Overview

This strategy combines the MACD indicator’s golden cross and dead cross signals, the closing price’s relationship with the median line, and price volatility characteristics to determine entry and exit points. It also sets re-entry and correction entry mechanisms to gain more trading opportunities while controlling risks and realizing steady returns.

Strategy Principles

The strategy is mainly based on the following principles:

Use MACD fast line and slow line golden cross and dead cross to determine bull and bear markets and specific entry points.

Use the closing price’s relationship with the median line to determine the end of trends and exit points.

Set re-entry mechanism to re-enter the market in the same direction after the end of the current MACD trend to increase profit.

Set correction entry mechanism to add positions during partial price corrections within a trend.

Dynamically adjust positions based on the above to maximize profits within trends while exiting quickly when the trend ends.

Specifically, the strategy first checks if a golden cross or dead cross occurs between the MACD fast and slow lines to go long or short. It then checks if the closing price touches the median line to determine the end of the trend and close positions.

In addition, the strategy has a re-entry mechanism to re-open positions in the original direction if MACD continues to show signals in the same direction after the initial trend ends. There is also a correction entry mechanism to moderately add positions during small pullbacks before full reversals.

Through these settings, the strategy can dynamically adjust positions, increase entry and exit frequencies, and maximize returns while controlling risks within trends.

Advantages

The main advantages of this multi-indicator strategy are:

MACD identifies trends and reversal points for entry.

Closing price and median line relationship accurately determines trend end.

Re-entry increases capital utilization efficiency.

Correction entry timely adds positions to capture trends.

High trade frequency with controllable risk yields high profit factors.

Customizable parameters for optimization across products and markets.

Clear logic and concise code for easy live trading.

Sufficient backtest data ensures reliability.

Risks

The main risks are:

Probability of false MACD signals needs verification with other indicators.

Stops that are too tight may get stopped out by volatile moves.

Increased trade frequency requires controlling capital utilization.

Correction entries can cause losses during pullbacks.

Optimization required for different products and markets.

Requires ongoing backtesting and optimization.

Slippage costs need consideration for live trading.

Risk management measures include using stops to limit losses, evaluating capital utilization, optimizing parameters per product via backtesting, monitoring market dynamics to refine parameters, and accounting for slippage in tests.

Enhancement Opportunities

Enhancement opportunities:

Add other indicators to verify signals, e.g. KDJ.

Implement adaptive dynamic stops.

Optimize re-entry and correction entry logic.

Parameter optimization per product.

Optimize capital utilization for entries.

Incorporate volume indicators to avoid losses from pullback entries.

Add exit mechanisms like moving stops.

Build automated trading bot.

Account for real-world factors like slippage.

These can further improve stability, adaptability, automation, and live performance.

Conclusion

This strategy integrates MACD signals, closing price analysis, and multiple entry mechanisms to maximize trends while controlling risk. It has high capital efficiency and ease of implementation but requires risk control and optimization. Automation can make it a robust quantitative trading system.

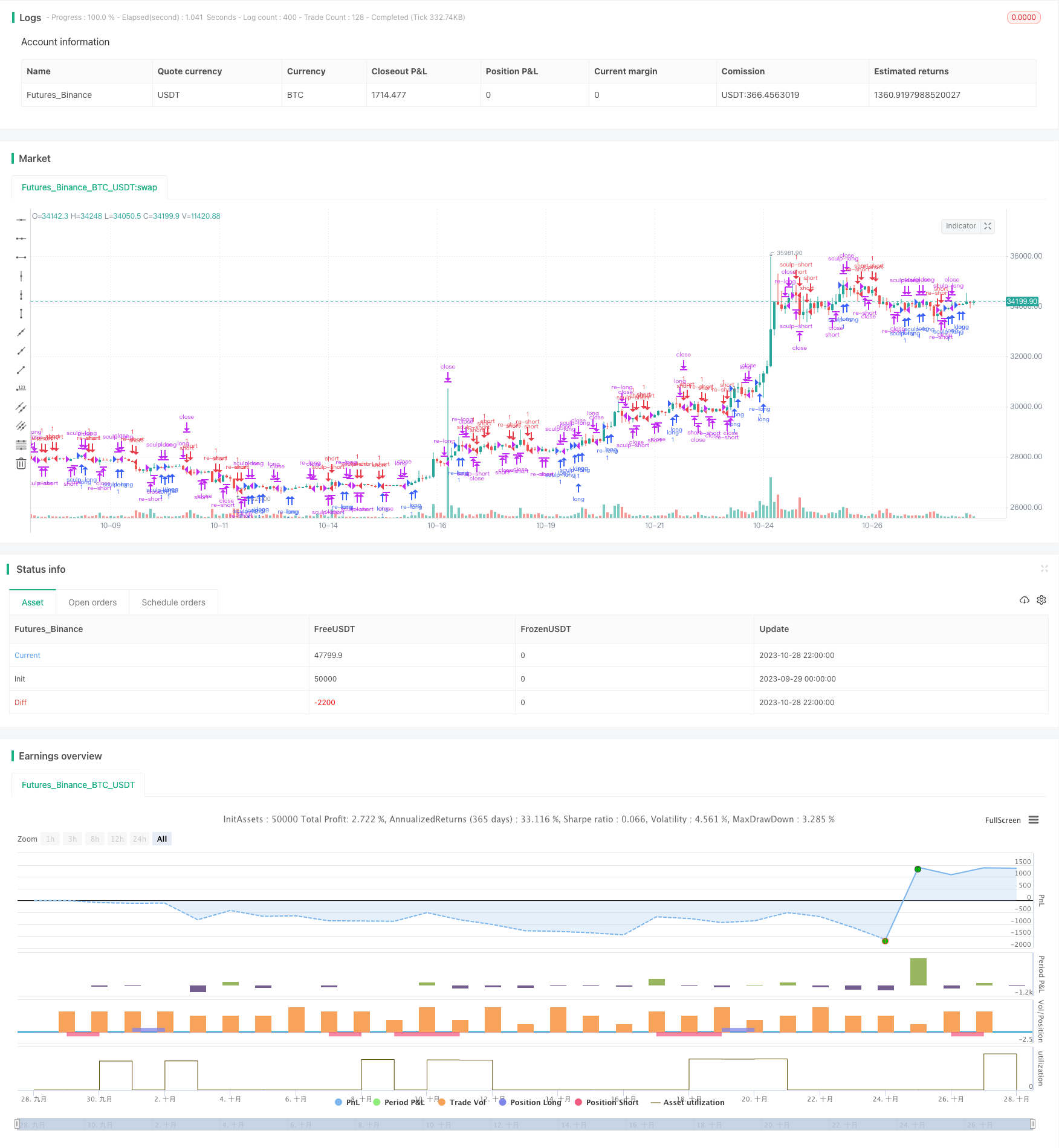

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Puckapao

//@version=4

// strategy(title="MACD", shorttitle="MACD", overlay=true, initial_capital=10000.00, currency="USD", default_qty_type=strategy.cash, default_qty_value=10000.00)

// Getting inputs

reenter_delay = input(title="Re-enter Delay", type=input.integer, defval=2)

sculp_delay = input(title="Sculp Delay", type=input.integer, defval=4)

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=true)

ema_period = input(title="EMA Period", type=input.integer, defval=21)

// Get date

startDate = input(title="Start Date", type=input.integer,

defval=19, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=09, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2017, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=3, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100)

// STEP 2:

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

reenter_cnt = 0

reenter_cnt := nz(reenter_cnt[1])

sculp_cnt = 0

sculp_cnt := nz(sculp_cnt[1])

close_cnt = 0

close_cnt := nz(close_cnt[1])

on_long = false

on_long := nz(on_long[1])

on_short = false

on_short := nz(on_short[1])

sculp = false

reenter = false

slowdown = false

ema = ema(close, ema_period)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

// plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

// plot(macd, title="MACD", color=col_macd, transp=0)

// plot(signal, title="Signal", color=col_signal, transp=0)

cross_up = crossover(macd, signal)

cross_down = crossunder(macd, signal)

if (inDateRange)

over_macd = macd > 0 and signal > 0 ? true : false

under_macd = macd < 0 and signal < 0 ? true : false

over_water = close > ema ? true : false

under_water = close < ema ? true : false

slowdown := hist >= 0 ? (hist[1] > hist ? true : false) : (hist[1] > hist ? false : true)

reenter := hist >= 0 ? (hist[1] < hist ? true : false) : (hist[1] > hist ? true : false)

sculp := (hist >= 0 ? (hist[1] > hist ? true : false) : (hist[1] < hist ? true : false))

if(reenter == true)

if(reenter_cnt < reenter_delay)

reenter_cnt := reenter_cnt + 1

else

if(reenter_cnt > 0)

reenter_cnt := reenter_cnt - 1

if(sculp == true)

if(sculp_cnt < sculp_delay)

sculp_cnt := sculp_cnt + 1

else

if(sculp_cnt > 0)

sculp_cnt := sculp_cnt - 1

if(slowdown == false)

if(close_cnt < 2)

close_cnt := close_cnt + 1

else

close_cnt := 0

// plotchar(fork_cnt, "fork count", "")

// plotchar(spoon_cnt, "spoon count", "")

// Entry

if (cross_up == true)

strategy.entry("long", strategy.long, comment = "long", alert_message = "long")

on_long := true

on_short := false

if (cross_down == true)

strategy.entry("short", strategy.short, comment = "short", alert_message = "short")

on_short := true

on_long := false

// Sculp bottom / top

if (sculp == true and sculp_cnt >= sculp_delay)

if (hist >= 0)

strategy.entry("sculp-short", strategy.short, comment = "sculp-short", alert_message = "sculp-short")

else

strategy.entry("sculp-long", strategy.long, comment = "sculp-long", alert_message = "sculp-long")

sculp_cnt := 0

sculp := false

// Re-Entry

if (reenter == true and reenter_cnt >= reenter_delay)

if (hist >= 0)

strategy.entry("re-long", strategy.long, comment = "re-long", alert_message = "re-long")

else

strategy.entry("re-short", strategy.short, comment = "re-short", alert_message = "re-short")

reenter_cnt := 0

reenter := false

// Close

strategy.close("long", when = slowdown, comment = "close long", alert_message = "close long")

strategy.close("short", when = slowdown, comment = "close short", alert_message = "close short")

strategy.close("re-long", when = slowdown, comment = "close re-long", alert_message = "close re-long")

strategy.close("re-short", when = slowdown, comment = "close re-short", alert_message = "close re-short")

strategy.close("sculp-long", when = slowdown, comment = "close sculp-long", alert_message = "close sculp-long")

strategy.close("sculp-short", when = slowdown, comment = "close sculp-short", alert_message = "close sculp-short")

if (slowdown)

if (hist >= 0)

on_long := false

else

on_short := false

plotchar(slowdown, "close", "")

plotchar(reenter, "reenter", "")

plotchar(reenter_cnt, "reenter count", "")

plotchar(sculp, "sculp", "")

plotchar(sculp_cnt, "sculp count", "")