Multi-exchange spot price differential strategy logical sharing

Author: @cqz, Created: 2022-06-27 21:26:27, Updated: 2024-12-02 21:35:44

The Principles of Strategy

Due to liquidity reasons, large price fluctuations will inevitably occur when a large market is triggered, and instantaneous price differences will form between exchanges. The strategy is to capture these moments by executing quick trades to complete the process of low buy-overs. I've had clients ask me why I'm buying so many exchanges, and it's inevitable that we're buying the instantaneous price difference between exchanges, and the more exchanges there are, the greater the opportunity for price differences after crossing.

The core logic of the strategy

- To simultaneously access transaction information from multiple exchanges, you must access it simultaneously, reducing the transaction delay, and you can access the plug-in tools I shared.Plugins for multiple exchanges

- Combine the ask and bids of all the exchanges to get a combined bid information, where RealPrice is the price after the transaction fee is deducted.

function createOrders(depths, askOrders, bidOrders) {

let asksIndex = 0;

let bidIndex = 0;

for (let i = 0; i < depths.length; i++) {

let exchangeTariff = getExchangeTariff(i);

let asks = depths[i].Asks;

let bids = depths[i].Bids;

for (let j = 0; j < Math.min(asks.length, bids.length, 20); j++) {

if (asks[j].Amount >= minTakerAmount) {

askOrders[asksIndex] = {

"Price": asks[j].Price,

"Amount": asks[j].Amount,

"Fee": asks[j].Price * exchangeTariff,

"RealPrice": asks[j].Price * (1 + exchangeTariff),

"Index": i,

};

asksIndex++;

}

if (bids[j].Amount >= minTakerAmount) {

bidOrders[bidIndex] = {

"Price": bids[j].Price,

"Amount": bids[j].Amount,

"Fee": bids[j].Price * exchangeTariff,

"RealPrice": bids[j].Price * (1 - exchangeTariff),

"Index": i,

};

bidIndex++;

}

}

}

askOrders.sort(function (a, b) {

return a.RealPrice - b.RealPrice;

});

bidOrders.sort(function (a, b) {

return b.RealPrice - a.RealPrice;

});

}

- From the combined transaction information, the highest bid spread is calculated. Since we are bidding, we buy from the lowest ask price and sell from the highest bid, as long as bid.RealPrice > ask.RealPrice means there is profit margin.

function getArbitrageOrders(askOrders, bidOrders) {

let ret = [];

for (let i = 0; i < askOrders.length; i++) {

for (let j = 0; j < bidOrders.length; j++) {

let bidOrder = bidOrders[j];

let askOrder = askOrders[i];

if (bidOrder.Index === askOrder.Index) {

continue

}

let minMigrateDiffPrice = ((askOrder.Price + bidOrder.Price) / 2 * minMigrateDiffPricePercent / 100);

if (bidOrder.RealPrice - askOrder.RealPrice > minMigrateDiffPrice) {

ret.push({

"Ask": askOrder,

"Bid": bidOrder,

})

}

}

}

if (ret.length === 0) {

ret.push({

"Ask": askOrders[0],

"Bid": bidOrders[0],

});

}

//按最优价差排序

ret.sort((a, b) => {

return (b.Bid.RealPrice - b.Ask.RealPrice) - (a.Bid.RealPrice - a.Ask.RealPrice);

});

return ret;

}

- Here we have some information on the market's available interest rate differential, how to choose whether to execute the transaction and how many minor transactions to make, here are some judgments:

- Current remaining assets

- The size of the price difference (too small to balance the number of currencies, too large to maximize the number of transactions)

- The number of invoices pending

var askOrder = arbitrageOrder.Ask;

var bidOrder = arbitrageOrder.Bid;

var perAmountFee = arbitrageOrder.Ask.Fee + arbitrageOrder.Bid.Fee;

var minRealDiffPrice = (askOrder.Price + bidOrder.Price) / 2 * minDiffPricePercent / 100;

var minMigrateDiffPrice = ((askOrder.Price + bidOrder.Price) / 2 * minMigrateDiffPricePercent / 100);

var curRealDiffPrice = arbitrageOrder.Bid.RealPrice - arbitrageOrder.Ask.RealPrice;

var buyExchange = exchanges[arbitrageOrder.Ask.Index];

var sellExchange = exchanges[arbitrageOrder.Bid.Index];

var buySellAmount = 0;

if (curRealDiffPrice > minRealDiffPrice) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price

);

} else if (bidOrder.Index !== askOrder.Index) {

if (migrateCoinEx == -1) {

if (curRealDiffPrice > minMigrateDiffPrice && runningInfo.Accounts[bidOrder.Index].CurStocks - runningInfo.Accounts[askOrder.Index].CurStocks > maxAmountDeviation) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price,

runningInfo.Accounts[bidOrder.Index].CurStocks - ((runningInfo.Accounts[bidOrder.Index].CurStocks + runningInfo.Accounts[askOrder.Index].CurStocks) / 2)

);

if (buySellAmount >= minTakerAmount) {

Log("启动交易所平衡!");

}

}

} else if (migrateCoinEx == askOrder.Index) {

if (curRealDiffPrice > minMigrateDiffPrice && runningInfo.Accounts[bidOrder.Index].CurStocks > 0) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price

);

if (buySellAmount >= minTakerAmount) {

Log("启动货币迁移:", exchanges[bidOrder.Index].GetName(), "-->", exchanges[askOrder.Index].GetName());

}

}

}

}

- Calculates the number of orders to be executed, the strategy is to order simultaneously using the direct swipe point method.

var buyWait = buyExchange.Go("Buy", _N(askOrder.Price * (1.01), pricePrecision), buySellAmount);

var sellWait = sellExchange.Go("Sell", _N(bidOrder.Price * (0.99), pricePrecision), buySellAmount);

var startWaitTime = new Date().getTime()

Sleep(3000);

var buyOrder = buyWait.wait()

var sellOrder = sellWait.wait()

- The rest is the logic of calculating the profit, dealing with failed orders and stopping losses.

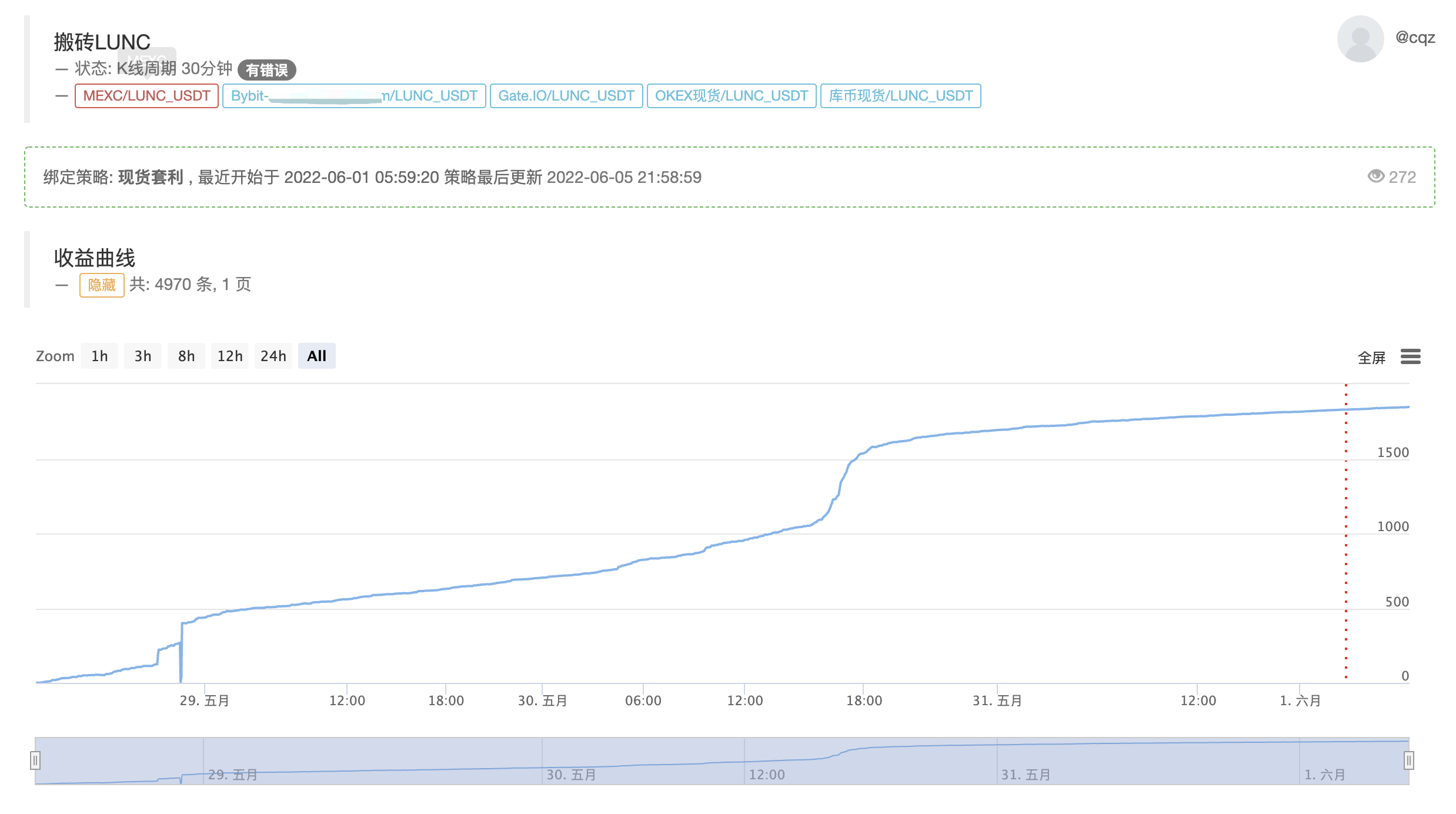

The real benefits of this strategy

Currently, the real-time demonstration shows that the core logic remains unchanged and optimizes support for multi-currency

https://www.fmz.com/robot/464965

Finally, welcome to the old-autumn exchange:https://t.me/laoqiu_arbitrage

- Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

- DEX exchange quantitative practices ((2) -- Hyperliquid user guide

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (4)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (3)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (2)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (1)

- Cryptocurrency spot hedging strategy design(2)

- An example of general protocol contract access on FMZ

- Multi-Exchange Spot Spread Arbitrage Strategy Logic Sharing

- Visualization module to build trading strategies - in-depth

- Use the KLineChart function to make strategy drawing design easier

- Use the KlineChart function to simplify strategy chart design

- JavaScript strategy backtesting is debugged in DevTools of Chrome browser

- JavaScript policy retrieval in the Chrome browser by DevTools debugging

- Visualizing modules to build trading strategies - in depth

- Sustainable balancing strategies for bear markets

- If you haven't written a strategy yet with Pine, which is so easy to learn, then I...

- Detailed Explanation of Equilibrium & Grid Strategies

- It's about a beauty - how to design simple and effective strategies.

- The digital currency market has a new strategy for robbing coins (Teaching)

- Design a Multiple-Chart Plotting Library

- Designing a multigraph line library

ianzeng123Hi, how is the minTakerAmount parameter set?

The bride too.I'm afraid that the small exchange will run out of money.

JohnnyThank you.

h503059288I'm not going to say anything about it.