Multi-Exchange Spot Spread Arbitrage Strategy Logic Sharing

Author: Inventors quantify - small dreams, Created: 2022-07-12 17:20:06, Updated: 2024-12-02 21:43:21

Principles of strategy

Due to liquidity reasons, when there is a large amount of smashing and pulling in the market, there will inevitably be large price fluctuations, and an instantaneous price difference will be formed between exchanges, and the strategy is to capture these moments in which quick trades are executed to complete the process of buying low and selling high. Some clients asked me why I have to get so many exchanges. This is inevitable. What we earn is the instantaneous price difference between exchanges. The more exchanges, the more opportunities for the price difference formed after the crossover.

Core logic of strategy

- To obtain multi-exchange market information concurrently, it must be obtained concurrently to reduce the delay of the obtained market. For concurrent acquisition, please refer to the tool plug-in I shared Multi-Exchange Concurrent Plug-in

- Combine the ask and bid of all exchange orders to get a combined order information, where RealPrice is the price after deducting the handling fee,

function createOrders(depths, askOrders, bidOrders) {

let asksIndex = 0;

let bidIndex = 0;

for (let i = 0; i < depths.length; i++) {

let exchangeTariff = getExchangeTariff(i);

let asks = depths[i].Asks;

let bids = depths[i].Bids;

for (let j = 0; j < Math.min(asks.length, bids.length, 20); j++) {

if (asks[j].Amount >= minTakerAmount) {

askOrders[asksIndex] = {

"Price": asks[j].Price,

"Amount": asks[j].Amount,

"Fee": asks[j].Price * exchangeTariff,

"RealPrice": asks[j].Price * (1 + exchangeTariff),

"Index": i,

};

asksIndex++;

}

if (bids[j].Amount >= minTakerAmount) {

bidOrders[bidIndex] = {

"Price": bids[j].Price,

"Amount": bids[j].Amount,

"Fee": bids[j].Price * exchangeTariff,

"RealPrice": bids[j].Price * (1 - exchangeTariff),

"Index": i,

};

bidIndex++;

}

}

}

askOrders.sort(function (a, b) {

return a.RealPrice - b.RealPrice;

});

bidOrders.sort(function (a, b) {

return b.RealPrice - a.RealPrice;

});

}

- Calculate the best arbitrage spread from the combined market information. Since we are taking the order, that is, buying from the lowest price ask and selling from the highest price bid, as long as bid.RealPrice > ask.RealPrice, there is room for profit

function getArbitrageOrders(askOrders, bidOrders) {

let ret = [];

for (let i = 0; i < askOrders.length; i++) {

for (let j = 0; j < bidOrders.length; j++) {

let bidOrder = bidOrders[j];

let askOrder = askOrders[i];

if (bidOrder.Index === askOrder.Index) {

continue

}

let minMigrateDiffPrice = ((askOrder.Price + bidOrder.Price) / 2 * minMigrateDiffPricePercent / 100);

if (bidOrder.RealPrice - askOrder.RealPrice > minMigrateDiffPrice) {

ret.push({

"Ask": askOrder,

"Bid": bidOrder,

})

}

}

}

if (ret.length === 0) {

ret.push({

"Ask": askOrders[0],

"Bid": bidOrders[0],

});

}

//Sort by best spread

ret.sort((a, b) => {

return (b.Bid.RealPrice - b.Ask.RealPrice) - (a.Bid.RealPrice - a.Ask.RealPrice);

});

return ret;

}

- At this point, we have obtained the information on the arbitrage spread in the market, so there are several points of judgment on how to choose whether to execute a trade and how much to trade:

- Current remaining assets

- The size of spread (if the spread is too small, only the amount of currency will be balanced, and if the spread is large enough, the number of trade will be maximized)

- The number of pending orders

var askOrder = arbitrageOrder.Ask;

var bidOrder = arbitrageOrder.Bid;

var perAmountFee = arbitrageOrder.Ask.Fee + arbitrageOrder.Bid.Fee;

var minRealDiffPrice = (askOrder.Price + bidOrder.Price) / 2 * minDiffPricePercent / 100;

var minMigrateDiffPrice = ((askOrder.Price + bidOrder.Price) / 2 * minMigrateDiffPricePercent / 100);

var curRealDiffPrice = arbitrageOrder.Bid.RealPrice - arbitrageOrder.Ask.RealPrice;

var buyExchange = exchanges[arbitrageOrder.Ask.Index];

var sellExchange = exchanges[arbitrageOrder.Bid.Index];

var buySellAmount = 0;

if (curRealDiffPrice > minRealDiffPrice) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price

);

} else if (bidOrder.Index !== askOrder.Index) {

if (migrateCoinEx == -1) {

if (curRealDiffPrice > minMigrateDiffPrice && runningInfo.Accounts[bidOrder.Index].CurStocks - runningInfo.Accounts[askOrder.Index].CurStocks > maxAmountDeviation) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price,

runningInfo.Accounts[bidOrder.Index].CurStocks - ((runningInfo.Accounts[bidOrder.Index].CurStocks + runningInfo.Accounts[askOrder.Index].CurStocks) / 2)

);

if (buySellAmount >= minTakerAmount) {

Log("Start exchange balancing!");

}

}

} else if (migrateCoinEx == askOrder.Index) {

if (curRealDiffPrice > minMigrateDiffPrice && runningInfo.Accounts[bidOrder.Index].CurStocks > 0) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price

);

if (buySellAmount >= minTakerAmount) {

Log("Initiate currency migration:", exchanges[bidOrder.Index].GetName(), "-->", exchanges[askOrder.Index].GetName());

}

}

}

}

- After calculating the number of orders to be placed, the transaction can be executed. The strategy adopts the method of directly adding slippage and taking orders at the same time

var buyWait = buyExchange.Go("Buy", _N(askOrder.Price * (1.01), pricePrecision), buySellAmount);

var sellWait = sellExchange.Go("Sell", _N(bidOrder.Price * (0.99), pricePrecision), buySellAmount);

var startWaitTime = new Date().getTime()

Sleep(3000);

var buyOrder = buyWait.wait()

var sellOrder = sellWait.wait()

- All that remains is the logic of calculating returns, handling stop losses on failed orders, and so on.

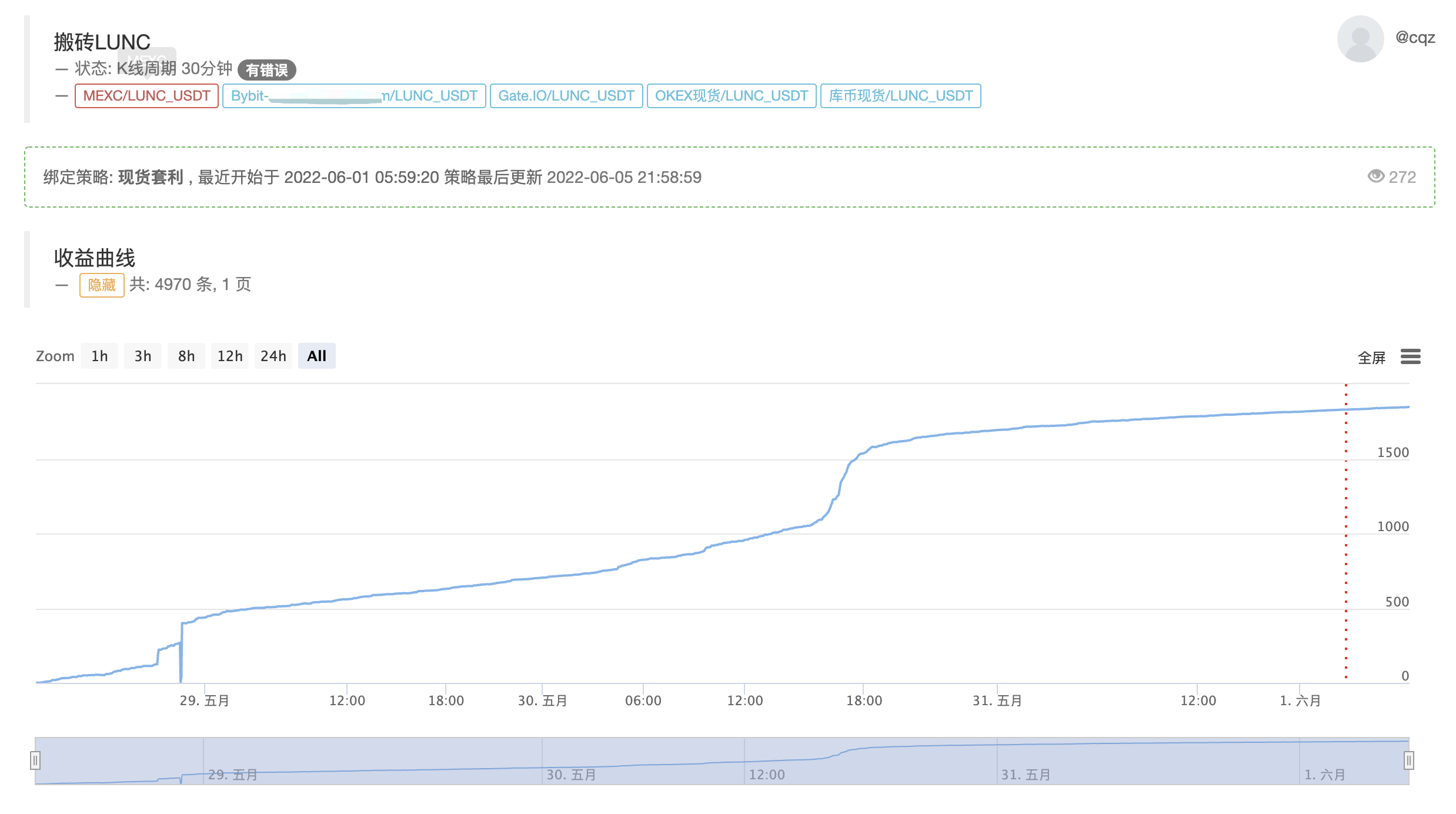

The actual profits of the strategy

Current real bot display, core logic remains unchanged, optimized to support multiple currencies

https://www.fmz.com/robot/464965

Finally, welcome to join the Laoqiu quantitative exchange communication: https://t.me/laoqiu_arbitrage

Related

- Quantitative Practice of DEX Exchanges (2) -- Hyperliquid User Guide

- DEX exchange quantitative practices ((2) -- Hyperliquid user guide

- Quantitative Practice of DEX Exchanges (1) -- dYdX v4 User Guide

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- DEX exchange quantitative practice ((1) -- dYdX v4 user guide

- Introduction to the Lead-Lag suite in digital currency (3)

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

More

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (6)

- Overview and architecture of the main interface of FMZ Quant Trading Platform

- Martingale strategy design for cryptocurrency futures

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (5)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (4)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (3)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (2)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (1)

- Cryptocurrency spot hedging strategy design(2)

- An example of general protocol contract access on FMZ

- Visualization module to build trading strategies - in-depth

- Use the KLineChart function to make strategy drawing design easier

- Use the KlineChart function to simplify strategy chart design

- Multi-exchange spot price differential strategy logical sharing

- JavaScript strategy backtesting is debugged in DevTools of Chrome browser

- JavaScript policy retrieval in the Chrome browser by DevTools debugging

- Visualizing modules to build trading strategies - in depth

- Sustainable balancing strategies for bear markets

- If you haven't written a strategy yet with Pine, which is so easy to learn, then I...

- Detailed Explanation of Equilibrium & Grid Strategies