EMA Crossover tracking Strategy

Author: ChaoZhang, Date: 2023-10-25 17:44:35Tags:

Overview

The EMA crossover strategy generates buy and sell signals by tracking the crossover between two EMA lines of different periods. When the shorter period EMA crosses over the longer period EMA, a buy signal is generated. When the shorter period EMA crosses below the longer period EMA, a sell signal is generated. This strategy also incorporates the SuperTrend indicator to filter false breakouts.

Strategy Logic

This strategy is mainly based on the golden cross and death cross of EMA lines. EMA lines can smooth price data and filter out noise. The crossover between EMA lines indicates price trend changes. When the shorter period EMA (20-period) crosses over the longer period EMA (50-period), it means the short term price is now above the long term price, implying an upside breakout trend and generating a buy signal. When the shorter period EMA crosses below the longer period EMA, it means the short term price breaks below the long term price, implying a downtrend and generating a sell signal.

In addition, this strategy uses the SuperTrend indicator to filter false signals generated by EMA crossovers. The SuperTrend indicator is calculated based on the ATR to plot upper and lower bands that better define the real trend. When the price breaks above the SuperTrend upper band, a buy signal is generated. When the price breaks below the SuperTrend lower band, a sell signal is generated. The EMA crossover signals are only valid when confirmed by the SuperTrend signals. This helps to remove false signals caused by price fluctuations.

Specifically, the strategy entry logic is defined as follows:

-

When 20EMA crosses above 50EMA, and price breaks above SuperTrend upper band, generate buy signal.

-

When 20EMA crosses below 50EMA, and price breaks below SuperTrend lower band, generate sell signal.

Using EMA crossovers to determine the major trend direction combined with SuperTrend filter could improve the accuracy of trading signals.

Advantages

The EMA crossover strategy has the following advantages:

-

Simple to implement. Only requires calculating two EMA crossovers.

-

Provides some noise filtering effect. EMA as moving average can filter out some noise.

-

Combining with SuperTrend further reduces false signals caused by price fluctuations.

-

The EMA periods can be adjusted for different market environments.

-

Customizable for long or short direction trades. Applicable to various trading approaches.

-

Can be implemented in different timeframes for various trading styles.

Risks

There are also some risks associated with the EMA crossover strategy:

-

EMA crossover signals may lag during extreme price swings, failing to timely reflect price changes.

-

EMA lines have lagging effect, which could generate incorrect signals.

-

Improper EMA period settings could lead to excessive false signals.

-

Crossover alone cannot determine actual trend, still largely lagging.

-

Proper risk management like stop loss is needed to control risks.

Some ways to reduce the risks:

-

Optimize EMA periods to fit better fast and slow lines.

-

Shorten holding period and apply timely stop loss.

-

Combine with other indicators like moving averages, candlestick patterns for comprehensive judgment.

-

Adjust trading frequency to lower number of trades.

Enhancements

This strategy can be enhanced and optimized in the following aspects:

-

Optimize EMA periods for different cycles and market environments. Introduce adaptive optimization mechanisms.

-

Test different moving average indicators like SMA, KWMA.

-

Incorporate more technical indicators to form multivariate models, like MACD, RSI. Apply machine learning algorithms to optimize parameters and weights.

-

Add stop loss techniques like trailing stop loss, percentage stop loss to control risks.

-

Introduce volume filters working with volume indicators to avoid false signals.

-

Optimize exits by setting exit rules, combining with chart patterns, breakouts etc.

-

Confirm trend on higher timeframe, enter trades on lower timeframe to follow trends.

Conclusion

The EMA crossover strategy is a simple and practical trend following system. It can identify mid-term trends and generate timing signals. Combining with SuperTrend filter could reduce false trades effectively. But risks like lagging and wrong signals still exist. The strategy can be enhanced via parameter optimization, stop loss, combining indicators, etc. The EMA crossover strategy is easy to use, suitable for mid-long term trend tracking, and effective for novice traders.

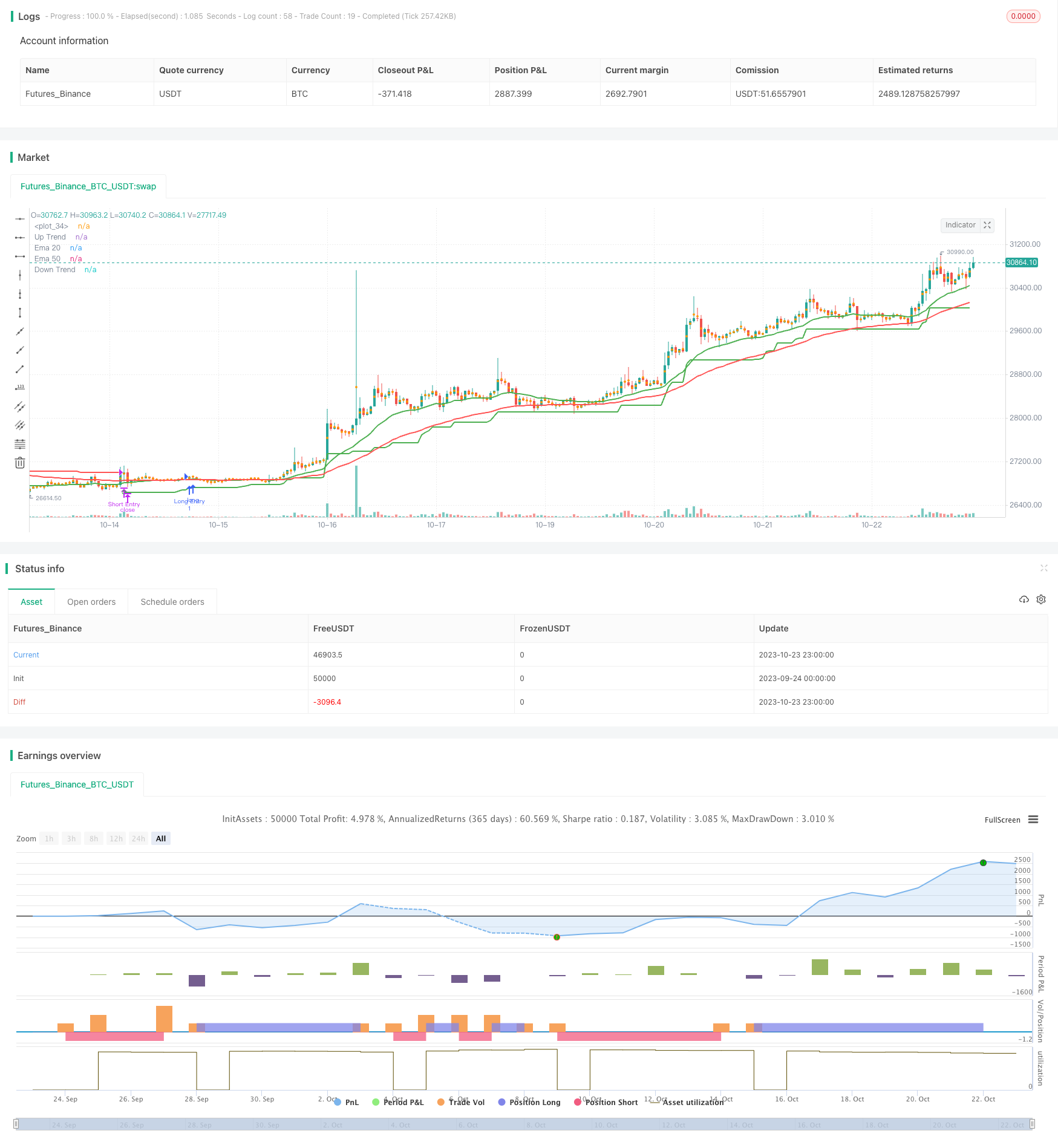

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © alokbothra

//@version=5

strategy("Ema Crossover", overlay=true, initial_capital = 1000)

start = timestamp(2021,1,1,0,0)

end = timestamp(2023,10,30,0,0)

plot (ta.ema(close,20), title = "Ema 20", color = color.green , linewidth = 2)

plot (ta.ema(close,50), title = "Ema 50", color = color.red, linewidth = 2 )

//supertrend 1

Periods = input(title='ATR Period', defval=11)

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3)

changeATR = input(title='Change ATR Calculation Method ?', defval=true)

showsignals = input(title='Show Buy/Sell Signals ?', defval=true)

highlighting = input(title='Highlighter On/Off ?', defval=true)

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

up = close - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn =close+ Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0)

changeCond = trend != trend[1]

longonly = input.bool(defval = true, title = 'Long Only')

shortonly = input.bool(defval = true, title = 'Short Only')

longCondition = (ta.ema(close, 20) >= ta.ema(close, 50))

shortCondition = (ta.ema(close, 20) <= ta.ema(close, 50))

long = (trend == 1)

short = (trend == -1)

sell= short

cover= long

if time >= start and time < end

if longonly

if ((longCondition) and (long))

strategy.entry ("Long Entry", strategy.long, comment ="Long Entry")

if strategy.position_size > 0

strategy.close("Long Entry", when = sell, comment = "Long Exit")

if shortonly

if ((shortCondition) and (short))

strategy.entry("Short Entry", strategy.short, comment = "Short Entry")

if strategy.position_size < 0

strategy.close("Short Entry", when = cover, comment = "Short Exit")

- RSI Trend Following Strategy

- Mean Reversion Trading Strategy Based on Moving Average

- EMA Mean Reversion Trading Strategy

- Multi-indicator Combination Trading Strategy

- Multi-Factor Strategy Combination

- The strategy of voting with a stopgap

- Two-stage Stop Loss Strategy

- Quantitative Trading Strategy Based on Multiple Indicators

- Price Gap and Trend Following Trading Strategy

- Breakout Scalper - Catching Trend Changes Quickly

- SSL Channel Breakout Strategy with Trailing Stop Loss

- Momentum Tracking CCI Strategy

- Gradual Accumulation Breakout Trading Strategy

- Dynamic Candle Direction Strategy

- RSI Divergence Trading Strategy

- Multi-indicator Decision Based Short Term Trend Strategy

- Multi Timeframe MACD Heatmap Strategy

- Double Moving Average Crossover Strategy

- ATR Adjustable Trailing Stop Loss Strategy

- Bollinger Band Width Scaling Double Moving Average Trend Filter Strategy