Progressive Take Profit Strategy

Author: ChaoZhang, Date: 2023-10-24 14:14:00Tags:

Progressive Take Profit Strategy

Overview

This strategy combines RSI indicator and price moving average to identify oversold opportunities when price breaks below the moving average line. As the price further declines, the strategy will progressively pyramid more long positions based on preset percentages to achieve cost averaging. When the profit of the positions reaches the configured take profit percentage, the strategy will close the positions. It also introduces a progressive take profit mechanism that dynamically adjusts the overall stop profit price based on per position profits realized. This can effectively reduce the risk of losses and achieve gradual exiting.

Strategy Logic

When RSI drops below the oversold line of 29 and closing price is below moving average, open the first long position.

When price drops 2% below the first entry price, add a second long position, and so on until maximum 8 entries. This achieves dollar cost averaging.

After each entry, record the entry price. These prices serve as the reference prices for entries. Plot them as lines on the chart.

After entries, calculate the average holding price. Use 3% of average price as take profit for each position, and 4% for overall position.

When price rises above take profit price of a position, close that position.

Progressive take profit calculation: after closing each position, deduct the realized profit from the overall take profit price. This slowly drags down the take profit line. Only when the total profit covers max loss will the strategy take profit completely.

When price hits the progressive take profit line, close all positions.

Advantages

RSI is good at identifying oversold/overbought zones, allowing good entries for reversals.

Multiple entries allow cost averaging at low prices.

Progressive take profit reduces risk and achieves gradual exits. Losses are contained within a range.

Customizable take profit ratio and entry steps allows risk adjustment.

Plotted entry and take profit lines offer visual guidance on positions.

Risks

Whipsaw markets may trigger excessive entries and exits, causing slippage. Widen the RSI range to reduce trades.

Bad configuration of entry steps and ratios may cause over-trading. Be prudent based on account size.

Continued pyramiding during declines brings unlimited loss risks. Set a max limit on entries. Keep last entry conservative.

Take profit set too tight may exit prematurely. Optimize based on backtest data.

Enhancements

Add filters like MACD to avoid bad RSI signals.

Incorporate stop loss based on ATR to limit extreme loss events.

Optimize entry, take profit and other parameters for different assets.

Dynamically adjust take profit based on volatility. Widen when volatile.

Conclusion

The strategy fully utilizes RSI for identifying oversold, combining with MA for reversal trading. The pyramiding and progressive take profit mechanisms control risk while allowing effective long entries. Further optimizations on indicators, take profit etc. can make the strategy more robust. It can be widely applied on trending instruments like index futures and crypto for great investment value.

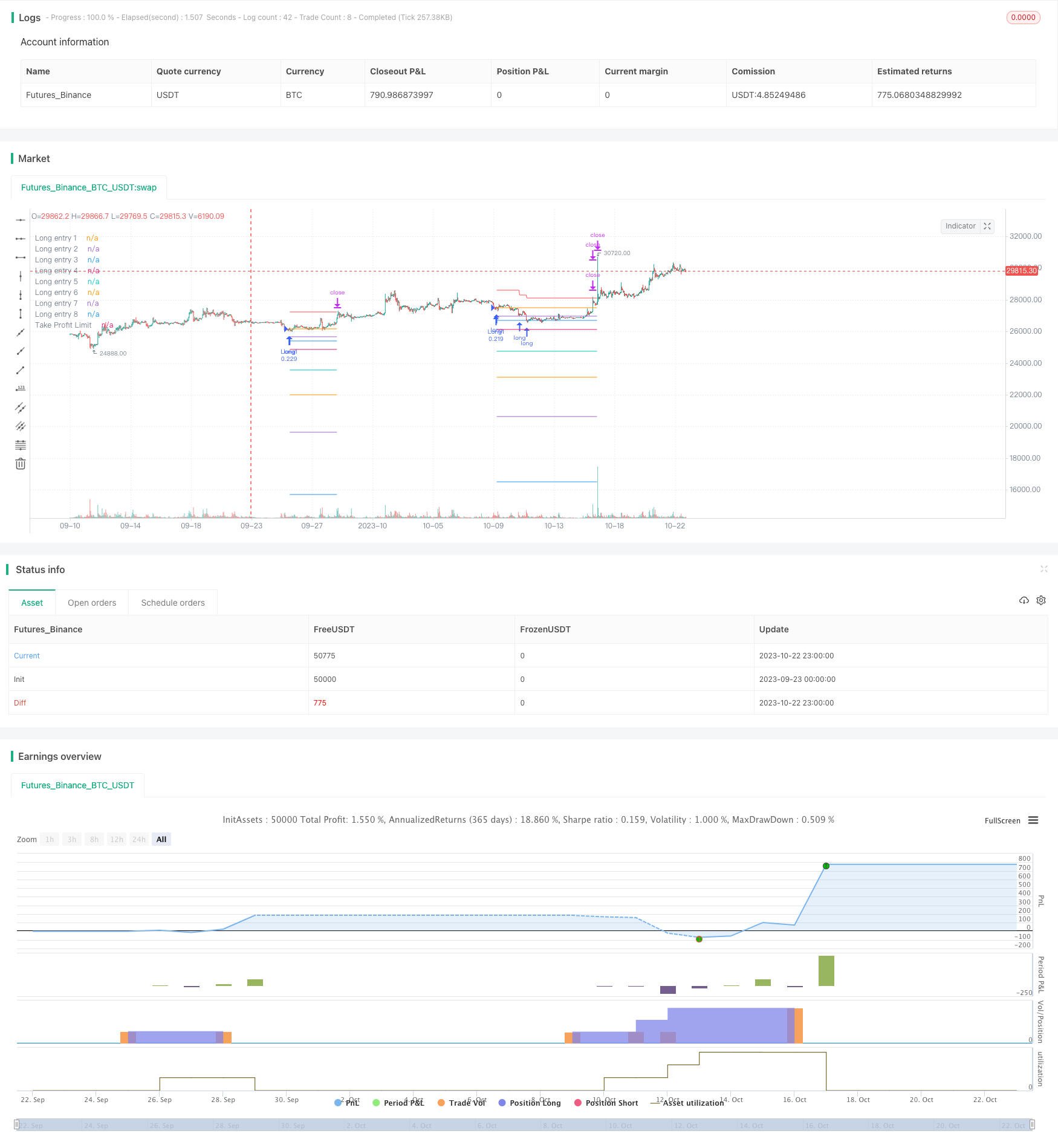

/*backtest

start: 2023-09-23 00:00:00

end: 2023-10-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

// © A3Sh

// RSI Strategy that buys the dips, uses Price Averaging and Pyramiding.

// When the price drops below specified percentages of the price (8 PA layers), new entries are openend to average the price of the assets.

// Open entries are closed by a specified take profit.

// Entries can be reopened, after closing and consequently crossing a PA layer again.

// This strategy is based on the RSI+PA+DCA strategy I created earlier. The difference is the way the Take Profit is calculated.

// Instead of directly connecting the take profit limit to the decreasing average price level with an X percent above the average price,

// the take profit is calculated for a part on the decreasing average price and for another part on the deduction

// of the profits of the individual closed positions.

// The Take Profit Limit drop less significant then the average price level and the full position only completely exits

// when enough individual closed positions made up for the losses.

// This makes it less risky and more conservative and great for a long term trading strategy

// RSI code is adapted from the build in Relative Strength Index indicator

// MA Filter and RSI concept adapted from the Optimized RSI Buy the Dips strategy, by Coinrule

// https://www.tradingview.com/script/Pm1WAtyI-Optimized-RSI-Strategy-Buy-The-Dips-by-Coinrule/

// Pyramiding entries code adapted from Pyramiding Entries on Early Trends startegy, by Coinrule

// Pyramiding entries code adapted from Pyramiding Entries on Early Trends startegy, by Coinrule

// https://www.tradingview.com/script/7NNJ0sXB-Pyramiding-Entries-On-Early-Trends-by-Coinrule/

// Plot entry layers code adapted from HOWTO Plot Entry Price by vitvlkv

// https://www.tradingview.com/script/bHTnipgY-HOWTO-Plot-Entry-Price/

strategy(title='RSI+PA+PTP', pyramiding=16, overlay=true, initial_capital=400, default_qty_type=strategy.percent_of_equity, default_qty_value=15, commission_type=strategy.commission.percent, commission_value=0.075, close_entries_rule='FIFO')

port = input.float(12, group = "Risk", title='Portfolio % Used To Open The 8 Positions', step=0.1, minval=0.1, maxval=100)

q = strategy.equity / 100 * port / open

// Long position PA entry layers. Percentage from the entry price of the the first long

ps2 = input.float(2, group = "Long Position Entry Layers", title='2nd Long Entry %', step=0.1)

ps3 = input.float(3, group = "Long Position Entry Layers", title='3rd Long Entry %', step=0.1)

ps4 = input.float(5, group = "Long Position Entry Layers", title='4th Long Entry %', step=0.1)

ps5 = input.float(10, group = "Long Position Entry Layers", title='5th Long Entry %', step=0.1)

ps6 = input.float(16, group = "Long Position Entry Layers", title='6th Long Entry %', step=0.1)

ps7 = input.float(25, group = "Long Position Entry Layers" ,title='7th Long Entry %', step=0.1)

ps8 = input.float(40, group = "Long Position Entry Layers", title='8th Long Entry %', step=0.1)

// Calculate Moving Averages

plotMA = input.bool(group = "Moving Average Filter", title='Plot Moving Average', defval=false)

movingaverage_signal = ta.sma(close, input(100, group = "Moving Average Filter", title='MA Length'))

plot (plotMA ? movingaverage_signal : na, color = color.new (color.green, 0))

// RSI inputs and calculations

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

overSold = input.int(29, title="Oversold, Trigger to Enter First Position", group = "RSI Settings")

// Long trigger (co)

co = ta.crossover(rsi, overSold) and close < movingaverage_signal

// Store values to create and plot the different PA layers

long1 = ta.valuewhen(co, close, 0)

long2 = ta.valuewhen(co, close - close / 100 * ps2, 0)

long3 = ta.valuewhen(co, close - close / 100 * ps3, 0)

long4 = ta.valuewhen(co, close - close / 100 * ps4, 0)

long5 = ta.valuewhen(co, close - close / 100 * ps5, 0)

long6 = ta.valuewhen(co, close - close / 100 * ps6, 0)

long7 = ta.valuewhen(co, close - close / 100 * ps7, 0)

long8 = ta.valuewhen(co, close - close / 100 * ps8, 0)

eps1 = 0.00

eps1 := na(eps1[1]) ? na : eps1[1]

eps2 = 0.00

eps2 := na(eps2[1]) ? na : eps2[1]

eps3 = 0.00

eps3 := na(eps3[1]) ? na : eps3[1]

eps4 = 0.00

eps4 := na(eps4[1]) ? na : eps4[1]

eps5 = 0.00

eps5 := na(eps5[1]) ? na : eps5[1]

eps6 = 0.00

eps6 := na(eps6[1]) ? na : eps6[1]

eps7 = 0.00

eps7 := na(eps7[1]) ? na : eps7[1]

eps8 = 0.00

eps8 := na(eps8[1]) ? na : eps8[1]

plot(strategy.position_size > 0 ? eps1 : na, title='Long entry 1', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps2 : na, title='Long entry 2', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps3 : na, title='Long entry 3', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps4 : na, title='Long entry 4', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps5 : na, title='Long entry 5', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps6 : na, title='Long entry 6', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps7 : na, title='Long entry 7', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps8 : na, title='Long entry 8', style=plot.style_linebr)

// Take Profit Settings

ProfitTarget_Percent = input.float(3.0, group = "Take Profit Settings", title='Take Profit % (Per Position)')

ProfitTarget_Percent_All = input.float(4.0, group = "Take Profit Settings", title='Take Profit % (Exit All, Progressive Take Profit Limit')

TakeProfitProgression = input.float(12, group = "Take Profit Settings", title='Take Profit Progression', tooltip = 'Progression is defined by the position size. By default 12% of the start equity (portfolio) is used to open a position, see Risk. This same % percentage is used to calculate the profit amount that will be deducted from the Take Profit Limit.')

entryOn = input.bool (true, group = "Take Profit Settings", title='New entries affect Take Profit limit', tooltip = 'This option changes the behaviour of the Progressive Take Profit. When switchted on, the difference between the former and current original Take Profit is deducted from the Progressive Take Profit. When switchted off, the Progressive Take Profit is only affected by the profit deduction or each closed position.')

avPricePlot = input.bool (false, group = "Take Profit Settings", title='Plot Average Price (FIFO)')

// Original Take Profit Limit

tpLimit = strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All)

// Create variables to calculate the Take Profit Limit Progresssion

var endVal = 0.0

var startVal = 0.0

// The value at the the start of the loop is the value of the end of the previous loop

startVal := endVal

// Set variable to the original Take Profit Limit when the first position opens.

if strategy.position_size > 0 and strategy.position_size[1] ==0

endVal := tpLimit

// Everytime a specific position opens, the difference of the previous (original) Take Profit price and the current (original) Take Profit price will be deducted from the Progressive Take Profit Limit

// This feature can be toggled on and off in the settings panel. By default it is toggled on.

entryAmount = 0.0

for i = 1 to strategy.opentrades

entryAmount := i

if entryOn and strategy.position_size > 0 and strategy.opentrades[1] == (entryAmount) and strategy.opentrades == (entryAmount + 1)

endVal := startVal - (tpLimit[1] - tpLimit)

// Everytime a specific position closes, the amount of profit from that specific position will be deducted from the Progressive Take Profit Limit.

exitAmount = 0.0

for id = 1 to strategy.opentrades

exitAmount := id

if strategy.opentrades[1] ==(exitAmount + 1) and strategy.opentrades == (exitAmount)

endVal := startVal - (TakeProfitProgression / 100 * strategy.opentrades.entry_price (id - 1) / 100 * ProfitTarget_Percent )

// The Final Take Profit Price

tpn = (strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All)) - (strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All) - endVal)

plot (strategy.position_size > 0 ? tpn : na, title = "Take Profit Limit", color=color.new(color.red, 0), style = plot.style_linebr, linewidth = 1)

// Plot position average price as reference

plot (avPricePlot ? strategy.position_avg_price : na, title= "Average price", color = color.new(color.white, 0), style = plot.style_linebr, linewidth = 1)

// When to trigger the Take Profit per position or the Progressive Take Profit

tpl1 = close < tpn ? eps1 + close * (ProfitTarget_Percent / 100) : tpn

tpl2 = close < tpn ? eps2 + close * (ProfitTarget_Percent / 100) : tpn

tpl3 = close < tpn ? eps3 + close * (ProfitTarget_Percent / 100) : tpn

tpl4 = close < tpn ? eps4 + close * (ProfitTarget_Percent / 100) : tpn

tpl5 = close < tpn ? eps5 + close * (ProfitTarget_Percent / 100) : tpn

tpl6 = close < tpn ? eps6 + close * (ProfitTarget_Percent / 100) : tpn

tpl7 = close < tpn ? eps7 + close * (ProfitTarget_Percent / 100) : tpn

tpl8 = close < tpn ? eps8 + close * (ProfitTarget_Percent / 100) : tpn

// Submit Entry Orders

if co and strategy.opentrades == 0

eps1 := long1

eps2 := long2

eps3 := long3

eps4 := long4

eps5 := long5

eps6 := long6

eps7 := long7

eps8 := long8

strategy.entry('Long1', strategy.long, q)

if strategy.opentrades == 1

strategy.entry('Long2', strategy.long, q, limit=eps2)

if strategy.opentrades == 2

strategy.entry('Long3', strategy.long, q, limit=eps3)

if strategy.opentrades == 3

strategy.entry('Long4', strategy.long, q, limit=eps4)

if strategy.opentrades == 4

strategy.entry('Long5', strategy.long, q, limit=eps5)

if strategy.opentrades == 5

strategy.entry('Long6', strategy.long, q, limit=eps6)

if strategy.opentrades == 6

strategy.entry('Long7', strategy.long, q, limit=eps7)

if strategy.opentrades == 7

strategy.entry('Long8', strategy.long, q, limit=eps8)

// Submit Exit orders

if strategy.position_size > 0

strategy.exit(id='Exit 1', from_entry='Long1', limit=tpl1)

strategy.exit(id='Exit 2', from_entry='Long2', limit=tpl2)

strategy.exit(id='Exit 3', from_entry='Long3', limit=tpl3)

strategy.exit(id='Exit 4', from_entry='Long4', limit=tpl4)

strategy.exit(id='Exit 5', from_entry='Long5', limit=tpl5)

strategy.exit(id='Exit 6', from_entry='Long6', limit=tpl6)

strategy.exit(id='Exit 7', from_entry='Long7', limit=tpl7)

strategy.exit(id='Exit 8', from_entry='Long8', limit=tpl8)

// Make sure that all open limit orders are canceled after exiting all the positions

longClose = strategy.position_size[1] > 0 and strategy.position_size == 0 ? 1 : 0

if longClose

strategy.cancel_all()

- Breakout Strategy Based on Camarilla Channels

- Going with the Trend Moving Average Crossover Strategy

- Monthly Trend Breakout Strategy

- DEMA Volatility Index Strategy

- A Trend Following Strategy

- Multi Timeframe Stochastic Crossover Strategy

- Moving Average Tracking Trading Strategy

- SMA Crossing RSI Golden Cross Death Cross Trading Strategy

- Following the Supertrend Strategy

- Trend Reversal Volatility Combination Strategy

- Dual-position Breakthrough Strategy

- Trend Following Buy Dip Sell Peak Strategy

- Moving Average Crossover and MACD Combination Strategy

- Momentum Moving Average Crossover Trend Following Strategy

- Trend Following Strategy Based on Moving Average Crossover

- Dual Moving Average Turning Point Strategy

- Fast RSI Breakthrough Strategy

- Moving Average Tracking Stop Loss Strategy

- Multi-factor Quantitative Trading Strategy

- Trend Following Strategy Based on Moving Average Crossover