RSI and SuperTrend Based Dual Direction Trading Strategy

Author: ChaoZhang, Date: 2023-11-03 14:22:50Tags:

Overview

This is a dual direction trading strategy that comprehensively utilizes the RSI indicator and the SuperTrend indicator. The strategy aims to identify the strength and weakness in the market and make timely position switching when the trend direction changes, in order to obtain higher returns.

Strategy Principle

The strategy is mainly based on the following principles:

-

Use the RSI indicator to determine the current market strength and weakness. Above 50 RSI indicates a strong market, and below 50 a weak one.

-

Use the SuperTrend indicator as a trend filter. Trading signals are triggered only when the price breaks through the SuperTrend lines.

-

When RSI gives a strong signal, go long if the price breaks above the upper band, and close position if it breaks below the lower band.

-

When RSI gives a weak signal, go short if the price breaks below the lower band, and close position if it breaks above the upper band.

-

Capture turning points by monitoring the transitions of RSI between long and short, and make timely position switching.

Implementation

-

Calculate RSI values with length of 14, using 50 as the threshold for strength/weakness.

-

Calculate SuperTrend with length of 10 and multiplier of 2.

-

Go long when RSI goes above 50 and price breaks above SuperTrend upper band. Go short when RSI falls below 50 and price breaks below lower band.

-

When already long, if RSI turns weak and price breaks below upper band, close long position. Vice versa when short.

-

Configurable for long-only or short-only modes.

Advantages

This strategy combines trend following and overbought/oversold analysis, and has the following advantages:

-

Can capture trend changes in a timely manner and avoid unnecessary entries.

-

RSI effectively identifies overbought/oversold zones to avoid chasing tops and bottoms.

-

SuperTrend filters out market noise well and tracks mid-long term trends.

-

Combining RSI and SuperTrend improves stability.

-

The strategy has large parameter tuning space for different products and timeframes.

-

Supports long-only/short-only modes to handle different market conditions flexibly.

Risks

There are also some risks with this strategy:

-

RSI can generate false signals easily, requiring price confirmation.

-

Bad SuperTrend parameters may cause missed trades or chasing.

-

Divergence risk exists when combining two indicators. Parameters need to be adjusted for best match.

-

Stop loss may be taken out instantly in extreme volatility. Reasonable stop loss placement is necessary.

-

Avoid taking reversal positions near major support/resistance levels.

Enhancements

The strategy can be further optimized in the following aspects:

-

Adjust RSI parameters to find the optimal length for filtering out false signals.

-

Optimize SuperTrend parameters for better trend tracking capability.

-

Test different parameter combinations on different products and timeframes to find the optimum.

-

Add other indicators like MACD, KDJ to improve signal accuracy.

-

Add analysis of key support/resistance, Bollinger Bands, moving averages etc. to qualify strategy signals.

-

Optimize stop loss strategy to reduce being stopped out while maintaining effectiveness.

Conclusion

This strategy integrates the strengths of RSI and SuperTrend to effectively identify mid-term trend changes between bull and bear markets. The strategy is easy to implement with clear logic and has strong practical value. With parameter tuning it can adapt to more market conditions. Common issues like false signals and bad parameters need to be watched out for. Overall this is a solid trend following strategy.

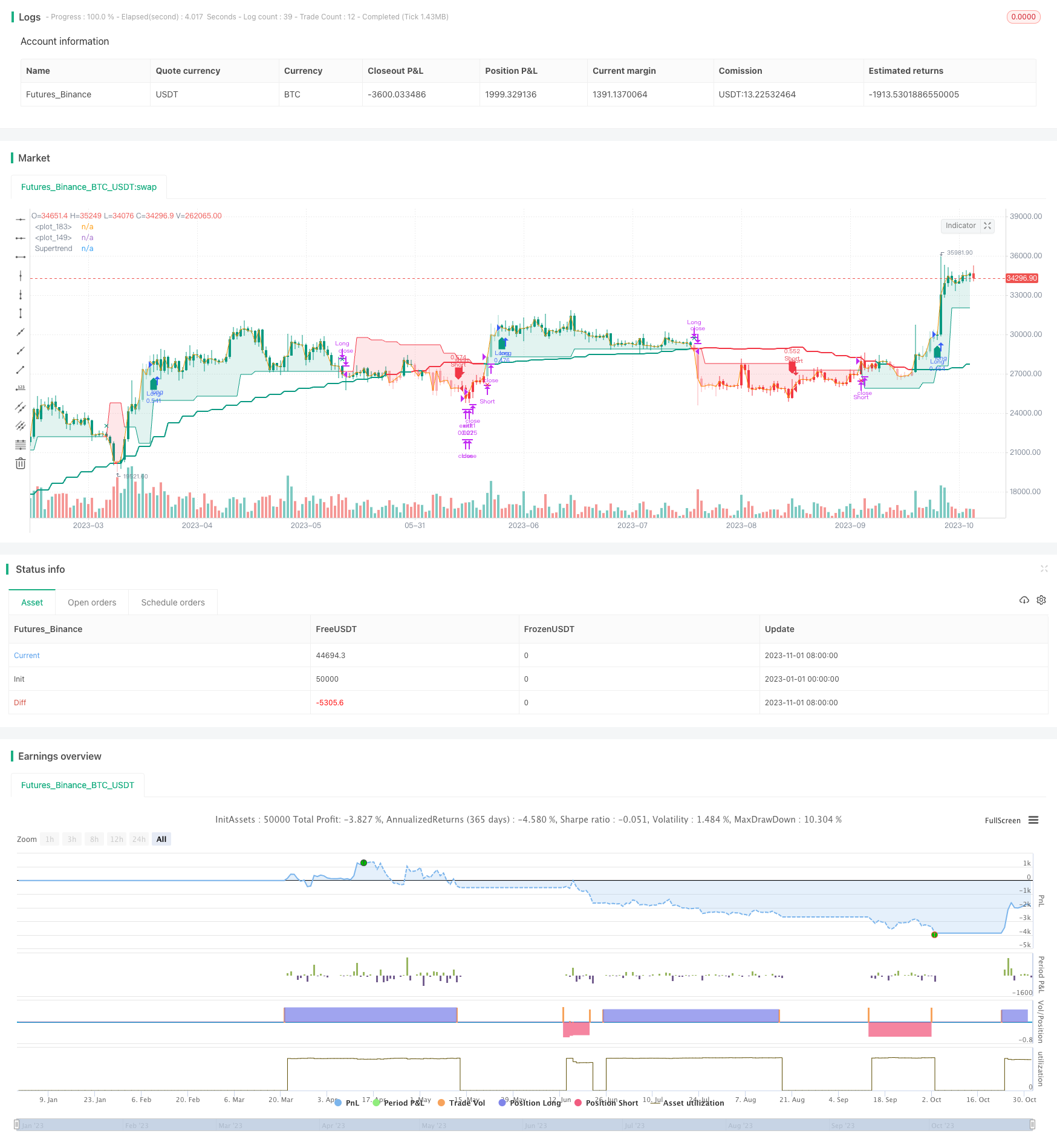

/*backtest

start: 2023-01-01 00:00:00

end: 2023-11-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//Created by @CITIAlgo

// —————————————————————————————————————————————————————————————————————————————————————————————————————————

strategy('CITI Trends A with RSI Candles', shorttitle = "CITI Trends A" , overlay = true ,

initial_capital = 10000,

commission_value = 0.025,

default_qty_value = 25,

slippage = 1,

pyramiding = 0,

max_lines_count = 500,

max_labels_count = 500,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity)

bullColor1 = #089981

bearColor1 = #f23645

bullColor2 = #3873e3

bearColor2 = #630ef5

neutralColor1 = #d5d5d5

//Base Settings

groupBase = "Base Settings ---------------------------------------"

Repaint_type = input.string('Non-Repainting', "Allow Repainting ?", options = ['Non-Repainting', 'Repainting'], inline ='repaint' , group = groupBase , tooltip = 'The default value is Non-Repainting. To learn more visit https://www.tradingview.com/pine-script-docs/en/v5/concepts/Repainting.html')

//Configure trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"] , group=groupBase , inline = 'Type' )

longOK = tradeDirection == "Long" or tradeDirection == "Both"

shortOK = tradeDirection == "Short" or tradeDirection == "Both"

var bool PlotEntries = input.bool (true, "Show Entries" ,group=groupBase , inline = 'Signals' )

var bool PlotExits = input.bool (true, "Show Exits" , group=groupBase, inline = 'Signals' )

//Display Settings

groupDisplay = "Display Settings ------------------------------------"

MomBars = input.bool( true , title="Apply Bar Colors", inline = 'candles' , group=groupDisplay)

cbullColor = input.color( bullColor1 , 'Candle Colors' , inline = 'candles1a',group=groupDisplay)

cbearColor = input.color( bearColor1 , '' , inline = 'candles1a',group=groupDisplay)

//Candle & label Colors

Bullish_Bars = color.new( cbullColor , 0)

WBullish_Bars = color.new( cbullColor , 60)

Bearish_Bars = color.new( cbearColor , 0)

WBearish_Bars = color.new( cbearColor , 60)

lbullColor = input.color( bullColor1 , 'Long/Short Labels' , group=groupDisplay, inline = 'Signals1' )

lbearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'Signals1' )

st_status = input.bool( true , title="Show Supertrend", inline = 'st' , group=groupDisplay)

st_bullColor = input.color( bullColor1 , '' , group=groupDisplay, inline = 'st' )

st_bearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'st' )

//Build Your Signals Settings

groupEntry = " Trend & Signal Settings---------------------"

Entry1a = input.bool(true, title= "Entry", inline='entry1a', group=groupEntry)

Exit1a = input.bool(false, title= "Exit | Strong/Weak Momentum", inline='entry1a', group=groupEntry)

Entry1b = input.bool(false, title= 'Entry' , inline='entry1b', group=groupEntry)

Exit1b = input.bool(false, title= 'Exit | Bull/Bear Momentum' , inline='entry1b', group=groupEntry)

Entry3a = input.bool(false, title= "Filter", inline='entry3a', group=groupEntry)

Exit3a = input.bool(false, title= "Exit | MA ", inline='entry3a', group=groupEntry)

Entry4a = input.bool(false, title= "Filter | Disable RSI Ranges ", inline='entry4a', group=groupEntry)

Entry4b = input.bool(true, title= "Filter", inline='entry4b', group=groupEntry)

Exit4b = input.bool(true, title= "Exit | Supertrend ", inline='entry4b', group=groupEntry)

Entry4c = input.bool(true, title= "Filter | Disable Supertrend Ranges ", inline='entry4c', group=groupEntry)

// —————————————————————————————————————MTF FUNCTIONS

// —————————— PineCoders MTF Selection Framework functions

// ————— Converts current "timeframe.multiplier" plus the TF into minutes of type float.

f_resInMinutes() =>

_resInMinutes = timeframe.multiplier * (timeframe.isseconds ? 1. / 60. : timeframe.isminutes ? 1. : timeframe.isdaily ? 1440. : timeframe.isweekly ? 10080. : timeframe.ismonthly ? 43800. : na)

_resInMinutes

// Get current resolution in float minutes.

var ResInMinutes = f_resInMinutes()

// ————— Returns resolution of _resolution period in minutes.

f_tfResInMinutes(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

request.security(syminfo.tickerid, _res, f_resInMinutes())

// ————— Returns a multiple of current resolution as a string in "timeframe.period" format usable with "security()".

f_multipleOfRes(_res, _mult) =>

// _res: current resolution in minutes, in the fractional format supplied by f_resInMinutes() companion function.

// _mult: Multiple of current TF to be calculated.

// Convert current float TF in minutes to target string TF in "timeframe.period" format.

_targetResInMin = _res * math.max(_mult, 1)

// Find best string to express the resolution.

_targetResInMin <= 0.083 ? '5S' : _targetResInMin <= 0.251 ? '15S' : _targetResInMin <= 0.501 ? '30S' : _targetResInMin <= 1440 ? str.tostring(math.round(_targetResInMin)) : _targetResInMin <= 43800 ? str.tostring(math.round(math.min(_targetResInMin / 1440, 365))) + 'D' : str.tostring(math.round(math.min(_targetResInMin / 43800, 12))) + 'M'

// ————— Converts current resolution

f_resInString(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

_res == "1" ? "1m" :

_res == "3" ? "3m" :

_res == "5" ? "5m" :

_res == "15" ? "15m" :

_res == "30" ? "30m" :

_res == "45" ? "45m" :

_res == "60" ? "1h" :

_res == "120" ? "2h" :

_res == "180" ? "3h" :

_res == "240" ? "4h" :

_res == "1D" ? "D" :

_res == "1W" ? "W" :

_res == "1M" ? "M" : _res

//Set repaint security function

repaint_sw = Repaint_type == 'Non-Repainting' ? false : true

f_security(_symbol, _res, _src, _repaint) => request.security(_symbol, _res, _src[_repaint ? 0 : barstate.isrealtime ? 1 : 0] , barmerge.gaps_off, barmerge.lookahead_on)[_repaint ? 0 : barstate.isrealtime ? 0 : 1]

f_source(_res , source) => f_security(syminfo.tickerid , _res , source , repaint_sw )

Type1 = 'Auto Multiplied TF'

Type2 = 'Fixed TF'

//---------------------------------------------------------------------------

//RSI Settings // INPUTS

groupRange = "RSI Settings ----------------------------------"

TF1type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf1' , group=groupRange)

setHTF1a = input.int( 4 , '' , inline ='tf1', group=groupRange)

setHTF1b = input.timeframe( 'D' , '' , inline ='tf1', group=groupRange)

// Get HTF from user-defined mode.

var TF1 = TF1type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF1a) : setHTF1b

mLength = input.int( 14 , "RSI Length" ,inline='lines', group=groupRange)

BullLevel = input.int( 50 , "Bullish Level | Above 50 ",inline='lines1a', group=groupRange)

BearLevel = input.int( 50 , "Bearish Level | Below 50 ",inline='lines1b', group=groupRange)

ma_length = input.int( 21 , "MA Length" ,inline='ma', group=groupRange)

ma_status = input.bool( true , "Show MA" ,inline='ma1', group=groupRange)

ma_bullColor = input.color( bullColor1 , '' , inline='ma1', group=groupRange)

ma_bearColor = input.color( bearColor1 , '' , inline='ma1', group=groupRange)

//--------------------------------------------------------------------------

//Momentum Calculations

f_momTF( _tf ) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

rsi_ = _isShow ? f_security(syminfo.tickerid , _tf, ta.rsi( close_, mLength) , repaint_sw) : na

ma = _isShow ? f_security(syminfo.tickerid , _tf, ta.vwma( hlc3 , ma_length ) , repaint_sw) : na

[rsi_ , ma]

[ rsi , ma ] = f_momTF(TF1)

ma_color = close > ma ? ma_bullColor : ma_bearColor

plot( ma_status ? ma : na , color = ma_color , linewidth = 2 , style = plot.style_line)

//---------------------------------------------------------------------------

//Supertrend Settings // INPUTS

groupST = "Supertrend Settings ----------------------------------"

TF2type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf2' , group=groupST)

setHTF2a = input.int( 4 , '' , inline ='tf2', group=groupST)

setHTF2b = input.timeframe( 'D' , '' , inline ='tf2', group=groupST)

// Get HTF from user-defined mode.

var TF2 = TF2type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF2a) : setHTF2b

stLength = input.int( 10 , "Supertrend Length" ,inline='lines', group=groupST)

stmult = input.int( 2 , "Mult" ,inline='lines', group=groupST)

stHighlights = input.bool( true , "Highlights",inline='lines1a', group=groupST)

f_st( _tf) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

atr= f_security(syminfo.tickerid , _tf, ta.atr(stLength) , repaint_sw)

Up=close_ -(stmult*atr)

Dn=close_ +(stmult*atr)

TrendUp = 0.0

TrendUp := close_[1]>TrendUp[1] ? math.max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := close_[1]<TrendDown[1]? math.min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := close_ > TrendDown[1] ? 1: close_< TrendUp[1]? -1: nz(Trend[1],1)

stLine = Trend==1? TrendUp: TrendDown

[Trend, stLine]

[Trend, stLine] = f_st( TF2 )

stTrend = close > stLine ? 1:-1

stplot = plot( st_status? stLine : na , color= stTrend ==1 ? st_bullColor : st_bearColor , linewidth=1 ,title ="Supertrend")

priceLineP = plot( close , color= na , linewidth=1 , display = display.none)

fill(priceLineP , stplot , color = stHighlights ? stTrend ==1 ? color.new(st_bullColor , 85) : color.new( st_bearColor , 85 ) : na )

//---------------------------------------------------------------------------

//Momentum BarColors

mom2a = rsi > BullLevel ? Bullish_Bars : WBullish_Bars

mom2b = rsi < BearLevel ? Bearish_Bars : WBearish_Bars

mom2_color = close > ma ? mom2a : mom2b

mom_color = MomBars ? mom2_color : na

barcolor(mom_color)

//-------------------------------------------------

//Momentum Strength & Values

momVal2a = rsi > BullLevel ? 2 : 1

momVal2b = rsi < BearLevel ? -2 : -1

momVal2 = close > ma ? momVal2a : momVal2b

momVal = momVal2

///==============================================================================================================

//Long Trend Conditions

Entry1aL = Entry1a ? momVal == 2 : true

Entry1bL = Entry1b ? momVal == 1 or momVal == 2 : true

Entry3aL = Entry3a ? close > ma : true

Entry4aL = Entry4a ? rsi > BullLevel : true

Entry4bL = Entry4b ? close > stLine : true

Entry4cL = Entry4c ? stLine > stLine[1] : true

//------

noEntry = Entry1a == false and Entry1b == false and Entry3a == false and Entry4a == false and Entry4b == false and Entry4c == false ? false : true

noExit = Exit1a == false and Exit1b == false and Exit3a == false and Exit4b == false ? false : true

//------

EntryL = noEntry and Entry1aL and Entry1bL and Entry3aL and Entry4aL and Entry4bL and Entry4cL

Exit1aL = Exit1a ? momVal == 1 and momVal[1] == 2 : true

Exit1bL = Exit1b ? momVal == -1 or momVal == -2 : true

Exit3aL = Exit3a ? close < ma : true

Exit4bL = Exit4b ? close < stLine : true

ExitL = noExit and Exit1aL and Exit3aL and Exit1bL and Exit4bL

//Short Trend Conditions

Entry1aS = Entry1a ? momVal == -2 : true

Entry1bS = Entry1b ? momVal == -1 or momVal == -2 : true

Entry3aS = Entry3a ? close < ma : true

Entry4aS = Entry4a ? rsi < BearLevel : true

Entry4bS = Entry4b ? close < stLine : true

Entry4cS = Entry4c ? stLine < stLine[1] : true

EntryS = noEntry and Entry1aS and Entry1bS and Entry3aS and Entry4aS and Entry4bS and Entry4cS

Exit1aS = Exit1a ? momVal == -1 and momVal[1] == -2 : true

Exit1bS = Exit1b ? momVal == 1 or momVal == 2 : true

Exit3aS = Exit3a ? close > ma : true

Exit4bS = Exit4b ? close > stLine : true

ExitS = noExit and Exit1aS and Exit3aS and Exit1bS and Exit4bS

///==============================================================================================================

//Entry & exit conditions

isLong = false

isLong := nz(isLong[1], false)

isShort = false

isShort := nz(isShort[1], false)

goLong = not isLong and EntryL and not ExitL and longOK and barstate.isconfirmed

goShort = not isShort and EntryS and not ExitS and shortOK and barstate.isconfirmed

longExit = isLong and ExitL and barstate.isconfirmed

shortExit = isShort and ExitS and barstate.isconfirmed

if (goLong)

isLong := true

isShort := false

if (goShort)

isLong := false

isShort := true

if (longExit)

isLong := false

if (shortExit)

isShort := false

//------------------------------------------------------------------------------

// ——Backtester

grouptime = 'Step 5 - 📆 Time Filter 📆-------------'

startTime = input (group=grouptime, title="Start Timeㅤㅤ", defval=timestamp('UTC 01 Jan 2020 00:00'), inline="Start")

endTime = input (group=grouptime, title="End Time ㅤ ㅤ", defval=timestamp('UTC 31 Dec 2025 23:45'), inline="End")

dateRange = true

//------------------------------------------------------------------------------

// Risk Managment

grouprisk = 'Step 6 - Risk Management-------------'

takeprofit = input.bool(true,title = "TP Price %",group=grouprisk, inline="profit")

tppercent = input.float(1, '', group=grouprisk, inline="profit") / 100

q1 = input.int (5 , "Quantity %",group=grouprisk , inline="profit")

stoploss = input.bool(false,title = "SL Price %",group=grouprisk, inline="loss")

stoppercent = input.float(5, '', group=grouprisk, inline="loss") / 100

// Determine where you've entered and in what direction

longtp = strategy.position_avg_price * (1 + tppercent)

longStop = strategy.position_avg_price * (1 - stoppercent)

shorttp = strategy.position_avg_price * (1 - tppercent)

shortStop = strategy.position_avg_price * (1 + stoppercent)

QTYMethod = input.string ('EQUITY', 'Order Size', group=grouprisk, inline=' ', options=['NONE', 'EQUITY', 'SIZE', 'CONTRACTS'])

useNetProfit = input.bool (true, 'Use Net Profit', group=grouprisk, inline=' ', tooltip='Use Net Profit- On/Off the use of profit in the following trades. *Only works if the type is EQUITY')

riskPerc = input.int (30, '🇪🇶🇺🇮🇹🇾 %', group=grouprisk, inline='.', minval=1, maxval=100)

riskSize = input.int (10000, '🇸🇮🇿🇪', group=grouprisk, inline='.', minval=1)

riskCntr = input.int (1, '🇨🇴🇳🇹🇷🇦🇨🇹🇸', group=grouprisk, inline='.', minval=1, tooltip='Order Size: \nNone- Use the default position size settings in Tab "Properties". \nEquity% - per trade from the initial capital. \nSize- Fixed size amount of trade. \nContracts- The fixed amount of the deal in contracts. \n')

// —————— Order Size

eqty = switch QTYMethod

'NONE' => na

'EQUITY' => riskPerc / close

'SIZE' => riskSize / close

'CONTRACTS' => riskCntr

//-----------------------------------------------------------------------------

// —————— Trade variables

entry = strategy.position_avg_price

sizePos = strategy.position_size

inLong = sizePos > 0

inShort = sizePos < 0

inTrade = inLong or inShort

inPos = (inLong and not inShort[1]) or (inShort and not inLong[1])

var ID = 'TradeID'

var tpPrice = float(na)

var slPrice = float(na)

///==============================================================================================================

// ALERTS

groupalerts = 'Step 7 - Alerts & Bot Trading Settings-------------'

broker = input.string('Binance', "Broker", options=['Binance', 'Alpaca', 'Kucoin', '3Commas'], group=groupalerts, tooltip = 'Choose which type you are using to send the correct Json Alert message for entry and exit alerts.')

my_sym = input("FTMM/USDT", "Ticker", group = 'Cloud Function Server', tooltip = 'Only used with Alerts to fix ticker ID in json message. Some exchanges use the forward slash and some do not.')

my_pass = input('Passphrase', "Passphrase" , group = 'Cloud Function Server', tooltip = 'Only enter your Passphrase and nothing else goes here. Only needed when using a Cloud Function Server.')

i_alert_3CID_txt = input('Bot ID', "Bot ID", group =groupalerts, tooltip = 'Only enter your 3Commas Bot ID and nothing else goes here.')

i_alert_3CET_txt = input('Bot Email Token', title = 'Bot Email Token', group =groupalerts , tooltip = 'Only enter your 3Commas Bot Email Token and nothing else goes here.')

Alert='{"passphrase": "'+str.tostring(my_pass)+'","symbol": "'+ str.tostring(my_sym) +'","type":"market", "side":"{{strategy.order.action}}","amount":"{{strategy.order.contracts}}","price": "' + str.tostring(close) + '"}'

//---------------------------------------------------------------------------------

// JSON alert message used for 3Commas Bots

C3_EntryAlert ='{"message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0 }'

C3_ExitAlert ='{"action": "close_at_market_price_all", "message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0}'

//---------------------------------------------------------------------------------

// JSON alert message used for setting up a Google Cloud Function Server works when using Alpaca Exchange

Alert_Alpaca = '{"symbol": "{{ticker}}", "quantity": "{{strategy.order.contracts}}", "side": "{{strategy.order.action}}", "order_type": "market", "time_in_force": "gtc", "passphrase": "' + str.tostring(my_pass) + '"}'

entryAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_EntryAlert

exitAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_ExitAlert

strategy.initial_capital = 50000

// —————— Entry's

goLongEntry = goLong and dateRange and barstate.isconfirmed

goShortEntry = goShort and dateRange and barstate.isconfirmed

eqty(qty) => QTYMethod=='EQUITY' ? qty / 100 * (strategy.initial_capital + (useNetProfit ? strategy.netprofit : 0)) : QTYMethod=='SIZE' ? qty / syminfo.pointvalue : qty

if goLongEntry

ID := 'Long'

strategy.entry(ID, strategy.long, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

if goShortEntry

ID := 'Short'

strategy.entry(ID, strategy.short, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

// —————— Exit's

qty(perc) => math.abs(sizePos*perc/100)

if longExit

strategy.close("Long",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Long", limit=takeprofit ? longtp : na, stop=stoploss ? longStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Long", stop=stoploss ? longStop : na, comment_loss='SL')

if shortExit

strategy.close("Short",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Short", limit=takeprofit ? shorttp : na, stop=stoploss ? shortStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Short", stop=stoploss ? shortStop : na, comment_loss='SL')

///==============================================================================================================

//Style- Plots on Chart

posH = high + 2 * stLine

posL = low - 2 * stLine

plotshape( goLong and PlotEntries ? posL : na ,'Long Entry Signals' , text= '' , location=location.belowbar, style=shape.labelup , size=size.small , color=lbullColor , textcolor = color.white )

plotshape( longExit and PlotExits ? posH : na ,'Long Exit' , location=location.abovebar, style= shape.xcross , size=size.small, color=lbullColor )

plotshape( goShort and PlotEntries ? posH : na ,'Short Entry Signals' , text= '' , location=location.abovebar, style=shape.labeldown , size=size.small , color=lbearColor , textcolor = color.white )

plotshape( shortExit and PlotExits ? posL : na ,'Short Exit' , location=location.belowbar, style=shape.xcross , size=size.small , color=lbearColor )

///==============================================================================================================

// Alerts

alertcondition( goLong , 'Long Entry Alerts', 'Long Alerts')

alertcondition( goShort , 'Short Entry Alerts', 'Short Alerts')

- Jupiter and Saturn Momentum MA Crossover Filtered Strategy

- Beyond The Clouds Strategy

- Shadow Trading Strategy

- Trend Breakout Moving Average Tracking Strategy

- Volume Oscillator Based Trend Tracking Strategy

- Trend Following Long Term Strategy Based on SuperTrend and Fisher Transform

- Dual Golden Cross Reversal Trading Strategy

- Fibonacci withdraws the trading strategy script

- RSI-BB Momentum Breakout Strategy

- Breakout Band Fixed Stop Loss Strategy

- EMA 13 48 Trend Following Strategy

- Williams Accumulation/Distribution (Williams AD) Strategy

- Relative Momentum Index Strategy

- Double Box Trend Following System

- Martingale Strategy with Expanded Moving Average Range for Stock Trading

- Bull and Bear Balance Strategy

- Oma and Apollo Dual Rail Trading Strategy

- Dual Moving Average Crossover Strategy

- Dual Signal Trend Tracking Strategy

- Trend Following SMA Strategy