Overview

The RSI momentum reversal strategy identifies overbought and oversold conditions by combining RSI indicators and candlestick body directions for reversal trading. This strategy uses both conventional RSI and fast RSI, along with candlestick body filters, to effectively identify reversal opportunities.

Strategy Logic

The strategy is mainly implemented through the following parts:

Connors RSI indicator

Calculates conventional RSI, RSI Win Ratio, and RSI Parisian to get Connors RSI as an average.

Fast RSI indicator

Uses price changes to calculate fast RSI, reflecting ultra short-term cycles.

Candlestick body filter

Requires bullish body for long and bearish body for short to prevent false breakouts.

Long and short conditions

Go long when Connors RSI below 20 and fast RSI below 25 with bullish body.

Go short when Connors RSI above 80 and fast RSI above 75 with bearish body.

Stop loss exit

Exits with stop loss when candlestick body turns around.

Connors RSI identifies long-term trend reversal points, fast RSI identifies short-term reversals, and candlestick body ensures the validity of breakouts. This allows effectively detecting reversal opportunities and making counter-trend trades during overbought and oversold conditions.

Advantage Analysis

The advantages of this strategy include:

Combining long and short-term indicators

Connors RSI reflects long-term cycles and fast RSI reflects short-term cycles, combining both can accurately identify reversal points.

Candlestick body filter

Trading only on body breakouts can reduce losses from false breakouts.

Adjustable parameters

RSI parameters, trading products, and trading time frames can be freely adjusted to suit different markets.

Simple and intuitive

RSI and candlestick body are basic indicators, easy-to-understand logic.

Easy to implement

Uses built-in indicators only, requiring little code and easy to implement.

Risk Analysis

The main risks of this strategy:

Failed reversal risk

Price continues the original trend after reversal signal, leading to losses.

Ranging market risk

Frequent ineffective signals triggered in ranging markets.

False breakout risk

Candlestick body filter cannot completely avoid false breakouts.

Parameter risk

Inappropriate RSI parameters may miss trades or trigger multiple ineffective trades.

Special market conditions risk

RSI indicators may fail and generate incorrect signals in special market conditions.

Optimization Directions

The strategy can be optimized from the following aspects:

Add stop loss mechanisms

Optimize stop loss strategies for more reasonable stops, reducing single trade losses.

Integrate multiple indicators

Add filters like MACD and KD to make signals more reliable.

Add probability filters

Combine trend, support/resistance analysis to avoid low probability trades.

Optimize parameter settings

Test parameters on different products and time frames to find optimum values.

Avoid special market conditions

Identify and avoid trading in special market conditions to prevent huge losses.

Conclusion

The RSI momentum reversal strategy identifies long and short-term reversals using Connors RSI and fast RSI, with candlestick body filters to increase signal validity. The advantages like indicator combinations and adjustable parameters allow capturing reversals and trading counter-trend when overbought or oversold. But risks like failed reversals and false breakouts remain, requiring further optimizations in stop loss, indicator combinations to reduce risks and improve profitability.

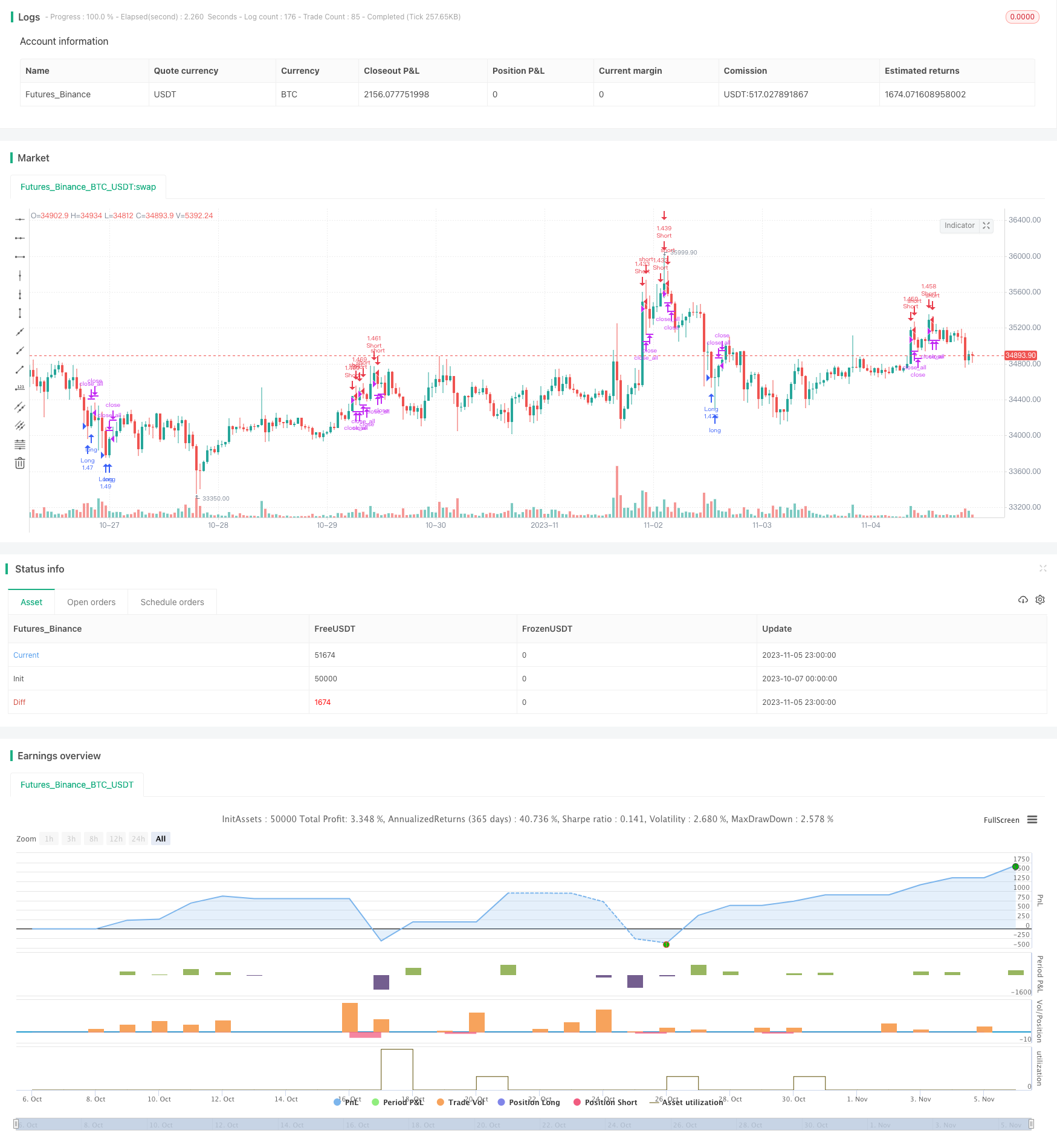

/*backtest

start: 2023-10-07 00:00:00

end: 2023-11-06 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's Connors RSI Strategy v1.0", shorttitle = "CRSI str 1.0", overlay = false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 10)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usemar = input(false, defval = false, title = "Use Martingale")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

usecrsi = input(true, defval = true, title = "Use CRSI Strategy")

usefrsi = input(true, defval = true, title = "Use FRSI Strategy")

usemod = input(true, defval = true, title = "CRSI+FRSI Mode")

limit = input(25, defval = 25, minval = 1, maxval = 100, title = "RSI limit")

usebod = input(true, defval = true, title = "Use Body-filter")

usecol = input(true, defval = true, title = "Use Color-filter")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//CRSI

rsilen = 3

streaklen = 2

lookback = 100

rsi = rsi(close,rsilen)

upday = close > close[1] ? 1 : 0

downday = close < close[1] ? -1 : 0

upstreak = upday!=0 ? upstreak[1] + upday : 0

downstreak = downday!=0 ? downstreak[1] + downday : 0

streak = upstreak + downstreak

streakrsi = rsi(streak,streaklen)

roc = close/close[1] - 1

roccount = 0

for i=1 to lookback-1

roccount := roc[i]<roc ? roccount + 1 : roccount

crsi = (rsi + streakrsi + roccount) / 3

//Oscilator

// rsiplot = plot(crsi, title="RSI", style=line, linewidth=1, color=blue)

// band1 = hline(80, title="Upper Line", linestyle=dashed, linewidth=1, color=red)

// band0 = hline(20, title="Lower Line", linestyle=dashed, linewidth=1, color=green)

// fill(band1, band0, color=purple, transp=90)

//Fast RSI

fastup = rma(max(change(close), 0), 7)

fastdown = rma(-min(change(close), 0), 7)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Body Filter

nbody = abs(close - open)

abody = sma(nbody, 10)

body = nbody > abody / 3 or usebod == false

//Color Filter

bar = close > open ? 1 : close < open ? -1 : 0

gbar = bar == 1 or usecol == false

rbar = bar == -1 or usecol == false

//Signals

up1 = rbar and (strategy.position_size == 0 or close < strategy.position_avg_price) and crsi < limit and body and usecrsi

dn1 = gbar and (strategy.position_size == 0 or close > strategy.position_avg_price) and crsi > 100 - limit and body and usecrsi

up2 = rbar and (strategy.position_size == 0 or close < strategy.position_avg_price) and fastrsi < limit and body and usefrsi

dn2 = gbar and (strategy.position_size == 0 or close > strategy.position_avg_price) and fastrsi > 100 - limit and body and usefrsi

exit = ((strategy.position_size > 0 and bar == 1) or (strategy.position_size < 0 and bar == -1)) and body

//Trading

profit = exit ? ((strategy.position_size > 0 and close > strategy.position_avg_price) or (strategy.position_size < 0 and close < strategy.position_avg_price)) ? 1 : -1 : profit[1]

mult = usemar ? exit ? profit == -1 ? mult[1] * 2 : 1 : mult[1] : 1

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 * mult : lot[1]

if ((up1 or up2) and usemod == false) or (up1 and up2 and usemod)

if strategy.position_size < 0

strategy.close_all()

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot)

if ((dn1 or dn2) and usemod == false) or (dn1 and dn2 and usemod)

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot)

if exit

strategy.close_all()