尝个鲜

- 完全兼容文华麦语言语法

- 基于发明者强大的低层, 完全支持数字货币现货期货与国内大宗商品期货

- 兼容工作会一直持续, 目前兼容度90%大部分策略可以直接运行, 无需修改

- API文档 https://www.fmz.com/bbs-topic/2569

语言增强

发明者量化不单实现了麦语言的解释器, 而且还增强让其能与高级语言Javascript混合编程,放个例子

%%

// 这里面可以调用发明者量化的任何API

scope.TEST = function(obj) {

return obj.val * 100;

}

%%

收盘价:C;

收盘价放大100倍:TEST(C);

上一个收盘价放大100倍:TEST(REF(C, 1)); // 鼠标移动到回测的K线上就会提示变量值

策略源码

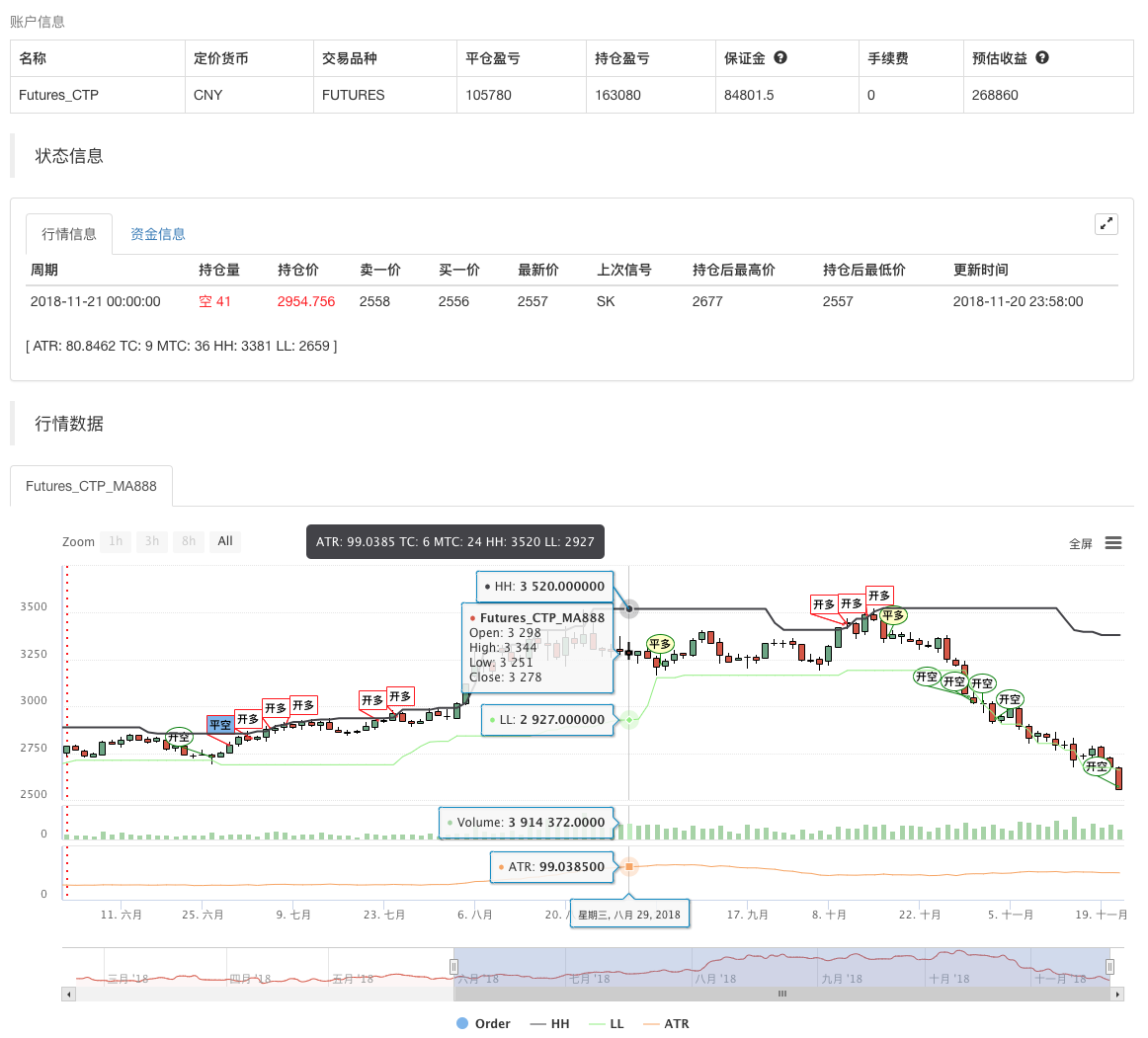

(*backtest

start: 2018-11-01 00:00:00

end: 2018-12-19 00:00:00

period: 1d

exchanges: [{"eid":"Futures_BitMEX","currency":"XBT_USD"}]

args: [["ContractType","XBTUSD",126961]]

*)

// this demonstration mainly uses the Turtle Trading Rules to demonstrate the method of writing "position management, maximum position control and other fund management".

// only the demonstration key content statement is annotated, other statements please consult customer service

//This model is only used to demonstrate the use of this strategy, and enters the market accordingly, at your own risk.

TR:=MAX(MAX((HIGH-LOW),ABS(REF(CLOSE,1)-HIGH)),ABS(REF(CLOSE,1)-LOW));// True volatility

ATR:MA(TR,26); // Find a simple moving average of the true amplitude in 26 cycles, shown in the figure

ZOOM:=IFELSE(ISCONTRACT('@Futures_(?!CTP).*'), CLOSE, 1); // Compatible with cryptocurrency futures as margin

LOT:=((MONEYTOT*0.01*ZOOM)/(UNIT*ATR))*ZOOM;// Calculate the number of one hand based on 1% of equity

TC..IFELSE(ISCONTRACT('@Futures.*'), INTPART(LOT), LOT); // Compatible futures and spot ISCONTRACT starts with @ to indicate matching exchange name, support

MTC..4*TC; // Total position

HH^^HV(H,20); // Attached to the main image display

LL^^LV(L,20); // Attached to the main image display

CROSSUP(C,HH)&&ISLASTBK=0&&ISLASTSK=0&&BARPOS>=26,BK(TC);// The latest price exceeds the highest value of 20 cycles, the first time to buy long, the quality is TC hands

CROSSDOWN(C,LL)&&ISLASTBK=0&&ISLASTSK=0,SK(TC); // The latest price fell below the lowest value of 20 cycles, the first time to sell short, the quality is TC hands

C>=BKPRICE+0.5*ATR&&BKVOL<MTC&&ISLASTBK,BK(TC);// The price has increased by 0.5 times ATR on the basis of the last holding position, and when the number of hands does not exceed 4 times of TC, buy long the adding position of TC hands

C<=SKPRICE-0.5*ATR&&SKVOL<MTC&&ISLASTSK,SK(TC);// The price fell 0.5 times ATR on the basis of the last holding position, and when the number of hands does not exceed 4 times of TC, sell short the adding position of TC hand.

C<=(BKPRICE-2*ATR)&&BKVOL>0,SP(BKVOL);// The latest price is less than the opening price minus 2 times of ATR, stop loss and close position

C>=(SKPRICE+2*ATR)&&SKVOL>0,BP(SKVOL); // The latest price is greater than the opening price plus 2 times of ATR, stop loss and close position

CROSSUP(H,HV(H,10))&&SKVOL>0,BP(SKVOL);// The highest price up-cross the highest price of 10 cycles, closing the position

CROSSDOWN(L,LV(L,10))&&BKVOL>0,SP(BKVOL); // The lowest price down-cross the lowest price of 10 cycles, closing position

TRADE_AGAIN(10);

相关推荐