Overview

The Moving Average Crossover strategy is a momentum strategy that uses the crossover signals of double moving averages to determine the trend direction and generate trading signals. It employs 2 simple moving averages and 1 exponential moving average, judging long and short based on their crossover, belonging to a medium-term trading strategy.

Strategy Logic

The strategy uses 3 moving averages:

- EMA1: A shorter period exponential moving average, acting as the fast line

- SMA1: A longer period simple moving average, acting as the slow line

- SMA2: An even longer period simple moving average, determining the trend direction

The strategy judges the trend based on the relationship between EMA1, SMA1 and SMA2:

- Uptrend: EMA1 > SMA1 > SMA2

- Downtrend: EMA1 < SMA1 < SMA2

Entry signals:

- Long entry: When the fast line crosses above the slow line

- Short entry: When the fast line crosses below the slow line

Exit signals:

- Close long: When the fast line crosses below the slow line

- Close short: When the fast line crosses above the slow line

The strategy provides multiple parameter configurations, with customizable moving averages for entry and exit.

Advantage Analysis

The advantages of this strategy:

- Captures momentum: Detects trend changes, momentum strategy

- Flexible configuration: Provides multiple MA choices, flexible parameter tuning

- Trend filtering: Uses long period MA to determine trend, avoids counter-trend trades

- Risk management: Configurable stop loss and take profit controls single trade risk

Risk Analysis

The risks of this strategy:

- Whipsaws: Prolonged choppiness before breakout may cause multiple false signals

- Sensitive to MA parameters: Improper tuning of MA periods may result in over-sensitivity or sluggishness

- Lagging: Inherent lagging nature of moving averages, may miss best entry timing

- No fundamentals: Purely technical indicator driven, no consideration of fundamentals

Whipsaw risk can be mitigated by tuning MA periods; Parameter sensitivity can be solved by optimization; Lagging risk can be reduced by incorporating other leading indicators.

Optimization Directions

Potential optimizations:

- Add other technical filters like RSI, Bollinger Bands to improve signal quality

- Optimize MA periods to find optimum parameters

- Incorporate machine learning models to judge trend and signal reliability

- Consider trading volume to avoid false breakouts in low volume conditions

- Incorporate fundamental factors to avoid trading against economic cycles

Conclusion

The Moving Average Crossover strategy is straight-forward, judging trend and timing by crossing of fast and slow MAs. Its advantage is capturing momentum with flexible configurations, but risks like whipsaw and lagging exist. With optimizations like additional filters, it can become a very practical quantitative trading strategy.

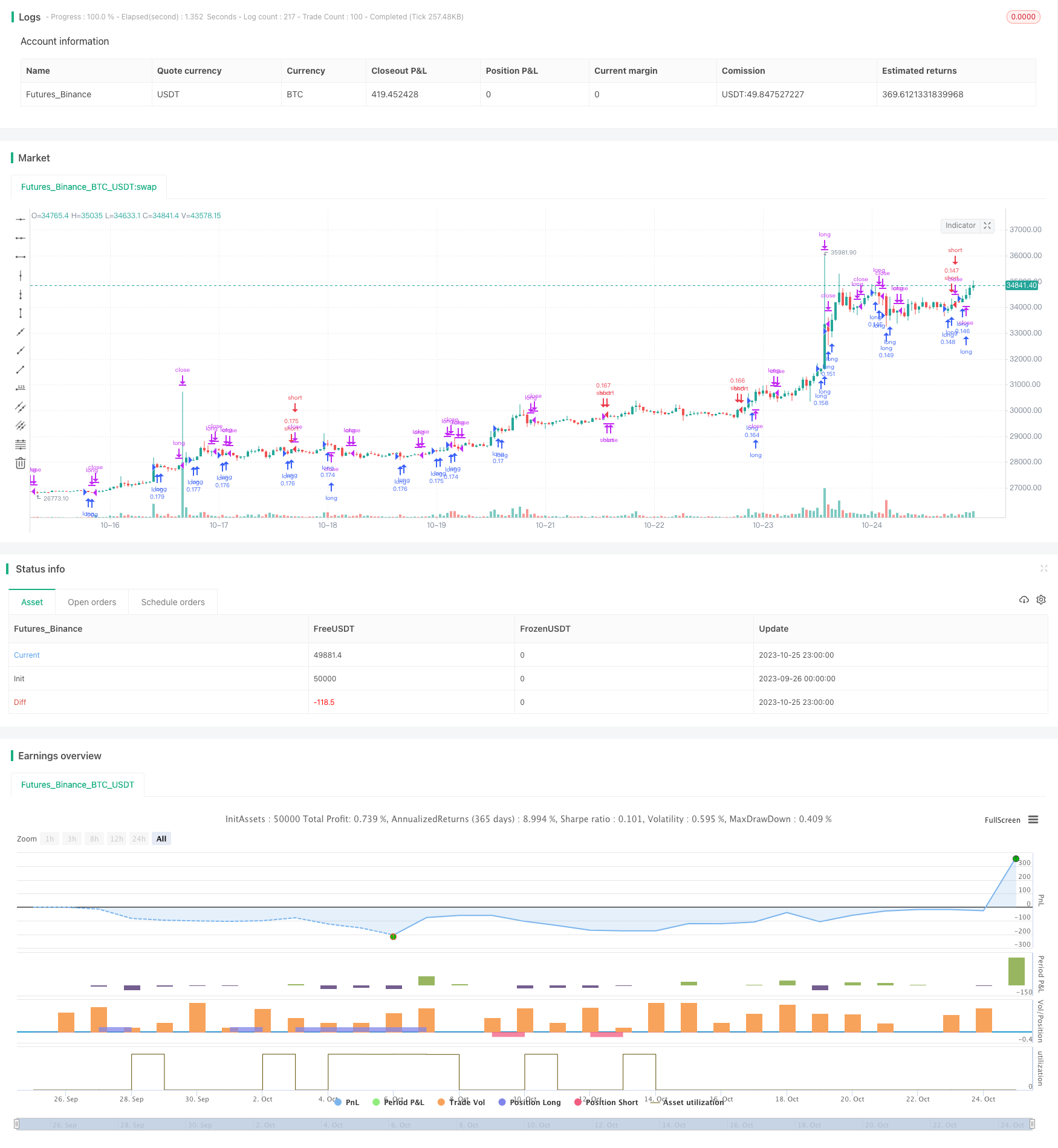

/*backtest

start: 2023-09-26 00:00:00

end: 2023-10-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Decam9

//@version=5

strategy(title = "Moving Average Crossover", shorttitle = "MA Crossover Strategy", overlay=true,

initial_capital = 100000,default_qty_type = strategy.percent_of_equity, default_qty_value = 10)

//Moving Average Inputs

EMA1 = input.int(title="Fast EMA", group = "Moving Averages:",

inline = "EMAs", defval=5, minval = 1)

isDynamicEMA = input.bool(title = "Dynamic Exponential Moving Average?", defval = true,

inline = "EMAs", group = "Moving Averages:", tooltip = "Changes the source of the MA based on trend")

SMA1 = input.int(title = "Slow SMA", group = "Moving Averages:",

inline = "SMAs", defval = 10, minval = 1)

isDynamicSMA = input.bool(title = "Dynamic Simple Moving Average?", defval = false,

inline = "SMAs", group = "Moving Averages:", tooltip = "Changes the source of the MA based on trend")

SMA2 = input.int(title="Trend Determining SMA", group = "Moving Averages:",

inline = "MAs", defval=13, minval = 1)

//Moving Averages

Trend = ta.sma(close, SMA2)

Fast = ta.ema(isDynamicEMA ? (close > Trend ? low : high) : close, EMA1)

Slow = ta.sma(isDynamicSMA ? (close > Trend ? low : high) : close, SMA1)

//Allowed Entries

islong = input.bool(title = "Long", group = "Allowed Entries:",

inline = "Entries",defval = true)

isshort = input.bool(title = "Short", group = "Allowed Entries:",

inline = "Entries", defval= true)

//Entry Long Conditions

buycond = input.string(title="Buy when", group = "Entry Conditions:",

inline = "Conditions",defval="Fast-Slow Crossing",

options=["Fast-Slow Crossing", "Fast-Trend Crossing","Slow-Trend Crossing"])

intrendbuy = input.bool(title = "In trend", defval = true, group = "Entry Conditions:",

inline = "Conditions", tooltip = "In trend if price is above SMA 2")

//Entry Short Conditions

sellcond = input.string(title="Sell when", group = "Entry Conditions:",

inline = "Conditions2",defval="Fast-Slow Crossing",

options=["Fast-Slow Crossing", "Fast-Trend Crossing","Slow-Trend Crossing"])

intrendsell = input.bool(title = "In trend",defval = true, group = "Entry Conditions:",

inline = "Conditions2", tooltip = "In trend if price is below SMA 2?")

//Exit Long Conditions

closebuy = input.string(title="Close long when", group = "Exit Conditions:",

defval="Fast-Slow Crossing", options=["Fast-Slow Crossing", "Fast-Trend Crossing","Slow-Trend Crossing"])

//Exit Short Conditions

closeshort = input.string(title="Close short when", group = "Exit Conditions:",

defval="Fast-Slow Crossing", options=["Fast-Slow Crossing", "Fast-Trend Crossing","Slow-Trend Crossing"])

//Filters

filterlong =input.bool(title = "Long Entries", inline = 'linefilt', group = 'Apply Filters to',

defval = true)

filtershort =input.bool(title = "Short Entries", inline = 'linefilt', group = 'Apply Filters to',

defval = true)

filterend =input.bool(title = "Exits", inline = 'linefilt', group = 'Apply Filters to',

defval = true)

usevol =input.bool(title = "", inline = 'linefiltvol', group = 'Relative Volume Filter:',

defval = false)

rvol = input.int(title = "Volume >", inline = 'linefiltvol', group = 'Relative Volume Filter:',

defval = 1)

len_vol = input.int(title = "Avg. Volume Over Period", inline = 'linefiltvol', group = 'Relative Volume Filter:',

defval = 30, minval = 1,

tooltip="The current volume must be greater than N times the M-period average volume.")

useatr =input.bool(title = "", inline = 'linefiltatr', group = 'Volatility Filter:',

defval = false)

len_atr1 = input.int(title = "ATR", inline = 'linefiltatr', group = 'Volatility Filter:',

defval = 5, minval = 1)

len_atr2 = input.int(title = "> ATR", inline = 'linefiltatr', group = 'Volatility Filter:',

defval = 30, minval = 1,

tooltip="The N-period ATR must be greater than the M-period ATR.")

usersi =input.bool(title = "", inline = 'linersi', group = 'Overbought/Oversold Filter:',

defval = false)

rsitrhs1 = input.int(title = "", inline = 'linersi', group = 'Overbought/Oversold Filter:',

defval = 0, minval=0, maxval=100)

rsitrhs2 = input.int(title = "< RSI (14) <", inline = 'linersi', group = 'Overbought/Oversold Filter:',

defval = 100, minval=0, maxval=100,

tooltip="RSI(14) must be in the range between N and M.")

issl = input.bool(title = "SL", inline = 'linesl1', group = 'Stop Loss / Take Profit:',

defval = false)

slpercent = input.float(title = ", %", inline = 'linesl1', group = 'Stop Loss / Take Profit:',

defval = 10, minval=0.0)

istrailing = input.bool(title = "Trailing", inline = 'linesl1', group = 'Stop Loss / Take Profit:',

defval = false)

istp = input.bool(title = "TP", inline = 'linetp1', group = 'Stop Loss / Take Profit:',

defval = false)

tppercent = input.float(title = ", %", inline = 'linetp1', group = 'Stop Loss / Take Profit:',

defval = 20)

//Conditions for Crossing

fscrossup = ta.crossover(Fast,Slow)

fscrossdw = ta.crossunder(Fast,Slow)

ftcrossup = ta.crossover(Fast,Trend)

ftcrossdw = ta.crossunder(Fast,Trend)

stcrossup = ta.crossover(Slow,Trend)

stcrossdw = ta.crossunder(Slow,Trend)

//Defining in trend

uptrend = Fast >= Slow and Slow >= Trend

downtrend = Fast <= Slow and Slow <= Trend

justCrossed = ta.cross(Fast,Slow) or ta.cross(Slow,Trend)

//Entry Signals

crosslong = if intrendbuy

(buycond =="Fast-Slow Crossing" and uptrend ? fscrossup:(buycond =="Fast-Trend Crossing" and uptrend ? ftcrossup:(buycond == "Slow-Trend Crossing" and uptrend ? stcrossup : na)))

else

(buycond =="Fast-Slow Crossing"?fscrossup:(buycond=="Fast-Trend Crossing"?ftcrossup:stcrossup))

crossshort = if intrendsell

(sellcond =="Fast-Slow Crossing" and downtrend ? fscrossdw:(sellcond =="Fast-Trend Crossing" and downtrend ? ftcrossdw:(sellcond == "Slow-Trend Crossing" and downtrend ? stcrossdw : na)))

else

(sellcond =="Fast-Slow Crossing"?fscrossdw:(buycond=="Fast-Trend Crossing"?ftcrossdw:stcrossdw))

crossexitlong = (closebuy =="Fast-Slow Crossing"?fscrossdw:(closebuy=="Fast-Trend Crossing"?ftcrossdw:stcrossdw))

crossexitshort = (closeshort =="Fast-Slow Crossing"?fscrossup:(closeshort=="Fast-Trend Crossing"?ftcrossup:stcrossup))

// Filters

rsifilter = usersi?(ta.rsi(close,14) > rsitrhs1 and ta.rsi(close,14) < rsitrhs2):true

volatilityfilter = useatr?(ta.atr(len_atr1) > ta.atr(len_atr2)):true

volumefilter = usevol?(volume > rvol*ta.sma(volume,len_vol)):true

totalfilter = volatilityfilter and volumefilter and rsifilter

//Filtered signals

golong = crosslong and islong and (filterlong?totalfilter:true)

goshort = crossshort and isshort and (filtershort?totalfilter:true)

endlong = crossexitlong and (filterend?totalfilter:true)

endshort = crossexitshort and (filterend?totalfilter:true)

// Entry price and TP

startprice = ta.valuewhen(condition=golong or goshort, source=close, occurrence=0)

pm = golong?1:goshort?-1:1/math.sign(strategy.position_size)

takeprofit = startprice*(1+pm*tppercent*0.01)

// fixed stop loss

stoploss = startprice * (1-pm*slpercent*0.01)

// trailing stop loss

if istrailing and strategy.position_size>0

stoploss := math.max(close*(1 - slpercent*0.01),stoploss[1])

else if istrailing and strategy.position_size<0

stoploss := math.min(close*(1 + slpercent*0.01),stoploss[1])

if golong and islong

strategy.entry("long", strategy.long )

if goshort and isshort

strategy.entry("short", strategy.short)

if endlong

strategy.close("long")

if endshort

strategy.close("short")

// Exit via SL or TP

strategy.exit(id="sl/tp long", from_entry="long", stop=issl?stoploss:na,

limit=istp?takeprofit:na)

strategy.exit(id="sl/tp short",from_entry="short",stop=issl?stoploss:na,

limit=istp?takeprofit:na)