EMA Crossover Strategy

Author: ChaoZhang, Date: 2023-11-10 15:05:22Tags:

Overview

This strategy uses the crossover of fast EMA and slow EMA lines as buy and sell signals to implement automated trading based on EMA crossovers. The fast EMA line closely follows price action while the slow EMA line smooths price action. When the fast EMA line crosses above the slow EMA line from below, a buy signal is generated. When the fast EMA line crosses below the slow EMA line from above, a sell signal is generated. The strategy is flexible and customizable by adjusting the parameters of the fast and slow EMAs to define custom signal points for entries and exits.

Strategy Logic

The strategy mainly generates trading signals by calculating fast and slow EMA lines and comparing their relationship.

First, the period of the fast EMA emaFast is set to 1 in the input parameters so that it can closely follow price changes. At the same time, the periods of the slow EMAs are set - emaSlowBuy for generating buy signals and emaSlowSell for sell signals.

Then, the fast EMA and slow EMAs are calculated according to the input periods. The fast EMA has a fixed period of 1 to follow prices closely while the slow EMAs are adjustable parameters to smooth price data.

Next, the relationship between the fast EMA and slow EMAs is compared to determine crossovers. If the fast EMA crosses above the slow EMA, forming a golden cross, the buy condition is met. If the fast EMA crosses below the slow EMA, forming a death cross, the sell condition is met.

Finally, entry and exit orders are executed when the buy and sell conditions are met to complete trades. Meanwhile, it checks that the current time is within the backtest date range to avoid erroneous trades outside the date range.

Advantage Analysis

- Using EMA crossovers to determine entry and exit points is a mature and reliable technical indicator

- Adjustable fast and slow EMA periods allow parameters to be tuned to find optimal trading opportunities in different market conditions

- The logic of buying on golden crosses and selling on death crosses is straightforward and easy to understand

- Flexible configuration of buy and sell EMAs enables full customization of the trading strategy

- Options for long-only, short-only or two-way trading provides flexibility for different market environments

- Customizable backtest date range allows optimization testing on specific time periods

Risk Analysis

- EMA crossover signals have lag and may miss the optimal timing of price changes

- Frequent crossover signals may occur in volatile markets, leading to over-trading

- Extensive testing is required to find the optimal EMA combinations, otherwise excessive false signals may occur

- The fixed 1-period fast EMA cannot filter noise effectively during market shock events

- Sideways choppy markets may generate unnecessary trade signals

Possible enhancements to mitigate risks:

-

Add filters using other indicators to validate EMA crossover signals and avoid false signals

-

Adjust EMA periods based on market volatility to reduce trade frequency

-

Incorporate stop loss and take profit to control risk

-

Optimize the fast EMA period for better performance in specific market conditions

-

Add trend determination to avoid over-trading in ranging markets

Enhancement Opportunities

Some ways the strategy can be further optimized:

-

Optimize EMA parameters by testing different period combinations to find the optimal settings

-

Add filters using other indicators like MACD, KDJ, Bollinger Bands to validate signals

-

Incorporate trend metrics like ATR to avoid ranging markets

-

Optimize stop loss and take profit strategies for better risk and profitability

-

Test other EMA combinations like dual or triple EMAs to find better parameters

-

Adjust parameters dynamically for different market cycles like faster EMAs for trending and slower EMAs for choppy markets

Conclusion

The EMA crossover strategy has clear, easy-to-understand logic using established technical indicators to determine entries and exits. It is highly customizable via EMA parameter tuning for optimization across different market conditions. However, EMA signals have lag and extensive testing is required to find the best parameters. Additionally, further enhancements are needed to mitigate risks by adding signal filters, optimizing stops, and avoiding ranging markets. With continuous optimization and testing, this strategy has potential for strong trading performance.

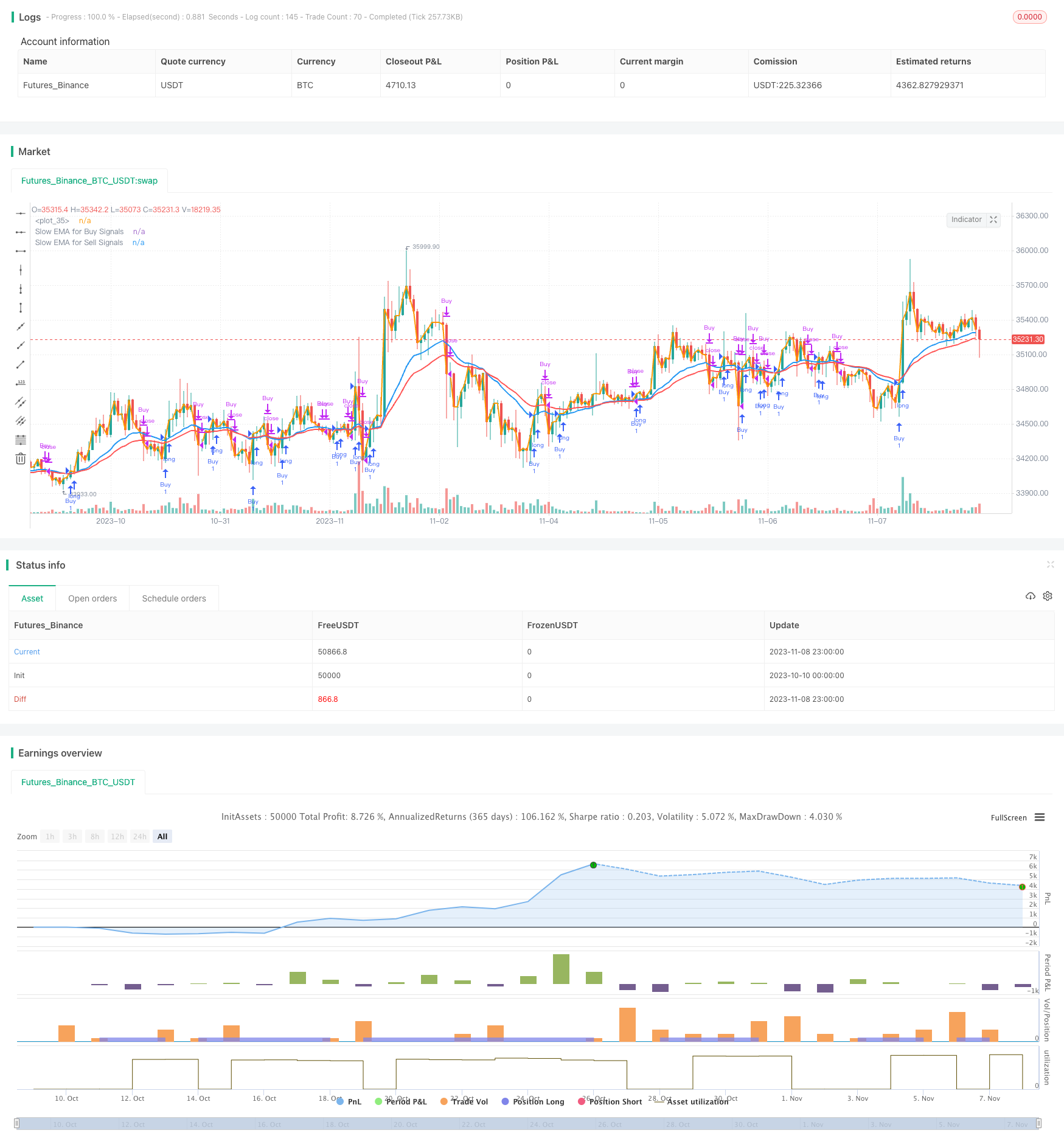

/*backtest

start: 2023-10-10 00:00:00

end: 2023-11-09 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(

"EMA Cross Strategy with Custom Buy/Sell Conditions",

overlay=true

)

// INPUT:

// Options to enter fast Exponential Moving Average (EMA) value

emaFast = 1

// Options to enter slow EMAs for buy and sell signals

slowEMABuy = input(title="Slow EMA for Buy Signals", defval=20, minval=1, maxval=9999)

slowEMASell = input(title="Slow EMA for Sell Signals", defval=30, minval=1, maxval=9999)

// Option to select trade directions

tradeDirection = input(title="Trade Direction", options=["Long", "Short", "Both"], defval="Both")

// Options that configure the backtest date range

startDate = input(title="Start Date", type=input.time, defval=timestamp("01 Jan 2018 00:00"))

endDate = input(title="End Date", type=input.time, defval=timestamp("31 Dec 2025 23:59"))

// CALCULATIONS:

// Use a fixed fast EMA of 1 and calculate slow EMAs for buy and sell signals

fastEMA = ema(close, emaFast)

slowEMABuyValue = ema(close, slowEMABuy)

slowEMASellValue = ema(close, slowEMASell)

// PLOT:

// Draw the EMA lines on the chart

plot(series=fastEMA, color=color.orange, linewidth=2)

plot(series=slowEMABuyValue, color=color.blue, linewidth=2, title="Slow EMA for Buy Signals")

plot(series=slowEMASellValue, color=color.red, linewidth=2, title="Slow EMA for Sell Signals")

// CONDITIONS:

// Check if the close time of the current bar falls inside the date range

inDateRange = true

// Translate input into trading conditions for buy and sell signals

buyCondition = crossunder(slowEMABuyValue, fastEMA)

sellCondition = crossover(slowEMASellValue, fastEMA)

// Translate input into overall trading conditions

longOK = (tradeDirection == "Long") or (tradeDirection == "Both")

shortOK = (tradeDirection == "Short") or (tradeDirection == "Both")

// ORDERS:

// Submit entry (or reverse) orders based on buy and sell conditions

if (buyCondition and inDateRange)

strategy.entry("Buy", strategy.long)

if (sellCondition and inDateRange)

strategy.close("Buy")

// Submit exit orders based on opposite trade conditions

if (strategy.position_size > 0 and sellCondition)

strategy.close("Sell")

if (strategy.position_size < 0 and buyCondition)

strategy.close("Sell")

- Comprehensive Automated Trading Moving Average Rainbow Strategy

- Twin Range Filter Trading Strategy

- Dynamic Channel Breakout Strategy

- Dynamic Moving Average Crossover Trading Strategy

- Quantitative Trading Strategy Based on Ichimoku with Multiple Signals

- Bollinger Breakout Strategy

- RSI Pullback Breakout Strategy

- Traders Dynamic Index Strategy

- Momentum Reversal Strategy

- Dual Moving Average RSI Indicator Combination Reversal Strategy

- Closing Position Strategy

- Momentum Tracking Strategy

- ZVWAP Strategy Based on Z-Distance from VWAP

- Backtesting and Optimization of RSI Strategy

- Three EMA Trend Following Strategy

- Bullish Divergence Short-term Long Trade Finder Strategy

- An Indicator-Driven Stop Loss and Take Profit Strategy

- Dual Moving Average Reversal Trading Strategy

- High Low Breakout for Quantitative Trading

- Volatility Squeeze Breakout Strategy