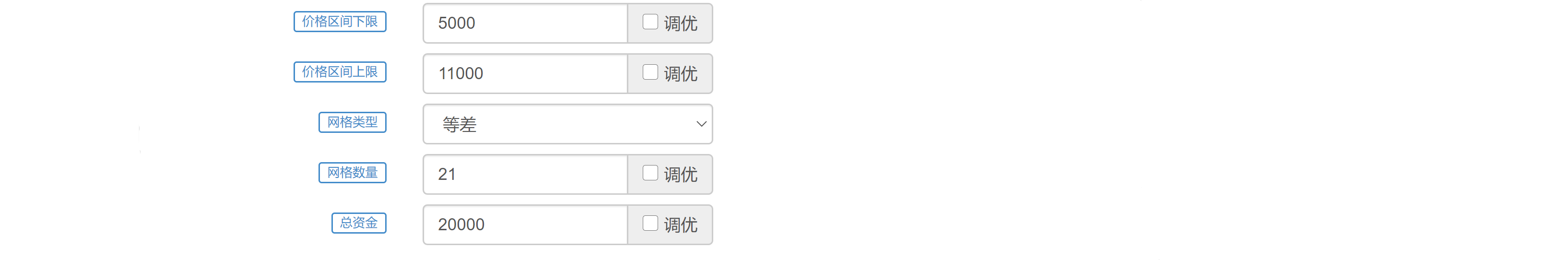

Retesting of grid policy

The parameters required for the grid strategy are relatively complex, requiring setting the upper limit of the grid, the type of grid, the number of grids, the investment funds, etc. The parameters are as follows: The results of the tests:

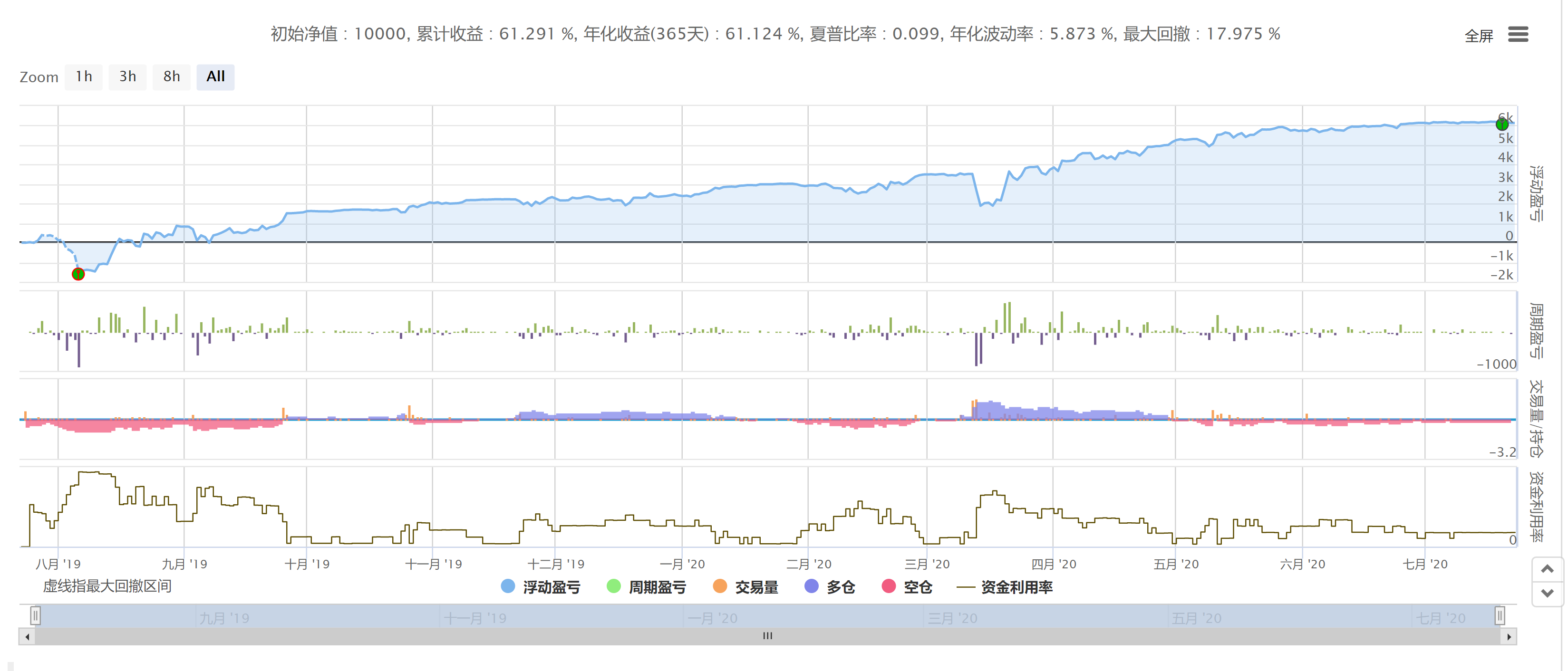

The results of the tests: The profit curve:

The profit curve:

Comparing the two strategies

从浮动收益图上来看,两种策略结果比较类似,在比特币价格长期横盘的情况下,都获得了稳定的收益,也都在同时出现了回撤。毕竟策略原理很接近,都是涨了卖跌了买。由于参数不同,两种策略很难直接比较。从收益/交易额这个指标来看,网格策略为18.6,平衡策略为22.7。平衡策略的表现更高效一些。

However, balancing strategies are deadlocked, in order to increase the trading volume, in addition to more frequent adjustments, only increase the total capital input. The grid strategy is more demanding on the setup, if you choose a very small upper limit of price fluctuations, then each grid will have a large amount of funds, the volume of transactions will be enlarged, if the price remains in the range, the returns will be high, and of course also face the danger of the price exceeding the set range.

For beginners, it is highly recommended to use a balanced strategy, simple to operate, only need to set a holding proportion of parameters, can run without brains. A certain experience can choose the grid strategy, decide the upper and lower limits of the fluctuating funds per grid, improve the utilization of funds, seeking the maximum return.

Balancing strategies can be chosen to balance multiple currencies at the same time, grid strategies also have many variations, such as parallel grids, infinite grids, etc.

Policy source code

There are a lot of open platforms for balancing strategies, and I recently wrote a new version, with simple, easy-to-understand parameters.https://www.fmz.com/strategy/214943Of course, there are other balancing strategies on the platform:https://www.fmz.com/square/s:tag:平衡/1This version of the Zero Tower is also recommended here:https://www.fmz.com/strategy/345

It's not just that there's a lot of publicity on the Net Strategy platform.https://www.fmz.com/square/s:tag:网格/1This version of this article will not be published for the time being, and I recommend the teaching version of this article:https://www.fmz.com/strategy/113144 。

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- Digital currency options strategy back to basics

- TradingViewWebHook alarm directly connected to FMZ robot

- Add an alarm clock to the trading strategy

- OKEX futures contract hedging strategy by using C++

- Trading strategy based on the active flow of funds

- Use trading terminal plug-in to facilitate manual trading

- Quantitative typing rate trading strategy

- Balance strategy and grid strategy

- Multi-robot market quotes sharing solution

- Robot WeChat message push implementation scheme

- Graphical Martingale Trading Strategy

- Python version iceberg commission strategy

- The Logic of Crypto Currency Futures Trading

- Bottom shape ZDZB strategy

- Multi-robot market sharing solutions

- Bitcoin volatility modeling and analysis based on the ARMA-EGARCH model

- Solution of numerical calculation accuracy problem in JavaScript strategy design

- Teach you to encapsulate a Python strategy into a local file

- FMEX trading unlocks the optimal order volume optimization Part 2

- FMEX trading unlocks the optimal order volume optimization

948794480The collection

The grass /upload/asset/24fdcbcd8399fedd169.png

Lieutenant Jaya.Is there an automatic stop?

maxgeBoth of these strategies are afraid of one-sidedness, i.e. the timing of the entry must be accurate, high and low prices are difficult to judge, in fact the median is also difficult to judge.

excmA balancing strategy is a strategy with low risk, but very low capital utilization, which can be up to 1-2 times the leverage.

barryzhangAre you renting or selling?

High suction low throwThe mainstream currency is balanced, and it is not possible to imitate the trend without using money and coins.

The grassYes, so it needs to run for a long time, leave a footprint.

The grassThis is one way.

The grassCustomized strategies, but consistent principles and publicity