Bull and Bear Power Backtest Strategy

Author: ChaoZhang, Date: 2023-10-24 16:43:52Tags:

Overview

The Bull and Bear Power strategy was developed by Dr. Alexander Elder using the Elder-ray indicator to measure buying and selling pressure in the market. The Elder-ray is often used with the Triple Screen system but can also be used on its own.

Dr. Elder uses a 13-period exponential moving average (EMA) to indicate the market consensus of value. Bull power measures the ability of buyers to drive prices above the consensus of value. Bear power reflects the ability of sellers to drive prices below the average consensus of value.

Bull power is calculated by subtracting the 13-period EMA from the high. Bear power subtracts the 13-period EMA from the low.

Strategy Logic

The strategy judges market sentiment through calculating bull and bear power indicators.

- Calculate 13-period EMA as market value consensus

- Calculate bull power: High minus 13-period EMA

- Calculate bear power: Low minus 13-period EMA

- Compare bull power and bear power with threshold to determine long and short signals

- Option to trade reverse signals

When bull power is greater than threshold, it’s long signal. When bear power is greater than threshold, it’s short signal. Reverse trading can be selected.

Advantage Analysis

- Simple and intuitive using bull and bear power indicators to judge market sentiment

- Flexible configuration of parameters, adjustable threshold and period

- Option for reverse trading adapts to different market environments

- Uses exponential moving average, less sensitive to outliers

Risk Analysis

- Prone to false signals, needs combining with trend and other filters

- Fixed period cannot adapt to market changes, adaptive period can optimize

- No stop loss, easily chasing market with huge losses

- Only judges long or short, lacks timing selection

Can add stop loss, optimize moving average period, combine with trend filter etc.

Optimization Directions

- Optimize moving average period, use adaptive period EMA

- Add trend filter to avoid counter trend trading

- Add stop loss to control single trade loss

- Combine other indicators to select better entry timing

- Utilize machine learning to optimize parameters

Conclusion

The Bull and Bear Power strategy judges market sentiment simply and intuitively with configurable parameters. But it’s prone to false signals and needs further optimization with trend and stop loss. The logic is worth learning but direct application needs caution.

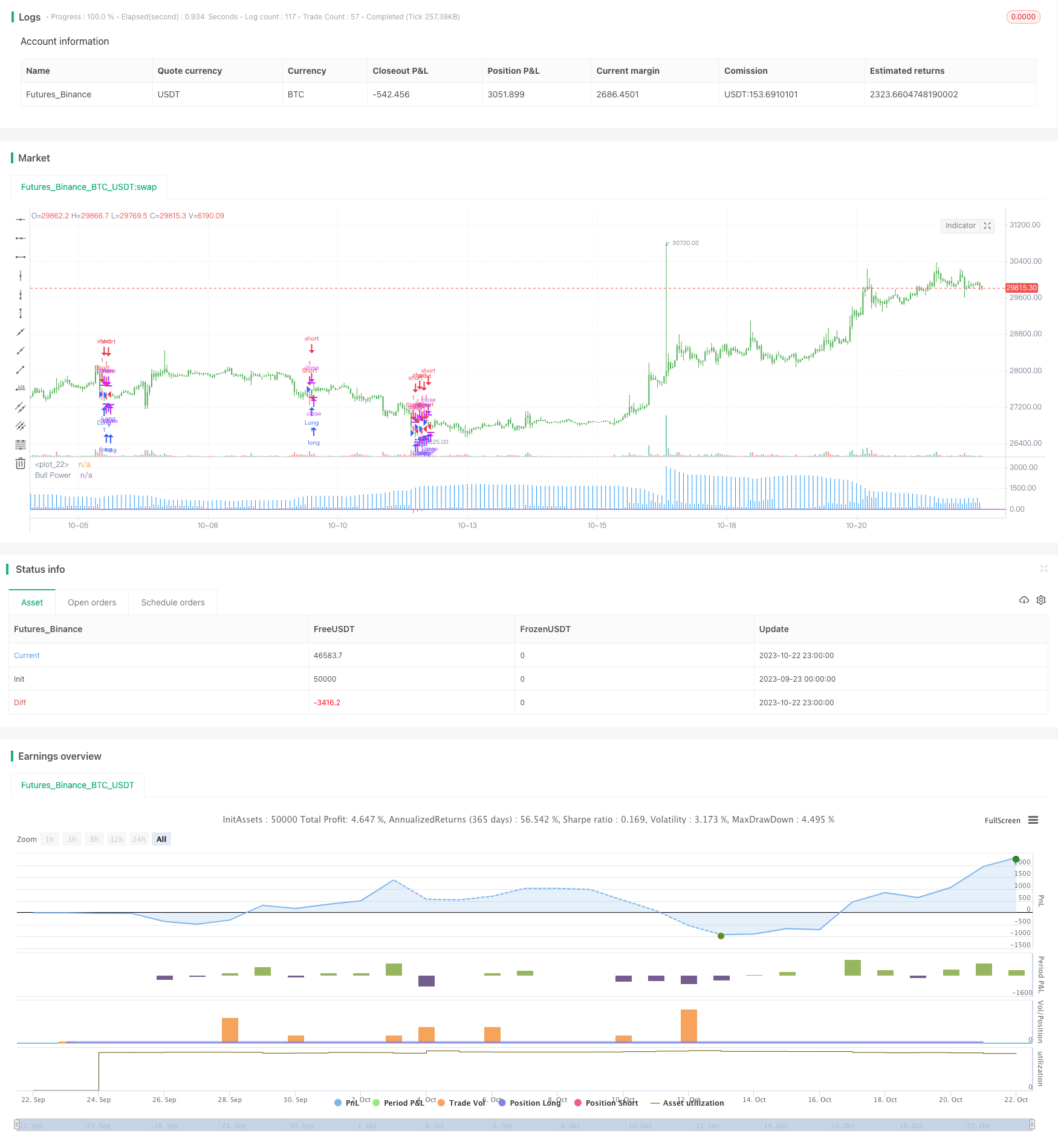

/*backtest

start: 2023-09-23 00:00:00

end: 2023-10-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version = 2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 08/12/2016

// Developed by Dr Alexander Elder, the Elder-ray indicator measures buying

// and selling pressure in the market. The Elder-ray is often used as part

// of the Triple Screen trading system but may also be used on its own.

// Dr Elder uses a 13-day exponential moving average (EMA) to indicate the

// market consensus of value. Bull Power measures the ability of buyers to

// drive prices above the consensus of value. Bear Power reflects the ability

// of sellers to drive prices below the average consensus of value.

// Bull Power is calculated by subtracting the 13-day EMA from the day's High.

// Bear power subtracts the 13-day EMA from the day's Low.

//

// You can use in the xPrice any series: Open, High, Low, Close, HL2, HLC3, OHLC4 and ect...

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Elder Ray (Bull Power) Strategy Backtest")

Length = input(13, minval=1)

Trigger = input(0)

reverse = input(false, title="Trade reverse")

hline(0, color=purple, linestyle=line)

xPrice = close

xMA = ema(xPrice,Length)

DayHigh = iff(dayofmonth != dayofmonth[1], high, max(high, nz(DayHigh[1])))

nRes = DayHigh - xMA

pos = iff(nRes > Trigger, 1,

iff(nRes < Trigger, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(nRes, color=blue, title="Bull Power", style = histogram)

- Glory Hole Breakout Strategy

- Heiken Ashi Moving Average Crossover Strategy with MACD Filter V3

- RSI Cross-Cycle Trading Strategy

- SuperTrend Enhanced Pivot Reversal Strategy

- Momentum Arbitrage Strategy Backtest Analysis

- Mean Reversion Bollinger Bands Strategy

- Linear Regression Moving Average Trading Strategy

- Dual Bandpass Filter Strategy

- Dual Moving Average Cross Market Trading Strategy

- Bollinger Band Fitting Strategy

- Moving Average Crossover Strategy

- Stochastic Momentum Breakout Strategy

- Qullamaggie Breakout V2 Strategy

- Breakout Strategy Based on Camarilla Channels

- Going with the Trend Moving Average Crossover Strategy

- Monthly Trend Breakout Strategy

- DEMA Volatility Index Strategy

- A Trend Following Strategy

- Multi Timeframe Stochastic Crossover Strategy

- Moving Average Tracking Trading Strategy