websocket version of OKEX cross-term hedging strategy (learning)

Author: Inventors quantify - small dreams, Date: 2019-04-17 10:10:55Tags: HedgeWebscoket

OKEX cross-currency hedging strategy (teachable)

-

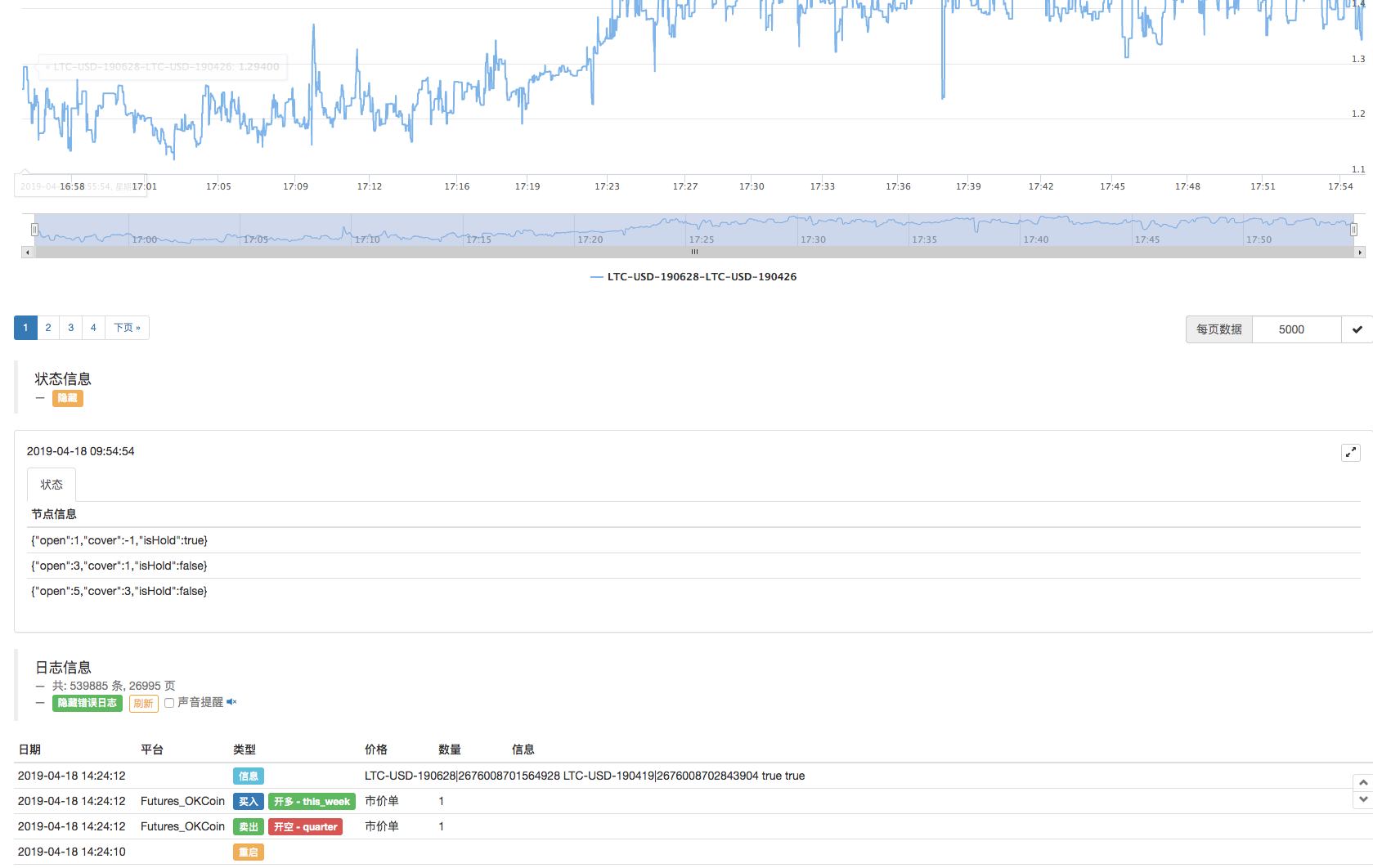

This is a screenshot of the video:

-

The only thing that can be done is to make the original set, the reverse set can be modified, the contract can be changed, that is, the reverse set.

-

Add two exchange objects, the first one for the quarter, the second one for the week.

-

There is a lot of room to optimize, the teaching strategy is careful, and there is a certain risk in the transition period.

-

Orders can be placed at the same price.

-

Welcome to feedback BUG.

Teaching strategies, practical use and caution.

Teaching strategies, practical use and caution.

Teaching strategies, practical use and caution.

function Hedge (isOpen, retSetA, retSetB) {

exchanges[0].SetDirection(isOpen ? "sell" : "closesell")

exchanges[1].SetDirection(isOpen ? "buy" : "closebuy");

(function (routineA, routineB) {

Log(routineA.wait(), routineB.wait(), retSetA, retSetB)

})(exchanges[0].Go(isOpen ? "Sell" : "Buy", -1, _ContractNum), exchanges[1].Go(isOpen ? "Buy" : "Sell", -1, _ContractNum))

}

function main () {

var param = {"op": "subscribe", "args": ["futures/ticker:" + _Instrument_id_A, "futures/ticker:" + _Instrument_id_B]}

var client = Dial("wss://real.okex.com:8443/ws/v3|compress=gzip_raw&mode=recv&reconnect=true&payload=" + JSON.stringify(param))

client.write(JSON.stringify(param))

var tickerA, tickerB

var arr = []

for (var i = 0 ; i < _Count ; i++) {

arr.push({open: _Begin + i * _Add, cover: _Begin + i * _Add - _Profit, isHold: false})

}

while (1) {

var tab = {type: "table", title: "状态", cols: ["节点信息"], rows: []}

Sleep(10)

var ret = client.read(-2)

if (!ret || ret == "") {

continue

}

var obj = null

try {

obj = JSON.parse(ret)

} catch (e) {

Log(e)

continue

}

if (obj.table == "futures/ticker" && obj.data[0].instrument_id == _Instrument_id_A) {

tickerA = obj.data[0]

} else if (obj.table == "futures/ticker" && obj.data[0].instrument_id == _Instrument_id_B) {

tickerB = obj.data[0]

}

if (tickerA && tickerB) {

$.PlotLine(tickerA.instrument_id + "-" + tickerB.instrument_id, tickerA.last - tickerB.last)

for (var j = 0 ; j < arr.length; j++) {

if (tickerA.best_bid - tickerB.best_ask > arr[j].open && !arr[j].isHold) {

Hedge(true, exchanges[0].SetContractType("quarter"), exchanges[1].SetContractType("this_week"))

arr[j].isHold = true

}

if (tickerA.best_ask - tickerB.best_bid < arr[j].cover && arr[j].isHold) {

Hedge(false, exchanges[0].SetContractType("quarter"), exchanges[1].SetContractType("this_week"))

arr[j].isHold = false

}

tab.rows.push([JSON.stringify(arr[j])])

}

}

LogStatus(_D(), "\n `" + JSON.stringify(tab) + "`")

}

}

- C++ futures high-frequency suite currency policy OKEX Websocket version

- Hedge_BTC/ETH Demo

- Bitcoin Cash Staircase to hedge differences

- OKEx's cross-currency hedging strategy

- Two platforms hedging-JS

- Hedging strategies for different currencies (Teaching)

- Newcomer testing cross-platform

- Testing the speed of the websocket versus rest

- Double platform hedging Practice using exchange seeking points

- OkEX Websocket Realtime v3

- The market price is fixed every day

- Triangle Suits - Basic

- Triangle Leverage Strategy experience

- Coin futures currency transfer patterns

- Bitcoin Coin example code

- Deribit websocket example

- python status bar tables showing button examples

- boll+maboll

- Deep market, market control, manipulative robots, and market tools

- rest version of OKEX cross-currency hedging strategy

- 60 lines of triangle hedging strategies (teachings)

- OkEX Websocket Realtime v3

- The Mayan language grid strategy

- Trending strategies based on random forests

- crawl Binance announcements and sell Delist coin

- Interactive templates

- Multiple charts example

- Contract hedging _ download multi-threaded version

- M Language “Turtle Trading strategy” implementations(V 1.0)

- OrdersDetail interface wrapped in Bithumb

chaoOK, V5 is now a private channel.

I love Jimmy.I'm going to try to find a way to do that, but I'm not sure how to do it. Time Platform type price quantity information 2021-02-13 00:00:00 Error main:12:12 - TypeError: Cannot read property 'write' of undefined 2021-02-13 00:00:00 Error sandbox not support Dial

fmzeroWhere's the teaching video?

Inventors quantify - small dreamsThis policy cannot be used if the dial function is not supported.