Python version iceberg commission strategy

0

0

1332

1332

This article brings two classic strategies for transplantation: Iceberg commission (buy/sell). The strategy is transplanted from the Iceberg commission JavaScript version of the FMZ platform. The strategy address is https://www.fmz.com/square/s:Iceberg/1

Quoting JavaScript version of Iceberg commission trading strategy introduction:

Iceberg commission refers to the fact that when investors conduct large-value transactions, in order to avoid excessive impact on the market, the large order commission is automatically split into multiple commissions, based on the current latest buy 1/sell 1 price and the price set by the trader. The strategy automatically commissions a small order. When the last commission is completely transacted or the latest price deviates significantly from the current commission price, the commission operation is automatically restarted.

Many exchange trading pages come with iceberg commissioning tools, which have rich functions, but if you want to customize some functions or modify some functions according to your own needs, you need a more flexible tool. The FMZ platform is designed to solve this problem correctly. Our strategy square hasn’t got too many Python trading strategies. Some traders who want to use Python language to write trading tools and strategies need to refer to examples. Therefore, the classic iceberg commissioning strategy was ported to the Python version.

Iceberg Commission for Python - Buying

import random # Import random number library

def CancelPendingOrders(): # The function of CancelPendingOrders is to cancel all pending orders of the current transaction.

while True: # Loop detection, call GetOrders function to detect the current pending order, if orders is an empty array, that is, len(orders) is equal to 0, indicating that all orders have been cancelled, you can exit the function and call return to exit.

orders = _C(exchange.GetOrders)

if len(orders) == 0 :

return

for j in range(len(orders)): # Traverse the current array of pending orders, and call CancelOrder to cancel the orders one by one.

exchange.CancelOrder(orders[j]["Id"])

if j < len(orders) - 1: # Except for the last order, execute Sleep every time and let the program wait for a while to avoid canceling orders too frequently.

Sleep(Interval)

LastBuyPrice = 0 # Set a global variable to record the the latest buying price.

InitAccount = None # Set a global variable to record the initial account asset information.

def dispatch(): # Main functions of iceberg commission logic

global InitAccount, LastBuyPrice # Reference global variables

account = None # Declare a variable to record the account information obtained in real time for comparison calculation.

ticker = _C(exchange.GetTicker) # Declare a variable to record the latest market quotes.

LogStatus(_D(), "ticker:", ticker) # Output time and latest quotation in the status bar

if LastBuyPrice > 0: # When LastBuyPrice is greater than 0, that is, when the commission has started, the code in the if condition is executed.

if len(_C(exchange.GetOrders)) > 0: # Call the exchange.GetOrders function to get all current pending orders, determine that there are pending orders, and execute the code in the if condition.

if ticker["Last"] > LastBuyPrice and ((ticker["Last"] - LastBuyPrice) / LastBuyPrice) > (2 * (EntrustDepth / 100)): # Detect the degree of deviation, if the condition is triggered, execute the code in the if, and cancel the order.

Log("Too much deviation, the latest transaction price:", ticker["Last"], "Commission price", LastBuyPrice)

CancelPendingOrders()

else :

return True

else : # If there is no pending order, it proves that the order is completely filled.

account = _C(exchange.GetAccount) # Get current account asset information.

Log("The buying order is completed, the cumulative cost:", _N(InitAccount["Balance"] - account["Balance"]), "Average buying price:", _N((InitAccount["Balance"] - account["Balance"]) / (account["Stocks"] - InitAccount["Stocks"]))) # Print transaction information.

LastBuyPrice = 0 # Reset LastBuyPrice to 0

BuyPrice = _N(ticker["Buy"] * (1 - EntrustDepth / 100)) # Calculate the price of pending orders based on current market conditions and parameters.

if BuyPrice > MaxBuyPrice: # Determine whether the maximum price set by the parameter is exceeded

return True

if not account: # If account is null, execute the code in the if statement to retrieve the current asset information and copy it to account

account = _C(exchange.GetAccount)

if (InitAccount["Balance"] - account["Balance"]) >= TotalBuyNet: # Determine whether the total amount of money spent on buying exceeds the parameter setting.

return False

RandomAvgBuyOnce = (AvgBuyOnce * ((100.0 - FloatPoint) / 100.0)) + (((FloatPoint * 2) / 100.0) * AvgBuyOnce * random.random()) # random number 0~1

UsedMoney = min(account["Balance"], RandomAvgBuyOnce, TotalBuyNet - (InitAccount["Balance"] - account["Balance"]))

BuyAmount = _N(UsedMoney / BuyPrice) # Calculate the buying quantity

if BuyAmount < MinStock: # Determine whether the buying quantity is less than the minimum buying quantity limit on the parameter.

return False

LastBuyPrice = BuyPrice # Record the price of this order and assign it to LastBuyPrice

exchange.Buy(BuyPrice, BuyAmount, "spend:¥", _N(UsedMoney), "Last transaction price", ticker["Last"]) # Place orders

return True

def main():

global LoopInterval, InitAccount # Refer to LoopInterval, InitAccount global variables

CancelPendingOrders() # Cancel all pending orders when starting to run

InitAccount = _C(exchange.GetAccount) # Account assets at the beginning of the initial record

Log(InitAccount) # Print initial account information

if InitAccount["Balance"] < TotalBuyNet: # If the initial assets are insufficient, an error will be thrown and the program will stop

raise Exception("Insufficient account balance")

LoopInterval = max(LoopInterval, 1) # Set LoopInterval to at least 1

while dispatch(): # The main loop, the iceberg commission logic function dispatch is called continuously, and the loop stops when the dispatch function returns false.

Sleep(LoopInterval * 1000) # Pause each cycle to control the polling frequency.

Log("委托全部完成", _C(exchange.GetAccount)) # When the loop execution jumps out, the current account asset information is printed.

Iceberg Commission for Python - Selling

The strategy logic is the same as that of buying, with only a slight difference.

import random

def CancelPendingOrders():

while True:

orders = _C(exchange.GetOrders)

if len(orders) == 0:

return

for j in range(len(orders)):

exchange.CancelOrder(orders[j]["Id"])

if j < len(orders) - 1:

Sleep(Interval)

LastSellPrice = 0

InitAccount = None

def dispatch():

global LastSellPrice, InitAccount

account = None

ticker = _C(exchange.GetTicker)

LogStatus(_D(), "ticker:", ticker)

if LastSellPrice > 0:

if len(_C(exchange.GetOrders)) > 0:

if ticker["Last"] < LastSellPrice and ((LastSellPrice - ticker["Last"]) / ticker["Last"]) > (2 * (EntrustDepth / 100)):

Log("Too much deviation, the latest transaction price:", ticker["Last"], "Commission price", LastSellPrice)

CancelPendingOrders()

else :

return True

else :

account = _C(exchange.GetAccount)

Log("The buy order is completed, and the accumulated selling:", _N(InitAccount["Stocks"] - account["Stocks"]), "Average selling price:", _N((account["Balance"] - InitAccount["Balance"]) / (InitAccount["Stocks"] - account["Stocks"])))

LastSellPrice = 0

SellPrice = _N(ticker["Sell"] * (1 + EntrustDepth / 100))

if SellPrice < MinSellPrice:

return True

if not account:

account = _C(exchange.GetAccount)

if (InitAccount["Stocks"] - account["Stocks"]) >= TotalSellStocks:

return False

RandomAvgSellOnce = (AvgSellOnce * ((100.0 - FloatPoint) / 100.0)) + (((FloatPoint * 2) / 100.0) * AvgSellOnce * random.random())

SellAmount = min(TotalSellStocks - (InitAccount["Stocks"] - account["Stocks"]), RandomAvgSellOnce)

if SellAmount < MinStock:

return False

LastSellPrice = SellPrice

exchange.Sell(SellPrice, SellAmount, "Last transaction price", ticker["Last"])

return True

def main():

global InitAccount, LoopInterval

CancelPendingOrders()

InitAccount = _C(exchange.GetAccount)

Log(InitAccount)

if InitAccount["Stocks"] < TotalSellStocks:

raise Exception("Insufficient account currency")

LoopInterval = max(LoopInterval, 1)

while dispatch():

Sleep(LoopInterval)

Log("All commissioned", _C(exchange.GetAccount))

Strategy operation

Use WexApp to simulate exchange test:

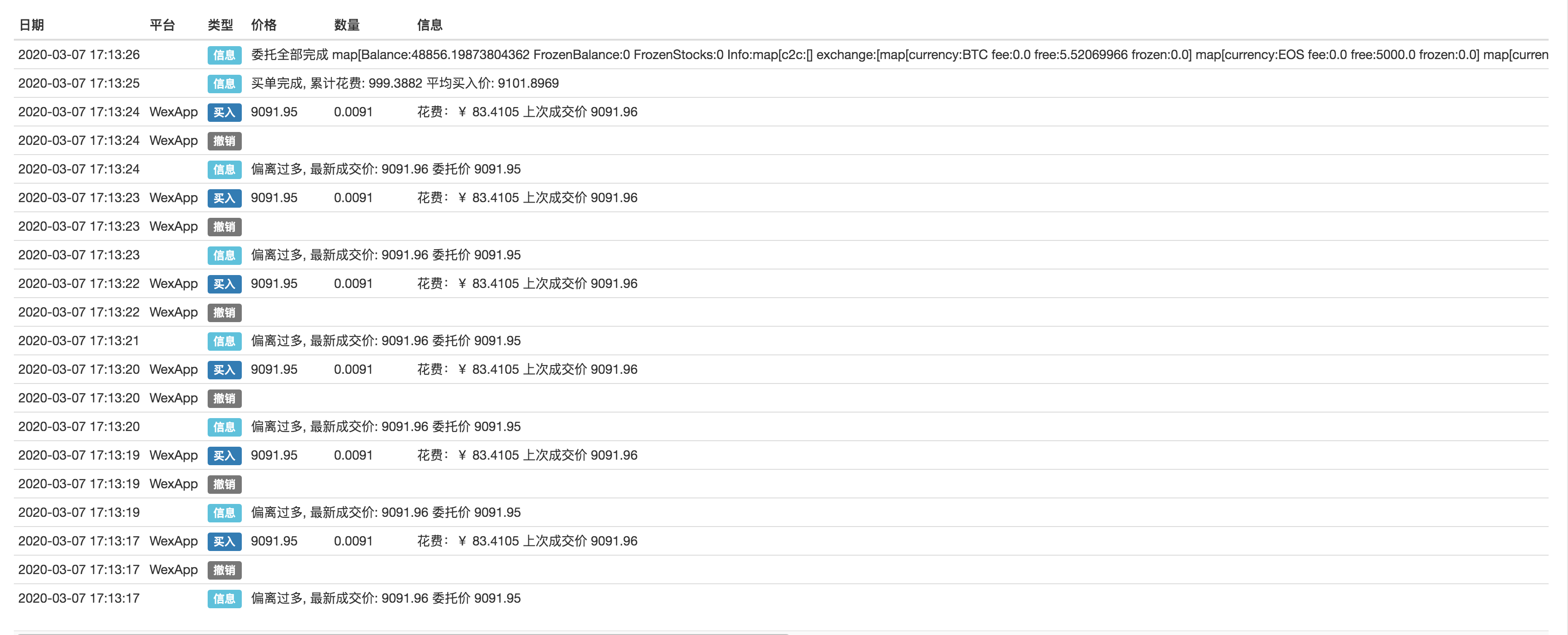

Buying:

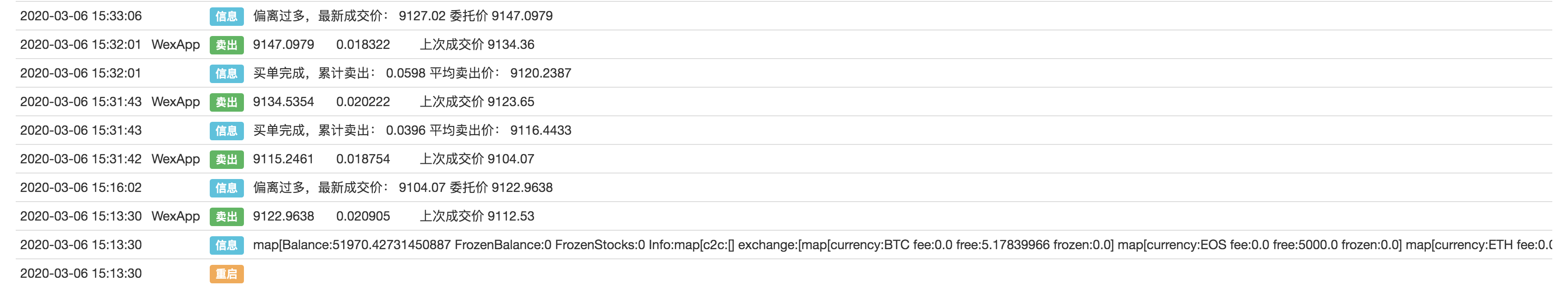

Selling:

The strategy logic is not complicated. When the strategy is executed, it will dynamically place and cancel orders based on the strategy parameters and the current market price. When the transaction amount/coin number reaches or approaches the parameter setting number, the strategy stops. The strategy code is very simple and suitable for beginners. Interested readers can modify it and design a strategy that suits their trading style.

- Add an alarm clock to the trading strategy

- OKEX futures contract hedging strategy by using C++

- Trading strategy based on the active flow of funds

- Use trading terminal plug-in to facilitate manual trading

- Quantitative typing rate trading strategy

- Balance strategy and grid strategy

- Multi-robot market quotes sharing solution

- Robot WeChat message push implementation scheme

- 平衡策略与网格策略详解

- Graphical Martingale Trading Strategy

- The Logic of Crypto Currency Futures Trading

- Bottom shape ZDZB strategy

- 多机器人行情共享解决方案

- 基于ARMA-EGARCH模型的比特币波动率建模和分析

- Solution of numerical calculation accuracy problem in JavaScript strategy design

- Teach you to encapsulate a Python strategy into a local file

- FMEX trading unlocks the optimal order volume optimization Part 2

- FMEX trading unlocks the optimal order volume optimization

- Analysis and Realization of Commodity Futures Volume Footprint Chart

- FMEX排序解锁最优下单量优化