概述

全方位自动交易移动平均彩虹策略是一种典型的多时间周期移动平均线组合策略。它采用12条不同周期的移动平均线,通过移动平均线的排列顺序和价格的关系来判断行情走势方向,以及确定建仓、止损、止盈条件,实现自动交易。该策略可以自动识别趋势,并且有完善的止损机制来控制风险。

原理

该策略使用12条移动平均线,包括3周期、5周期、8周期一直到55周期,移动平均线类型可以选择EMA、SMA、RMA等。策略首先判断短周期和长周期移动平均线(1-4周期 Lines 和 5-8周期 Lines)的排列关系,如果短周期上方则判断为上涨趋势环境,如果短周期下方则判断为下跌趋势环境。

在上涨趋势中,如果价格突破上一个低点对应的移动平均线,就判断为符合建仓信号,做多;止损位于上一个低点对应的移动平均线,止盈距离止损的1.6倍。在下跌趋势中,如果价格突破上一个高点对应的移动平均线,就判断为符合建仓信号,做空;止损位于上一个高点对应的移动平均线,止盈距离止损的1.6倍。

该策略还具有趋势反转检测功能。在持仓期间,如果短周期移动平均线发生排列变化,同时价格超过最近一个高点或低点,则判断为可能发生了趋势反转,这时退出当前头寸,转换至相反方向头寸,以新的高点或低点作为止损和止盈位置。

优势

该策略综合运用多重时间周期分析,能较好判断趋势方向。

策略加入移动平均线顺逆排列关系判断,避免被震荡市场误导。

策略具有完善的止损机制,可以有效控制单笔交易的风险。

该策略具有趋势反转检测功能,可以及时捕捉趋势反转机会,降低系统性风险。

该策略参数设置灵活,移动平均线周期和类型都可以自定义。

策略采用跟踪止损方式,能锁定最大程度利润。

风险

多重移动平均线组合策略,参数设置会影响策略表现,需要进行优化测试。

震荡行情中,移动平均线将发出错误信号,应适当调整参数或暂时不交易。

存在一定的滞后性,在趋势转折点附近可能会有错失良机的风险。

需关注其他技术指标情况,避免在重要支撑位附近逢低开仓做空。

系统性风险需要关注,反转检测机制并不能完全规避该风险。

回撤控制需要加入额外机制,可以考虑加入动态仓位管理。

优化方向

测试不同类型移动平均线和参数设置,找到最佳组合。

优化反转检测机制,设定更精确的反转触发条件。

加入动态仓位管理机制,当回撤过大时降低仓位。

考虑加入机器学习算法,利用大数据训练判断关键点位。

结合其他指标信号进行综合判断,提高决策准确性。

建立多品种交易 portfolio,利用非相关关系分散风险。

总结

全方位自动交易移动平均彩虹策略整体来说是一个扎实的趋势跟踪策略,具有较强的趋势识别能力和风险控制能力。通过参数优化、加入动态仓位管理等进一步优化,可以成为一个非常实用的量化交易策略。该策略思路清晰易懂,同时又具有一定的灵活性,值得深入研究使用和持续优化。

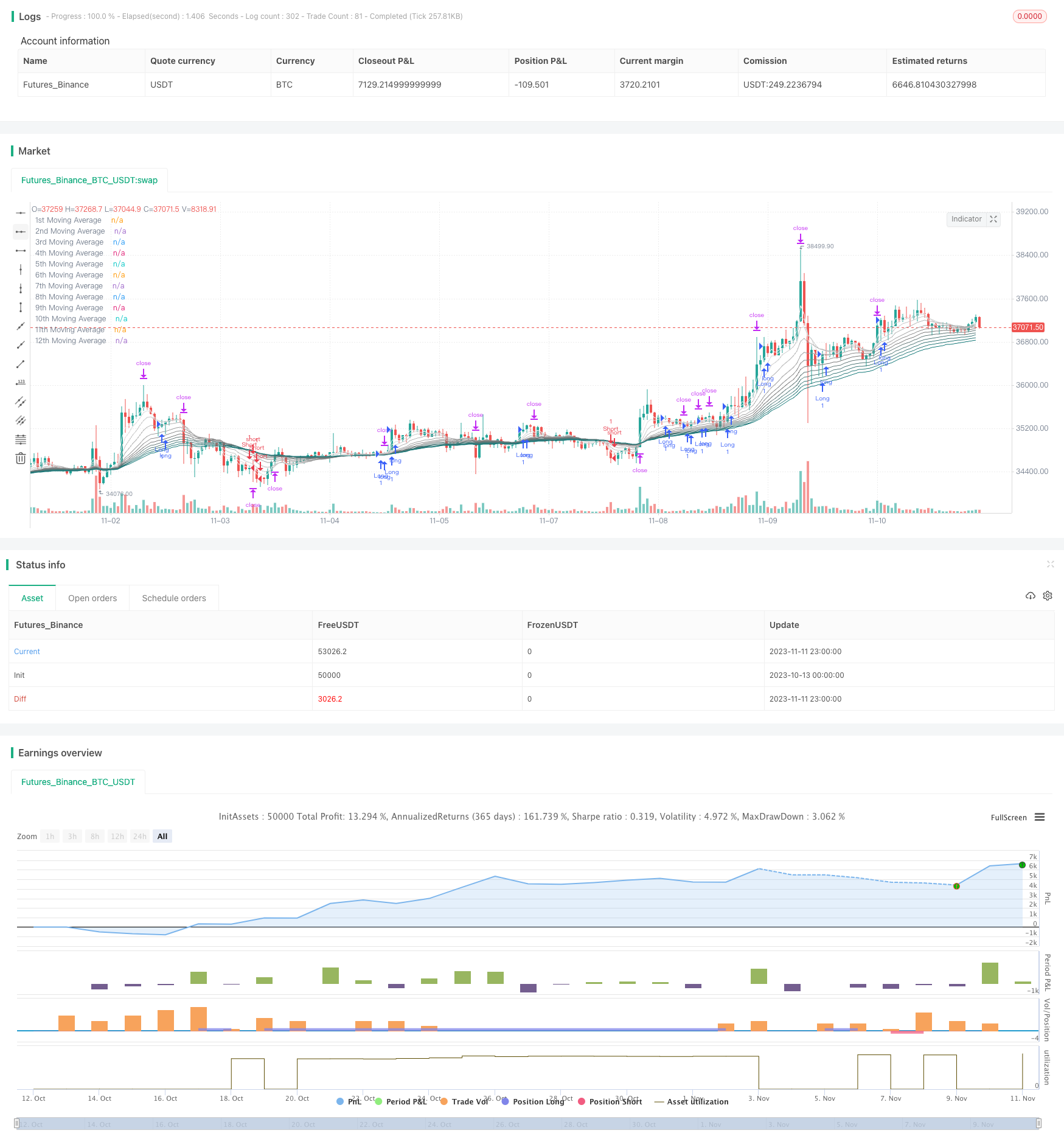

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AugustoErni

//@version=5

strategy('Moving Average Rainbow (Stormer)', overlay=true)

maType = input.string('EMA', title='Moving Average Type/Tipo de Média Móvel', options=['EMA', 'SMA', 'RMA', 'WMA', 'HMA', 'VWMA'], tooltip='This option is to select the type of Moving Average that the Rainbow will use./Esta opção é para selecionar o tipo de Média Móvel que o Rainbow utilizará.', group='Moving Averages/Médias Móveis')

maLengthFirst = input.int(3, title='MA #1', minval=1, step=1, tooltip='First MA length./Comprimento da primeira MA.', group='Moving Averages/Médias Móveis')

maLengthSecond = input.int(5, title='MA #2', minval=1, step=1, tooltip='Second MA length./Comprimento da segunda MA.', group='Moving Averages/Médias Móveis')

maLengthThird = input.int(8, title='MA #3', minval=1, step=1, tooltip='Third MA length./Comprimento da terceira MA.', group='Moving Averages/Médias Móveis')

maLengthFourth = input.int(13, title='MA #4', minval=1, step=1, tooltip='Fourth MA length./Comprimento da quarta MA.', group='Moving Averages/Médias Móveis')

maLengthFifth = input.int(20, title='MA #5', minval=1, step=1, tooltip='Fifth MA length./Comprimento da quinta MA.', group='Moving Averages/Médias Móveis')

maLengthSixth = input.int(25, title='MA #6', minval=1, step=1, tooltip='Sixth MA length./Comprimento da sexta MA.', group='Moving Averages/Médias Móveis')

maLengthSeventh = input.int(30, title='MA #7', minval=1, step=1, tooltip='Seventh MA length./Comprimento da sétima MA.', group='Moving Averages/Médias Móveis')

maLengthEighth = input.int(35, title='MA #8', minval=1, step=1, tooltip='Eighth MA length./Comprimento da oitava MA.', group='Moving Averages/Médias Móveis')

maLengthNineth = input.int(40, title='MA #9', minval=1, step=1, tooltip='Nineth MA length./Comprimento da nona MA.', group='Moving Averages/Médias Móveis')

maLengthTenth = input.int(45, title='MA #10', minval=1, step=1, tooltip='Tenth MA length./Comprimento da décima MA.', group='Moving Averages/Médias Móveis')

maLengthEleventh = input.int(50, title='MA #11', minval=1, step=1, tooltip='Eleventh MA length./Comprimento da décima primeira MA.', group='Moving Averages/Médias Móveis')

maLengthTwelveth = input.int(55, title='MA #12', minval=1, step=1, tooltip='Twelveth MA length./Comprimento da décima segunda MA.', group='Moving Averages/Médias Móveis')

targetFactor = input.float(1.6, title='Target Take Profit/Objetivo de Lucro Alvo', minval=0.1, step=0.1, tooltip='Calculate the take profit factor when entry position./Calcula o fator do alvo lucro ao entrar na posição.', group='Risk Management/Gerenciamento de Risco')

verifyTurnoverTrend = input.bool(true, title='Verify Turnover Trend/Verificar Tendência de Rotatividade', tooltip='This option checks for a supposedly turnover trend and setup new target (for long is the highest high and for short is the lowest low identified)./Esta opção verifica uma suposta tendência de rotatividade e estabelece um novo objetivo (para long é a máxima mais alta, para short é a mínima mais baixa identificados).', group='Turnover Trend/Rotatividade Tendência')

verifyTurnoverSignal = input.bool(false, title='Verify Turnover Signal/Verificar Sinal de Rotatividade', tooltip='This option checks for a supposedly turnover signal, closing the current position and opening a new one (for long it will close and open a new for short, for short it will close and open a new for long)./Essa opção verifica um sinal de possível reversão, fechando a posição atual e abrindo uma nova (para long fechará e abrirá uma nova para short, para short fechará e abrirá uma nova para long).', group='Turnover Signal/Rotatividade Sinal')

verifyTurnoverSignalPriceExit = input.bool(false, title='Verify Price Exit Turnover Signal/Verificar Saída de Preço Sinal de Rotatividade', tooltip='This option complements "turnover signal" by veryfing the price if profitable before exiting the current position./Esta opção complementa o "sinal de rotatividade" verificando o preço do lucro antes de sair da posição atual.', group='Turnover Signal/Rotatividade Sinal')

mas(maType, maLengthFirst, maLengthSecond, maLengthThird, maLengthFourth, maLengthFifth, maLengthSixth, maLengthSeventh, maLengthEighth, maLengthNineth, maLengthTenth, maLengthEleventh, maLengthTwelveth) =>

if (maType == 'SMA')

[ta.sma(close, maLengthFirst), ta.sma(close, maLengthSecond), ta.sma(close, maLengthThird), ta.sma(close, maLengthFourth), ta.sma(close, maLengthFifth), ta.sma(close, maLengthSixth), ta.sma(close, maLengthSeventh), ta.sma(close, maLengthEighth), ta.sma(close, maLengthNineth), ta.sma(close, maLengthTenth), ta.sma(close, maLengthEleventh), ta.sma(close, maLengthTwelveth)]

else if (maType == 'RMA')

[ta.rma(close, maLengthFirst), ta.rma(close, maLengthSecond), ta.rma(close, maLengthThird), ta.rma(close, maLengthFourth), ta.rma(close, maLengthFifth), ta.rma(close, maLengthSixth), ta.rma(close, maLengthSeventh), ta.rma(close, maLengthEighth), ta.rma(close, maLengthNineth), ta.rma(close, maLengthTenth), ta.rma(close, maLengthEleventh), ta.rma(close, maLengthTwelveth)]

else if (maType == 'WMA')

[ta.wma(close, maLengthFirst), ta.wma(close, maLengthSecond), ta.wma(close, maLengthThird), ta.wma(close, maLengthFourth), ta.wma(close, maLengthFifth), ta.wma(close, maLengthSixth), ta.wma(close, maLengthSeventh), ta.wma(close, maLengthEighth), ta.wma(close, maLengthNineth), ta.wma(close, maLengthTenth), ta.wma(close, maLengthEleventh), ta.wma(close, maLengthTwelveth)]

else if (maType == 'HMA')

[ta.hma(close, maLengthFirst), ta.hma(close, maLengthSecond), ta.hma(close, maLengthThird), ta.hma(close, maLengthFourth), ta.hma(close, maLengthFifth), ta.hma(close, maLengthSixth), ta.hma(close, maLengthSeventh), ta.hma(close, maLengthEighth), ta.hma(close, maLengthNineth), ta.hma(close, maLengthTenth), ta.hma(close, maLengthEleventh), ta.hma(close, maLengthTwelveth)]

else if (maType == 'VWMA')

[ta.vwma(close, maLengthFirst), ta.vwma(close, maLengthSecond), ta.vwma(close, maLengthThird), ta.vwma(close, maLengthFourth), ta.vwma(close, maLengthFifth), ta.vwma(close, maLengthSixth), ta.vwma(close, maLengthSeventh), ta.vwma(close, maLengthEighth), ta.vwma(close, maLengthNineth), ta.vwma(close, maLengthTenth), ta.vwma(close, maLengthEleventh), ta.vwma(close, maLengthTwelveth)]

else

[ta.ema(close, maLengthFirst), ta.ema(close, maLengthSecond), ta.ema(close, maLengthThird), ta.ema(close, maLengthFourth), ta.ema(close, maLengthFifth), ta.ema(close, maLengthSixth), ta.ema(close, maLengthSeventh), ta.ema(close, maLengthEighth), ta.ema(close, maLengthNineth), ta.ema(close, maLengthTenth), ta.ema(close, maLengthEleventh), ta.ema(close, maLengthTwelveth)]

[ma1, ma2, ma3, ma4, ma5, ma6, ma7, ma8, ma9, ma10, ma11, ma12] = mas(maType, maLengthFirst, maLengthSecond, maLengthThird, maLengthFourth, maLengthFifth, maLengthSixth, maLengthSeventh, maLengthEighth, maLengthNineth, maLengthTenth, maLengthEleventh, maLengthTwelveth)

maTouchPriceTrend(ma1, ma2, ma3, ma4, ma5, ma6, ma7, ma8, ma9, ma10, ma11, ma12, trend) =>

var float touchPrice = na

if (trend == 'UPTREND')

if (low <= ma1 and low >= ma2)

touchPrice := ma2

else if (low <= ma2 and low >= ma3)

touchPrice := ma3

else if (low <= ma3 and low >= ma4)

touchPrice := ma4

else if (low <= ma4 and low >= ma5)

touchPrice := ma5

else if (low <= ma5 and low >= ma6)

touchPrice := ma6

else if (low <= ma6 and low >= ma7)

touchPrice := ma7

else if (low <= ma7 and low >= ma8)

touchPrice := ma8

else if (low <= ma8 and low >= ma9)

touchPrice := ma9

else if (low <= ma9 and low >= ma10)

touchPrice := ma10

else if (low <= ma10 and low >= ma11)

touchPrice := ma11

else if (low <= ma11 and low >= ma12)

touchPrice := ma12

else

touchPrice := na

else if (trend == 'DOWNTREND')

if (high >= ma1 and high <= ma2)

touchPrice := ma2

else if (high >= ma2 and high <= ma3)

touchPrice := ma3

else if (high >= ma3 and high <= ma4)

touchPrice := ma4

else if (high >= ma4 and high <= ma5)

touchPrice := ma5

else if (high >= ma5 and high <= ma6)

touchPrice := ma6

else if (high >= ma6 and high <= ma7)

touchPrice := ma7

else if (high >= ma7 and high <= ma8)

touchPrice := ma8

else if (high >= ma8 and high <= ma9)

touchPrice := ma9

else if (high >= ma9 and high <= ma10)

touchPrice := ma10

else if (high >= ma10 and high <= ma11)

touchPrice := ma11

else if (high >= ma11 and high <= ma12)

touchPrice := ma12

else

touchPrice := na

maMean = ((ma1 + ma2 + ma3 + ma4 + ma5 + ma6 + ma7 + ma8 + ma9 + ma10 + ma11 + ma12) / 12)

isMa1To4Above = ma1 > ma2 and ma2 > ma3 and ma3 > ma4 ? 1 : 0

isMa1To4Below = ma1 < ma2 and ma2 < ma3 and ma3 < ma4 ? 1 : 0

isMa5To8Above = ma5 > ma6 and ma6 > ma7 and ma7 > ma8 ? 1 : 0

isMa5To8Below = ma5 < ma6 and ma6 < ma7 and ma7 < ma8 ? 1 : 0

isCloseGreaterMaMean = close > maMean ? 1 : 0

isCloseLesserMaMean = close < maMean ? 1 : 0

isCurHighGreaterPrevHigh = high > high[1] ? 1 : 0

isCurLowLesserPrevLow = low < low[1] ? 1 : 0

isMaUptrend = isCloseGreaterMaMean and isMa5To8Above ? 1 : 0

isMaDowntrend = isCloseLesserMaMean and isMa5To8Below ? 1 : 0

isUptrend = isMaUptrend ? 'UPTREND' : na

isDowntrend = isMaDowntrend ? 'DOWNTREND' : na

curTouchPriceUptrend = maTouchPriceTrend(ma1, ma2, ma3, ma4, ma5, ma6, ma7, ma8, ma9, ma10, ma11, ma12, isUptrend)

prevTouchPriceUptrend = curTouchPriceUptrend[1]

curTouchPriceDowntrend = maTouchPriceTrend(ma1, ma2, ma3, ma4, ma5, ma6, ma7, ma8, ma9, ma10, ma11, ma12, isDowntrend)

prevTouchPriceDowntrend = curTouchPriceDowntrend[1]

isPrevTouchPriceUptrendTouched = prevTouchPriceUptrend > 0.0 or not na(prevTouchPriceUptrend) ? 1 : 0

isPrevTouchPriceDowntrendTouched = prevTouchPriceDowntrend > 0.0 or not na(prevTouchPriceDowntrend) ? 1 : 0

isPrevTouchedPriceUptrend = isPrevTouchPriceUptrendTouched and isMaUptrend ? 1 : 0

isPrevTouchedPriceDowntrend = isPrevTouchPriceDowntrendTouched and isMaDowntrend ? 1 : 0

isPositionFlat = strategy.position_size == 0 ? 1 : 0

var float positionEntryPrice = na

var bool positionIsEntryLong = false

var bool positionIsEntryShort = false

var float longPositionHighestHigh = na

var float shortPositionLowestLow = na

var float stopLossLong = na

var float stopLossShort = na

var float targetLong = na

var float targetShort = na

var bool isTurnoverTrendLongTrigger = na

var bool isTurnoverTrendShortTrigger = na

isPositionLongClose = na(positionEntryPrice) and not positionIsEntryLong ? 1 : 0

isPositionShortClose = na(positionEntryPrice) and not positionIsEntryShort ? 1 : 0

isLongCondition = isMaUptrend and isCurHighGreaterPrevHigh and isPrevTouchedPriceUptrend ? 1 : 0

isShortCondition = isMaDowntrend and isCurLowLesserPrevLow and isPrevTouchedPriceDowntrend ? 1 : 0

longTurnoverExit = verifyTurnoverSignal and verifyTurnoverSignalPriceExit ? (verifyTurnoverSignal and isLongCondition and positionIsEntryShort and close < positionEntryPrice) : verifyTurnoverSignal ? (verifyTurnoverSignal and isLongCondition and positionIsEntryShort) : na

shortTurnoverExit = verifyTurnoverSignal and verifyTurnoverSignalPriceExit ? (verifyTurnoverSignal and isShortCondition and positionIsEntryLong and close > positionEntryPrice) : verifyTurnoverSignal ? (verifyTurnoverSignal and isShortCondition and positionIsEntryLong) : na

if (isPositionFlat)

positionEntryPrice := na

positionIsEntryLong := false

positionIsEntryShort := false

stopLossLong := na

targetLong := na

stopLossShort := na

targetShort := na

isTurnoverTrendLongTrigger := na

isTurnoverTrendShortTrigger := na

if ((isLongCondition and isPositionLongClose) or longTurnoverExit)

positionEntryPrice := close

positionIsEntryLong := true

positionIsEntryShort := false

longPositionHighestHigh := na

shortPositionLowestLow := na

isTurnoverTrendLongTrigger := na

isTurnoverTrendShortTrigger := na

stopLossLong := prevTouchPriceUptrend

if (isCurLowLesserPrevLow)

curLowToucedPrice = na(curTouchPriceUptrend) ? low : curTouchPriceUptrend

stopLossLong := na(curTouchPriceUptrend) ? ((stopLossLong + curLowToucedPrice) / 2) : curLowToucedPrice

targetLong := (positionEntryPrice + (math.abs(positionEntryPrice - stopLossLong) * targetFactor))

if (targetLong > 0 and stopLossLong > 0)

alertMessage = '{ "side/lado": "buy", "entry/entrada": ' + str.tostring(positionEntryPrice) + ', "stop": ' + str.tostring(stopLossLong) + ', "target/alvo": ' + str.tostring(targetLong) + ' }'

alert(alertMessage)

strategy.entry('Long', strategy.long)

strategy.exit('Exit Long', 'Long', stop=stopLossLong, limit=targetLong)

if ((isShortCondition and isPositionShortClose) or shortTurnoverExit)

positionEntryPrice := close

positionIsEntryLong := false

positionIsEntryShort := true

longPositionHighestHigh := na

shortPositionLowestLow := na

isTurnoverTrendLongTrigger := na

isTurnoverTrendShortTrigger := na

stopLossShort := prevTouchPriceDowntrend

if (isCurHighGreaterPrevHigh)

curHighToucedPrice = na(curTouchPriceDowntrend) ? high : curTouchPriceDowntrend

stopLossShort := na(curTouchPriceDowntrend) ? ((stopLossShort + curHighToucedPrice) / 2) : curHighToucedPrice

targetShort := (positionEntryPrice - (math.abs(positionEntryPrice - stopLossShort) * targetFactor))

if (targetShort > 0 and stopLossShort > 0)

alertMessage = '{ "side/lado": "sell", "entry/entrada": ' + str.tostring(positionEntryPrice) + ', "stop": ' + str.tostring(stopLossShort) + ', "target/alvo": ' + str.tostring(targetShort) + ' }'

alert(alertMessage)

strategy.entry('Short', strategy.short)

strategy.exit('Exit Short', 'Short', stop=stopLossShort, limit=targetShort)

if (verifyTurnoverTrend and positionIsEntryLong)

curHighestHigh = high

if (curHighestHigh > longPositionHighestHigh or na(longPositionHighestHigh))

longPositionHighestHigh := curHighestHigh

if (isMa1To4Below and isCloseLesserMaMean and longPositionHighestHigh > positionEntryPrice)

isTurnoverTrendLongTrigger := true

alertMessage = '{ "side/lado": "buy", "stop": ' + str.tostring(stopLossLong) + ', "target/alvo": ' + str.tostring(longPositionHighestHigh) + ', "new setup/nova definição": ' + str.tostring(isTurnoverTrendLongTrigger) + ' }'

alert(alertMessage)

strategy.exit('Exit Long', 'Long', stop=stopLossLong, limit=longPositionHighestHigh)

if (verifyTurnoverTrend and positionIsEntryShort)

curLowestLow = low

if (curLowestLow < shortPositionLowestLow or na(shortPositionLowestLow))

shortPositionLowestLow := curLowestLow

if (isMa1To4Above and isCloseGreaterMaMean and shortPositionLowestLow < positionEntryPrice)

isTurnoverTrendShortTrigger := true

alertMessage = '{ "side/lado": "sell", "stop": ' + str.tostring(stopLossShort) + ', "target/alvo": ' + str.tostring(shortPositionLowestLow) + ', "new setup/nova definição": ' + str.tostring(isTurnoverTrendShortTrigger) + ' }'

alert(alertMessage)

strategy.exit('Exit Short', 'Short', stop=stopLossShort, limit=shortPositionLowestLow)

plot(ma1, title='1st Moving Average', color=color.rgb(240, 240, 240))

plot(ma2, title='2nd Moving Average', color=color.rgb(220, 220, 220))

plot(ma3, title='3rd Moving Average', color=color.rgb(200, 200, 200))

plot(ma4, title='4th Moving Average', color=color.rgb(180, 180, 180))

plot(ma5, title='5th Moving Average', color=color.rgb(160, 160, 160))

plot(ma6, title='6th Moving Average', color=color.rgb(140, 140, 140))

plot(ma7, title='7th Moving Average', color=color.rgb(120, 120, 120))

plot(ma8, title='8th Moving Average', color=color.rgb(100, 120, 120))

plot(ma9, title='9th Moving Average', color=color.rgb(80, 120, 120))

plot(ma10, title='10th Moving Average', color=color.rgb(60, 120, 120))

plot(ma11, title='11th Moving Average', color=color.rgb(40, 120, 120))

plot(ma12, title='12th Moving Average', color=color.rgb(20, 120, 120))

tablePosition = position.bottom_right

tableColumns = 2

tableRows = 7

tableFrameWidth = 1

tableBorderColor = color.gray

tableBorderWidth = 1

tableInfoTrade = table.new(position=tablePosition, columns=tableColumns, rows=tableRows, frame_width=tableFrameWidth, border_color=tableBorderColor, border_width=tableBorderWidth)

table.cell(table_id=tableInfoTrade, column=0, row=0)

table.cell(table_id=tableInfoTrade, column=1, row=0)

table.cell(table_id=tableInfoTrade, column=0, row=1, text='Entry Side/Lado da Entrada', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=0, row=2, text=positionIsEntryLong ? 'LONG' : positionIsEntryShort ? 'SHORT' : 'NONE/NENHUM', text_color=color.yellow)

table.cell(table_id=tableInfoTrade, column=1, row=1, text='Entry Price/Preço da Entrada', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=1, row=2, text=not na(positionEntryPrice) ? str.tostring(positionEntryPrice) : 'NONE/NENHUM', text_color=color.blue)

table.cell(table_id=tableInfoTrade, column=0, row=3, text='Take Profit Price/Preço Alvo Lucro', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=0, row=4, text=positionIsEntryLong ? str.tostring(targetLong) : positionIsEntryShort ? str.tostring(targetShort) : 'NONE/NENHUM', text_color=color.green)

table.cell(table_id=tableInfoTrade, column=1, row=3, text='Stop Loss Price/Preço Stop Loss', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=1, row=4, text=positionIsEntryLong ? str.tostring(stopLossLong) : positionIsEntryShort ? str.tostring(stopLossShort) : 'NONE/NENHUM', text_color=color.red)

table.cell(table_id=tableInfoTrade, column=0, row=5, text='New Target/Novo Alvo', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=0, row=6, text=verifyTurnoverTrend and positionIsEntryLong and isTurnoverTrendLongTrigger ? str.tostring(longPositionHighestHigh) : verifyTurnoverTrend and positionIsEntryShort and isTurnoverTrendShortTrigger ? str.tostring(shortPositionLowestLow) : 'NONE/NENHUM', text_color=color.green)

table.cell(table_id=tableInfoTrade, column=1, row=5, text='Possible Market Turnover/Possível Virada do Mercado', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=1, row=6, text=verifyTurnoverTrend and positionIsEntryLong and isTurnoverTrendLongTrigger ? 'YES/SIM (Possible long going short/Possível long indo short)' : verifyTurnoverTrend and positionIsEntryShort and isTurnoverTrendShortTrigger ? 'YES/SIM (Possible short going long/Possível short indo long)' : 'NONE/NENHUM', text_color=color.red)